Earnings summaries and quarterly performance for CAPITAL SOUTHWEST.

Executive leadership at CAPITAL SOUTHWEST.

Board of directors at CAPITAL SOUTHWEST.

Research analysts who have asked questions during CAPITAL SOUTHWEST earnings calls.

Robert Dodd

Raymond James

6 questions for CSWC

Mickey Schleien

Ladenburg Thalmann

5 questions for CSWC

Douglas Harter

UBS

4 questions for CSWC

Erik Zwick

Lucid Capital Markets

3 questions for CSWC

Dillion Hines

B. Riley Securities

2 questions for CSWC

Doug Harter

UBS Group AG

2 questions for CSWC

Justin Marcon

Lucid Capital Markets

2 questions for CSWC

Brian McKenna

Citizens JMP Securities

1 question for CSWC

Bryce Rowe

B. Riley Securities

1 question for CSWC

Matthew Hurwit

Jefferies

1 question for CSWC

Sean-Paul Adams

Not Provided in Transcript

1 question for CSWC

Recent press releases and 8-K filings for CSWC.

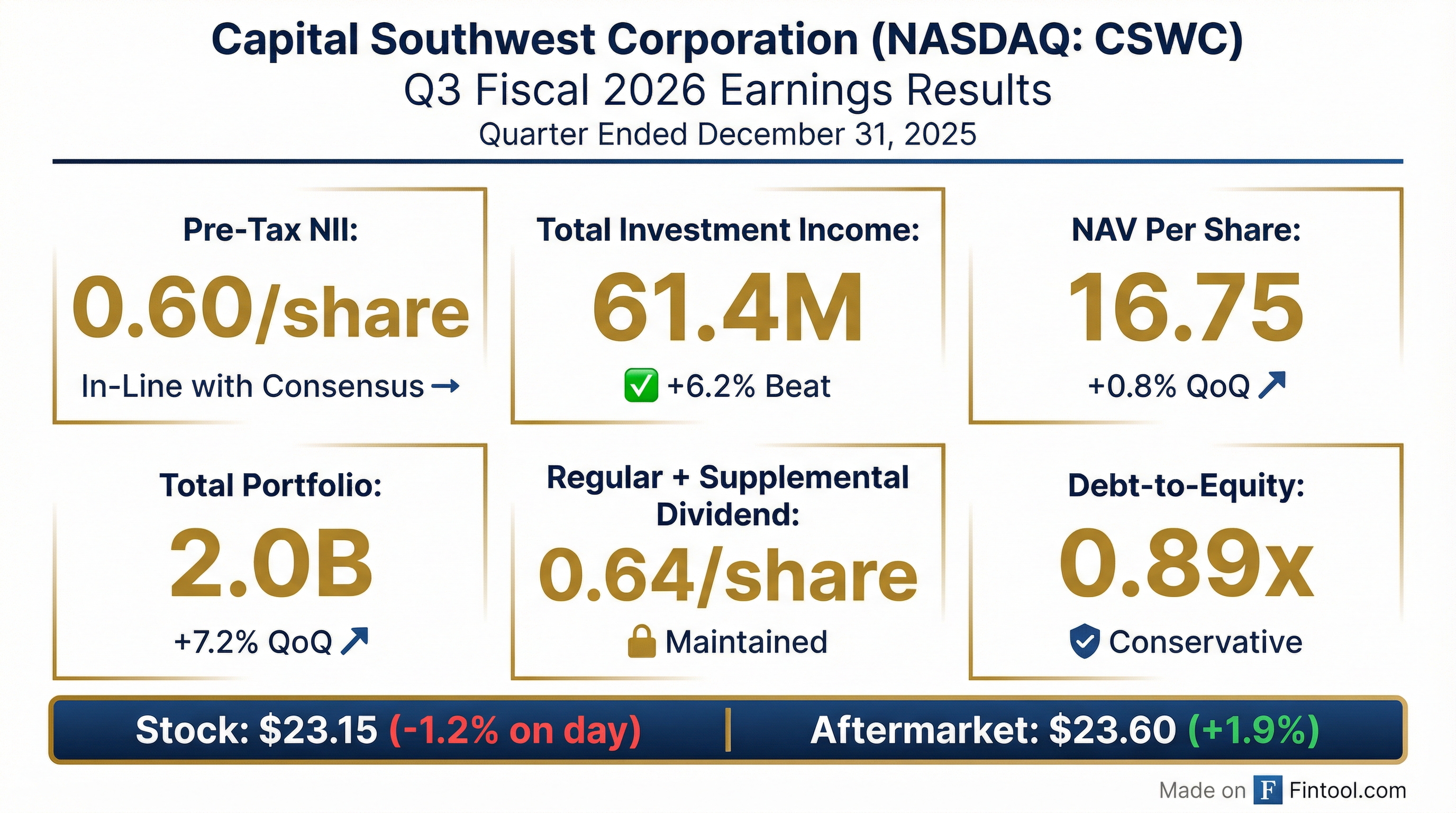

- CSWC reported Pre-Tax Net Investment Income of $34.6 million, or $0.60 per share, for Q3 2026 (quarter ended December 31, 2025).

- The company declared a regular monthly dividend of $0.1934 per share for January, February, and March 2026 ($0.58 per share quarterly), and a supplemental dividend of $0.06 per share for the quarter ending March 31, 2026.

- Net Asset Value per share increased to $16.75 as of December 31, 2025, from $16.62 per share as of September 30, 2025, with total balance sheet assets of $2.1 billion.

- The investment portfolio stood at approximately $2.0 billion at fair value as of December 31, 2025, with 90.0% allocated to first lien investments. During the quarter, CSWC originated $244.0 million in new committed investments.

- For the third fiscal quarter of 2026, Capital Southwest Corporation generated pre-tax net investment income of $0.60 per share and saw its NAV per share increase to $16.75.

- The company's Board of Directors declared a total of $0.64 per share in dividends for the March quarter, comprising a $0.58 regular dividend and a $0.06 supplemental dividend.

- Capital Southwest closed $244 million in total new commitments during the quarter, with a weighted average spread of approximately 6.4% and a weighted average yield of approximately 10.50% on new originations.

