Earnings summaries and quarterly performance for Cipher Digital.

Executive leadership at Cipher Digital.

Board of directors at Cipher Digital.

Research analysts who have asked questions during Cipher Digital earnings calls.

Mike Grondahl

Lake Street Capital Markets

6 questions for CIFR

John Todaro

Needham & Company

5 questions for CIFR

Chris Brendler

Rosenblatt Securities

4 questions for CIFR

Bill Papanastasiou

Keefe, Bruyette & Woods (KBW)

3 questions for CIFR

Brett Knoblauch

Cantor Fitzgerald & Co.

3 questions for CIFR

Reggie Smith

JPMorgan Chase & Co.

3 questions for CIFR

Gregory Lewis

BTIG, LLC

2 questions for CIFR

Paul Golding

Macquarie Capital

2 questions for CIFR

Brett Niblock

Cantor Fitzgerald

1 question for CIFR

Joseph Vafi

Canaccord Genuity - Global Capital Markets

1 question for CIFR

Justin Pan

Clear Street

1 question for CIFR

Michael Colonnese

H.C. Wainwright & Co.

1 question for CIFR

Reginald Smith

JPMorgan Chase & Co.

1 question for CIFR

Recent press releases and 8-K filings for CIFR.

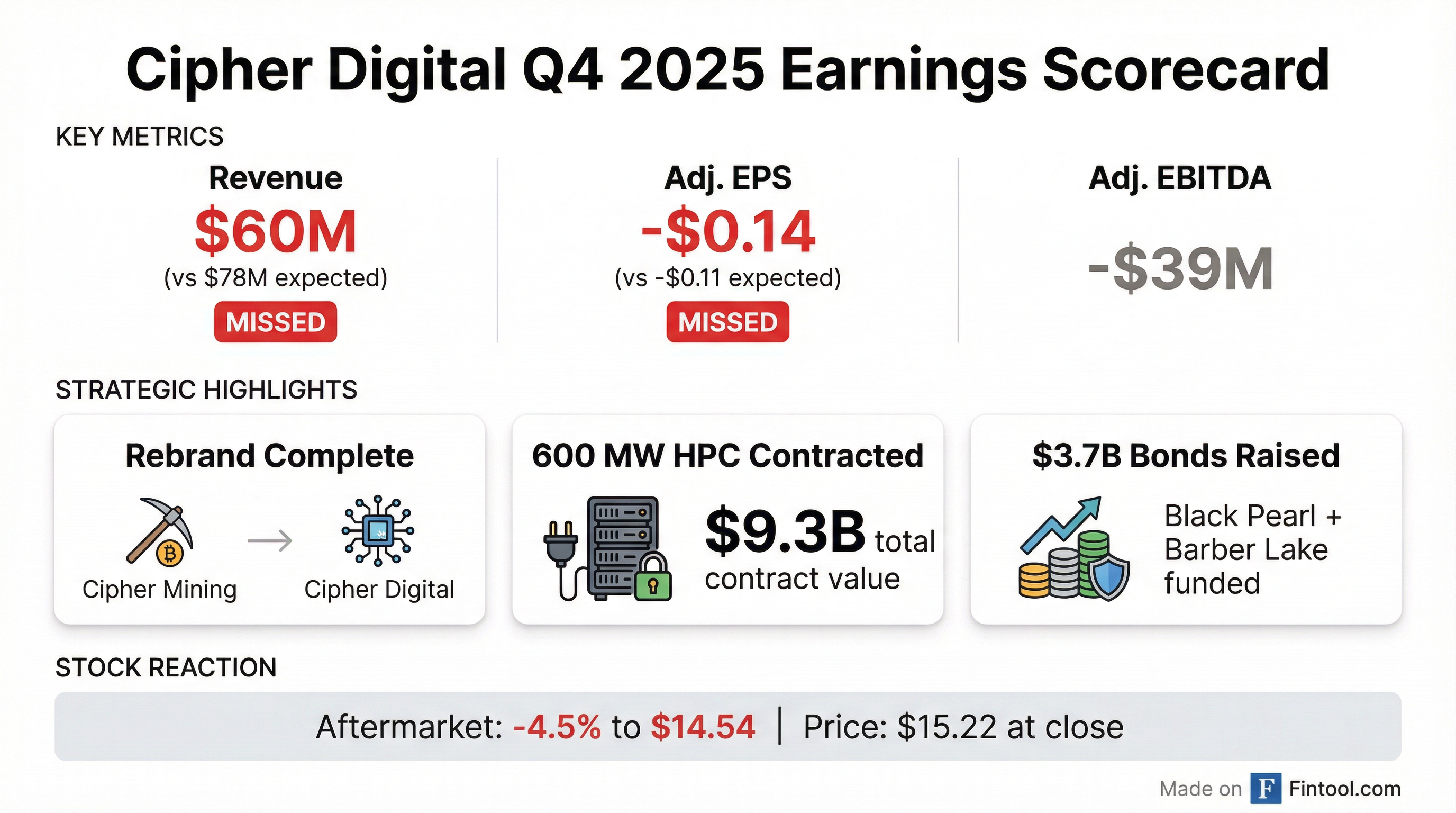

- Cipher Mining is formally rebranding as Cipher Digital, signifying a complete strategic transformation from a Bitcoin miner to a digital infrastructure company focused on delivering hyperscale compute with stable, long-duration cash flows.

- The company has executed two data center campus leases, totaling 600 megawatts of gross capacity and approximately $9.3 billion in contracted revenue over initial terms of 10-15 years. These agreements are projected to generate $669 million of average annualized Net Operating Income (NOI) from October 2026 to September 2036.

- Cipher completed a $2 billion bond offering at a 6.125% yield to fully fund the Black Pearl build-out, which included a $233 million reimbursement for prior equity contributions. This follows a previous $1.73 billion financing for Barber Lake at 7.125%.

- For Q4 2025, Cipher reported $60 million in revenue and a GAAP net loss of $734 million, primarily driven by a $450 million non-cash mark-to-market loss on convertible notes and impairments related to the Bitcoin mining transition. The company plans to exit its Bitcoin position entirely by the end of 2026.

- Cipher acquired Ulysses, a 200 MW site in Ohio expected to energize in 2027, and maintains a total development pipeline of 3.4 gigawatts prioritized for High-Performance Computing (HPC).

- Cipher Mining has rebranded to Cipher Digital, signaling a complete strategic transition from Bitcoin mining to a pure-play digital infrastructure company focused on hyperscale compute, aiming for stable, long-duration cash flows from long-term leases.

