Earnings summaries and quarterly performance for CABOT.

Executive leadership at CABOT.

Sean Keohane

President and Chief Executive Officer

Erica McLaughlin

Executive Vice President and Chief Financial Officer

Jeff Zhu

Executive Vice President and President, Carbon and Silica Technologies and Battery Materials; Head of Asia Pacific Region

Karen Kalita

Senior Vice President and General Counsel

Matthew Wood

Senior Vice President and President, Reinforcement Materials Segment

Board of directors at CABOT.

Christine Yan

Director

Cynthia Arnold

Director

Douglas Del Grosso

Director

Frank Wilson

Director

Juan Enriquez

Director

Michael Morrow

Non-Executive Chair of the Board

Michelle Williams

Director

Raffiq Nathoo

Director

Thierry Vanlancker

Director

William Kirby

Director

Research analysts who have asked questions during CABOT earnings calls.

John Ezekiel Roberts

Mizuho Securities

7 questions for CBT

Kevin Estok

Jefferies

5 questions for CBT

Chris Perrella

UBS

3 questions for CBT

David Begleiter

Deutsche Bank

3 questions for CBT

Jeffrey Zekauskas

JPMorgan Chase & Co.

3 questions for CBT

Christopher Perrella

UBS Group AG

2 questions for CBT

Daniel Rizzo

Jefferies

2 questions for CBT

Emily Fusco

Deutsche Bank

2 questions for CBT

Josh Spector

UBS Group

2 questions for CBT

Joshua Spector

UBS

1 question for CBT

Laurence Alexander

Jefferies

1 question for CBT

Lydia Huang

JPMorgan Chase & Co.

1 question for CBT

Lydia Wong

JPMorgan Chase & Co.

1 question for CBT

Saurabh Dhir

Mizuho Financial Group

1 question for CBT

Wenyi Huang

JPMorgan Chase & Co.

1 question for CBT

Recent press releases and 8-K filings for CBT.

