Earnings summaries and quarterly performance for Brookfield Renewable.

Research analysts who have asked questions during Brookfield Renewable earnings calls.

Nelson Ng

RBC Capital Markets

7 questions for BEPC

Sean Steuart

TD Securities

7 questions for BEPC

Mark Jarvi

CIBC Capital Markets

6 questions for BEPC

Robert Hope

Scotiabank

6 questions for BEPC

Benjamin Pham

BMO Capital Markets

4 questions for BEPC

Baltej Sidhu

National Bank of Canada

3 questions for BEPC

Anthony Crowdell

Mizuho Financial Group

2 questions for BEPC

Mark W. Strouse

J.P. Morgan Chase & Co.

2 questions for BEPC

Rupert Merer

National Bank Financial, Inc.

2 questions for BEPC

William Grippin

UBS Group AG

2 questions for BEPC

Christine Cho

Goldman Sachs Group

1 question for BEPC

Jessica Hoyle

Scotiabank

1 question for BEPC

Jon Windham

UBS Group AG

1 question for BEPC

Mark Wesley Strouse

JPMorgan Chase & Co

1 question for BEPC

Recent press releases and 8-K filings for BEPC.

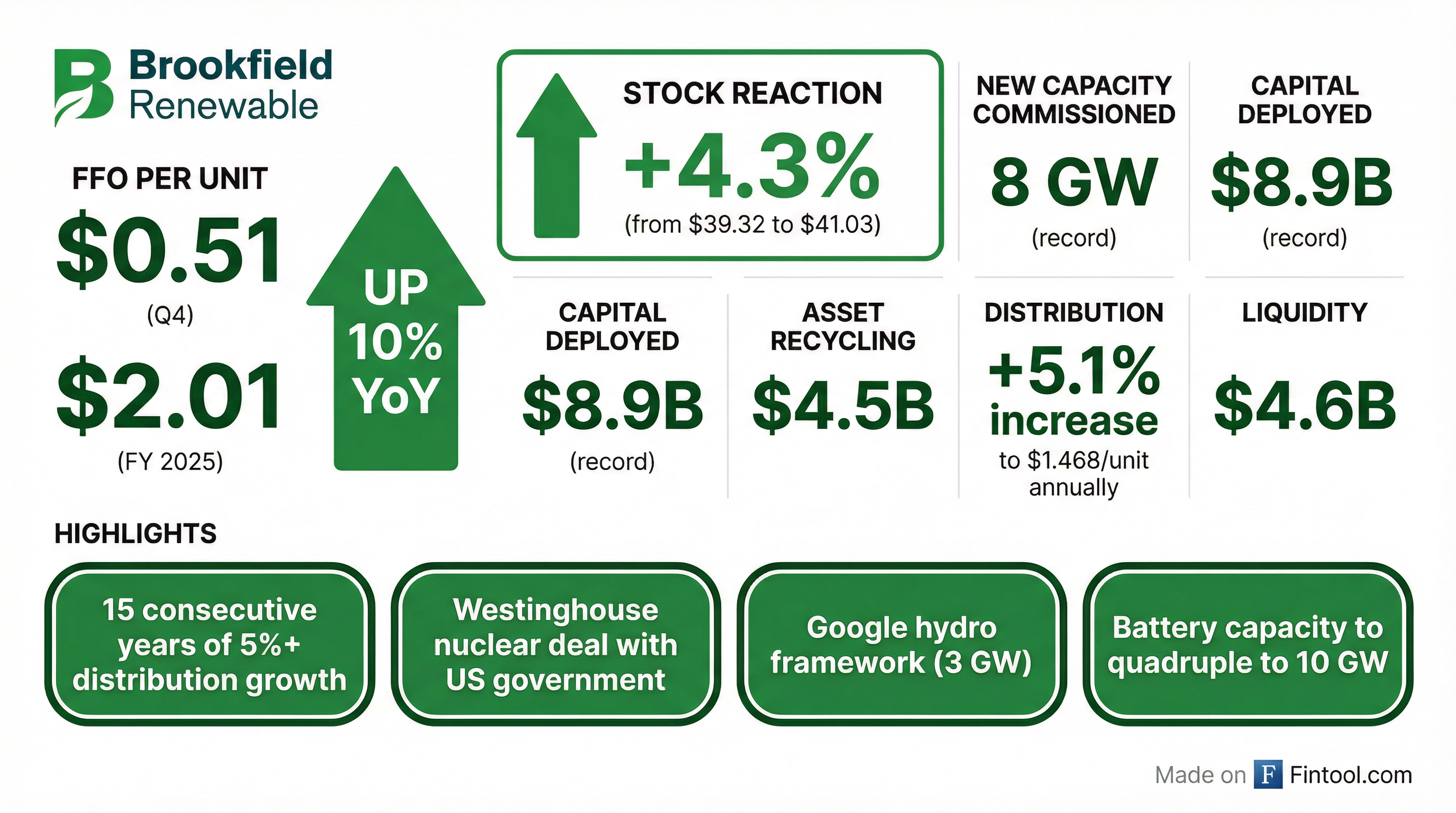

- For the full year 2025, BEPC delivered $2.01 of FFO per unit, representing a 10% year-over-year increase, and reported $346 million in FFO for Q4 2025, up 14% year-over-year, or $0.51 per unit.

