Earnings summaries and quarterly performance for BCE.

Research analysts who have asked questions during BCE earnings calls.

Jérome Dubreuil

Desjardins Group

8 questions for BCE

Maher Yaghi

Scotiabank

8 questions for BCE

Sebastiano Petti

JPMorgan Chase & Co.

8 questions for BCE

Vince Valentini

TD Securities

8 questions for BCE

Stephanie Price

CIBC World Markets

6 questions for BCE

Aravinda Galappatthige

Canaccord Genuity

5 questions for BCE

Drew McReynolds

RBC Capital Markets

5 questions for BCE

Matthew Griffiths

Bank of America

5 questions for BCE

Tim Casey

BMO Capital Markets

5 questions for BCE

Batya Levi

UBS

4 questions for BCE

David Barden

Bank of America

2 questions for BCE

Patrick Ho

Morgan Stanley

2 questions for BCE

Lauren Bonham

Barclays

1 question for BCE

Simon Flannery

Morgan Stanley

1 question for BCE

Recent press releases and 8-K filings for BCE.

- BCE's strategic priorities for the new year remain consistent: balanced capital allocation, strengthening the balance sheet, de-leveraging, and funding strategic growth opportunities focused on customer experience, digital transformation, AI, and network investments.

- The company aims to reach 3.5 leverage by next year through free cash flow generation, EBITDA growth, and asset sales, including considering tower monetization. There is no expectation for a dividend increase over the three-year horizon due to the focus on deleveraging and funding growth.

- BCE continues to build fiber in Canada, adding hundreds of thousands of new locations annually, and anticipates significant penetration growth in newer fiber footprints, where more tenured areas are already 50% or more penetrated.

- In the U.S., BCE plans to ramp up its Ziply fiber build to achieve 3 million homes by 2028, leveraging its expertise in fiber deployment.

- Churn improved by 17 basis points in Q4, driven by enhanced customer experience and network quality. The company is also targeting CAD 1.5 billion in cost efficiencies through technology leverage and automation.

- BCE's priorities remain consistent: balanced capital allocation, strengthening the balance sheet, de-leveraging, and funding strategic growth opportunities, including digital transformation, AI, and network investments.

- In the wireless market, Q1 2026 has seen increased promotional activity, but BCE's strategy focuses on long-term customer value and churn improvement, with churn improving by 17 basis points in Q4 year-over-year.

- BCE continues to expand its fiber footprint in Canada, building hundreds of thousands of new fiber locations annually, and aims to build 3 million homes in the U.S. by 2028 through Ziply, with permitting being the main obstacle.

- The company's deleveraging plan targets 3.5 leverage by next year (2027) through free cash flow, EBITDA growth, and non-core asset sales, with no expectation for a dividend increase over the three-year horizon.

- BCE's priorities for 2026 include balanced capital allocation, strengthening the balance sheet to achieve 3.5 leverage by 2027, and funding strategic growth opportunities, with no expectation for a dividend increase over the next three years.

- The company reported 17 basis points of churn improvement in Q4 2025, marking the third consecutive quarter of improvement, primarily driven by enhanced network, service, and customer experience rather than hardware upgrades.

- BCE is focused on fiber expansion, continuing to build fiber in Canada (a couple hundred thousand per year) and significantly ramping up its US Ziply fiber build to reach 3 million homes by 2028, with a strong increase in pace expected in H2 2026 and beyond.

- BCE is targeting CAD 1.5 billion in cost efficiencies by leveraging technology, such as AI in customer care and network automation, to eliminate manual work and friction, aiming to provide better service at a lower cost.

