Earnings summaries and quarterly performance for CULLEN/FROST BANKERS.

Executive leadership at CULLEN/FROST BANKERS.

Phillip D. Green

Chief Executive Officer

Coolidge E. Rhodes, Jr.

Group Executive Vice President, General Counsel and Corporate Secretary

Daniel J. Geddes

Group Executive Vice President and Chief Financial Officer

Jimmy Stead

Group Executive Vice President and Chief Consumer Banking and Technology Officer

Paul H. Bracher

President, Group Executive Vice President and Chief Banking Officer

Board of directors at CULLEN/FROST BANKERS.

Anthony R. Chase

Director

Charles W. Matthews

Lead Independent Director

Chris M. Avery

Director

Crawford H. Edwards

Director

Cynthia J. Comparin

Director

David J. Haemisegger

Director

Hope Andrade

Director

Jack Willome

Director

John T. Engates

Director

Joseph A. Pierce

Director

Linda B. Rutherford

Director

Samuel G. Dawson

Director

Research analysts who have asked questions during CULLEN/FROST BANKERS earnings calls.

Jon Arfstrom

RBC Capital Markets

6 questions for CFR

Manan Gosalia

Morgan Stanley

6 questions for CFR

Peter Winter

D.A. Davidson

6 questions for CFR

Catherine Mealor

Keefe, Bruyette & Woods

5 questions for CFR

Ebrahim Poonawala

Bank of America Securities

5 questions for CFR

Casey Haire

Jefferies

3 questions for CFR

Jared Shaw

Barclays

3 questions for CFR

Matt Olney

Stephens Inc.

3 questions for CFR

Benjamin Gerlinger

Citigroup Inc.

2 questions for CFR

Casey Harowith

Autonomous Research

1 question for CFR

David Rochester

Compass Point

1 question for CFR

Michael Rose

Raymond James Financial, Inc.

1 question for CFR

Will Jones

Keefe, Bruyette & Woods (KBW)

1 question for CFR

Recent press releases and 8-K filings for CFR.

- Cullen/Frost Bankers reported strong financial metrics as of December 31, 2025, including $53.0 billion in total assets, $21.9 billion in total loans, and $42.9 billion in total deposits. The company demonstrated robust profitability for 2025 with a Return on Average Assets of 1.19% and a Return on Average Common Equity of 15.7%.

- The company maintains a strong capital position, with a Common Equity Tier 1 ratio of 14.06% and a Tier 1 Leverage ratio of 8.80% as of December 31, 2025. Cullen/Frost has also increased dividends for 32 consecutive years, reaching $3.95 in 2025.

- Cullen/Frost's organic expansion strategy in Texas has significantly contributed to growth, with expansion loans and deposits totaling $2.4 billion and $3.0 billion, respectively, as of December 31, 2025. This strategy accounted for approximately a third of loan growth and 20% of deposit growth from 2018 to 2025, and helped increase its share of total Texas deposits from 3.0% in 2019 to 3.7% in 2025.

- The loan portfolio is diversified, with Commercial loans making up 81% and Consumer loans 19% as of Q4-2025, and exhibits excellent credit quality with 0.10% non-accrual loans as a percentage of total Commercial Real Estate loans and 4.0x coverage for non-accrual loans. Fee income constituted 22.4% of total revenue in 2025, primarily driven by trust and investment management fees.

- Cullen/Frost reported strong second-quarter 2025 results, with average deposits increasing 3.1% to $41.8 billion and average loans growing 7.2% to $21.1 billion year-over-year. The net interest margin percentage improved to 3.67%, up 7 basis points from the previous quarter.

- The company's expansion efforts continue to drive growth, contributing 37% of total loan growth and 44% of total deposit growth year-over-year. These efforts have generated $2.76 billion in deposits and $2.003 billion in loans, and are expected to be accretive to earnings in 2026.

- For full-year 2025, Cullen/Frost updated its guidance, now expecting net interest income growth in the range of 6%-7% (up from 5%-7%) and non-interest income growth between 3.5%-4.5% (up from 2%-3%). This guidance assumes two 25 basis point Fed funds rate cuts in September and October 2025.

- The company maintains a strong capital position with CET1 nearly 14%, prioritizing building its capital base and protecting the dividend, with no current plans for share repurchases.

- Cullen Frost reported Q2 2025 earnings of $2.39 per share, with average deposits growing 3.1% to $41.8 billion and average loans increasing 7.2% to $21.1 billion year-over-year. The net interest margin improved to 3.67% in Q2 2025, up 7 basis points from the prior quarter.

- The company updated its full-year 2025 guidance, now expecting net interest income growth of 6%-7% (up from 5%-7%) and non-interest income growth of 3.5%-4.5% (up from 2%-3%), based on an assumption of two 25 basis point Fed funds rate cuts in September and October.

- Cullen Frost's organic expansion strategy continues to show strong results, having generated $2.76 billion in deposits and $2.003 billion in loans from new locations, and is expected to be accretive to earnings in 2026.

