Earnings summaries and quarterly performance for Addus HomeCare.

Executive leadership at Addus HomeCare.

Dirk Allison

Chairman and Chief Executive Officer

Bradley Bickham

Advisor to the Chief Executive Officer

Brian Poff

Executive Vice President, Chief Financial Officer, Treasurer and Secretary

Cliff Blessing

Executive Vice President, Chief Development Officer

Darby Anderson

Executive Vice President, Chief Government Relations Officer

David Tucker

Executive Vice President, Chief Strategy Officer

Heather Dixon

President and Chief Operating Officer

Michael Wattenbarger

Executive Vice President, Chief Information Officer

Monica Raines

Executive Vice President, Chief Compliance & Quality Officer

Roberton Stevenson

Executive Vice President, Chief Human Resource Officer

Sean Gaffney

Executive Vice President, Chief Legal Officer

Board of directors at Addus HomeCare.

Research analysts who have asked questions during Addus HomeCare earnings calls.

Brian Tanquilut

Jefferies

6 questions for ADUS

Jared Haase

William Blair & Company

6 questions for ADUS

Joanna Gajuk

Bank of America

6 questions for ADUS

Matthew Gillmor

KeyCorp

6 questions for ADUS

Ryan Langston

TD Cowen

6 questions for ADUS

Andrew Mok

Barclays

5 questions for ADUS

John Ransom

Raymond James

4 questions for ADUS

Constantine Davides

Citizens JMP

3 questions for ADUS

Raj Kumar

Stephens

3 questions for ADUS

Tao Qiu

Macquarie Group

3 questions for ADUS

A.J. Rice

UBS

2 questions for ADUS

Ben Hendricks

RBC Capital Markets

2 questions for ADUS

Clark Murphy

Truist Securities

2 questions for ADUS

Scott Fidel

Stephens Inc.

2 questions for ADUS

Thomas Keller

BMO Capital Markets

2 questions for ADUS

Benjamin Hendrix

RBC Capital Markets

1 question for ADUS

Michael Murray

RBC Capital Markets

1 question for ADUS

Mike Murray

RBC Capital Markets

1 question for ADUS

Recent press releases and 8-K filings for ADUS.

