Earnings summaries and quarterly performance for BASSETT FURNITURE INDUSTRIES.

Executive leadership at BASSETT FURNITURE INDUSTRIES.

Robert H. Spilman, Jr.

Chief Executive Officer and President

Bruce R. Cohenour

Senior Vice President and Chief Sales Officer

J. Michael Daniel

Senior Vice President and Chief Financial and Administrative Officer

John E. Bassett, III

Senior Vice President and Chief Operations Officer

Board of directors at BASSETT FURNITURE INDUSTRIES.

Emma S. Battle

Director

J. Walter McDowell

Director

James E. Goergen

Director

John R. Belk

Director

Kristina Cashman

Director

Virginia W. Hamlet

Director

William C. Wampler, Jr.

Director

William C. Warden, Jr.

Lead Independent Director

Research analysts who have asked questions during BASSETT FURNITURE INDUSTRIES earnings calls.

Anthony Lebiedzinski

Sidoti & Company, LLC

8 questions for BSET

Douglas Lane

Water Tower Research

4 questions for BSET

Brian Gordon

Water Tower Research

3 questions for BSET

Michael McCormack

Water Tower Research LLC

1 question for BSET

Recent press releases and 8-K filings for BSET.

- Bassett Furniture Industries reported a 5.1% increase in consolidated revenue for Q4 2025, reaching $86.4 million, with wholesale sales up 8.3% and retail sales up 7.9%. Diluted earnings per share were $0.18 for the quarter.

- The company maintains a strong balance sheet with $59.2 million in cash and short-term investments and no debt. It generated $7.8 million in operating cash flow during Q4 2025 and plans $8 million-$12 million in capital expenditures for 2026, significantly more than the $4.5 million spent in 2025.

- Bassett is focusing on cost optimization, having reduced headcount by 11% last year and an additional 4% recently. The company plans to open three new stores in 2026 and saw e-commerce sales increase 14% in Q4 and 27% for the full year, despite a challenging macro environment with slow housing sales and high mortgage rates.

- Bassett Furniture reported a 5.1% increase in consolidated revenue for Q4 2025, reaching $86.4 million. Diluted earnings per share were $0.18, compared to $0.38 in the prior year, which included a $2.6 million tax benefit.

- Gross margin decreased by 30 basis points to 56.3%, primarily due to lower retail margins, while Selling, General, and Administrative expenses decreased by 60 basis points to 53.2% of sales due to restructuring benefits and cost optimization. The company reduced headcount by 11% last year and an additional 4% recently.

- The company maintains a strong balance sheet with $59.2 million in cash and short-term investments and no debt. It generated $13.5 million in operating cash flow and $2 million in free cash flow for the full year.

- Despite a challenging market with slow housing sales, Bassett plans to open three new stores in 2026, forecasting $8-$12 million in capital expenditures. E-commerce sales increased 14% in Q4 and 27% for the full year.

- Bassett Furniture reported a 5.1% increase in consolidated revenue for Q4 2025, or 6.4% excluding the impact of the Noa Home closure, driven by 8.3% growth in wholesale sales and 7.9% growth in retail sales.

- Diluted earnings per share for Q4 2025 were $0.18, compared to $0.08 in the prior year quarter when excluding a tax benefit.

- The company maintains a strong financial position with $59.2 million in cash and short-term investments and no debt, generating $7.8 million in operating cash flow in Q4 2025.

- Strategic growth drivers include a 14% increase in e-commerce sales for the quarter, successful new product lines (case goods up over 50%, upholstery up 19%), and plans to open three new stores in 2026.

