Earnings summaries and quarterly performance for AMERICAN FINANCIAL GROUP.

Executive leadership at AMERICAN FINANCIAL GROUP.

Carl H. Lindner III

Co-Chief Executive Officer

S. Craig Lindner

Co-Chief Executive Officer

Brian S. Hertzman

Senior Vice President and Chief Financial Officer

Craig Lindner, Jr.

Divisional President, AFG Real Estate Investments

David L. Thompson, Jr.

President and Chief Operating Officer, Great American Insurance Group

John B. Berding

President

Mark A. Weiss

Senior Vice President and General Counsel and Chief Compliance Officer

Michelle A. Gillis

Senior Vice President, Chief Human Resources Officer and Chief Administrative Officer

Board of directors at AMERICAN FINANCIAL GROUP.

Research analysts who have asked questions during AMERICAN FINANCIAL GROUP earnings calls.

Andrew Andersen

Jefferies

12 questions for AFG

Meyer Shields

Keefe, Bruyette & Woods

10 questions for AFG

Michael Zaremski

BMO Capital Markets

9 questions for AFG

C. Gregory Peters

Raymond James

5 questions for AFG

Robert Farnam

Boenning & Scattergood

5 questions for AFG

Dan Cohen

BMO

2 questions for AFG

Gregory Peters

Raymond James Financial, Inc.

2 questions for AFG

Hristian Getsov

Wells Fargo

2 questions for AFG

Jing Li

Keefe, Bruyette & Woods (KBW)

2 questions for AFG

Charles Peters

Raymond James

1 question for AFG

Jon Paul Newsome

Piper Sandler & Co.

1 question for AFG

Paul Newsom

Piper Sandler

1 question for AFG

Paul Newsome

Piper Sandler Companies

1 question for AFG

Recent press releases and 8-K filings for AFG.