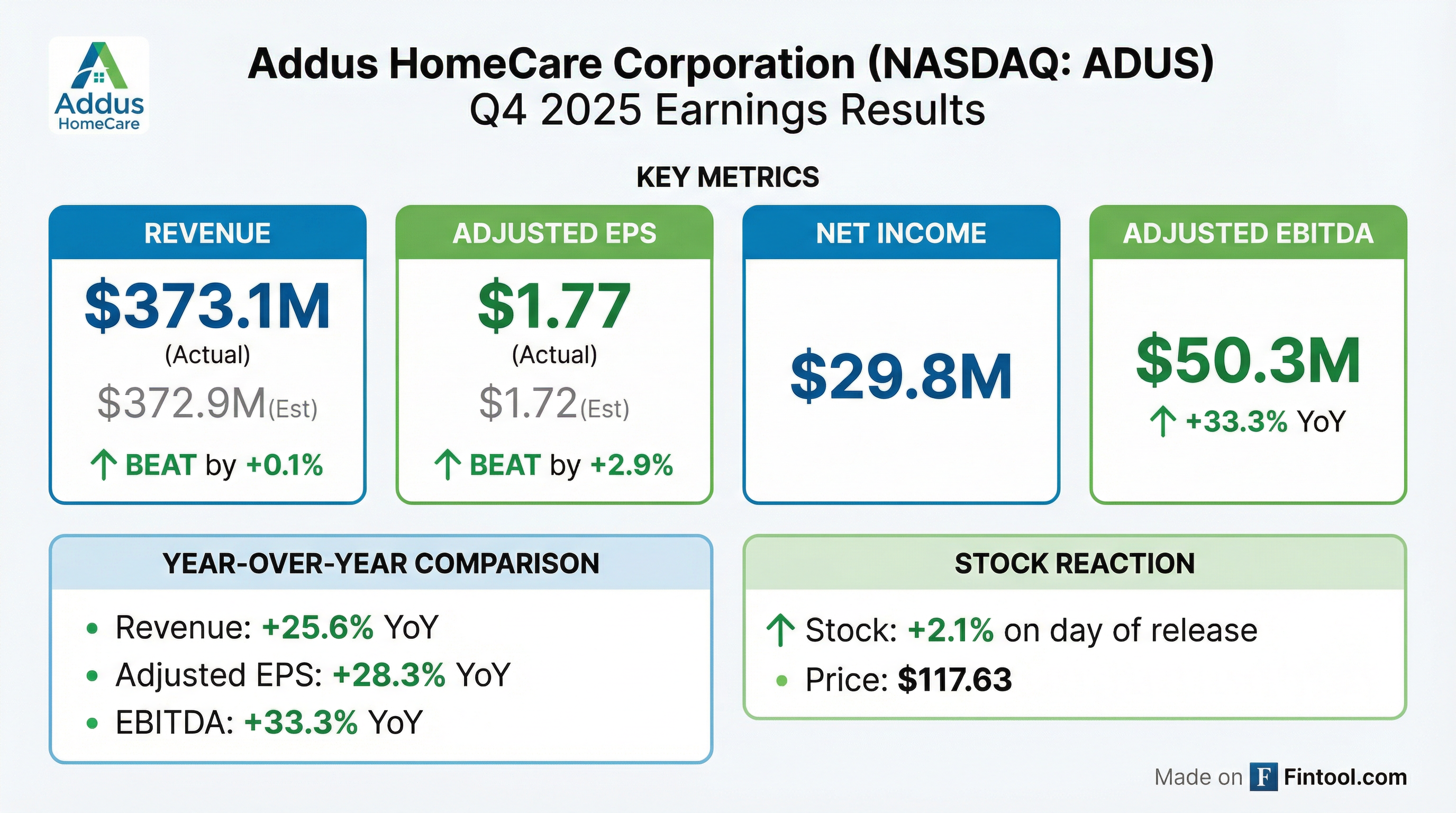

- Addus HomeCare reported strong financial results for Q4 2025, with total revenue increasing 25.6% to $373.1 million and adjusted earnings per share rising 28.3% to $1.77 compared to Q4 2024. For the full year 2025, total revenue was approximately $1.4 billion, an increase of 23.2% from 2024, with adjusted EPS of $6.23, an 18.4% increase.

- The Personal Care segment was a primary driver, achieving 6.3% organic revenue growth in Q4 2025, supported by recent acquisitions and rate increases in states like Texas (effective September 1, 2025) and Illinois (effective January 1, 2026, expected to add approximately $17.5 million in annualized revenue).

- Adjusted EBITDA for Q4 2025 increased 33.3% to $50.3 million, resulting in an adjusted EBITDA margin of 13.6%. The company maintained a strong balance sheet with $81.6 million in cash and $124.3 million in bank debt as of December 31, 2025, leading to net leverage of under 1x adjusted EBITDA.

- Operationally, Addus HomeCare continued to experience positive hiring trends, with 101 hires per business day in Q4 2025, and is rolling out its Addus Connect app in New Mexico and Texas to enhance service efficiency. Management also expressed confidence that the 80/20 provision of the Medicaid Access Rule will be eliminated in the near future.

- Addus HomeCare reported robust financial performance for Q4 2025, with total revenue increasing 25.6% to $373.1 million and adjusted earnings per share rising 28.3% to $1.77 compared to the prior year period.

- For the full year 2025, total revenue grew 23.2% to approximately $1.4 billion, while adjusted EBITDA increased 28.3% to $180 million.