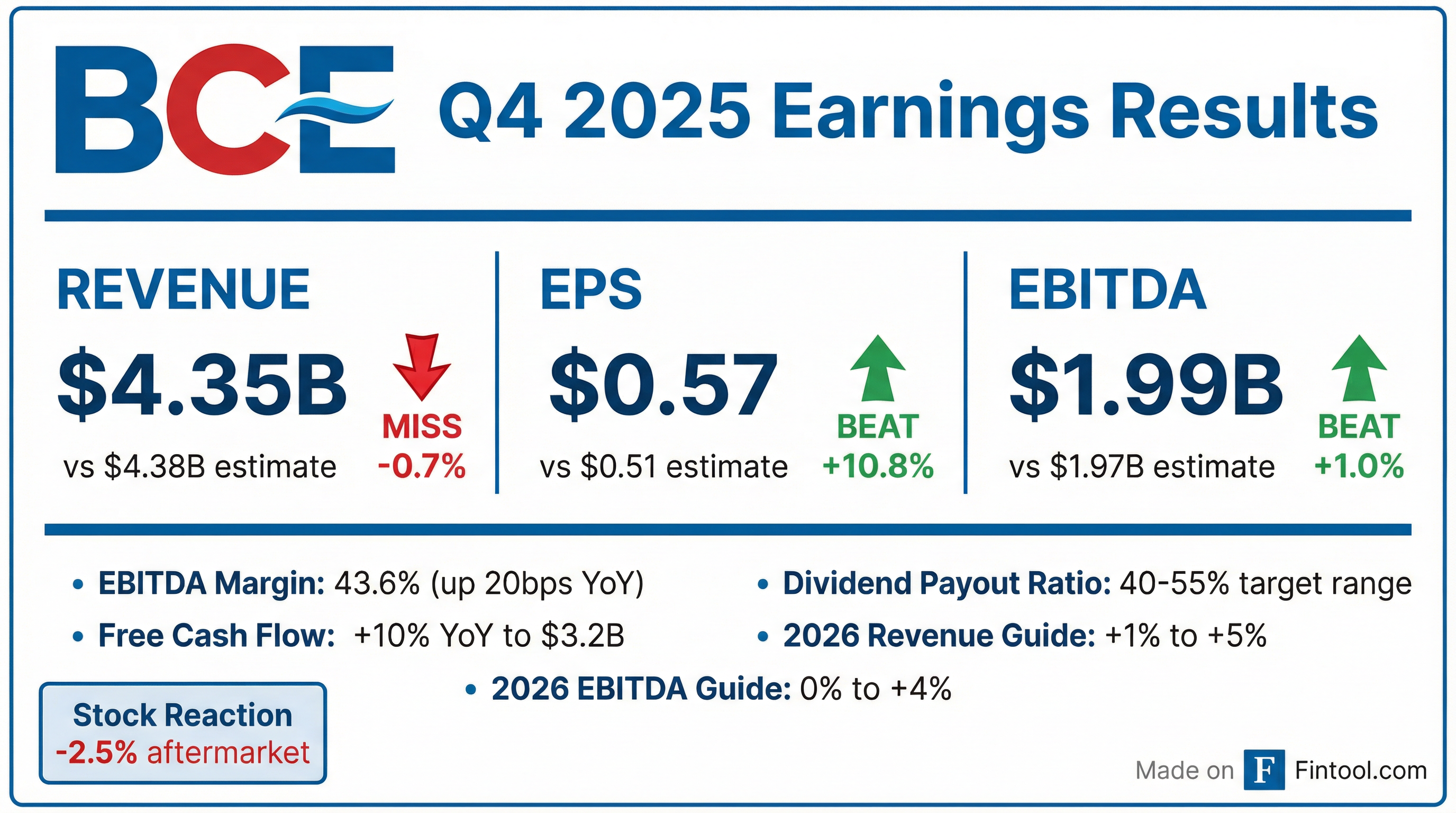

- BCE met its 2025 financial guidance, reporting 0.6% service revenue growth and 0.7% adjusted EBITDA growth, achieving a 43.6% adjusted EBITDA margin. Free cash flow increased 10% to CAD 3.2 billion.

- For 2026, BCE forecasts consolidated revenue growth of 1%-5% and adjusted EBITDA growth of 0%-4%. Adjusted EPS is projected at CAD 2.5-CAD 2.65 per share, a 5%-11% decline year-over-year, primarily due to increased depreciation and interest expenses.

- The company anticipates free cash flow growth of 4%-10% in 2026, with capital expenditures stable at approximately CAD 3.7 billion, targeting a capital intensity of 15% or less.

- Strategic growth areas demonstrated strong performance in 2025, with AI-powered solutions revenue growing 60% to CAD 700 million and Crave adding over 1 million subscribers to reach 4.6 million. Postpaid wireless churn improved by 17 basis points in Q4 2025.

- BCE maintained a net debt leverage ratio of approximately 3.8 times adjusted EBITDA at year-end 2025 and is targeting 3.5x by the end of 2027.

- BCE achieved its 2025 financial guidance targets, with service revenue increasing 0.6% and Adjusted EBITDA up 0.7%, resulting in a 43.6% adjusted EBITDA margin. Free cash flow grew 10% to CAD 3.2 billion, while adjusted EPS declined 7.9%.

- For 2026, BCE projects consolidated revenue growth of 1%-5% and adjusted EBITDA growth of 0%-4%. Adjusted EPS is expected to be between CAD 2.5-CAD 2.65 per share, representing a 5%-11% decline year-over-year, mainly due to higher depreciation and interest expenses.

