Earnings summaries and quarterly performance for Brookfield Renewable Partners.

Research analysts who have asked questions during Brookfield Renewable Partners earnings calls.

Nelson Ng

RBC Capital Markets

8 questions for BEP

Sean Steuart

TD Securities

7 questions for BEP

Robert Hope

Scotiabank

6 questions for BEP

Benjamin Pham

BMO Capital Markets

5 questions for BEP

Mark Jarvi

CIBC Capital Markets

5 questions for BEP

Baltej Sidhu

National Bank of Canada

3 questions for BEP

Mark W. Strouse

J.P. Morgan Chase & Co.

3 questions for BEP

Anthony Crowdell

Mizuho Financial Group

2 questions for BEP

Christine Cho

Goldman Sachs Group

2 questions for BEP

Jessica Hoyle

Scotiabank

1 question for BEP

Jon Windham

UBS Group AG

1 question for BEP

Mark Jarvey

CIBC

1 question for BEP

Rupert Merer

National Bank Financial, Inc.

1 question for BEP

William Grippin

UBS Group AG

1 question for BEP

Recent press releases and 8-K filings for BEP.

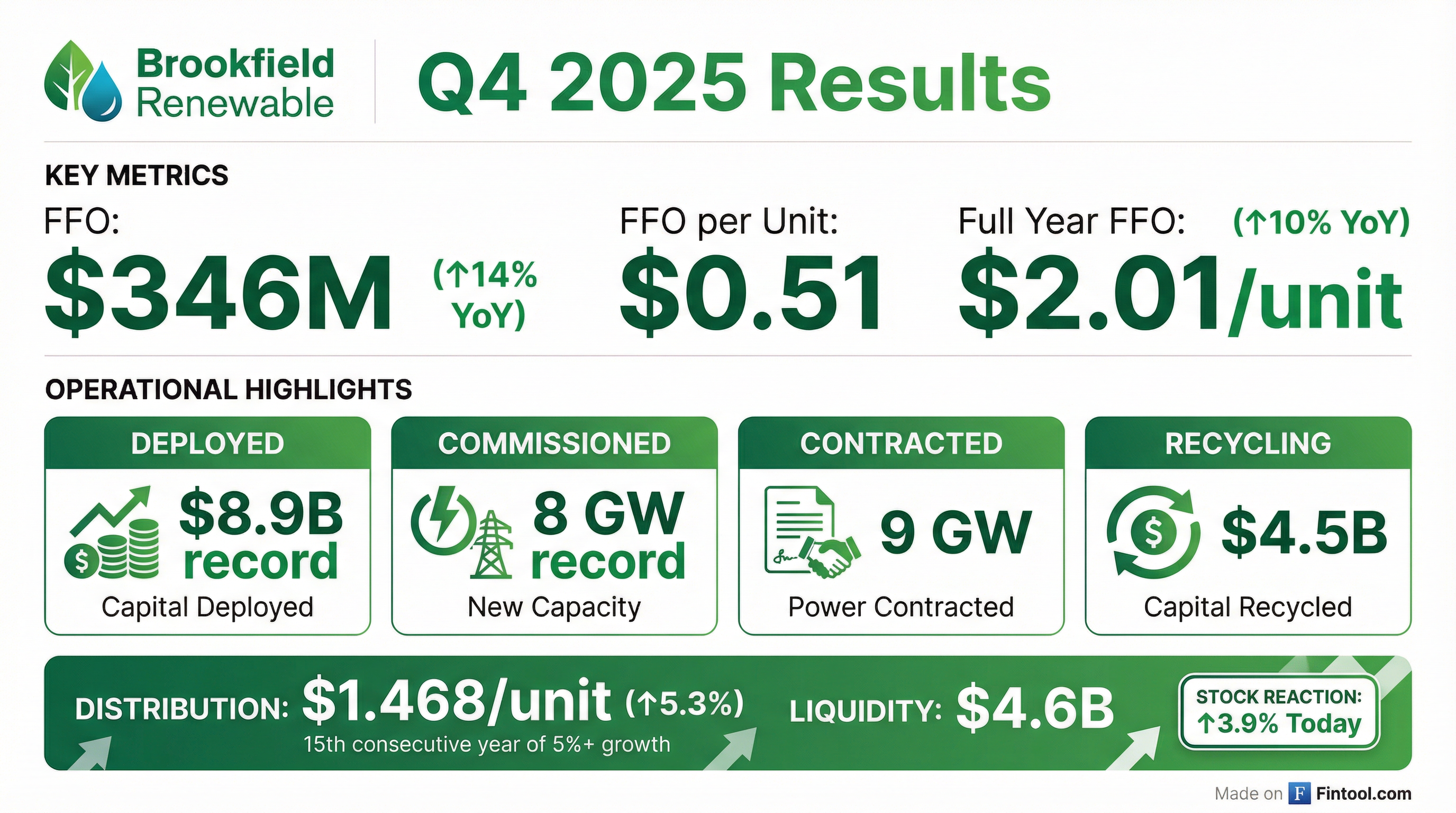

- Brookfield Renewable (BEP) delivered strong financial results for 2025, with FFO per unit of $0.51 in Q4 and $2.01 for the full year, marking a 10% year-over-year increase.

- The company deployed or committed a record $8.9 billion in growth capital, highlighted by the privatization of Neoen and carve-out of Geronimo Power, and generated record asset recycling proceeds of $4.5 billion.

- BEP ended 2025 with a strong balance sheet, holding $4.6 billion in available liquidity, and announced an over 5% increase in its annual distribution to $1.468 per unit, marking 15 consecutive years of growth.

- The company plans to quadruple its battery storage capacity to over 10 gigawatts in the next three years, driven by the Neoen acquisition and increasing energy demand from electrification and AI.

- Brookfield Renewable Partners (BEP) delivered $2.01 of FFO per unit in 2025, marking a 10% year-over-year increase and aligning with its long-term growth target.

- The company deployed or committed a record $8.9 billion in growth capital in 2025, including the privatization of Neoen and commissioning over 8 gigawatts of new capacity.