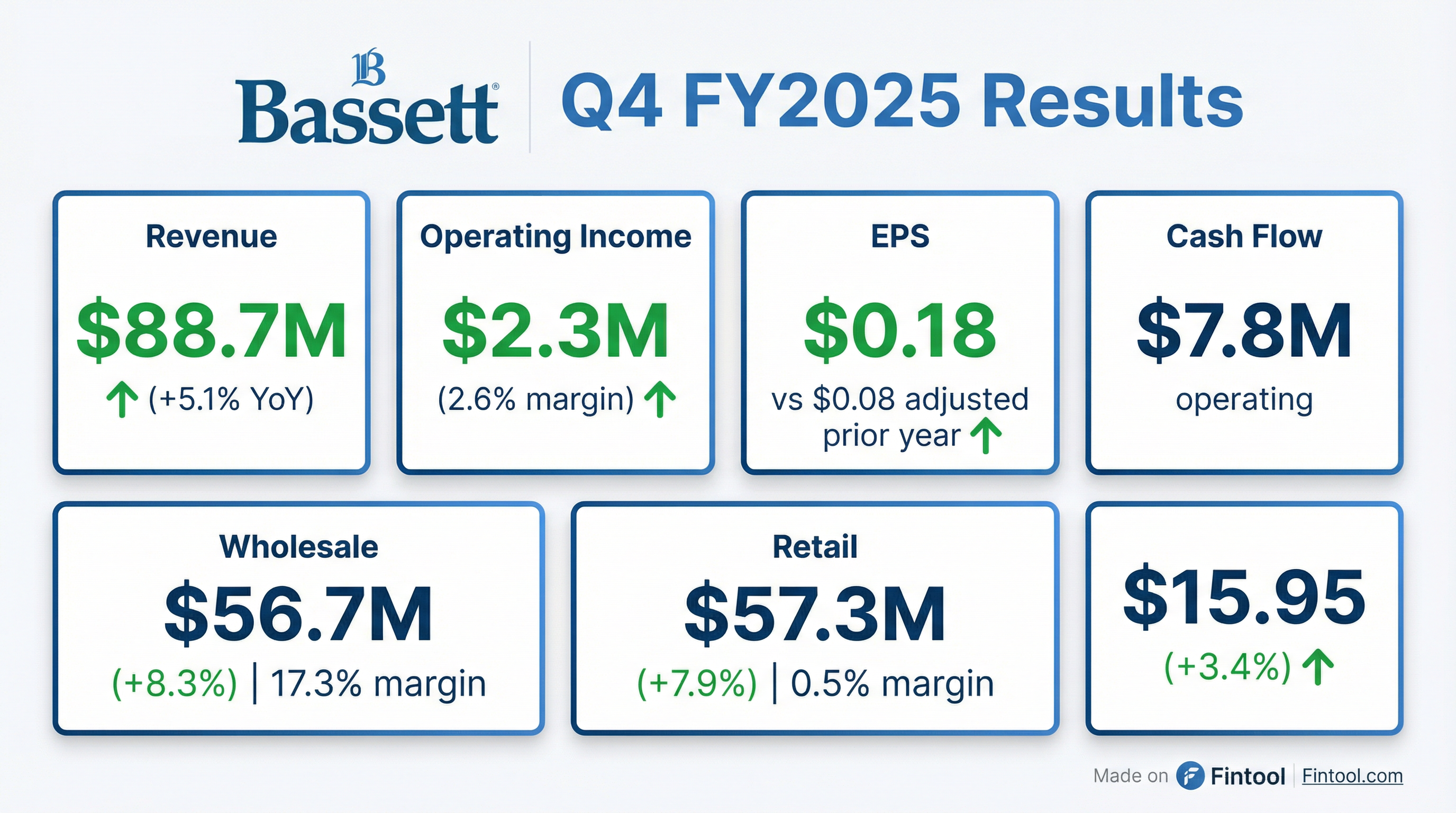

- Consolidated revenues for the fourth quarter ended November 29, 2025, increased 5.1% to $88.7 million compared to the prior year quarter.

- Operating income for Q4 2025 was $2.3 million, an increase from $0.9 million in the prior year quarter.

- Diluted earnings per share was $0.18 for Q4 2025, compared to $0.38 in the prior year period, which included a $2.6 million tax benefit.

- The company generated $7.8 million in operating cash flow during the fourth quarter.

- Bassett Furniture Industries reported a 5.1% increase in consolidated revenues for its fiscal fourth quarter ended November 29, 2025, compared to the prior year quarter.

- Operating income improved significantly to $2.3 million (2.6% of sales) in Q4 FY2025, up from $0.9 million (1.1% of sales) in the prior year period.

- Diluted earnings per share for Q4 FY2025 was $0.18, which, when adjusted for a prior year tax benefit, represents an increase from $0.08 in the prior year.

- The company generated $7.8 million in operating cash flow during the quarter.

- Management emphasized a continued restructuring mindset and a strategic plan for 2026 focused on growth and market share gains amidst projected slow housing activity.

- Bassett Furniture Industries reported a 5.9% increase in consolidated sales for Q3 2025, with consolidated revenues increasing 7.3% excluding sales from NOAA Home.

- The company achieved an operating income of $600,000 in Q3 2025, a significant improvement from a $6.4 million loss in the prior year, driven by ongoing operating efficiencies and higher sales. Gross margin improved by 320 basis points to 56.2%.

- Diluted earnings per share (EPS) for Q3 2025 were $0.09, compared to a $0.52 loss in the same quarter last year.

- The Board of Directors approved a regular quarterly cash dividend of $0.20 per share. The company spent $1.7 million on dividends and $400,000 on share buybacks during the quarter.

- Bassett ended Q3 2025 with $54.6 million in cash and short-term investments and no outstanding debt.

- Bassett Furniture Industries, Inc. reported consolidated revenues of $80.1 million for the third quarter ended August 30, 2025, an increase of 5.9% from the prior year quarter.

- The company achieved operating income of $0.6 million (0.7% of sales) in Q3 2025, a significant improvement from an operating loss of $(6.4) million in the prior year quarter.

- Diluted earnings per share were $0.09 for Q3 2025, compared to a loss of $(0.52) in the prior year quarter.

- Gross margin improved by 320 basis points to 56.2%, and selling, general and administrative expenses decreased by 420 basis points to 55.4% of sales compared to the prior year.

- Bassett Furniture Industries reported a 5.9% increase in revenues to $80.1 million for its third quarter ended August 30, 2025, compared to the prior year quarter. Excluding sales from Noa Home Inc., consolidated revenues increased 7.3%.

- The company achieved operating income of $0.6 million, or 0.7% of sales, a significant improvement from a loss of $(6.4) million in the prior year quarter.

- Gross margin improved by 320 basis points to 56.2%, and diluted earnings per share were $0.09, reversing a loss of $(0.52) in the prior year.

Quarterly earnings call transcripts for BASSETT FURNITURE INDUSTRIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more