Earnings summaries and quarterly performance for CIVISTA BANCSHARES.

Executive leadership at CIVISTA BANCSHARES.

Dennis G. Shaffer

President and Chief Executive Officer

Carl A. Kessler, III

Senior Vice President

Charles A. Parcher

Executive Vice President

Donna M. Waltz-Jaskolski

Senior Vice President, Customer Experience Officer

Ian Whinnem

Senior Vice President, Chief Financial Officer and Treasurer

Lance A. Morrison

Senior Vice President, Secretary and General Counsel

Michael Mulford

Senior Vice President, Chief Credit Officer

Richard J. Dutton

Senior Vice President

Robert L. Curry, Jr.

Senior Vice President

Robert L. Katitus

Executive Vice President & Chief Lending Officer

Russel J. Edwards, Jr.

Senior Vice President, Retail Banking

Board of directors at CIVISTA BANCSHARES.

Clyde A. Perfect, Jr.

Director

Darci Congrove

Director

Dennis E. Murray, Jr.

Chairperson of the Board

Gerald B. Wurm

Director

Harry Singer

Director

Julie A. Mattlin

Director

Lorina W. Wise

Director

Mark Macioce

Director

Mary Patricia Oliver

Director

Nathan E. Weaks

Director

Research analysts who have asked questions during CIVISTA BANCSHARES earnings calls.

Brendan Nosal

Hovde Group, LLC

6 questions for CIVB

Justin Crowley

Piper Sandler Companies

5 questions for CIVB

Manuel Navas

D.A. Davidson & Co.

4 questions for CIVB

Tim Switzer

Keefe, Bruyette & Woods (KBW)

4 questions for CIVB

Terence McEvoy

Stephens Inc.

3 questions for CIVB

Jeff Rulis

D.A. Davidson & Co.

2 questions for CIVB

Ryan Payne

D.A. Davidson & Co.

2 questions for CIVB

Terry McEvoy

Stephens Inc.

2 questions for CIVB

Terry McEvoy

Stephens

2 questions for CIVB

Timothy Switzer

KBW

2 questions for CIVB

Daniel Cardenas

Janney Montgomery Scott LLC

1 question for CIVB

Emily Lee

Keefe, Bruyette & Woods, Inc.

1 question for CIVB

Terence James McEvoy

Stephens

1 question for CIVB

Timothy Jeffrey Switzer

Keefe, Bruyette & Woods

1 question for CIVB

Recent press releases and 8-K filings for CIVB.