- The company deployed or committed a record $8.9 billion in growth capital in 2025, with $1.9 billion net to BEP, and generated record proceeds of $4.5 billion from asset recycling, or $1.3 billion net to BEP.

- BEPC ended 2025 with $4.6 billion in available liquidity and executed over $37 billion in financings.

- The company announced an over 5% increase to its annual distribution, reaching $1.468 per unit, marking 15 consecutive years of at least 5% annual distribution growth.

- BEPC expects to quadruple its battery storage capacity over the next three years to over 10 GW and is on track to deliver approximately 10 GW of new solar and onshore wind capacity per year by 2027.

- Brookfield Renewable Partners (BEP) delivered $2.01 of FFO per unit for the full year 2025, marking a 10% year-over-year increase, and concluded the year with $4.6 billion in available liquidity.

- The company deployed or committed a record $8.9 billion in growth capital in 2025, bringing online over 8 GW of new capacity globally and signing contracts for over 9 GW of generation capacity. BEP is on track to deliver approximately 10 GW of new capacity per year by 2027.

- BEP generated record proceeds of $4.5 billion ($1.3 billion net to BEP) from its asset recycling program in 2025 and established a framework for the future sale of up to $1.5 billion of additional assets.

- The annual distribution was increased by over 5% to $1.468 per unit, continuing a trend of 15 consecutive years of at least 5% annual distribution growth.

- Strategic growth initiatives include plans to quadruple battery storage capacity to over 10 GW within the next three years and leveraging its Westinghouse investment through a landmark agreement with the U.S. government for new nuclear reactors.

- Brookfield Renewable Corporation reported a net loss of $225 million for the three months ended September 30, 2025, and a net loss of $1,677 million for the nine months ended September 30, 2025.

- Revenues for the third quarter of 2025 were $931 million, and $2,790 million for the nine months ended September 30, 2025.

- Cash flow from operating activities was $259 million for the three months ended September 30, 2025, and $508 million for the nine months ended September 30, 2025.

- The company completed a corporate Arrangement on December 24, 2024, which involved Brookfield Renewable Corporation becoming the successor issuer to the former BEPC and the delisting of BRHC's class A exchangeable subordinate voting shares.

- During the third quarter of 2025 and subsequently, the company agreed to acquire an incremental 15% ownership in Isagen S.A. E.S.P. for up to $1 billion (company's share $900 million) and agreed to sell interests in a 403 MW hydroelectric portfolio and a 700 MW distributed generation portfolio for expected proceeds of approximately $490 million each.

- Brookfield Renewable (BEPC) generated $302 million in Funds From Operations (FFO) or $0.46 per unit in Q3 2025, marking a 10% year-over-year increase, and anticipates meeting its 10%+ FFO per unit growth target for 2025.

- The company announced a strategic partnership between the U.S. government and Westinghouse, involving an aggregate investment of at least $80 billion from the U.S. government to order new Westinghouse nuclear reactors for construction in the United States.

- BEPC advanced its growth initiatives by commissioning 1,800 MW of new projects and securing contracts to deliver an additional 4,000 GWh per year of generation during the quarter.

- Accelerating demand from hyperscalers is creating significant opportunities, including increased interest in BEPC's hydro capacity, with five terawatt hours of generation available for recontracting, and a new 20-year contract signed with Microsoft for a hydro asset.

- Brookfield Renewable (BEPC) reported $302 million in FFO, or $0.46 per unit, for Q3 2025, representing a 10% year-over-year increase, and continues to target 10%+ FFO per unit growth for 2025.

- In October 2025, BEPC's Westinghouse subsidiary announced a strategic partnership with the U.S. government, which intends to invest at least $80 billion in new Westinghouse nuclear reactors in the United States. This partnership is expected to contribute significant earnings growth to Westinghouse, with revenues starting in the next couple of quarters and ramping up over 3-4 years.

- The company commissioned 1,800 megawatts of new projects and signed contracts for an additional 4,000 gigawatt-hours per year of generation during Q3 2025. Accelerating demand from hyperscalers and reindustrialization is driving growth across nuclear, hydro, and battery storage, with nuclear projects targeting returns significantly above the company's 12-15% blended target.

- Brookfield Renewable (BEPC) generated $302 million of FFO, or $0.46 per unit, in Q3 2025, marking a 10% year-over-year increase, and continues to expect to deliver on its 10%+ FFO per unit growth target for 2025.

- The company announced a strategic partnership between Westinghouse and the U.S. government, under which the U.S. government will order new Westinghouse nuclear power reactors to be built in the United States with an aggregate investment value of at least $80 billion. This agreement aims to reinvigorate the nuclear power industrial base and is expected to contribute significant earnings growth to Westinghouse, with its energy systems division historically operating at at least a 20% margin during development and construction.

- Brookfield is experiencing accelerating demand for power from hyperscalers, leading to increased opportunities in hydro capacity, including a new 20-year contract with Microsoft for a hydro asset, and has advanced its battery storage strategy with the delivery of a 340-megawatt battery in Australia.

- Nuclear currently represents approximately 5% of Brookfield Renewable's FFO but is expected to grow, with target returns for nuclear projects being well and meaningfully above the 12-15% blended target for the business.

Quarterly earnings call transcripts for Brookfield Renewable.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more