- Capitalization efforts included issuing $350 million in 5.95% notes due 2030, redeeming older notes, and raising approximately $53 million in gross equity proceeds through its Equity ATM Program at 127% of the prevailing NAV per share.

- Subsequent to quarter-end, Capital Southwest announced a new first-out senior loan joint venture, which is expected to generate a low to mid-teens equity return once fully ramped.

- Capital Southwest reported pre-tax net investment income of $0.60 per share and an increase in NAV per share to $16.75 for Q3 2026. The Board declared total dividends of $0.64 per share for the March quarter, including a $0.06 per share supplemental dividend.

- The company closed $244 million in total new commitments during the quarter, with a weighted average spread of 6.4%. The on-balance sheet credit portfolio grew to $1.8 billion, with 99% remaining first lien senior secured.

- Capital Southwest strengthened its balance sheet by issuing $350 million in 5.95% notes due 2030 and redeeming $150 million notes due 2026 and $71.9 million notes due 2028. It also raised $53 million in gross equity proceeds through its ATM Program at $21.11 per share.

- Subsequent to quarter-end, the company announced a new first-out senior loan joint venture, which is expected to generate a low to mid-teens equity return for Capital Southwest once fully ramped, with each party committing $50 million of equity.

- Capital Southwest Corporation reported pre-tax net investment income of $0.60 per share for the third fiscal quarter of 2026.

- The Board of Directors declared total dividends of $0.64 per share for the March quarter, comprising $0.58 per share in regular dividends and a $0.06 per share supplemental dividend.

- A new first-out senior loan joint venture was announced, aimed at enhancing competitiveness and is expected to generate a low to mid-teens equity return once fully ramped.

- The company strengthened its balance sheet by redeeming $221.9 million in notes due 2026 and 2028, issuing $350 million in new notes due 2030, and raising approximately $53 million in equity through its ATM program, contributing to an increase in NAV per share to $16.75 and regulatory leverage of 0.89 to 1 debt to equity.

