Earnings summaries and quarterly performance for POPULAR.

Executive leadership at POPULAR.

Javier D. Ferrer

President and Chief Executive Officer

Beatriz Castellví

Executive Vice President and Chief Security Officer

Camille Burckhart

Executive Vice President, Chief Information and Digital Strategy Officer

Eduardo J. Negrón

Executive Vice President and Chief Administration Officer

Eli S. Sepúlveda

Executive Vice President, Commercial Credit and Services Group

Gilberto Monzón

Executive Vice President, Specialized Businesses Group

Jorge J. García

Executive Vice President and Chief Financial Officer

José R. Coleman Tió

Executive Vice President and Chief Legal Officer

Lidio V. Soriano

Executive Vice President and Chief Risk Officer

Luis E. Cestero

Executive Vice President, Retail and Business Solutions Group

Manuel Chinea

Executive Vice President and Chief Operating Officer of Popular Bank

María Cristina González

Executive Vice President and Chief Communications and Public Affairs Officer

Board of directors at POPULAR.

Alejandro M. Ballester

Director

Alejandro M. Sánchez

Director

Bertil E. Chappuis

Director

Betty DeVita

Director

C. Kim Goodwin

Director

Carlos A. Unanue

Director

José R. Rodríguez

Director

María Luisa Ferré Rangel

Lead Independent Director

Myrna M. Soto

Director

Richard L. Carrión

Chair of the Board

Robert Carrady

Director

Research analysts who have asked questions during POPULAR earnings calls.

Kelly Motta

Keefe, Bruyette & Woods

9 questions for BPOP

Jared Shaw

Barclays

8 questions for BPOP

Timur Braziler

Wells Fargo

8 questions for BPOP

Gerard Cassidy

RBC Capital Markets

6 questions for BPOP

Arren Cyganovich

Truist

4 questions for BPOP

Ben Gerlinger

Citigroup

4 questions for BPOP

Brett Rabatin

Hovde Group, LLC

4 questions for BPOP

Frank Schiraldi

Piper Sandler

3 questions for BPOP

Benjamin Gerlinger

Citigroup Inc.

2 questions for BPOP

Thomas Leddy

RBC Capital Markets

2 questions for BPOP

Brandon Berman

Bank of America

1 question for BPOP

Forrest Hamilton

RBC Capital Markets

1 question for BPOP

Jared David Shaw

Barclays Capital

1 question for BPOP

Manuel Navas

D.A. Davidson & Co.

1 question for BPOP

Michael Navas

Piper Sandler

1 question for BPOP

Samuel Varga

UBS

1 question for BPOP

Recent press releases and 8-K filings for BPOP.