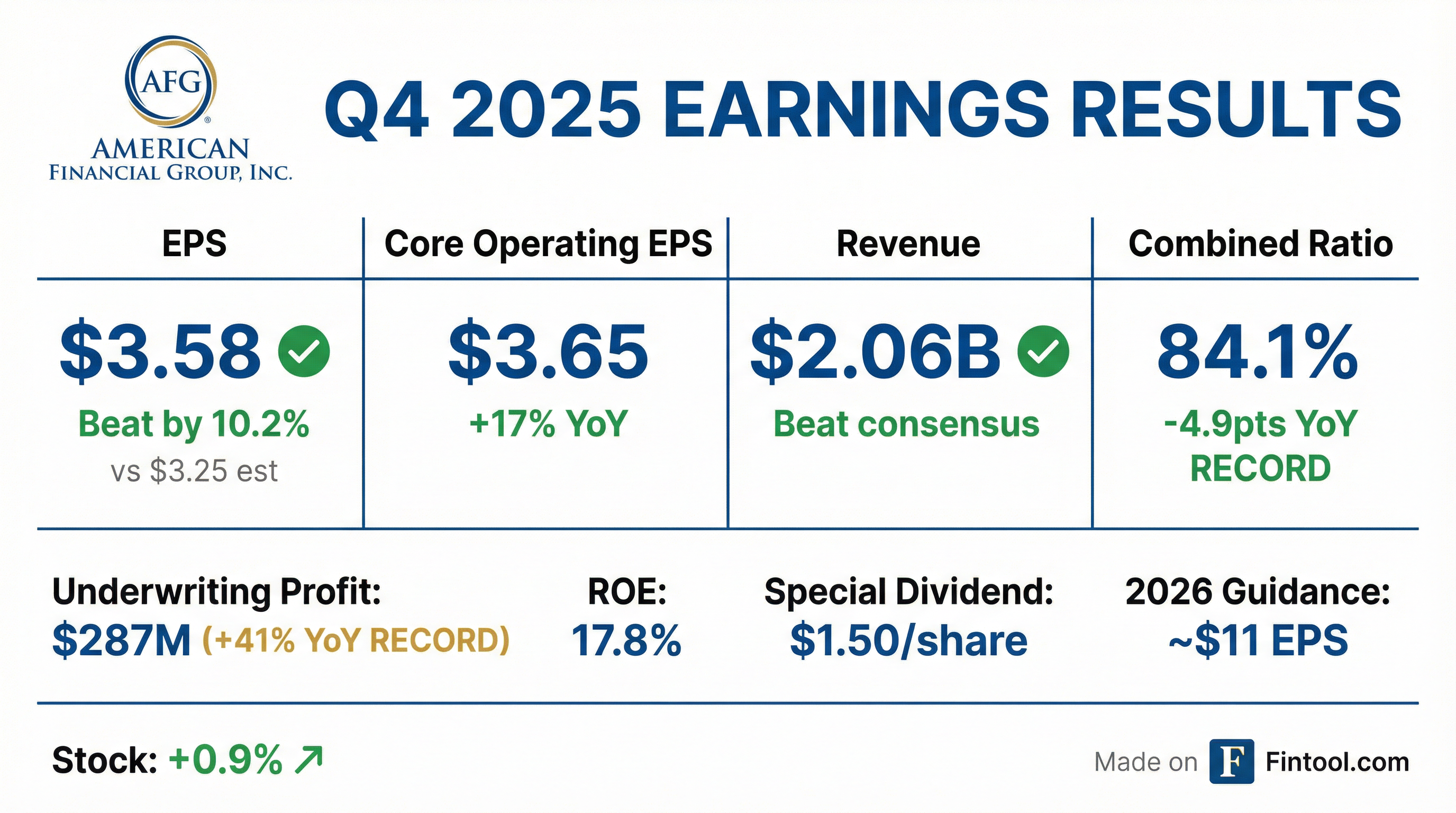

- American Financial Group, Inc. reported core net operating earnings of $305 million and diluted earnings per share of $3.58 for the fourth quarter of 2025.

- Property and Casualty net written premiums for Q4 2025 totaled $1,444 million.

- The Specialty combined ratio for Q4 2025 was 84.1%, contributing to an underwriting profit of $284 million.

- The company's annualized core operating return on equity for Q4 2025 was 25.2%.

- Dividends per common share for Q4 2025 were $2.88.

- American Financial Group (AFG) reported Core Net Operating Earnings per share of $3.65 for Q4 2025 and $10.29 for the full year, achieving a core operating return on equity of 18.2% for 2025.

- In 2025, AFG returned over $700 million to shareholders, including $334 million in special dividends, $274 million in regular common stock dividends, and $99 million in share repurchases. The company also declared a $1.50 per share special dividend payable in February 2026.

- Underwriting profit in AFG's specialty property and casualty insurance businesses grew 41% in Q4 2025, generating an 84.1% combined ratio.

- For 2026, AFG anticipates Core Net Operating Earnings per share of approximately $11 and a core operating return on equity of approximately 18%, based on assumptions including 3%-5% growth in net written premiums and a combined ratio of approximately 92.5%.

- AFG reported core net operating earnings per share of $3.65 for Q4 2025 and $10.29 for the full year 2025, generating an annualized Q4 core return on equity of 25.2% and a full year core operating return on equity of 18.2%.

- The company returned over $700 million to shareholders in 2025, comprising $334 million in special dividends, $274 million in regular common stock dividends, and $99 million in share repurchases.

- AFG increased its quarterly dividend by 10% to an annual rate of $3.52 per share starting October 2025 and declared an additional special dividend of $1.50 per share payable in February 2026.

- Property and Casualty (P&C) underwriting profit grew 41% in Q4 2025, achieving an 84.1% combined ratio.

- For 2026, AFG's business plan assumes 3%-5% growth in net written premiums from $7.1 billion, a combined ratio of approximately 92.5%, and projects core net operating earnings per share of approximately $11, generating a core operating return on equity of approximately 18%.

- American Financial Group (AFG) reported full-year 2025 core net operating earnings of $10.29 per share, generating a core operating return on equity of 18.2%. For Q4 2025, core net operating earnings per share were $3.65, with an annualized core return on equity of 25.2%.

- The company returned over $700 million to shareholders in 2025, including $334 million in special dividends, $274 million in regular common stock dividends, and $99 million in share repurchases. A special dividend of $1.50 per share was declared, payable in February 2026 , and the quarterly dividend was increased by 10% to an annual rate of $3.52 per share starting October 2025.

- Underwriting profits in Q4 2025 set a new quarterly record, achieving an 84.1 combined ratio, a nearly 5-point improvement from the prior year period. P&C net investment income was approximately 12% lower in Q4 2025 compared to the prior year, primarily due to lower returns from alternative investments, which yielded an annualized 0.9% for the quarter.

