Earnings summaries and quarterly performance for COLUMBUS MCKINNON.

Executive leadership at COLUMBUS MCKINNON.

David Wilson

President and Chief Executive Officer

Adrienne Williams

SVP and Chief Human Resources Officer

Alan Korman

SVP, General Counsel, Corp. Development and Secretary

Appal Chintapalli

President, EMEA and APAC

Gregory Rustowicz

Executive Vice President, Finance and Chief Financial Officer

Jon Adams

President, Americas

Mario Ramos Lara

Chief Product Technology Officer, GM Latin America

Mark Paradowski

SVP, Information Services and Chief Digital Officer

Board of directors at COLUMBUS MCKINNON.

Research analysts who have asked questions during COLUMBUS MCKINNON earnings calls.

Steve Ferazani

Sidoti & Company

6 questions for CMCO

James Kirby

JPMorgan Chase & Co.

5 questions for CMCO

Jonathan Tanwanteng

CJS Securities

5 questions for CMCO

Matt Summerville

D.A. Davidson & Co.

4 questions for CMCO

Walter Liptak

Seaport Research Partners

2 questions for CMCO

Canyon Hayes

D.A. Davidson & Co.

1 question for CMCO

Charles Strauzer

CJS Securities

1 question for CMCO

Recent press releases and 8-K filings for CMCO.

- Columbus McKinnon closed the Kito Crosby acquisition and targets $70 million in net run rate cost synergies, with 20% expected in year one, 60% in year two, and 100% in year three.