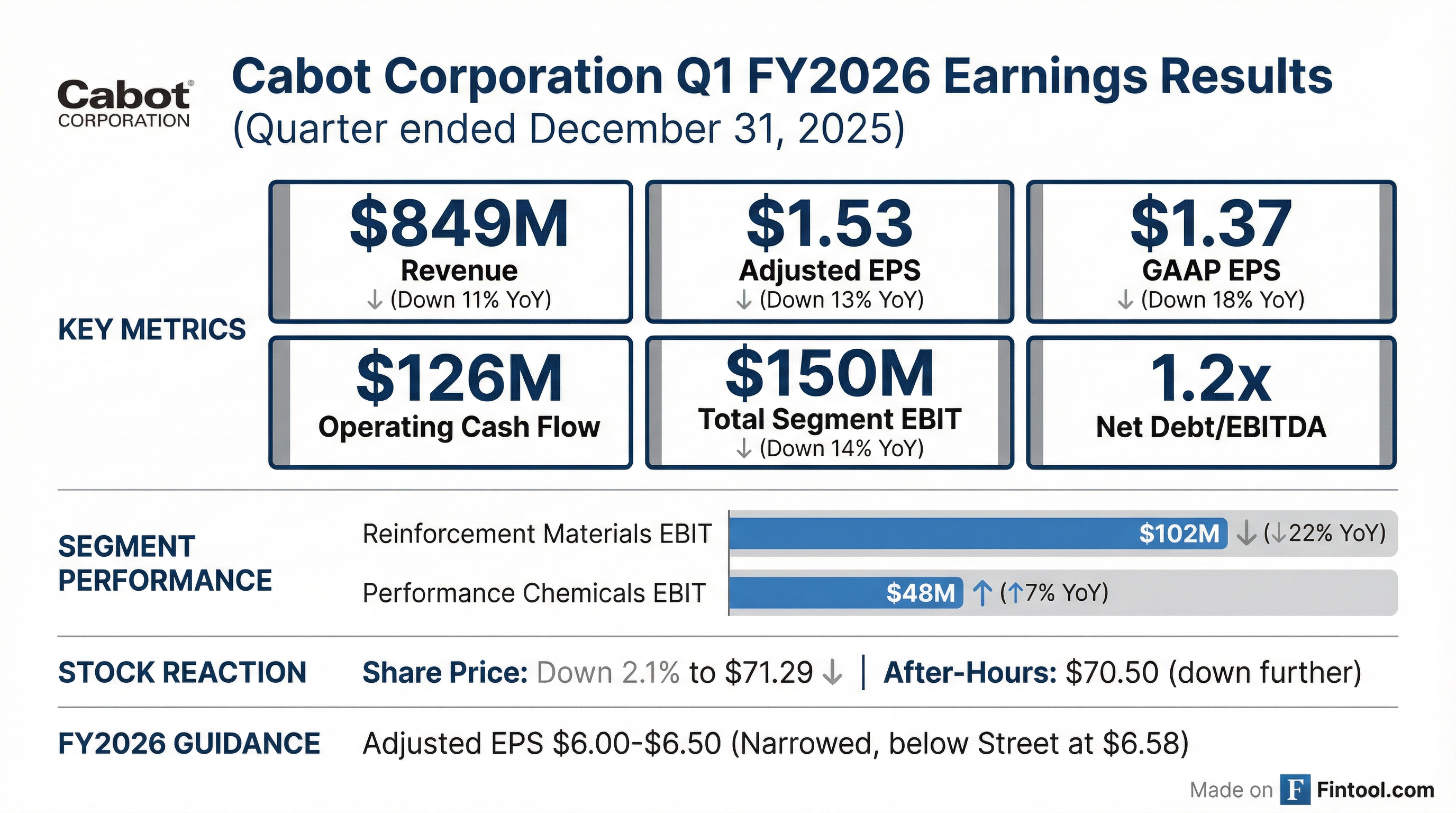

- Cabot Corporation reported Q1 2026 Adjusted EPS of $1.53, representing a 13% decrease year-over-year, and GAAP EPS of $1.37.

- The company generated $126 million in Cash Flows from Operations and returned $76 million to shareholders through dividends and share repurchases during Q1 2026.

- The Reinforcement Materials segment EBIT was $102 million, down 22% year-over-year, primarily due to declining western tire production and year-over-year price reductions, while the Performance Chemicals segment EBIT was $48 million, up 7% year-over-year.

- Cabot signed a multi-year supply agreement with PowerCo SE for lithium-ion battery applications, with its Battery Materials product line showing 39% revenue growth over Q1 FY25.

- For Fiscal Year 2026, the company expects Adjusted EPS in the range of $6.00 to $6.50 and is targeting an additional $30 million of savings.

- Cabot Corporation reported adjusted earnings per share of $1.53 for the first quarter of fiscal year 2026.

- The company narrowed its fiscal year 2026 adjusted earnings per share guidance range to between $6.00 and $6.50.

- The Reinforcement Materials segment's EBIT declined 22% year-over-year due to lower volumes and pricing pressure, while the Performance Chemicals segment's EBIT increased 7%, significantly boosted by 39% revenue growth in the Battery Materials product line.

- Cabot announced a multiyear agreement with PowerCo, a Volkswagen Group subsidiary, for its Battery Materials product line and is finalizing plans to rationalize Carbon Black capacity in the Americas and Europe.

- The company generated $126 million in operating cash flow and $71 million in discretionary free cash flow in Q1 2026, with expected fiscal 2026 capital expenditures between $200 million and $230 million.

- Cabot Corporation reported adjusted earnings per share of $1.53 for the first quarter of fiscal year 2026.

- The Reinforcement Materials segment's EBIT declined by 22% compared to the prior year, primarily due to 7% lower volumes and 7%-9% pricing declines in Western regions, leading to plans for capacity rationalization.

- Conversely, the Performance Chemicals segment's EBIT increased by 7%, with its Battery Materials product line achieving 39% revenue growth and securing a multiyear agreement with PowerCo.

- The company narrowed its adjusted EPS guidance for fiscal year 2026 to between $6 and $6.50.

- Cabot generated $126 million in operating cash flow in Q1 2026, is targeting $30 million in additional cost savings for fiscal year 2026, and reduced its capital expenditure outlook to between $200 million and $230 million.

- Cabot Corporation reported Q1 fiscal year 2026 Diluted EPS of $1.37 and Adjusted EPS of $1.53, representing a 13% decrease in Adjusted EPS year-over-year.

- The Reinforcement Materials segment EBIT decreased by 22% year-over-year to $102 million due to lower volumes, while the Performance Chemicals segment EBIT increased by 7% year-over-year to $48 million, driven by a favorable product mix and strength in Battery Materials.