- For 2026, AFG's business plan assumes core net operating earnings per share of approximately $11, a combined ratio of approximately 92.5%, and net written premiums growth of 3%-5%.

- American Financial Group reported Q4 2025 net earnings per share of $3.58 and core net operating earnings per share of $3.65. For the full year 2025, net earnings per share were $10.08 and core net operating earnings per share were $10.29.

- The company's Board of Directors declared a special cash dividend of $1.50 per share, payable on February 25, 2026.

- Total capital returned to shareholders during 2025 was $707 million, which included $334 million ($4.00 per share) in special dividends and $99 million in share repurchases.

- Fourth quarter 2025 underwriting profit increased 41% year-over-year and set a new quarterly record. The full year 2025 core operating return on equity was 18.2%.

- For 2026, the company expects core operating earnings per share of approximately $11.00.

- American Financial Group reported Q4 2025 net earnings per share of $3.58 and core net operating earnings per share of $3.65. For the full year 2025, net earnings per share were $10.08 and core net operating earnings per share were $10.29.

- The company achieved a record quarterly underwriting profit in Q4 2025, increasing 41% year-over-year, and reported a full year 2025 core operating ROE of 18.2%.

- AFG returned $707 million to shareholders in 2025, including $334 million ($4.00 per share) in special dividends and $99 million in share repurchases. A new $1.50 per share special dividend was declared, payable February 25, 2026.

- For 2026, the company anticipates core operating earnings per share of approximately $11.00 and a core operating return on equity excluding AOCI of approximately 18%.

- American Financial Group reported core net operating earnings of $2.69 per share for Q3 2025, a 16% increase from the prior year, and an annualized core operating return on equity of 19%.

- The company's specialty property and casualty insurance businesses achieved a 93 combined ratio in Q3 2025, an improvement of 1.3 points year over year, with underwriting profit growing 19%.

- Net investment income in property and casualty operations increased 5% year over year for the three months ended September 30, 2025.

- AFG increased its regular quarterly dividend by 10% to $0.88 per share and declared a special dividend of $2 per share, bringing total special dividends since early 2021 to $54 per share or $4.6 billion.

- Overall renewal pricing across the property and casualty group was up approximately 5% in Q3 2025, with full year 2025 premium growth anticipated in below single digits and a projected rebound in 2026.

- AFG reported Core Net Operating Earnings of $224 million, or $2.69 per share, and Net Earnings of $215 million, or $2.58 per share, for the third quarter of 2025.

- The P&C Insurance Segment generated operating earnings of $328 million , with Specialty P&C Underwriting Profit reaching $139 million and a combined ratio of 93.0%. Specialty Net Written Premiums totaled $2,252 million for the quarter.

- The company's investment portfolio had a total carrying value of $16.8 billion as of September 30, 2025.

- AFG declared a $2.00 per share special dividend, payable November 26, 2025, in addition to $66 million in regular dividends for the third quarter.

- American Financial Group reported core net operating earnings of $2.69 per share for Q3 2025, a 16% increase year-over-year, with an annualized core operating return on equity of 19%.

- The company announced a special dividend of $2 per share payable on November 26, 2025, and increased its regular quarterly dividend by 10% to $0.88 per share.

- Underwriting profit in specialty property and casualty insurance businesses grew 19% in Q3 2025, achieving a 93 combined ratio, an improvement of 1.3 points from the prior year.

- While overall gross written premiums decreased 2% and net written premiums decreased 4% year-over-year, excluding the crop business, gross written premiums grew 3% and net written premiums were flat.

- AFG anticipates 2026 premium growth to rebound and expects to continue generating significant excess capital through 2025 and into 2026.

- American Financial Group, Inc. reported net earnings of $215 million and core net operating earnings of $224 million for Q3 2025.

- Diluted earnings per share were $2.58 and core net operating earnings per share were $2.69 for Q3 2025.

- Property and Casualty net written premiums reached $2,252 million in Q3 2025.

- The Property and Casualty combined ratio was 93.1% for Q3 2025.

- Book value per share, excluding AOCI, stood at $57.59 as of September 30, 2025.

Quarterly earnings call transcripts for AMERICAN FINANCIAL GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more