Earnings summaries and quarterly performance for CAMDEN NATIONAL.

Executive leadership at CAMDEN NATIONAL.

Simon R. Griffiths

President and Chief Executive Officer

Michael R. Archer

Executive Vice President, Chief Financial Officer

Patricia A. Rose

Executive Vice President, Retail and Mortgage Banking

Ryan A. Smith

Executive Vice President, Chief Credit Officer

William H. Martel

Executive Vice President, Chief Technology Officer

Board of directors at CAMDEN NATIONAL.

Carl J. Soderberg

Director

Craig N. Denekas

Director

James H. Page

Director

Larry K. Haynes

Director

Lawrence J. Sterrs

Chair of the Board

Marie J. McCarthy

Vice-Chair of the Board

Raina L. Maxwell

Director

Rebecca K. Hatfield

Director

Robert D. Merrill

Director

Robin A. Sawyer

Director

S. Catherine Longley

Director

Research analysts who have asked questions during CAMDEN NATIONAL earnings calls.

Matthew Breese

Stephens Inc.

5 questions for CAC

Damon Del Monte

Keefe, Bruyette & Woods

4 questions for CAC

Stephen Moss

Raymond James Financial, Inc.

3 questions for CAC

Steve Moss

Raymond James

3 questions for CAC

Matthew Renck

Keefe, Bruyette & Woods (KBW)

2 questions for CAC

Daniel Cardenas

Janney Montgomery Scott LLC

1 question for CAC

David Mirochnick

Stephens Inc.

1 question for CAC

Recent press releases and 8-K filings for CAC.

