Earnings summaries and quarterly performance for ASGN.

Executive leadership at ASGN.

Ted Hanson

Chief Executive Officer

Jennifer Painter

Senior Vice President, Chief Legal Officer and Secretary

Marie Perry

Executive Vice President, Chief Financial Officer

Rand Blazer

Executive Vice Chairman

Rose Cunningham

Vice President, Chief Accounting Officer and Controller

Shiv Iyer

President

Board of directors at ASGN.

Arshad Matin

Chair of the Board

Brian Callaghan

Director

Carol Lindstrom

Director

Edwin Sheridan IV

Director

Jonathan Holman

Director

Joseph Dyer

Director

Maria Hawthorne

Director

Mark Frantz

Director

Patricia Obermaier

Director

Research analysts who have asked questions during ASGN earnings calls.

Tobey Sommer

Truist Securities, Inc.

8 questions for ASGN

Surinder Thind

Jefferies Financial Group

7 questions for ASGN

Jeffrey Silber

BMO Capital Markets

5 questions for ASGN

Kevin McVeigh

Credit Suisse Group AG

5 questions for ASGN

Mark Marcon

Baird

5 questions for ASGN

Alexander Sinatra

Robert W. Baird & Co.

3 questions for ASGN

Jason Haas

Wells Fargo

3 questions for ASGN

Joseph Vafi

Canaccord Genuity - Global Capital Markets

3 questions for ASGN

Maggie Nolan

William Blair & Company, L.L.C.

3 questions for ASGN

Ryan Griffin

BMO Capital Markets

2 questions for ASGN

Trevor Romeo

William Blair

2 questions for ASGN

Maggie Nolan

William Blair

1 question for ASGN

Margaret Nolan

William Blair & Company

1 question for ASGN

Ryan Krueger

KBW

1 question for ASGN

Recent press releases and 8-K filings for ASGN.

- ASGN has appointed Sangita Singh as President, India and International, a newly created role to accelerate the company's global growth strategy and expand its offshore delivery and digital engineering capabilities.

- This appointment follows ASGN's recent announcement of its intent to acquire Quinnox, an agile digital solutions provider with a strong offshore delivery footprint in India, underscoring ASGN's commitment to building a scaled global delivery platform.

- Singh brings over three decades of experience from major technology and consulting organizations, including Microsoft India, IBM, Infosys, and Wipro, and will establish India-based go-to-market operations and oversee international expansion.

- ASGN is preparing to transition to the Everforth brand in the first half of 2026, unifying its six brands under a single identity.

- ASGN Incorporated announced leadership changes, appointing Ashish Jandial as President, Commercial North America, and Sangita Singh as President, India and International, while Sean Casey will transition to an Executive Advisor role.

- These appointments are part of ASGN's "Next Wave Growth Strategy" to enhance leadership, scale commercial operations, and strengthen digital engineering and offshore delivery capabilities, aligning with its intent to acquire Quinnox and focus on AI-enabled services.

- ASGN plans to rebrand as Everforth and consolidate its six existing brands under this new name in the first half of 2026.

- At the time of the announcements, ASGN's stock was trading near its 52-week low of $39.25, having declined about 42% over the past year, despite the company remaining profitable with roughly $3.98 billion in annual revenue and positive free cash flow.