- The company ended Q4 2025 with a strong balance sheet, including $81.6 million in cash on hand and $124.3 million in bank debt, resulting in net leverage under 1x adjusted EBITDA, supporting continued acquisition strategy.

- Operational growth was driven by 6.3% organic revenue growth in personal care and 16% in hospice for Q4 2025, bolstered by recent acquisitions and rate increases in Texas and Illinois, with a potential 4-5% rate increase in New Mexico awaiting approval for the second half of 2026.

- Addus HomeCare reported total revenue of $373.1 million for Q4 2025, a 25.6% increase compared to Q4 2024, and $1.4 billion for the full year 2025, up 23.2% from 2024. Adjusted earnings per share for Q4 2025 were $1.77, a 28.3% increase, and $6.23 for the full year, up 18.4%.

- The company achieved 6.3% organic revenue growth in its Personal Care Services segment for Q4 2025 and a 16% increase in Hospice same-store revenue. Acquisitions in 2025 included Great Lakes Home Care, Helping Hands Home Care Service, and Del Cielo Home Care, building on the December 2024 acquisition of Gentiva personal care operations which added approximately $280 million in annualized revenues.

- Addus HomeCare benefited from recent rate increases, including a 9.9% increase in Texas (effective September 1, 2025) and a 3.9% increase in Illinois (effective January 1, 2026), which is expected to add $17.5 million in annualized revenue. New Mexico is also anticipating a 4% to 5% rate increase in the second half of 2026.

- The company ended Q4 2025 with $81.6 million in cash and $124.3 million in bank debt, resulting in net leverage of under 1x adjusted EBITDA.

- Addus HomeCare Corporation reported net service revenues of $373.1 million for Q4 2025, a 25.6% increase year-over-year, and $1.42 billion for the full year 2025, up 23.2% from 2024.

- For Q4 2025, adjusted EBITDA increased 33.3% to $50.3 million, and adjusted net income per diluted share rose 28.3% to $1.77.

- The personal care business was the key driver of growth, accounting for 76.6% of revenues in Q4 2025 with 6.3% organic revenue growth.

- As of December 31, 2025, the company had cash of $81.6 million and bank debt of $124.3 million, with $517.7 million available under its revolving credit facility.

- Management emphasized that acquisitions remain an integral part of their growth strategy, having completed three in 2025, and expects additional opportunities in 2026, supported by $111.5 million in net cash provided by operating activities for 2025.

- Addus HomeCare reported net service revenues of $373.1 million for the fourth quarter of 2025, marking a 25.6% increase compared to the prior year, and $1.42 billion for the full year 2025, a 23.2% increase.

- Adjusted EBITDA increased 33.3% to $50.3 million for Q4 2025 and 28.3% to $180.0 million for the full year 2025.

- Net income per diluted share was $1.61 for Q4 2025 and $5.22 for the full year 2025.

- The personal care business, which constituted 76.6% of Q4 revenues, achieved 6.3% organic revenue growth, while the hospice care business saw 16.0% organic revenue growth.

- As of December 31, 2025, the company had $81.6 million in cash and $124.3 million in bank debt, with acquisitions remaining an integral part of its growth strategy, including three completed in 2025.

- Addus HomeCare's new President and COO, Heather Dixon, outlined 2026 operational priorities focused on driving census, increasing hours utilization, and community-based initiatives, with the caregiver app rollout in Illinois showing high utilization and planned expansion to New Mexico and Texas.

- The company anticipates 2%-2.5% volume growth in personal care hours, with Illinois Medicaid redeterminations leading to admissions outpacing discharges, setting up for 2026 census growth. Key rate increases include almost 10% in Texas (effective September 1, 2025) and just under 4% in Illinois (effective January 1, 2026), with optimism for New Mexico in spring 2026.

- The hospice segment achieved low teens organic revenue growth year-to-date, exceeding the 5%-7% target, driven by leadership changes, business development, and the Bridge program. Addus maintains an annual M&A target of $100 million+ in annualized revenue and is optimistic about increased opportunities in 2026 due to potential rate decreases.