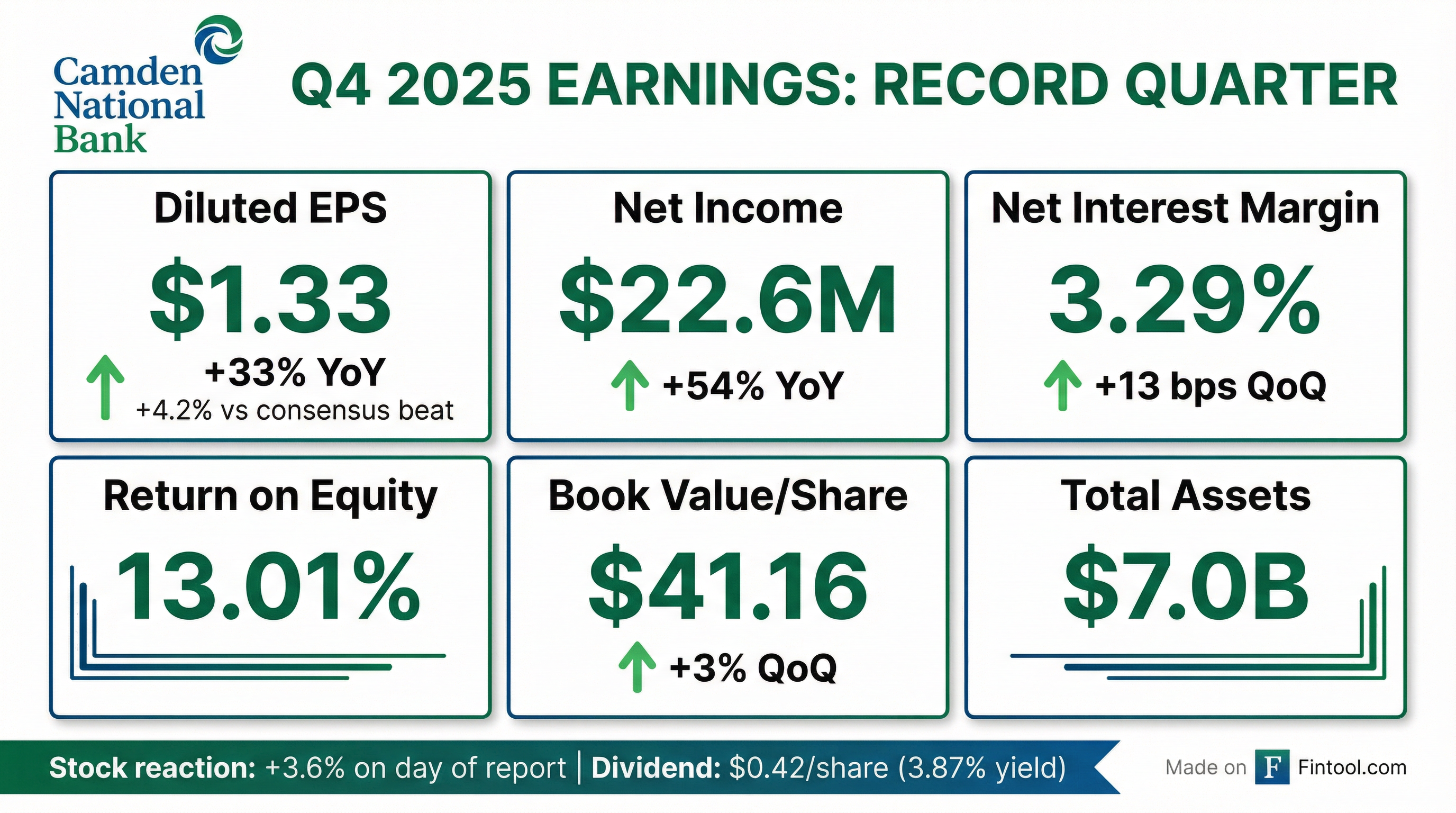

- Camden National Corporation reported record Q4 2025 earnings of $22.6 million and diluted EPS of $1.33, contributing to full-year 2025 net income of $65.2 million and diluted EPS of $3.84.

- Key financial performance indicators for Q4 2025 included a net interest margin expansion of 13 basis points to 3.29%, a non-GAAP efficiency ratio below 52%, and a return on average assets of 1.3%.

- The company achieved 15% organic growth in assets under administration to $2.4 billion by December 31, 2025, and 2% organic loan growth for the year, with home equity loans growing 18% organically.

- Credit quality remained strong, with non-performing assets at 10 basis points of total assets and a loan loss reserve of 91 basis points of total loans as of December 31, 2025.

- A new share repurchase program was announced in early January, authorizing the repurchase of up to 850,000 shares of the company's common stock, representing approximately 5% of shares currently outstanding.

- Camden National Corporation reported record fourth quarter 2025 earnings of $22.6 million, or $1.33 diluted EPS, representing a 6% increase from the prior quarter.

- For Q4 2025, the company achieved a net interest margin of 3.29%, an expansion of 13 basis points quarter-over-quarter, and an efficiency ratio of 51.69%.

- Loans grew organically by 2% for the year, though total loans decreased by 1% in Q4 2025 due to higher payoffs; deposits increased 2% since September 30, 2025.

- Credit quality remained strong with non-performing assets at 10 basis points of total assets and a loan loss reserve of 91 basis points of total loans as of December 31, 2025, despite a $3 million charge-off from a commercial real estate loan.

- Camden National announced a new share repurchase program authorizing the buyback of up to 850,000 shares, which is approximately 5% of shares currently outstanding.

- Camden National Corporation reported record fourth quarter 2025 earnings of $22.6 million and diluted earnings per share of $1.33, contributing to full-year 2025 net income of $65.2 million and diluted EPS of $3.84. The company also achieved a net interest margin of 3.29% and a non-GAAP efficiency ratio of 51.69% in Q4 2025.

- The company saw 2% organic loan growth for the year, with home equity lending growing 18% organically for 2025, and deposits increasing 2% in Q4 2025. Asset quality remained strong, with non-performing assets at 10 basis points of total assets and a loan loss reserve of 91 basis points of total loans as of December 31, 2025.

- Camden National announced a new share repurchase program to repurchase up to 850,000 shares, or approximately 5% of shares currently outstanding. The company continues to focus on organic growth and remains opportunistic regarding M&A in contiguous markets with a similar business template.

- Camden National Corporation reported net income of $22.6 million and diluted EPS of $1.33 for the fourth quarter ended December 31, 2025, both representing a 6% increase compared to the third quarter of 2025.

- For the full year ended December 31, 2025, the company achieved net income of $65.2 million and diluted EPS of $3.84, marking increases of 23% and 6%, respectively, over the year ended December 31, 2024.

- The company's net interest margin expanded to 3.29% in Q4 2025, a 13 basis point increase over Q3 2025, and the GAAP efficiency ratio was 54.16%.

- Total assets stood at $7.0 billion as of December 31, 2025, reflecting a 20% growth during 2025, primarily due to the acquisition of Northway Financial, Inc..

- Camden National announced a new share repurchase program for up to 850,000 shares of its common stock, approximately 5% of its outstanding stock, on January 8, 2026.

- Camden National Corporation reported record-breaking quarterly performance for the fourth quarter of 2025, with net income of $22.6 million and diluted EPS of $1.33, both increasing 6% over the third quarter of 2025.

- For the full year ended December 31, 2025, the company's net income was $65.2 million and diluted EPS was $3.84, representing increases of 23% and 6%, respectively, over the year ended December 31, 2024.

- The net interest margin for the fourth quarter of 2025 expanded to 3.29%, an increase of 13 basis points over the third quarter of 2025.

- A new share repurchase program for up to 850,000 shares (approximately 5% of its outstanding stock as of December 31, 2025) was announced on January 8, 2026.

