Earnings summaries and quarterly performance for CALIX.

Executive leadership at CALIX.

Board of directors at CALIX.

Research analysts who have asked questions during CALIX earnings calls.

Christian Schwab

Craig-Hallum Capital Group

6 questions for CALX

Ryan Koontz

Needham & Company, LLC

6 questions for CALX

Scott Searle

ROTH MKM

6 questions for CALX

Tim Savageaux

Northland Capital Markets

6 questions for CALX

George Notter

Jefferies

4 questions for CALX

Michael Genovese

Rosenblatt Securities Inc.

4 questions for CALX

Samik Chatterjee

JPMorgan Chase & Co.

3 questions for CALX

Joe Cardoso

JPMorgan Chase & Co.

2 questions for CALX

Joseph Cardoso

JPMorgan Chase & Co.

1 question for CALX

Mike Genovese

Rosenblatt Securities

1 question for CALX

Recent press releases and 8-K filings for CALX.

- Cablelynx achieved a 35% increase in average revenue per user (ARPU) among adopters in key markets by accelerating the adoption of Calix SmartBiz.

- In Pine Bluff, Arkansas, 40% of Cablelynx's small business base adopted SmartBiz, and in 2025, Cablelynx securely connected 7X more small businesses to Lynx@Work, their SmartBiz brand.

- Cablelynx also reported a 30-point increase in their Net Promoter Score (NPS) with SmartHome experiences and launched SmartTown for secure public Wi-Fi in Vicksburg, Mississippi in May 2025.

- Helexon, projected to be one of the nation’s largest BEAD grant recipients, has chosen the Calix One platform to support a significant rural broadband buildout.

- This multi-year deployment by Helexon aims to deliver thousands of miles of fiber across Illinois, Indiana, Kentucky, and Michigan.

- The Calix One platform, which includes Calix Agent Workforce Cloud and Calix SmartLife, is intended to accelerate deployment, streamline operations, and provide next-generation fiber experiences.

- Calix's AI-native platform is expected to enable Helexon to scale networks, automate operations, and enhance service delivery for communities.

- Calix, Inc. (NYSE: CALX) has launched Calix One, an AI-native platform that unifies appliances, cloud software, AI agents, and managed services for communication service providers (CSPs).

- Architected in partnership with Google Cloud, Calix One is designed to enable CSPs to operationalize secure agentic AI, aiming to acquire more subscribers, grow revenue, and increase subscriber loyalty.

- One-third of Calix's customers are already operating on the Calix One platform, with the entire customer base projected to transition by the end of March 2026.

- Early adopters, including ALLO Communications, Tombigbee Fiber, and Conexon Connect, are implementing the Calix Agent Workforce on Calix One, reporting benefits such as high Net Promoter Scores, rapid growth, higher average revenue per user (ARPU), and significant decreases in operational expenses (OPEX).

- Calix Inc. (NYSE: CALX) launched the next generation of its Engagement Cloud on the Calix Platform, along with enhancements to the Command mobile app, on February 11, 2026.

- These updates aim to empower service providers to deliver personalized offers, thereby increasing customer lifetime value (CLV) and average revenue per user (ARPU).

- Key new features include in-app promo tiles, advanced segmentation and geomap capabilities, and a business intelligence dashboard for campaign performance.

- Calix Market Insights data indicates that personalization significantly influences subscriber decisions, with some providers experiencing ARPU increases of 7% to 17% within six months of implementing such strategies.

- The new capabilities are expected to speed up product launches, lower operational costs, and lay the groundwork for future AI-driven marketing automation.