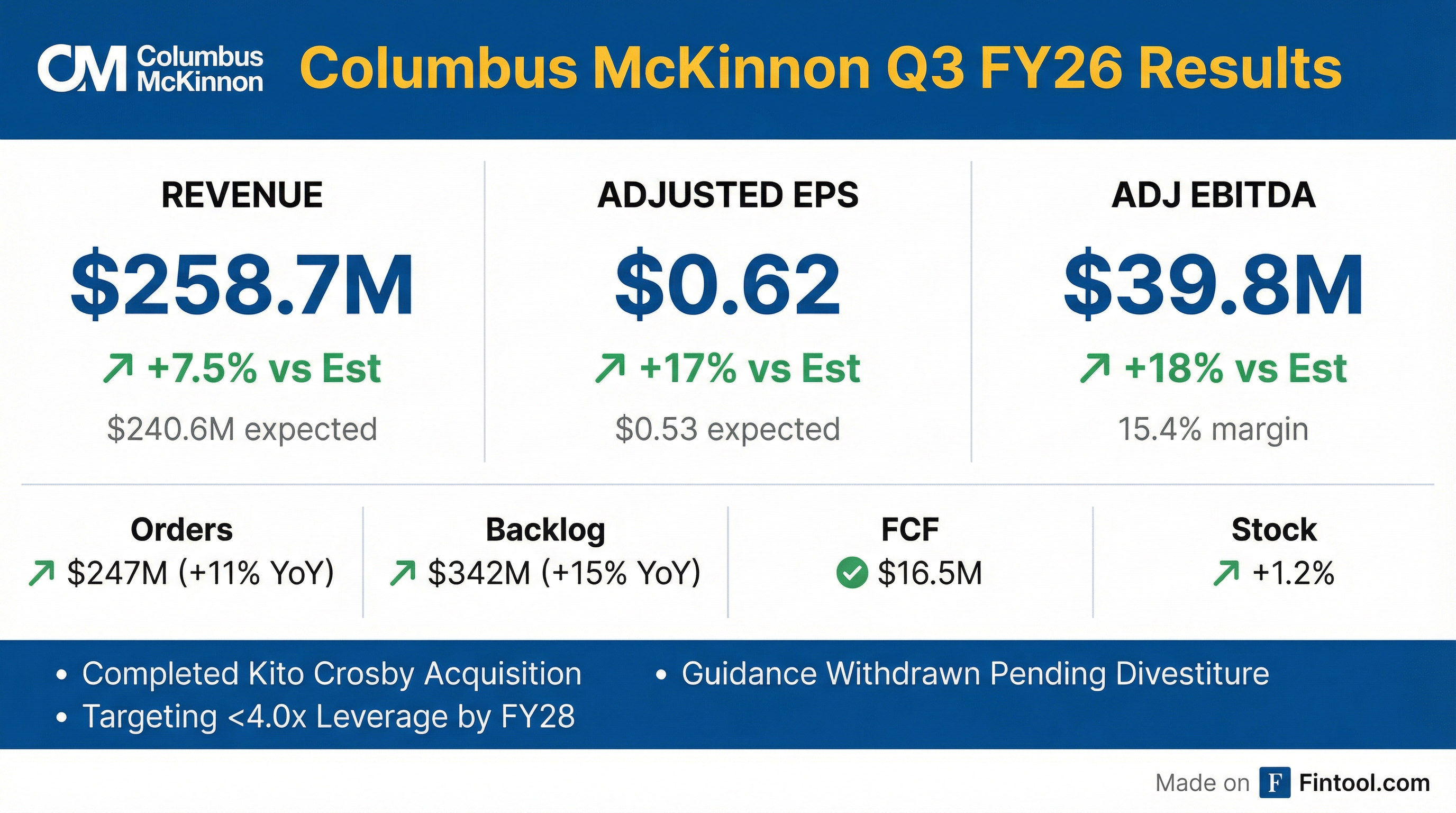

- For Q3 fiscal 2026, the company reported net sales of $258.7 million, an 11% increase in orders to $247 million, and adjusted EPS of $0.62. Adjusted EBITDA was $39.8 million with a 15.4% margin.

- The company expects to close the divestiture of its U.S. power chain hoist and chain operations by the end of the current quarter, with approximately $160 million in proceeds to be used for debt repayment. Debt repayment is the primary capital allocation priority, aiming for a net leverage ratio below 4x by the end of fiscal 2028.

- Columbus McKinnon has withdrawn its prior standalone guidance for fiscal year 2026 due to the Kito Crosby acquisition and the pending divestiture.

- Columbus McKinnon closed the Kito Crosby acquisition, which is expected to generate $70 million in net run rate cost synergies over three years, with 20% anticipated in year one. The company's primary capital allocation priority is now debt repayment, with a goal to reduce the net leverage ratio to below 4x by the end of fiscal 2028.

- For the third quarter of fiscal 2026, Columbus McKinnon reported net sales of $258.7 million, an increase of 10.5% from the prior year, and adjusted EPS of $0.62, up 11% year-over-year. Orders grew 11% to $247 million, and backlog increased 15% to $342 million.

- The company withdrew its prior fiscal year 2026 standalone guidance due to the Kito Crosby acquisition and the uncertainty surrounding the timing of its pending divestiture of U.S. power chain hoist and chain operations, which is expected to close by the end of Q4 2026.

- Net sales for Q3 FY26 reached $259 million, marking a 10% increase year-over-year.

- Adjusted Net Income was $18 million, leading to Adjusted EPS of $0.62, an 11% increase year-over-year.

- Orders grew 11% year-over-year to $247 million, with the backlog increasing 15% year-over-year to $342 million.

- The company generated $20.3 million in net cash from operating activities and $16.5 million in Free Cash Flow for Q3 FY26.

- Columbus McKinnon completed the Kito Crosby acquisition and withdrew its FY26 guidance due to uncertainties related to a pending divestiture and integration.

- Columbus McKinnon closed the Kito Crosby acquisition, targeting $70 million in net run rate cost synergies, with 20% expected in year one, 60% in year two, and 100% in year three. The company also expects to close the divestiture of its U.S. power chain hoist and chain operations by the end of Q4 fiscal 2026.

- For Q3 fiscal 2026, Columbus McKinnon reported net sales of $258.7 million, an increase of 10.5% year-over-year, and adjusted EPS of $0.62, up 11%. Orders were up 11% to $247 million, and backlog increased 15% to $342 million. Adjusted EBITDA was $40 million, with a 15.4% margin.

- The company withdrew its prior standalone guidance for fiscal year 2026 due to the acquisition and divestiture. It expects to reduce its net leverage ratio to below 4x by the end of fiscal 2028, with debt repayment as the primary capital allocation priority. Tariff cost neutrality is expected by the end of fiscal 2026, and margin neutrality in fiscal 2027.