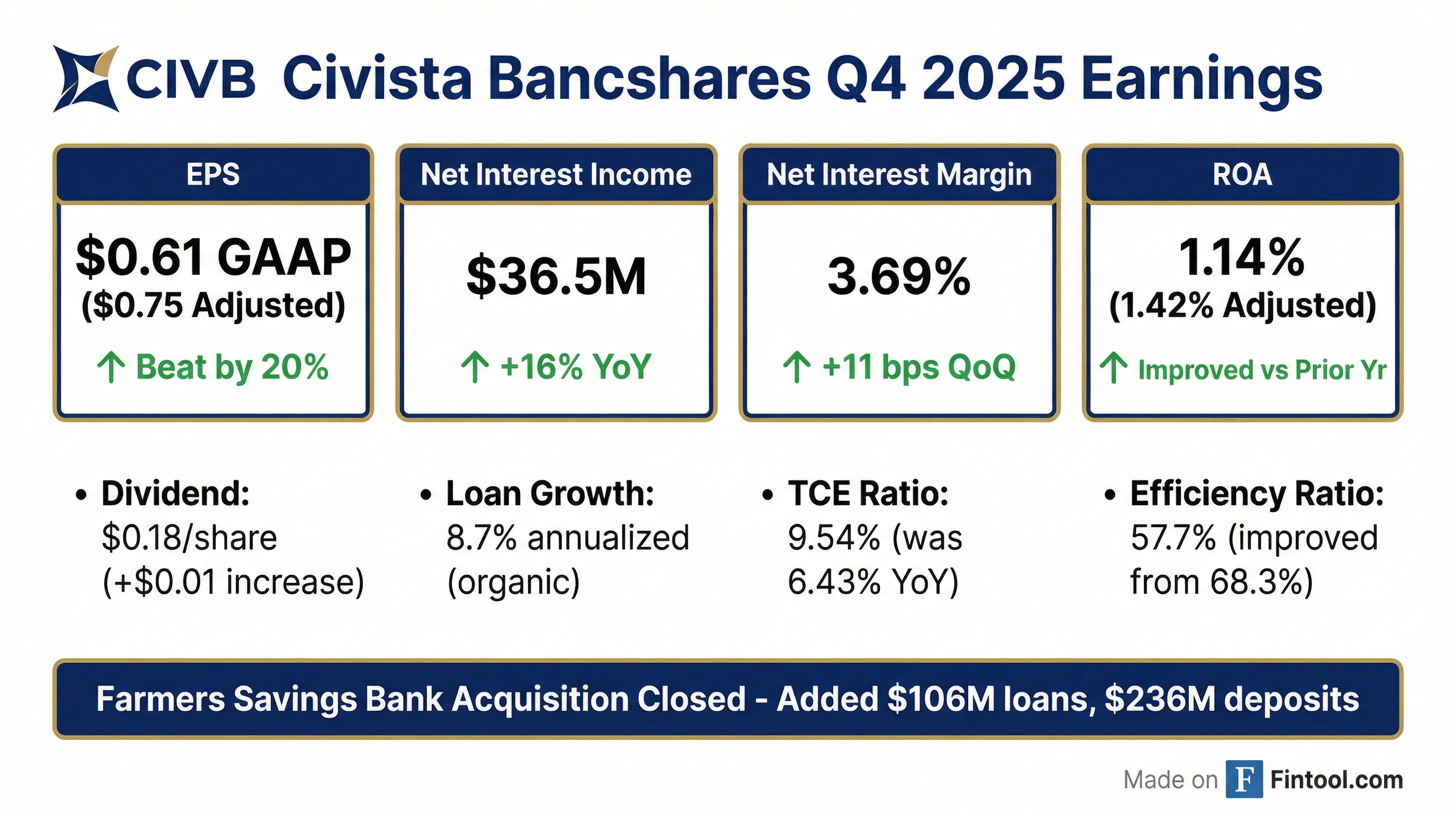

- Civista Bancshares reported strong financial results for Q4 2025, with net income of $12.3 million and $0.61 per diluted share, representing a 24% increase over Q4 2024. Full-year 2025 net income was $46.2 million, or $2.64 per diluted share, up 46% from 2024.

- The acquisition of Farmers Savings Bank contributed $106 million in loans and $236 million in low-cost deposits to the balance sheet, despite a $0.14 per common share negative impact on Q4 2025 net income from non-recurring expenses.

- The company expanded its net interest margin by 11 basis points to 3.69% in Q4 2025 and improved its efficiency ratio to 57.7%.

- Excluding acquired loans, organic loan growth was $68.7 million in Q4 2025, an 8.7% annualized rate, with mid-single-digit loan growth anticipated for 2026.

- Civista increased its quarterly dividend to $0.18 per share and ended 2025 with a strong tangible common equity ratio of 9.54% and a Tier 1 leverage ratio of 11.32%.

- Civista Bancshares reported net income of $12.3 million, or $0.61 per diluted share, for Q4 2025, representing a 24% increase over Q4 2024, despite $0.14 per common share in non-recurring expenses related to the Farmers Savings Bank acquisition.

- For the full year 2025, net income reached $46.2 million, or $2.64 per diluted share, a significant increase from $31.7 million, or $2.01 per diluted share, in 2024.

- The company's Net Interest Margin (NIM) expanded by 11 basis points to 3.69% in Q4 2025, driven by a 19 basis point decline in funding costs. Management anticipates further NIM expansion of 2-3 basis points in Q1 2026 and 3-4 basis points in Q2 2026 and beyond.

- Civista completed the acquisition of Farmers Savings Bank, adding $106 million in loans and $236 million in low-cost deposits. Organic loan growth (excluding acquired loans) was $68.7 million in Q4 2025, an annualized rate of 8.7%, and the company expects mid-single-digit loan growth in 2026.

- Capital ratios showed significant improvement, with the tangible common equity ratio increasing to 9.54% at December 31, 2025, from 6.43% a year prior, and the CRE to risk-based capital ratio reduced to 275% from 366%. The quarterly dividend was also increased to $0.18 per share.

- Civista Bancshares reported net income of $12.3 million, or $0.61 per diluted share, for the fourth quarter of 2025, and $46.2 million, or $2.64 per diluted share, for the full year 2025.

- The company completed its acquisition of Farmers Savings Bank in the fourth quarter of 2025, adding $106 million in loans and $236 million in low-cost deposits, though this resulted in $3.4 million in pre-tax non-recurring expenses.

- The net interest margin expanded by 11 basis points to 3.69% in Q4 2025, and the company anticipates mid-single-digit loan growth in 2026.

- Capital ratios showed significant improvement, with the tangible common equity ratio increasing to 9.54% and the CRE to risk-based capital ratio reducing to 275% by year-end 2025.

- The quarterly dividend was increased to $0.18 per share, reflecting management's confidence in continued strong earnings.