- The company secured long-term leases for 600 megawatts of gross capacity, representing approximately $9.3 billion in contracted revenue over 10-15 year terms, with an expected $669 million of average annualized net operating income from October 2026 to September 2036.

- Cipher successfully completed a $2 billion bond offering at 6.125% to fully fund the Black Pearl project, and previously secured $1.73 billion for Barber Lake, reinforcing its project-level financing strategy.

- For Q4 2025, Cipher reported revenue of $60 million and a GAAP net loss of $734 million, primarily driven by a $450 million non-cash mark-to-market on convertible notes and other impairments related to the Bitcoin mining transition.

- As part of its strategic shift, Cipher sold its 340 MW joint venture Bitcoin mining sites and plans to fully exit its Bitcoin holdings, which stood at approximately 1,166 Bitcoin as of February 20th, 2026, by the end of 2026.

- Cipher Mining is formally rebranding to Cipher Digital, marking a complete transition from a Bitcoin miner to a digital infrastructure company focused on delivering hyperscale compute, with plans to exit its Bitcoin inventory entirely by the end of 2026.

- For Q4 2025, the company reported $60 million in revenue and a GAAP net loss of $734 million, primarily due to a $450 million non-cash mark-to-market loss on convertible notes and impairments on legacy Bitcoin mining assets.

- Cipher Digital has executed two data center campus leases (Barber Lake and Black Pearl) representing 600 MW of gross capacity, securing approximately $9.3 billion in contracted revenue over initial terms of 10-15 years, with an expected $669 million of average annualized Net Operating Income (NOI) from October 2026 to September 2036.

- The company successfully completed a $2 billion bond offering at 6.125% to fully fund the Black Pearl project, which included a $233 million CapEx reimbursement, following a previous $1.73 billion financing for Barber Lake at 7.125%.

- Cipher Digital acquired Ulysses, a 200 MW site in Ohio expected to energize in 2027, and is in advanced lease negotiations for Stingray, a 100 MW site in Texas, which is on track to energize in Q4 2025.

- Cipher Mining Inc. rebranded to Cipher Digital Inc. on February 20, 2026, reflecting a strategic shift towards HPC data center development.

- For Q4 2025, the company reported Revenue of $60 million and an Adjusted Net Loss of $55 million.