- Strategic growth drivers include fiber and AI-powered solutions; 200,000 net new fiber subscribers were added in 2025. AI-powered solutions revenue grew 60% to CAD 700 million in 2025, targeting CAD 1.5 billion by 2028. The Ziply Fiber expansion plan will accelerate in H2 2026, aiming for 3 million fiber passings by end of 2028.

- Capital expenditures decreased by CAD 197 million to CAD 3.7 billion in 2025, with capital intensity at 15.1%. The net debt leverage ratio remained 3.8x at year-end 2025, with a target to reach 3.5x by the end of 2027.

- BCE achieved all 2025 financial guidance targets, reporting a 0.6% increase in service revenue and a 0.7% increase in Adjusted EBITDA for the year, resulting in a 43.6% margin. Free cash flow grew 10% to CAD 3.2 billion.

- In Q4 2025, the company recorded 56,124 postpaid wireless net adds and 43,000 fibre-to-the-home internet net adds, with postpaid churn improving 17 basis points to 1.49%.

- BCE provided 2026 guidance, expecting consolidated revenue growth of 1%-5% and Adjusted EBITDA growth of 0%-4%. Adjusted EPS is projected to decline 5%-11% to CAD 2.5-CAD 2.65 per share due to higher depreciation and interest expenses.

- Strategic initiatives in 2025 included AI-powered solutions revenue growing 60% to CAD 700 million, targeting CAD 1.5 billion by 2028. Crave subscribers increased by over 1 million, reaching 4.6 million.

- The Ziply Fiber acquisition contributed $232 million in Q4 revenue and $100 million in EBITDA , with plans to reach 3 million fibre passings by 2028. The net debt leverage ratio was 3.8x adjusted EBITDA at year-end 2025, with a target of 3.5x by end of 2027.

- BCE anticipates EBITDA dollar growth and relatively stable percent margins from 2025 to 2028, driven by a shift towards growth areas like wireless, internet, and AI-powered solutions, moving away from legacy services.

- The company is focused on achieving 15% free cash flow growth and deleveraging over the 2025-2028 period, supported by funding new businesses, including OpEx for AI-powered solutions.

- In the Canadian market, BCE expects RPU (Revenue Per User) growth to begin in the back end of 2026, as new contracts are being signed at higher monthly recurring charges.

- BCE plans to build fiber to 8 million homes pass in the US, strategically competing against cable providers and avoiding overbuilding existing fiber networks.

- The company maintains a higher bar for capital investments within its $3.7 billion CapEx budget (for 2025 and similar in 2028), prioritizing opportunities in AI-powered solutions, US fiber, and Canadian fiber for strong returns.

- BCE anticipates a resumption of EBITDA growth and 15% free cash flow growth over the 2025-2028 period, with overall percent margins expected to remain relatively stable.

- The company projects blended RPU growth to turn positive in the back end of 2026, driven by new subscriber rates that are higher than the existing base.

- BCE is committed to an 8 million homes passed fiber target in the US, focusing on competing against cable providers, and has budgeted $3.7 billion in CapEx for 2025 to prioritize high-return growth initiatives in AI and fiber.

- The Canadian telecom market is described as returning to a more rational competitive environment, and the B2B segment is outperforming, nearing a break-even point from legacy product turnover.

- BCE Inc. reported net earnings of $4,555 million for Q3 2025, a substantial increase from a net loss of ($1,191 million) in Q3 2024, primarily due to higher gains on investments from the sale of its minority stake in Maple Leaf Sports and Entertainment Ltd. (MLSE) and lower impairment of assets.

- Operating revenues grew by 1.3% to $6,049 million in Q3 2025, and Adjusted EBITDA increased by 1.5% to $2,762 million, partly driven by the acquisition of Ziply Fiber on August 1, 2025.

- Free cash flow rose by 20.6% to $1,003 million in Q3 2025, while capital expenditures decreased by 6.6% to $891 million.

- BCE reported Q3 2025 consolidated revenue growth of 1.3%, adjusted EBITDA growth of 1.5% (reaching a 45.7% margin), and adjusted EPS growth of 5.3%.

- The new Bell CTS U.S. segment, reflecting Ziply Fiber's operations since August 1st, generated $160 million in revenue and $71 million in EBITDA, with a 44.4% margin.

- AI-powered solutions revenue increased 34% year-over-year in Q3 2025, and the company is on track to generate approximately $700 million in AI-powered solutions revenue for the full year 2025.

- BCE's net debt leverage ratio stood at approximately 3.8x adjusted EBITDA at the end of Q3 2025, with a strategic goal to reduce it to 3.5x by the end of 2027 and 3.0x by 2030.

- The company reconfirmed all its financial guidance targets for 2025.

Fintool News

In-depth analysis and coverage of BCE.

Quarterly earnings call transcripts for BCE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more