- Capital Southwest reported Pre-Tax Net Investment Income of $34.6 million, or $0.60 per weighted average common share outstanding, for the third fiscal quarter ended December 31, 2025.

- The company's Net Asset Value (NAV) per share increased to $16.75 as of December 31, 2025, up from $16.62 in the prior quarter.

- The total investment portfolio reached $2.0 billion, including $241.4 million in new committed credit investments during the quarter ended December 31, 2025.

- Capital Southwest declared regular monthly dividends of $0.1934 per share for January, February, and March 2026, and a quarterly supplemental dividend of $0.06 per share payable in March 2026.

- The company raised approximately $53 million through its Equity ATM Program during the quarter and formed a joint venture with another private credit asset manager subsequent to quarter-end.

- Capital Southwest reported Pre-Tax Net Investment Income of $34.6 million, or $0.60 per weighted average common share outstanding, for the third fiscal quarter ended December 31, 2025.

- The company's Net Asset Value (NAV) per share increased to $16.75 as of December 31, 2025, up from $16.62 in the prior quarter.

- Total dividends for the quarter ended December 31, 2025, were $0.64 per share, and the Board declared regular monthly dividends of $0.1934 per share for January, February, and March 2026, along with a quarterly supplemental dividend of $0.06 per share payable in March 2026.

- During the quarter, Capital Southwest originated $244.0 million in new commitments, contributing to a total investment portfolio of $2.0 billion as of December 31, 2025.

- Capital Southwest Corporation (CSWC) has formed a joint venture with another private credit asset manager.

- This joint venture will operate as an off-balance sheet private fund, primarily investing in first out senior secured debt opportunities in the lower middle market.

- Capital Southwest and its partner will each hold a 50% equity interest, with investment and operational decisions made by a board with equal representation from both partners.

- The joint venture is anticipated to enter into a senior secured credit facility to fund its investments.

- Capital Southwest announced preliminary operating results for the third quarter of fiscal year 2026, which ended December 31, 2025.

- Preliminary estimates for Q3 FY2026 include net investment income in the range of $0.63 to $0.64 per share and pre-tax net investment income between $0.59 and $0.60 per share.

- The company's net asset value per share as of December 31, 2025, is estimated to be between $16.72 and $16.77.

- Non-accruals are preliminarily estimated at 3.2% of the total investment portfolio at cost and 1.5% at fair value.

- Finalized third quarter 2026 results will be released on Monday, February 2, 2026, with a conference call scheduled for Tuesday, February 3, 2026.

- CSWC reported pre-tax net investment income of $0.61 per share and increased its undistributed taxable income (UTI) balance to $1.13 per share in Q2 2026.

- The company declared total dividends of $0.64 per share for the December 2025 quarter, comprising a $0.58 per share regular dividend and a $0.06 per share supplemental dividend.

- CSWC successfully raised $350 million in 5.95% notes due 2030, using the proceeds to redeem earlier maturities and extending its earliest unsecured maturity to fiscal year 2030.

- Investment activity was robust, with $245 million in total new commitments, and the on-balance sheet credit portfolio grew 24% year-over-year to $1.7 billion as of September 2024.

- The company also raised approximately $40 million in gross equity proceeds through its ATM program at a weighted average share price of $22.81 per share, or 137% of the prevailing NAV per share.

- Capital Southwest reported Pre-Tax Net Investment Income of $34.0 million, or $0.61 per weighted average common share, and a Net Asset Value (NAV) of $16.62 per share for the second fiscal quarter ended September 30, 2025.

- The total investment portfolio reached $1.9 billion, with $245.5 million in new commitments originated during the quarter ended September 30, 2025.

- The company issued $350 million in 5.950% Notes due 2030 and raised approximately $40 million through its Equity ATM Program, while declaring total dividends of $0.6402 per share for the quarter ended September 30, 2025.

Quarterly earnings call transcripts for CAPITAL SOUTHWEST.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more