- Cipher Digital secured $3.73 billion through three high-yield bond offerings to fully finance its Barber Lake and Black Pearl HPC data center developments.

- The company divested its 49% stake in three joint venture bitcoin mining sites and select bitcoin mining machines for approximately $40 million in an all-stock transaction.

- 600 MW of total contracted HPC capacity has been secured through a 15-year 300 MW lease with AWS and a 10-year 300 MW lease with Fluidstack and Google.

- The Issuer is required to furnish unaudited consolidated financial statements within 60 days after the end of each of the first three fiscal quarters (starting Q1 2026) and audited consolidated financial statements within 120 days after the end of each fiscal year (starting FY 2025) to the Trustee and Holders.

- The document outlines optional redemption prices for the Notes, with specific percentages for redemptions on or after February 15, 2028 (103.063%), February 15, 2029 (101.531%), and February 15, 2030 and thereafter (100.000%).

- The Issuer and Subsidiary Guarantors are restricted to business activities primarily focused on the development and operation of the Project and any Additional Projects, with limitations on asset acquisition, mergers, and investments.

- Cipher Mining Inc.'s wholly-owned subsidiary, Black Pearl Compute LLC, has priced a $2.0 billion offering of 6.125% senior secured notes due 2031 at par.

- The offering is expected to close on February 11, 2026.

- The net proceeds will be used to finance the remaining cost of the Black Pearl Facility, reimburse Cipher approximately $232.5 million for prior equity contributions, fund debt service reserves, and cover fees and expenses.

- The notes will be fully and unconditionally guaranteed by Cipher Black Pearl and 11786 Wink LLC, and secured by first-priority liens on substantially all assets of the Issuer and Guarantors.

- Cipher Mining Inc.'s (CIFR) wholly-owned subsidiary, Black Pearl Compute LLC, has priced a $2.0 billion offering of 6.125% senior secured notes due 2031.

- The offering is expected to close on February 11, 2026, with net proceeds primarily allocated to finance the remaining cost of the Black Pearl Facility, a high-performance computing data center in Wink, Texas.

- Additionally, the proceeds will reimburse Cipher approximately $232.5 million for its prior equity contributions related to the Black Pearl Facility.

- The notes will be fully and unconditionally guaranteed by Cipher Black Pearl and 11786 Wink LLC, and secured by first-priority liens on substantially all assets of the Issuer and Guarantors.

- Cipher Mining Inc.'s wholly-owned subsidiary, Black Pearl Compute LLC, intends to offer $2.00 billion aggregate principal amount of senior secured notes due 2031.

- The net proceeds from the offering are primarily intended to finance the remaining cost of the Black Pearl Facility, a high-performance computing data center in Wink, Texas, and to reimburse Cipher approximately $232.5 million for prior equity contributions.

- The Black Pearl Facility, which has a 216 MW Critical IT load, is 100% pre-leased to Amazon Data Services, Inc. for at least 15 years, with initial rent targeted to commence in October 2026.

- Amazon.com, Inc. fully guarantees an amount equal to all base rent and operating expenses for the lease.

- Cipher Mining Inc.'s wholly-owned subsidiary, Black Pearl Compute LLC, intends to offer $2.00 billion aggregate principal amount of senior secured notes due 2031.

- The net proceeds from the offering are planned to finance the remaining cost of the Black Pearl Facility (a high-performance computing data center), reimburse Cipher approximately $232.5 million for prior equity contributions, and fund debt service reserves and related expenses.

- The Notes will be fully and unconditionally guaranteed by Cipher Black Pearl and 11786 Wink LLC, secured by first-priority liens on substantially all assets of the Issuer and Guarantors, and Cipher will provide a customary completion guarantee for the Black Pearl Facility.

- Cipher Mining Inc. announced the redemption of all its outstanding warrants, with the redemption date set for December 26, 2025, at 5:00 p.m. New York City time.

- The redemption price for each warrant is $0.01.

- The company initiated the redemption because its common stock closing price was at least $18.00 per share for 20 trading days within a 30-day period ending November 21, 2025.

- Warrant holders can exercise their warrants on a cashless basis until the redemption date, receiving 0.2687 of a share of Common Stock for each Warrant surrendered.

- Warrants that remain unexercised by the December 26, 2025 deadline will become void, and holders will only be entitled to receive the $0.01 redemption price per warrant.

Quarterly earnings call transcripts for Cipher Digital.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more