- BEP generated record proceeds of $4.5 billion ($1.3 billion net to BEP) from asset recycling in 2025, and further agreed to sell a two-thirds stake in a North American wind and solar portfolio for $860 million ($210 million net to BEP) in January 2026.

- The balance sheet ended 2025 with $4.6 billion in available liquidity, supported by over $37 billion in financings executed during the year and a reaffirmed BBB+ investment-grade credit rating.

- BEP announced an over 5% increase to its annual distribution, bringing it to $1.468 per unit, which marks 15 consecutive years of at least 5% annual distribution growth.

- Brookfield Renewable Partners (BEP) delivered $2.01 of FFO per unit in 2025, representing a 10% year-over-year increase, and announced an over 5% increase to its annual distribution to $1.468 per unit.

- The company deployed or committed a record $8.9 billion in growth capital in 2025 and brought online over 8 GW of new capacity globally, aiming to reach a run rate of delivering roughly 10 GW of new capacity per year by 2027.

- BEP generated record proceeds of $4.5 billion (or $1.3 billion net to BEP) from asset recycling in 2025, while ending the year with $4.6 billion in available liquidity and executing over $37 billion in financings.

- The business is strategically positioned for a period of "energy addition" driven by rising demand, with batteries identified as the fastest-growing part of its platform due to significant cost reductions.

- Brookfield Renewable Partners ULC has issued C$500,000,000 of 5.204% Medium Term Notes, Series 20, which are unsecured and mature on January 15, 2056.

- Interest on these notes will be paid in equal semi-annual installments on January 15 and July 15 of each year, commencing July 15, 2026.

- A Change of Control Triggering Event would require the Corporation to offer to repurchase the notes at 101% of the aggregate principal amount plus accrued and unpaid interest.

- The Corporation and its Guarantors are subject to a covenant that limits the Partnership's consolidated Funded Indebtedness to not exceed 75% of Total Consolidated Capitalization.