- Total assets reached $7.0 billion as of December 31, 2025, growing 20% during 2025, primarily due to the acquisition of Northway Financial, Inc. on January 2, 2025.

- Camden National Corporation reported record third-quarter 2025 earnings of $21.2 million, a 51% increase over the previous quarter, with diluted earnings per share of $1.25. Pre-tax, pre-provision income rose 19% to $29.5 million.

- Key financial metrics for Q3 2025 included a net interest margin expansion of 10 basis points to 3.16% , an improved non-GAAP efficiency ratio of 52.5% , and a return on average tangible equity of 19.1%.

- The tangible common equity ratio grew 32 basis points to 7.09%, and tangible book value increased 6% in the quarter, reaching $28.42 per share as of September 30. Assets under management and administration reached a record high of $2.4 billion.

- The company charged off $10.7 million related to a previously disclosed syndicated telecommunications loan , but overall credit trends remained strong, with non-performing assets decreasing 14 basis points to 12 basis points of total assets. The allowance for credit losses totaled $45.5 million, covering 5.5 times total non-performing loans.

- For Q4 2025, non-interest expense is estimated between $36 million and $36.5 million , with an anticipated net interest margin expansion of 5 to 10 basis points. Loan growth is projected to be flat to up 2% for Q4 2025 and in the mid-single digits for 2026.

- Camden National Corporation reported record third-quarter earnings of $21.2 million, marking a 51% increase over the previous quarter, with pretax pre-provision income rising 19% to $29.5 million.

- The company's tangible common equity ratio grew 32 basis points to 7.09%, and tangible book value increased 6% to $28.42 per share as of September 30.

- Key performance indicators improved, including a 10 basis point expansion in net interest margin to 3.16%, an efficiency ratio of 52.5%, and a return on average tangible equity of 19.1%.

- Annualized loan growth was 4%, and average core deposits grew 2% in the quarter. Nonperforming assets decreased 14 basis points to 0.12% of total assets, despite a $10.7 million charge-off for a previously disclosed syndicated loan.

- Management projects fourth-quarter non-interest expense to be between $36 million and $36.5 million and anticipates net interest margin expansion of 5 to 10 basis points in the next quarter.

- Camden National Corporation reported record third-quarter earnings of $21.2 million, representing a 51% increase over the previous quarter, with diluted earnings per share of $1.25.

- The company's pre-tax, pre-provision income for the third quarter rose 19% over the prior quarter to $29.5 million.

- The net interest margin expanded by 10 basis points to 3.16%, and the non-GAAP efficiency ratio improved to 52.5%.

- Annualized loan growth was 4%, and average core deposits grew 2% during the quarter.

- Non-interest income reached $14.1 million, an 8% increase over the second quarter, driven by assets under management and administration reaching a record high of $2.4 billion.

- Camden National Corporation reported record third-quarter earnings of $21.2 million, a 51% increase over the previous quarter, with diluted earnings per share of $1.25. Pre-tax, pre-provision income rose 19% over the prior quarter to $29.5 million.

- The company's tangible common equity ratio grew 32 basis points to 7.09%, and tangible book value increased 6% to $28.42 per share. Net interest margin expanded 10 basis points to 3.16%, and the non-GAAP efficiency ratio improved to 52.5%.

- Camden National achieved 4% annualized loan growth and 2% growth in average core deposits. Non-performing assets decreased by 14 basis points to 0.12% of total assets, despite a $10.7 million charge-off for a previously disclosed syndicated telecommunications loan.

- Non-interest income increased 8% over the second quarter to $14.1 million, supported by record $2.4 billion in assets under management and administration. Management expects Q4 2025 non-interest expense to be between $36 million and $36.5 million and projects net interest margin expansion of 5 to 10 basis points in the next quarter.

- Camden National Corporation reported record net income of $21.2 million and diluted earnings per share (EPS) of $1.25 for the third quarter ended September 30, 2025, both representing an increase of 51% compared to the second quarter of 2025.

- The company's net interest margin increased 10 basis points to 3.16% for Q3 2025, and the GAAP efficiency ratio improved to 54.94% from 60.37% in the second quarter of 2025.

- As of September 30, 2025, loans totaled $5.0 billion, a 1% increase from the second quarter of 2025, and total assets were $7.0 billion, also a 1% increase since June 30, 2025.

- Deposits totaled $5.4 billion as of September 30, 2025, representing a 2% decrease from June 30, 2025.

- Asset quality remained strong, with non-performing assets at 0.12% of total assets as of September 30, 2025. The company also announced a cash dividend of $0.42 per share.

Quarterly earnings call transcripts for CAMDEN NATIONAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more