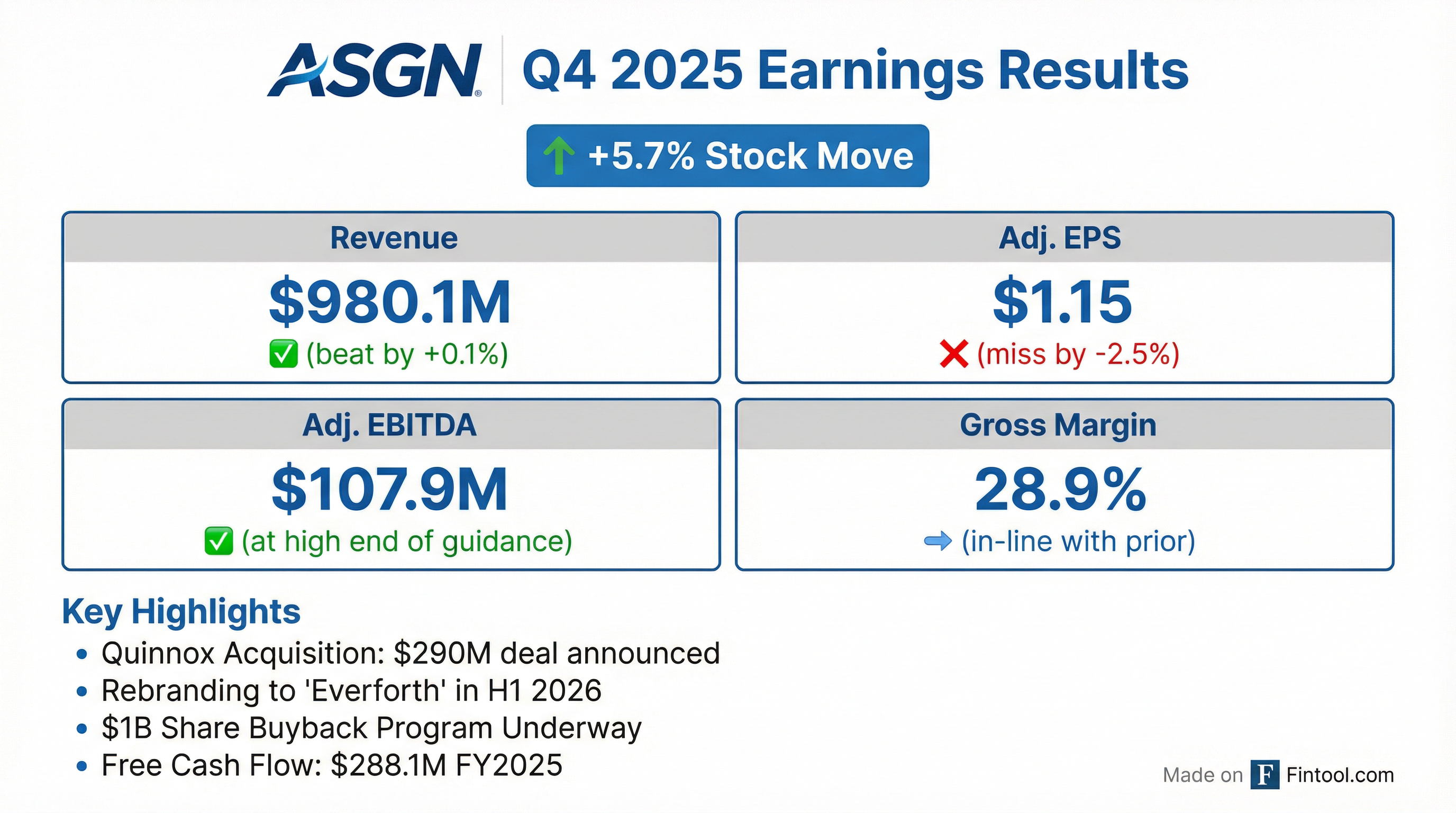

- ASGN Incorporated reported Q4 2025 revenues of $980.1 million and full year 2025 revenues of $3,980.4 million, with net income of $25.2 million for Q4 2025 and $113.5 million for the full year ended December 31, 2025.

- On January 20, 2026, the company announced a definitive agreement to acquire Quinnox Inc. for $290 million in cash, which is expected to enhance its digital engineering and complex global delivery capabilities.

- ASGN is transitioning its brand to Everforth in the first half of 2026, unifying its six brands under a new customer and investor-facing identity.

- For Q1 2026, ASGN estimates revenues between $960.0 million and $980.0 million, and net income between $25.8 million and $29.4 million. The company also repurchased 1.4 million shares for $64.2 million in Q4 2025.

- ASGN reported Q4 2025 revenues of $980.1 million and an adjusted EBITDA margin of 11%, with IT consulting revenues comprising 63% of the total. The company generated $93.7 million in free cash flow and repurchased $64.2 million in shares during the quarter.

- The company announced the acquisition of Quinnox for $290 million in cash, expected to close in March 2026, which is anticipated to increase the net leverage ratio to approximately 2.9 times post-acquisition. Quinnox is expected to generate approximately $100 million in 2025 revenues with low- to mid-teens growth in 2026 and low 20% adjusted EBITDA margins.

- For Q1 2026, ASGN estimates revenues between $960 million and $980 million, and adjusted EBITDA between $93.5 million and $98.5 million, with an adjusted EBITDA margin of 9.7% to 10.1%. This guidance does not include Quinnox's contribution.

- ASGN also announced a new $1 billion share repurchase program and plans to launch a new unified brand, Everforth, in the first half of 2026.

- ASGN reported Q4 2025 revenues of $980.1 million and full-year 2025 revenues of $3,980.4 million. Diluted earnings per share were $0.59 for Q4 2025 and $2.60 for the full year 2025.

- The company's Adjusted EBITDA was $107.9 million in Q4 2025 and $422.6 million for the full year 2025.