- Brookfield Renewable has agreed to issue C$500 million aggregate principal amount of Series 20 Notes, which are green bonds, due January 15, 2056, and will bear interest at a rate of 5.204% per annum.

- The Notes will be issued by Brookfield Renewable Partners ULC, a subsidiary, and will be fully and unconditionally guaranteed by Brookfield Renewable and certain of its key holding subsidiaries. The issue is expected to close on or about January 15, 2026.

- The net proceeds from this issuance, which represents Brookfield Renewable’s eighteenth green labelled corporate securities issuance in North America, are intended to fund Eligible Investments and repay related indebtedness.

- The Notes have been rated BBB+ by S&P Global Ratings, BBB (high) with a stable trend by DBRS Limited, and BBB+ by Fitch Ratings.

- Brookfield Renewable Partners L.P. (BEP) is registering 15,050,200 limited partnership units and up to 2,257,530 additional units through a prospectus supplement dated November 11, 2025.

- Legal counsel has opined that these units, when issued, will be validly issued, fully paid, and non-assessable under Bermuda law.

- For U.S. federal income tax purposes, BEP and Brookfield Renewable Energy L.P. (BRELP) are expected to be classified as a partnership and not as a corporation.

- Brookfield Renewable Partners L.P. proposes to issue 15,050,200 limited partnership units through underwriters at an offering price of $29.90 per Unit, for an aggregate purchase price of $450,000,980.

- The company has granted the underwriters an Over-Allotment Option for up to an additional 2,257,530 Units.

- A concurrent private placement will see 6,967,670 Units sold to BEP Holdings LP, a wholly-owned subsidiary of Brookfield Corporation, at a price of $28.704 per Unit.

- Brookfield Renewable Partners L.P. (BEP) announced an equity offering of US$450 million and a concurrent private placement of US$200 million, resulting in aggregate gross proceeds of approximately US$650 million.

- The LP Units are offered at a price of US$29.90 per LP Unit.

- The net proceeds from these transactions are intended to fund the recently completed acquisition of an increased stake in Isagen, future investment opportunities, and for general corporate purposes.

- The offering and concurrent private placement are expected to close on or about November 14, 2025. An over-allotment option, if fully exercised, could increase the total gross proceeds to approximately US$718 million.

- Brookfield Renewable Partners L.P. (BEP) published unaudited pro forma combined consolidated financial statements for the nine months ended September 30, 2025, and the year ended December 31, 2024, reflecting the acquisition of NGV NGR Acquisition Co LLC (Geronimo) as if it occurred on January 1, 2024.

- For the nine months ended September 30, 2025, the pro forma consolidated net loss was $(19) million, resulting in a basic and diluted loss per LP unit of $(0.84).

- The pro forma consolidated net loss for the year ended December 31, 2024, was $(101) million, with a basic and diluted loss per LP unit of $(0.94).

- NGV NGR Acquisition Co, LLC (Geronimo) reported total revenues of $106,094 thousand and a net loss of $(25,360) thousand for the quarter ended March 31, 2025.

- Geronimo's financial statements were adjusted from U.S. GAAP to International Financial Reporting Standards (IFRS) to conform with BEP's accounting policies for the pro forma presentation ,.

- Brookfield Renewable Partners (BEP) generated Funds From Operations (FFO) of $302 million, or $0.46 per unit, in Q3 2025, marking a 10% year-over-year increase, and anticipates meeting its 10%+ FFO per unit growth target for 2025.

- BEP's Westinghouse subsidiary entered a strategic partnership with the U.S. government for the construction of new nuclear power reactors in the U.S., involving an aggregate investment of at least $80 billion. This agreement includes the U.S. government receiving 20% of Westinghouse distributions after current shareholders receive $17.5 billion.

- The company commissioned 1,800 megawatts of new projects and secured contracts for an additional 4,000 gigawatt-hours per year of generation. BEP also maintained $4.7 billion in liquidity, executed $7.7 billion in financings during the quarter, and generated $2.8 billion from capital recycling activities.

Quarterly earnings call transcripts for Brookfield Renewable Partners.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more