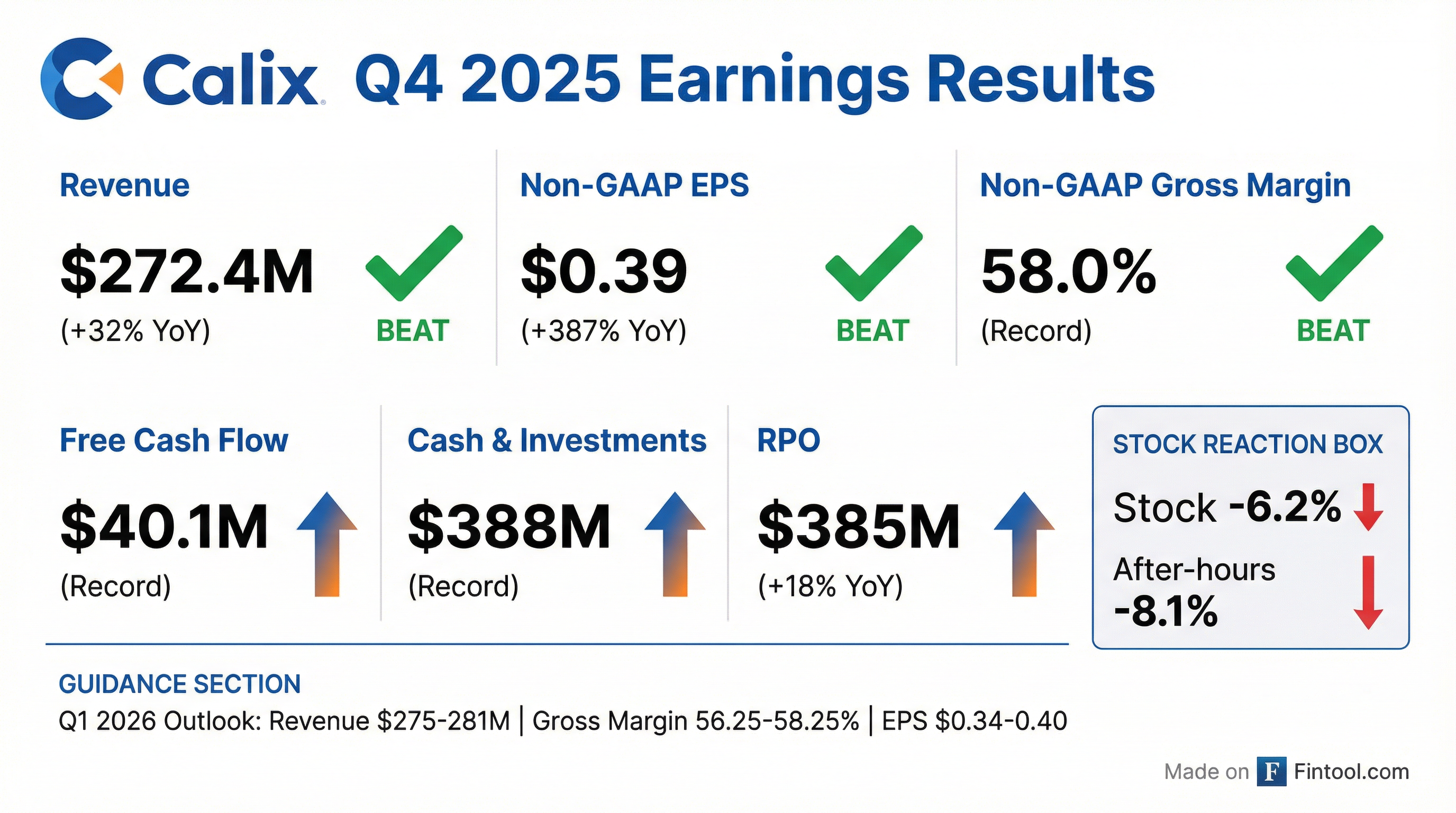

- Calix (CALX) reported record financial performance for Q4 and full-year 2025, with Q4 revenue of $272 million (up 32% year-over-year) and annual revenue surpassing $1 billion (up 20% over 2024).

- The company achieved a record non-GAAP gross margin of 58% in Q4 2025, generated record free cash flow of $40 million, and ended the year with record cash and investments of $388 million.