- The company signed a multi-year supply agreement with PowerCo SE to supply conductive carbons and dispersions for lithium-ion battery applications, reinforcing its leadership in Battery Materials.

- Cash Flows from Operations were $126 million, supporting the return of $76 million to shareholders through share repurchases and dividends in the quarter.

- Cabot narrowed its full-year fiscal 2026 Adjusted EPS outlook to a range of $6.00 to $6.50 per share.

- Cabot Corporation reported Diluted EPS of $1.37 and Adjusted EPS of $1.53 for the first quarter of fiscal year 2026, which represents a 13% decrease in Adjusted EPS year-over-year.

- The Reinforcement Materials segment EBIT was $102 million, down 22% year-over-year due to lower volumes, while the Performance Chemicals segment EBIT was $48 million, up 7% year-over-year, driven by a favorable product mix and strength in Battery Materials.

- The company signed a multi-year supply agreement with PowerCo SE to supply conductive carbons and dispersions for lithium-ion battery applications, reinforcing its leadership in Battery Materials.

- Cash Flows from Operations were $126 million, which supported the return of $76 million of cash to shareholders through share repurchases and dividends during the quarter.

- Cabot narrowed its full-year fiscal 2026 Adjusted EPS outlook to a range of $6.00 to $6.50 per share.

- Cabot Corporation (NYSE: CBT) successfully completed its acquisition of Mexico Carbon Manufacturing S.A. de C.V. (MXCB) from Bridgestone Corporation on February 2, 2026.

- This acquisition expands Cabot’s global manufacturing footprint and reinforces its position as a leading provider of reinforcing carbons.

- The MXCB facility enhances production capacity, operational flexibility, and the capability to manufacture a broader range of reinforcing carbon products, supporting future growth opportunities.

- The transaction also strengthens Cabot's partnership with Bridgestone, a long-time customer for reinforcing carbon products.

- CBT reported a record adjusted earnings per share of $7.25 for fiscal year 2025, a 3% increase year over year, alongside strong operating cash flow of $665 million and free cash flow of $391 million.

- For fiscal year 2026, the company projects adjusted earnings per share to be between $6.00 and $7.00, a decrease from 2025, citing a challenging market backdrop including declining automotive production and persistent elevated Asian tire imports.

- CBT is acquiring Bridgestone's reinforcing carbon plant in Mexico, expected to close in Q2 FY26 and be accretive in the first year, and reported a 20% year-over-year increase in total contribution margin for its battery materials business in fiscal year 2025.

- Robert Brist will assume the role of Vice President of Investor Relations and Corporate Planning, with Steve Della Hunt continuing as Vice President and Treasurer.

- Cabot Corporation reported record adjusted earnings per share of $7.25 for fiscal year 2025, an increase of 3% year over year, with adjusted EBITDA reaching $804 million. For Q4 2025, adjusted EPS was $1.70, a 6% decrease from the prior year.

- The company provided fiscal year 2026 adjusted EPS guidance of $6.00 to $7.00, anticipating a decline from 2025 due to a challenging macroeconomic environment, including expected decreases in light vehicle auto production and persistent Asian tire imports.

- Cabot maintained a strong balance sheet in fiscal year 2025 with net debt to EBITDA at 1.2 times and $1.5 billion in liquidity, while returning $264 million to shareholders through $96 million in dividends and $168 million in share repurchases.

- Strategic initiatives include the planned acquisition of Bridgestone's reinforcing carbon plants in Mexico, expected to close in Q2 2026 and be accretive in the first year, and continued strong growth in its battery materials business, which saw a 20% year-over-year increase in total contribution margin in fiscal 2025.

- Cabot delivered record adjusted earnings per share of $7.25 for fiscal year 2025, a 3% increase year-over-year, with adjusted EBITDA of $804 million and free cash flow of $391 million.

- For fiscal year 2026, the company expects adjusted earnings per share to be between $6 and $7, a step back from 2025, citing a challenging market backdrop including declining light vehicle auto production and persistent Asian tire imports.

- Capital expenditures for fiscal year 2026 are projected to be between $200-$250 million, and the company plans share repurchases in the range of $100 million-$200 million.

- Cabot announced the acquisition of Bridgestone's reinforcing carbon plants in Mexico, expected to close in the second fiscal quarter and be accretive in the first year. The company also noted that its 2027 targets are not expected to be met due to changes in market assumptions, particularly regarding automotive production and tire imports.

Quarterly earnings call transcripts for CABOT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more