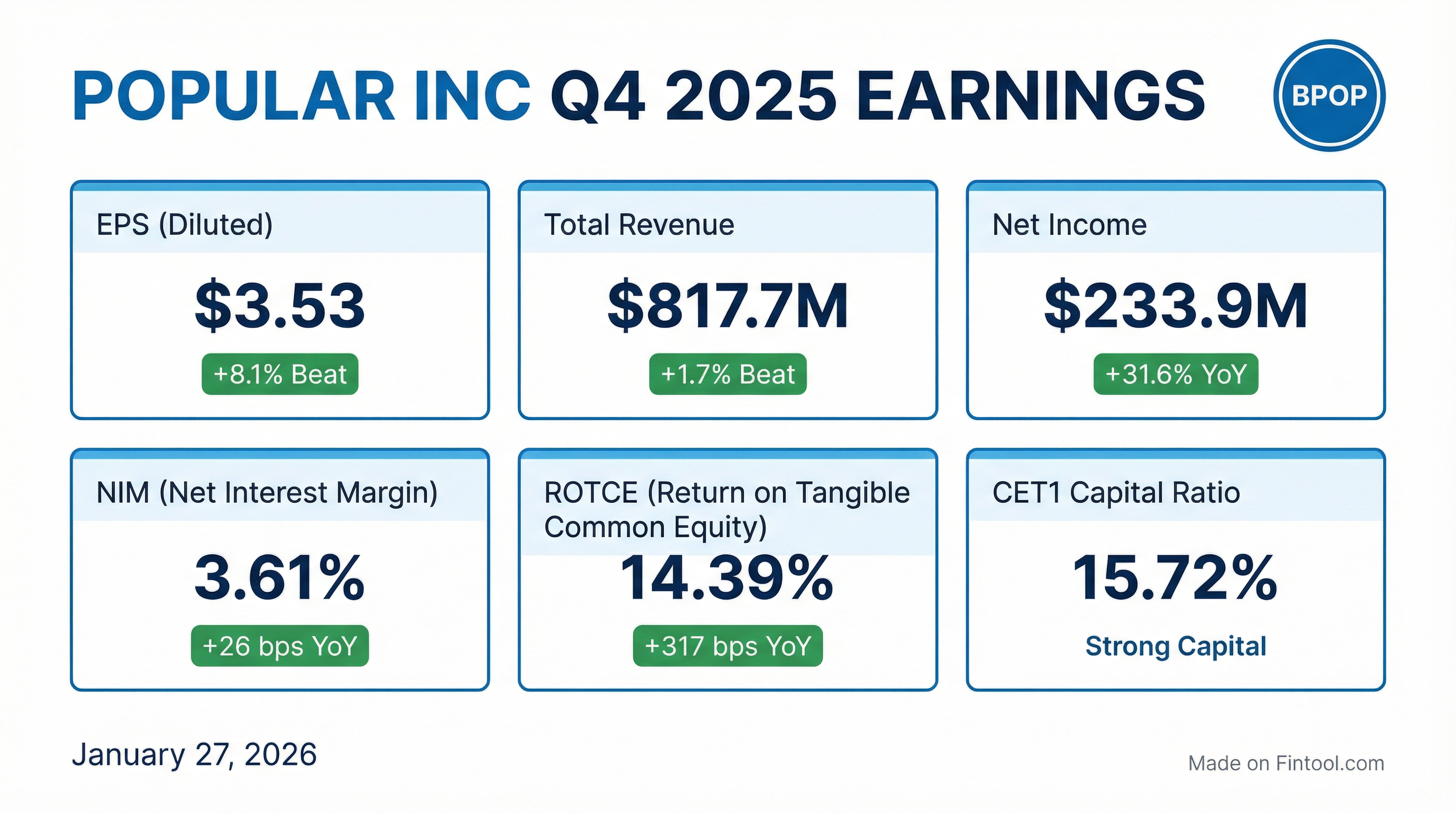

- Popular (BPOP) reported annual net income of $833 million for 2025, a 36% increase year-over-year, with Q4 2025 net income of $234 million and EPS of $3.53. The company achieved a 13% Return on Tangible Common Equity (ROTCE) for the full year and over 14% for Q4, aiming for a sustainable 14% ROTCE.

- The company saw total loan growth of $2.2 billion (6%) in 2025, including $641 million in Q4, and projects 3%-4% consolidated loan growth for 2026. Net Interest Income (NII) grew 11% in 2025 and is expected to increase 5%-7% in 2026, with Q4 Net Interest Margin (NIM) expanding 10 basis points to 3.61% (GAAP).

- Popular maintained a strong Common Equity Tier 1 ratio of 15.7% and repurchased $500 million in common stock during 2025, including $148 million in Q4. The quarterly common stock dividend was increased by $0.05 to $0.75 per share. Credit quality remained stable, with 2025 net charge-offs at 52 basis points, improving 16 basis points from the prior year, and a 2026 forecast of 55-70 basis points.

- BPOP reported net income of $234 million and EPS of $3.53 for Q4 2025. The company exceeded a 14% Return on Tangible Common Equity (ROTCE) for the quarter and achieved 13% ROTCE for the full year. Tangible book value per share reached $83.65 at the end of the quarter.

- The Common Equity Tier 1 ratio stood at 15.7% at year-end. BPOP repurchased approximately $148 million in common stock during Q4 2025, with $281 million remaining on the authorization as of December 31st. The quarterly common stock dividend was increased by $0.05 to $0.75 per share.

- For 2026, BPOP expects consolidated loan growth of 3%-4% and anticipates Net Interest Income (NII) to increase by 5%-7%. Full-year GAAP operating expenses are projected to increase by approximately 3% compared to 2025 , and quarterly non-interest income is guided to be between $160 million-$165 million.

- **Popular, Inc. (BPOP) reported a full-year 2025 net income of $833 million, a 36% increase compared to 2024, and Q4 2025 net income of $234 million with an EPS of $3.53. ** The company achieved a full-year Return on Tangible Common Equity (ROTCE) of 13% and exceeded 14% ROTCE for Q4 2025.