- Addus HomeCare is focused on driving census growth and increasing service utilization in personal care through initiatives like a caregiver app being rolled out in key states. The company targets 2%-2.5% volume growth in hours for personal care.

- Recent reimbursement updates include a nearly 10% increase in Texas (effective September 1, 2025) and just under 4% in Illinois (effective January 1, 2026), with optimism for a potential rate increase in New Mexico in spring 2026.

- The hospice segment has shown strong performance with year-to-date organic revenue growth in the low teens, exceeding the targeted 5-7%, driven by strategic investments in leadership and business development.

- Despite high valuations in hospice M&A, Addus maintains an annual target of $100 million in acquired revenue and is well-capitalized to pursue opportunities, especially if market conditions improve in 2026.

- The company's caregiver base includes 35%-40% family caregivers in states like Illinois and Texas, and it aims to improve its current 83%-83.5% fill rate for authorized hours into the mid-80s.

- Addus HomeCare (ADUS) is focused on driving census growth and hours utilization in 2026, supported by a caregiver app showing high utilization in Illinois and planned expansion to New Mexico and Texas.

- The company anticipates census growth in 2026 in Illinois as Medicaid redeterminations conclude, with admissions now exceeding discharges. New Mexico has already experienced over 3% growth in recent quarters post-redetermination.

- Addus targets $100 million in annualized acquired revenue annually, despite high hospice valuations, by focusing on mixed assets. The company is well-capitalized and expects more M&A opportunities in 2026 if interest rates decrease.

- With current EBITDA margins around 12%, Addus expects top-line growth to enhance G&A leverage, contributing to further EBITDA percentage growth. Technology investments, including the integration of Gentiva onto a single EMR system by late 2026, are key to efficiency.

- The personal care fill rate is approximately 83%-83.5%, with a goal to reach the mid-80s, highlighting the ongoing focus on caregiver supply and securing state rate increases to support wages.

- Addus HomeCare targets 10% annual revenue growth, with approximately half from organic growth (3-5%) and half from M&A. The company anticipates Personal Care organic growth at the high end or above the 3-5% range through mid-2026, driven by rate increases in Texas and Illinois, and strong hiring trends with 113 hires per business day in Q3 2024.

- Hospice organic revenue growth is projected at mid to upper single digits longer term, with current strong discharge growth (19% in Q3 2024) expected to moderate by mid-2026.

- The company prioritizes M&A, aiming for $100 million+ in acquired revenue annually, supported by a strong balance sheet with leverage just under one time. Personal Care acquisitions typically range from 4-8x EBITDA, while hospice deals are more expensive at mid to upper teens EBITDA multiples.

- The Home Health segment, which is less than 10% of the business, is primarily complementary, and a worst-case 6.4% rate cut could result in an approximate $3 million impact.

- Addus expects operating income to grow faster than revenue, aiming for G&A as a percentage of revenue to be below 20%, with $1 million in annual savings from Geneva EMR integration in 2026.

- Equasens Group reported total revenue of €172.2m for the nine months ended September 30, 2025, representing an 8.9% increase on a reported basis and 7.3% like-for-like growth compared to the same period in 2024.

- For Q3 2025, revenue reached €56.2m, showing a 12.1% increase on a reported basis and a strong 9.4% like-for-like growth.

- Systems and equipment sales were a significant growth driver, contributing €8.0m (+13.1%) to the nine-month revenue and €3.8m (+20.7%) in Q3.

- The PHARMAGEST Division maintained strong momentum, with revenue of €126.6m at 30 September 2025 (+5.4%) and €40.7m in Q3 (+7.1%).

- The Group maintains its guidance for revenue growth of nearly 10% on a reported basis in the second half of 2025.

Quarterly earnings call transcripts for Addus HomeCare.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more