- Management emphasized a focus on building its capital base, with CET1 nearing 14%, and protecting the dividend, while reiterating its strong preference for organic growth over M&A, citing cost efficiency and strategic benefits.

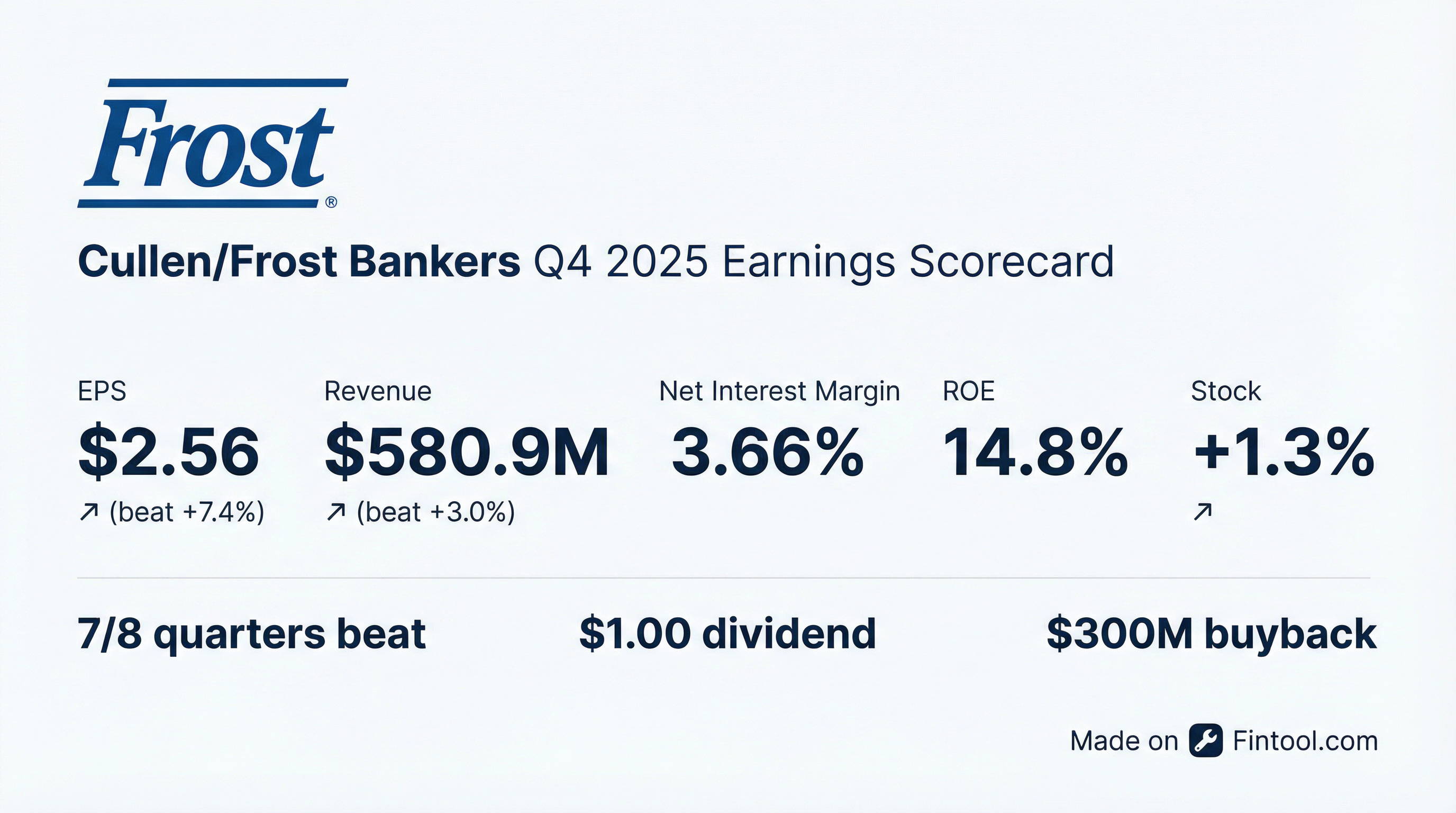

- Cullen/Frost Bankers, Inc. reported net income available to common shareholders of $164.6 million and diluted earnings per share of $2.56 for the fourth quarter of 2025, marking increases of 7.4% and 8.5% respectively from the fourth quarter of 2024. For the full year 2025, net income was $641.9 million and diluted EPS was $9.92, up 11.5% and 11.8% over 2024.

- Net interest income on a taxable-equivalent basis increased by 8.6% to $471.2 million in Q4 2025 compared to Q4 2024, with a net interest margin of 3.66%. Average loans grew 6.5% to $21.7 billion and average deposits increased 3.5% to $43.3 billion in Q4 2025 year-over-year.

- The company maintained strong capital ratios, with a Common Equity Tier 1 Risk-Based Capital Ratio of 14.06% and a Total Risk-Based Capital Ratio of 15.95% at December 31, 2025. The allowance for credit losses on loans as a percentage of total loans was 1.29% at year-end 2025.