- Civista Bancshares, Inc. reported net income of $12.3 million and diluted earnings per common share of $0.61 for the fourth quarter of 2025, and net income of $46.2 million and diluted earnings per common share of $2.64 for the full-year 2025.

- Net income for the fourth quarter of 2025 increased by 24% compared to the fourth quarter of 2024, and full-year 2025 net income increased by 46% compared to full-year 2024.

- The company completed the acquisition of The Farmers Savings Bank (FSB) on November 6, 2025, which added approximately $268.1 million of assets, $106.2 million of loans and leases, and $236.1 million of deposits.

- The efficiency ratio improved to 57.7% in the fourth quarter of 2025, a decrease from 68.3% in the fourth quarter of 2024 and 61.4% in the third quarter of 2025. Non-recurring adjustments related to the FSB merger negatively impacted Q4 2025 net income by approximately $2.9 million after-tax, or $0.14 per common share.

- Civista Bancshares, Inc. reported net income of $12.3 million and diluted earnings per common share of $0.61 for the fourth quarter ended December 31, 2025, representing a 24% increase in net income compared to the fourth quarter of 2024.

- For the full year ended December 31, 2025, net income reached $46.2 million, a 46% increase from $31.7 million in 2024, with diluted earnings per common share of $2.64, up 31% from $2.01 in 2024.

- The company completed the acquisition of The Farmers Savings Bank (FSB) on November 6, 2025, which added approximately $268.1 million of assets, $106.2 million of loans and leases, and $236.1 million of deposits.

- The fourth quarter of 2025 included non-recurring adjustments related to the FSB merger that negatively impacted net income by approximately $2.9 million on an after-tax basis, or $0.14 per common share.

- Civista's efficiency ratio improved to 57.7% for the fourth quarter of 2025, down from 68.3% in the fourth quarter of 2024, and the company achieved 7.9% deposit growth and 6.1% loan and lease balance growth since December 31, 2024.

- Civista Bancshares, Inc. (NASDAQ:CIVB) announced that its Board of Directors approved a quarterly dividend of 18 cents per common share, representing a 1-cent increase from the prior quarter.

- The dividend is payable on February 24, 2026, to shareholders of record as of February 10, 2026.

- Based on the company's closing stock price of $22.22 on December 31, 2025, this quarterly dividend produces an annualized yield of 3.24%.

- Civista Bancshares, Inc. (CIVB) has approved and declared a quarterly dividend of 18 cents per common share, which is a 1-cent increase from the prior quarter.

- The dividend is payable on February 24, 2026, to shareholders of record as of February 10, 2026.

- This dividend represents an approximate payout of $3.7 million and an annualized yield of 3.24%, based on the closing stock price of $22.22 on December 31, 2025.

- Civista Bancshares, Inc. (CIVB) completed its merger with The Farmers Savings Bank on November 6, 2025, expanding its community banking footprint into Medina and Lorain Counties in Northeast Ohio.

- The merger adds two new branches and approximately $236 million in low-cost deposits to Civista's portfolio.

- As of September 30, 2025, the combined organization will have approximately $4.4 billion in total assets, $3.2 billion in net loans, and $3.5 billion in total deposits.

- The aggregate consideration for the merger included $35,543,239 in cash and approximately 1,434,491 Civista common shares.

- Civista Bancshares, Inc. (NASDAQ: CIVB) successfully completed its merger with The Farmers Savings Bank on November 6, 2025, expanding its presence into Medina and Lorain Counties, Ohio.

- The merger adds two new branches and approximately $236 million in low-cost deposits to Civista's portfolio.

- Based on financial data as of September 30, 2025, the combined organization will have approximately $4.4 billion in total assets, $3.2 billion in net loans, and $3.5 billion in total deposits.

- The system conversion for the merged entity is scheduled for the first quarter of 2026.

- Civista Bancshares, Inc. announced its participation in the Hovde Group Financial Services Conference from November 6–7, 2025, and the Piper Sandler Financial Services Conference from November 10–12, 2025.

- The company reported strong financial performance for Q3 2025, with a net interest margin of 3.58% and an efficiency ratio of 61.4%. Year-to-date net income increased by $12.1 million to $33.9 million compared to the same period last year.

- Civista Bancshares, Inc. announced the acquisition of The Farmers Savings Bank in July 2025, which is expected to close in Q4 2025, increasing combined assets to an estimated $4.5 billion.

- The company maintains a strong capital position, bolstered by a successful $80.5 million common stock offering in July 2025. As of September 30, 2025, the Tier 1 risk-based capital ratio was 14.19%, and the total risk-based capital ratio was 17.80%.

- Credit quality remains strong, with nonperforming loans as a percent of total loans at 0.74% in Q3 2025.

Quarterly earnings call transcripts for CIVISTA BANCSHARES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more