- **Loan growth for the full year 2025 was $2.2 billion, an increase of 6%, with Q4 loan growth of $641 million. ** Consolidated loan growth is projected to be **3%-4% for 2026. ** Net interest income (NII) increased by 11% for the full year 2025 and is expected to increase **5%-7% in 2026. **

- **Capital levels remained strong, with a Common Equity Tier 1 ratio of 15.7% at year-end 2025. ** The company repurchased approximately $500 million in common stock during 2025 and increased its quarterly common stock dividend to **$0.75 per share in Q4 2025. **

- **Credit quality remained stable in Q4 2025, with net charge-offs at 52 basis points for the full year 2025. ** The outlook for annual net charge-offs in 2026 is projected to be **55-70 basis points. **

- For Q4 2025, BPOP reported Net Income of $234 million and EPS of $3.53, contributing to full-year 2025 Net Income of $833 million and EPS of $12.31. The Net Interest Margin (NIM) for Q4 2025 was 3.61%, increasing 10 basis points from Q3 2025, with the full-year NIM at 3.49%.

- Loans held in portfolio grew by $2.2 billion or 6.0% for the full year 2025, driven by commercial, construction, and mortgage loans. Total deposits also increased by $1.3 billion or 2.0% for the full year.

- The company authorized a new $500 million common stock repurchase program in Q3 2025, repurchasing $502 million by year-end. Additionally, the quarterly common stock dividend was increased from $0.70 to $0.75 per share.

- Credit quality showed improvement, with the Non-Performing Loans (NPL) Ratio decreasing to 1.27% in Q4 2025 from 1.30% in Q3 2025, and the Net Charge-Off (NCO) Ratio was 0.51%.

- Popular, Inc. reported net income of $233.9 million and EPS of $3.53 for Q4 2025, an increase from $211.3 million and $3.15 in Q3 2025, respectively. For the full year 2025, net income reached $833.2 million and EPS was $12.31, up from $614.2 million and $8.56 in 2024.

- Net interest income for Q4 2025 increased by $11.0 million to $657.6 million compared to Q3 2025, with the net interest margin improving to 3.61% from 3.51%.

- The company repurchased 1,252,303 shares of common stock for $147.8 million in Q4 2025 and declared a quarterly common stock dividend of $0.75 per share. As of December 31, 2025, $281.2 million remained available for stock repurchases under the active authorization.

- For 2026, Popular, Inc. provided guidance including a 5%-7% increase in net interest income, $160 million - $165 million in non-interest income per quarter, and loan growth of 3%-4%.

- Popular, Inc. reported a net income of $233.9 million in Q4 2025, an increase from $211.3 million in Q3 2025, with diluted earnings per share of $3.53. The company achieved a Return on average tangible common equity (ROTCE) of 14.39% for Q4 2025 and 13.04% for the full year 2025.

- Net interest income increased by $11.0 million to $657.6 million in Q4 2025, contributing to an improved net interest margin of 3.61% (up from 3.51% in Q3 2025), while operating expenses decreased to $473.2 million.

- Loans held-in-portfolio grew by $640.4 million to $39.3 billion in Q4 2025, although total deposits saw a decrease of $323.3 million to $66.2 billion.

- Popular Inc. reported net income of $211 million and EPS of $3.15 for Q3 2025, reflecting an increase of $1 million and $0.06 per share, respectively, driven by higher revenues and an expanding net interest margin.

- The company achieved strong loan growth of $502 million in Q3 2025 and subsequently raised its consolidated loan growth guidance for the full year 2025 to between 4% and 5%. Net interest income for the quarter was $647 million, an increase of $15 million.

- Credit quality metrics were impacted by two specific commercial loans, causing non-performing loans (NPLs) to total loans to rise to 1.3% and net charge-offs to reach $58 million (annualized 60 basis points). Management emphasized these were isolated incidents not indicative of broader credit concerns.

- Popular Inc. maintained strong regulatory capital with a CET1 ratio of 15.8% and increased tangible book value per share to $79.12. The company also declared a $0.75 per share common stock dividend and repurchased $119 million in shares during Q3 2025.

- The company reiterated its NII growth guidance of 10%-11% for 2025 and expects a full-year effective tax rate between 16% and 18%. Popular Inc. remains focused on achieving a sustainable 14% Return on Common Equity (ROCI) in the long term.

- Popular Inc. reported net income of $211 million and EPS of $3.15 for Q3 2025, driven by higher revenues and an expanding net interest margin.

- The company experienced strong loan growth of $502 million in the quarter, leading to an updated 2025 consolidated loan growth guidance of between 4% and 5%.

- Credit quality metrics were impacted by two commercial loans, increasing NPLs to 1.3% and net charge-offs to $58 million or an annualized 60 basis points.

- Popular Inc. updated its 2025 guidance, now expecting total non-interest income between $650 and $655 million and an effective tax rate between 16% and 18%.

- The company declared a quarterly common stock dividend of $0.75 per share and repurchased approximately $119 million in shares during Q3 2025.

Quarterly earnings call transcripts for POPULAR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more