- The board declared a first-quarter cash dividend of $1.00 per common share and authorized a new $300 million stock repurchase program.

- Cullen/Frost Bankers reported net income available to common shareholders of $164.6 million for the fourth quarter of 2025, an increase of 7.4% compared to the fourth quarter of 2024, and $641.9 million for the full year 2025, up 11.5% from 2024.

- Diluted earnings per common share were $2.56 for Q4 2025, compared to $2.36 for Q4 2024, and $9.92 for full-year 2025, up from $8.87 in 2024.

- The company's board declared a first-quarter cash dividend of $1.00 per common share and authorized a new $300 million stock repurchase program over a one-year period expiring on January 27, 2027.

- Average loans increased by 6.5% to $21.7 billion and average deposits increased by 3.5% to $43.3 billion in the fourth quarter of 2025 compared to the fourth quarter of 2024.

- At December 31, 2025, the Common Equity Tier 1, Tier 1, and Total Risk-Based Capital Ratios were 14.06%, 14.50%, and 15.95%, respectively, exceeding Basel III requirements.

- Off The Hook YS Inc. has formed a strategic partnership with CFR Yacht Sales, a Puerto Rico-based yacht dealer and brokerage, to expand into the Caribbean and Latin American markets.

- This agreement grants Off The Hook preferred access to select pre-owned vessels from CFR Yacht Sales' brokerage and trade activities, along with access to their facilities and inventory in Puerto Rico.

- Off The Hook reported record revenue of $82.6 million for the first nine months of 2025, representing a 19.3% increase year-over-year.

- The company anticipates full-year 2026 revenue to be between $140 million and $145 million.

- Cullen/Frost Bankers, Inc. (CFR) reported Q3 2025 earnings of $172.7 million, or $2.67 per share, marking a 19.2% increase from the prior year.

- Average deposits grew 3.3% year-over-year to $42.1 billion, and average loans increased 6.8% year-over-year to $21.5 billion in Q3 2025.

- The company's expansion strategy was accretive by $0.09 per share in Q3 2025, contributing $2.9 billion in deposits and $2.1 billion in loans.

- CFR updated its full-year 2025 guidance, raising expected net interest income growth to 7% to 8% and non-interest income growth to 6.5% to 7.5%.

- During Q3 2025, the company repurchased approximately 549,000 shares for $69.3 million as part of its $150 million approved share repurchase plan.

- Cullen/Frost Bankers, Inc. (CFR) reported Q3 2025 earnings of $172.7 million, or $2.67 per share, an increase of 19.2% from the prior year.

- Average deposits grew to $42.1 billion, up 3.3% year-over-year, and average loans increased to $21.5 billion, up 6.8% year-over-year.

- The company's expansion strategy delivered $0.09 of EPS accretion in Q3 2025, with Houston 1.0 generating $0.14 per share.

- The net interest margin percentage was 3.69%, up two basis points from the previous quarter, and management aims to moderate expense growth from high single digits towards mid-single digits for 2026/2027.

- Cullen/Frost Bankers, Inc. reported net income available to common shareholders of $172.7 million for Q3 2025, up from $144.8 million in Q3 2024, with diluted earnings per common share of $2.67 compared to $2.24 a year earlier.

- The company demonstrated solid growth in core banking metrics, with average loans increasing 6.8 percent to $21.5 billion and average deposits rising 3.3 percent to $42.1 billion in Q3 2025 compared to the prior year's third quarter.

- For the first nine months of 2025, net income available to common shareholders reached $477.3 million, a 12.9 percent increase, and diluted EPS was $7.36.

- Cullen/Frost maintained robust capital, with a Common Equity Tier 1 Risk-Based Capital Ratio of 14.14 percent at September 30, 2025, and the board declared a fourth-quarter cash dividend of $1.00 per common share.

- Cullen/Frost Bankers, Inc. reported net income available to common shareholders of $172.7 million and diluted earnings per share (EPS) of $2.67 for the third quarter of 2025, compared to $144.8 million and $2.24, respectively, for the third quarter of 2024.

- For the first nine months of 2025, net income available to common shareholders was $477.3 million, and diluted EPS was $7.36, representing increases of 12.9% and 13.1% respectively, compared to the same period in 2024.

- Net interest income on a taxable-equivalent basis increased by 9.1% to $463.7 million in Q3 2025 compared to Q3 2024, while non-interest income rose by 10.5% to $125.6 million.

- The company demonstrated improved asset quality, with credit loss expense decreasing significantly to $6.8 million in Q3 2025 from $19.4 million in Q3 2024, and non-accrual loans dropping to $44.8 million at September 30, 2025, from $104.9 million a year earlier.

- Capital ratios remained strong, with Common Equity Tier 1, Tier 1, and Total Risk-Based Capital Ratios at 14.14%, 14.59%, and 16.04% respectively at the end of Q3 2025, all exceeding Basel III minimum requirements. The board also declared a fourth quarter dividend.

Quarterly earnings call transcripts for CULLEN/FROST BANKERS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more