- For Q1 2026, ASGN estimates revenues between $960.0 million and $980.0 million, with diluted earnings per share projected to be between $0.62 and $0.71.

- As of December 31, 2025, ASGN had a total leverage ratio of 2.78 to 1 and a net leverage ratio of 2.40 to 1. The company also used $170.1 million for stock repurchases in 2025.

- ASGN reported Q4 2025 revenues of $980.1 million, at the top end of its guidance range, with an Adjusted EBITDA margin of 11%, exceeding expectations. The company generated $93.7 million in free cash flow and repurchased $64.2 million in shares during the quarter.

- The company announced the acquisition of Quinnox for $290 million in cash, expected to close in March 2026, which will enhance digital engineering and global delivery capabilities. Quinnox is projected to contribute $100 million in 2025 revenues with low- to mid-teens growth in 2026 and low 20% adjusted EBITDA margins.

- For Q1 2026, ASGN anticipates revenues between $960 million and $980 million and Adjusted EBITDA between $93.5 million and $98.5 million, with an Adjusted EBITDA margin of 9.7%-10.1%. This guidance does not include contributions from Quinnox.

- ASGN is implementing a rebranding to Everforth in the first half of 2026 and expects to achieve $80 million in structural cost savings over three years. The company also approved a new $1 billion share repurchase program.

- ASGN reported Q4 2025 revenues of $980.1 million and an Adjusted EBITDA margin of 11%, both at the top end or exceeding expectations.

- The company announced the acquisition of Quinnox for $290 million in cash, expected to close in March 2026, which will enhance digital engineering capabilities and is anticipated to be accretive. Post-acquisition, the net leverage ratio is projected to be 2.9x.

- ASGN generated $93.7 million in free cash flow in Q4 2025 and repurchased $64.2 million in shares.

- For Q1 2026, ASGN provided guidance of revenues between $960 million and $980 million and Adjusted EBITDA between $93.5 million and $98.5 million.

- The company is also adopting a new unified brand, Everforth, in the first half of 2026, to support its transition towards higher-value technology and digital engineering solutions, with AI being a dominant driver of demand.

- ASGN reported Q4 2025 revenues of $980.1 million and full-year 2025 revenues of $4.0 billion, with Adjusted EBITDA of $107.9 million (11.0% margin) for Q4 and $422.6 million (10.6% margin) for the full year.

- The company generated $288.1 million in Free Cash Flow for the full year 2025 and repurchased 3.1 million shares for $170.1 million during the same period.

- On January 20, 2026, ASGN announced a definitive agreement to acquire Quinnox Inc. for $290 million in cash.

- For Q1 2026, ASGN estimates revenues between $960.0 million and $980.0 million and Adjusted EBITDA between $93.5 million and $98.5 million.

- ASGN is transitioning its brand to Everforth in the first half of 2026.

- ASGN Incorporated has signed a definitive agreement to acquire Quinnox Inc., a digital solutions provider, for $290 million in cash. The transaction is expected to close in March 2026 and is anticipated to be accretive to Adjusted EPS in the first full year post close. Quinnox generated approximately $100 million in revenue in 2025 and expects low-to-mid teens revenue growth in 2026.

- The company reconfirmed that it expects Q4 2025 revenues to be at the high end of the previously announced guidance range of $960 million to $980 million. Adjusted EBITDA for Q4 2025 is also expected to be at the high end of the previously announced range of $102 million to $107 million.

- During Q4 2025, ASGN repurchased 1.4 million shares for $64.2 million at an average share price of $46.05 , with $972 million remaining under its $1 billion share buyback program.

- ASGN Incorporated announced its intent to rebrand to Everforth in the first half of 2026.

- ASGN Incorporated (soon to be renamed Everforth) has signed a definitive agreement to acquire Quinnox Inc., a digital solutions provider, for $290 million in cash, with the transaction expected to close in March 2026. This acquisition is intended to enhance ASGN's digital engineering and complex delivery capabilities.

- Quinnox generated approximately $100 million in revenue in 2025 and is projected to achieve low-to-mid teens revenue growth and low 20-percent Adjusted EBITDA margins in 2026. The acquisition is expected to be accretive to ASGN's Adjusted EPS in the first full year post close.

- ASGN reconfirmed its Q4 2025 financial estimates, expecting revenues to be at the high end of $960 million to $980 million and Adjusted EBITDA at the high end of $102 million to $107 million.

- During Q4 2025, ASGN repurchased 1.4 million shares for $64.2 million and has $972 million remaining under its $1 billion share buyback program.

Quarterly earnings call transcripts for ASGN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more