- Remaining Performance Obligation (RPO) reached a record $385 million, reflecting 18% year-over-year growth, with current RPOs also at a record $152 million.

- Calix launched the third generation of its platform in December 2025 and anticipates 2026 revenue growth in the 10%-15% range (excluding BEAD program contributions), with further acceleration expected from the BEAD program into 2027.

- In Q4 2025, Calix deployed $17 million to repurchase 300,000 shares, and its board authorized an additional $125 million for the stock repurchase plan.

- Calix closed 2025 with record revenue of $272 million in Q4, a 32% year-over-year increase, and surpassed $1 billion in annual revenue for 2025, reflecting 20% growth over 2024.

- The company achieved a record non-GAAP gross margin of 58% in Q4 2025, marking its eighth consecutive quarter of improvement, and generated record free cash flow of $40 million.

- For Q1 2026, Calix provided revenue guidance between $275 million and $281 million and announced an increase of $125 million in its stock repurchase plan, having deployed $17 million to buy back 300,000 shares in Q4 2025.

- Calix launched its third-generation platform in December, with over 300 customers already migrated and a goal to complete all migrations by the end of Q1 2026. This, combined with a $1 billion to $1.5 billion BEAD opportunity, positions the company for a sustained growth phase in 2026 and beyond.

- Calix closed 2025 with its best performance in company history, reporting record Q4 2025 revenue of $272 million, a 32% year-over-year growth, and surpassing $1 billion in annual revenue for 2025, reflecting 20% growth over 2024.

- The company achieved record gross margin for the eighth consecutive quarter and its eleventh consecutive quarter of eight-figure free cash flow, ending 2025 with record cash.

- Remaining performance obligation (RPO) reached a record $385 million, marking an 18% year-over-year increase.

- Calix launched its third-generation platform in December 2025, with over 300 customers already migrated and a goal to complete all customer migrations by the end of Q1 2026. This platform is expected to enable new global markets and large customers with private clouds.

- For Q1 2026, revenue guidance is between $275 million and $281 million. Non-GAAP gross margin is expected to remain strong, with some near-term impact due to customer mix and dual cloud costs during the platform transition. Operating expenses are projected to increase sequentially due to accelerated AI development, with an expectation to return to the target financial model by the end of 2026. The BEAD program represents an opportunity of $1 billion to $1.5 billion for Calix, with deliveries expected to ramp meaningfully in 2027 and beyond.

- Calix reported unaudited Q4 2025 revenue of $272.4 million, slightly above expectations, and non-GAAP EPS of $0.39, marginally below consensus.

- Following the announcement, Calix shares experienced a modest 2.2% decline in after-hours trading.

- The company has scheduled a conference call for January 29, 2026, to discuss the results and outlook.

- Real-time news services reported a Q1 outlook with adjusted EPS of $0.34–$0.40 and sales of $275.0M–$281.0M.

- Third-party data indicates a strong balance sheet with a current ratio of 5.02 and low leverage, despite historical profitability challenges and a negative net margin of ~-0.78%.

- Calix reported record revenue of $272 million for Q4 2025, representing 32% year-over-year growth, and $1 billion in annual revenue for FY 2025, a 20% year-over-year increase.

- The company achieved a record non-GAAP gross margin of 58% in Q4 2025 and generated $40 million in free cash flow, marking its eleventh consecutive quarter of eight-figure free cash flow.

- Remaining performance obligations (RPOs) grew 18% year-over-year to $385 million, driven by the addition of 25 new platform customers.

- Calix ended 2025 with record cash and investments of $388 million and maintained a low Days Sales Outstanding (DSO) of 35 days.

- Calix, Inc. announced an increase of $125 million in its common stock repurchase authorization on January 28, 2026.

- This additional authorization is added to the $109.3 million remaining at the end of the fourth quarter of 2025.

- The total authorization under the stock repurchase program is now $425 million.

- The board of directors approved this increase on January 27, 2026.

Quarterly earnings call transcripts for CALIX.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more