- Columbus McKinnon reported net sales of $258.7 million for Q3 FY26, marking a 10% increase from the prior-year period, with orders also growing 11% to $247.4 million.

- Net income for the quarter was $6.0 million, or $0.21 per diluted share, representing a 51% and 50% increase, respectively, while Adjusted Net Income rose 9% to $17.8 million, or $0.62 per diluted share.

- The company's backlog increased 15% to $341.6 million.

- Following the recently completed Kito Crosby acquisition and a pending divestiture, Columbus McKinnon withdrew its fiscal year 2026 guidance due to increased uncertainty in expected results for Q4 FY26.

- Year-to-date cash flow provided by operations significantly increased by 106% to $20.6 million.

- Columbus McKinnon reported net sales of $258.7 million for the third quarter of fiscal year 2026, marking a 10% increase compared to the prior-year period, with orders growing 11% to $247.4 million.

- Net income for Q3 FY26 increased 51% to $6.0 million, or $0.21 per diluted share, while Adjusted Net Income grew 9% to $17.8 million, or $0.62 per diluted share.

- The company has closed the acquisition of Kito Crosby and is proceeding with the pending divestiture of its U.S. power chain hoist and chain operations.

- Due to the recent acquisition and pending divestiture, Columbus McKinnon has withdrawn its fiscal year 2026 guidance and plans to issue financial guidance for fiscal year 2027 in late May 2026.

- The primary capital allocation priority is debt reduction, with an expectation to achieve a Net Leverage Ratio below 4.0x by the end of fiscal 2028.

- Columbus McKinnon Corporation (CMCO) completed its acquisition of Kito Crosby Limited on February 4, 2026, a transaction expected to create a global leader in lifting solutions.

- The acquisition is projected to deliver $70 million of expected net annual run rate cost synergies and improve Adjusted EBITDA Margin.

- A new Executive Leadership Team has been appointed, with David Wilson continuing as President and CEO and Gregory Rustowicz as Executive Vice President and CFO.

- In conjunction with the acquisition financing, which included an $800.0 million Series A cumulative convertible participating preferred share investment from CD&R, Columbus McKinnon expanded its Board of Directors from 9 to 12 members, appointing Michael Lamach, Nate Sleeper, and Andrew Campelli.

- Columbus McKinnon (CMCO) completed its acquisition of Kito Crosby from funds managed by KKR on February 4, 2026, after receiving approval from 14 regulatory review processes.

- The acquisition is expected to scale the business, deliver improved Adjusted EBITDA Margin, and generate $70 million of net annual run rate cost synergies.

- A new Executive Leadership Team has been appointed, with David Wilson serving as President and Chief Executive Officer and Gregory Rustowicz as Executive Vice President and Chief Financial Officer.

- In connection with CD&R's $800.0 million Series A cumulative convertible participating preferred share investment, Columbus McKinnon expanded its Board of Directors from 9 to 12 members, appointing Michael Lamach, Nate Sleeper, and Andrew Campelli.

- Columbus McKinnon Corporation (CMCO) has received clearance from the Antitrust Division of the U.S. Department of Justice (DOJ) for its previously announced acquisition of Kito Crosby Limited.

- The clearance was granted after CMCO entered into a consent decree with the DOJ, agreeing to divest its U.S. power chain hoist and chain operations. This divestiture was formalized through an Equity Purchase Agreement on January 13, 2026.

- All regulatory approvals for the acquisition have been obtained, and the acquisition is expected to close in February 2026.

- The company anticipates the acquisition will deliver $70 million of expected net annual run rate cost synergies, enhance customer service, and improve Adjusted EBITDA margin.

- Columbus McKinnon (CMCO) has received clearance from the U.S. Department of Justice (DOJ) for its acquisition of Kito Crosby Limited, with the acquisition expected to close in February 2026.

- The clearance was granted after Columbus McKinnon agreed to divest its U.S. power chain hoist and chain operations.

- The company anticipates the acquisition will deliver $70 million of expected net annual run rate cost synergies and improve Adjusted EBITDA margin.

Quarterly earnings call transcripts for COLUMBUS MCKINNON.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more