Earnings summaries and quarterly performance for DELUXE.

Executive leadership at DELUXE.

Barry C. McCarthy

President and Chief Executive Officer

Jeffrey L. Cotter

Senior Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary

Tracey G. Engelhardt

Senior Vice President, President, Print

William C. Zint

Senior Vice President, Chief Financial Officer

Yogaraj Jeyaprakasam

Senior Vice President, Chief Technology and Digital Officer

Board of directors at DELUXE.

Angela L. Brown

Director

Cheryl E. Mayberry McKissack

Independent Chair of the Board

Hugh S. (Beau) Cummins III

Director

John L. Stauch

Director

Michelle T. Collins

Director

Morgan M. (Mac) Schuessler, Jr.

Director

Paul R. Garcia

Director

Telisa L. Yancy

Director

Thomas J. Reddin

Director

Research analysts who have asked questions during DELUXE earnings calls.

Marc Riddick

Sidoti & Company, LLC

6 questions for DLX

Kartik Mehta

Northcoast Research

5 questions for DLX

Charles Strauzer

CJS Securities

4 questions for DLX

Jonnathan Navarrete

Northland Capital Markets

3 questions for DLX

Lance Vitanza

TD Cowen

1 question for DLX

Will

CJS Securities

1 question for DLX

Will Brenneman

Northcoast Research

1 question for DLX

Recent press releases and 8-K filings for DLX.

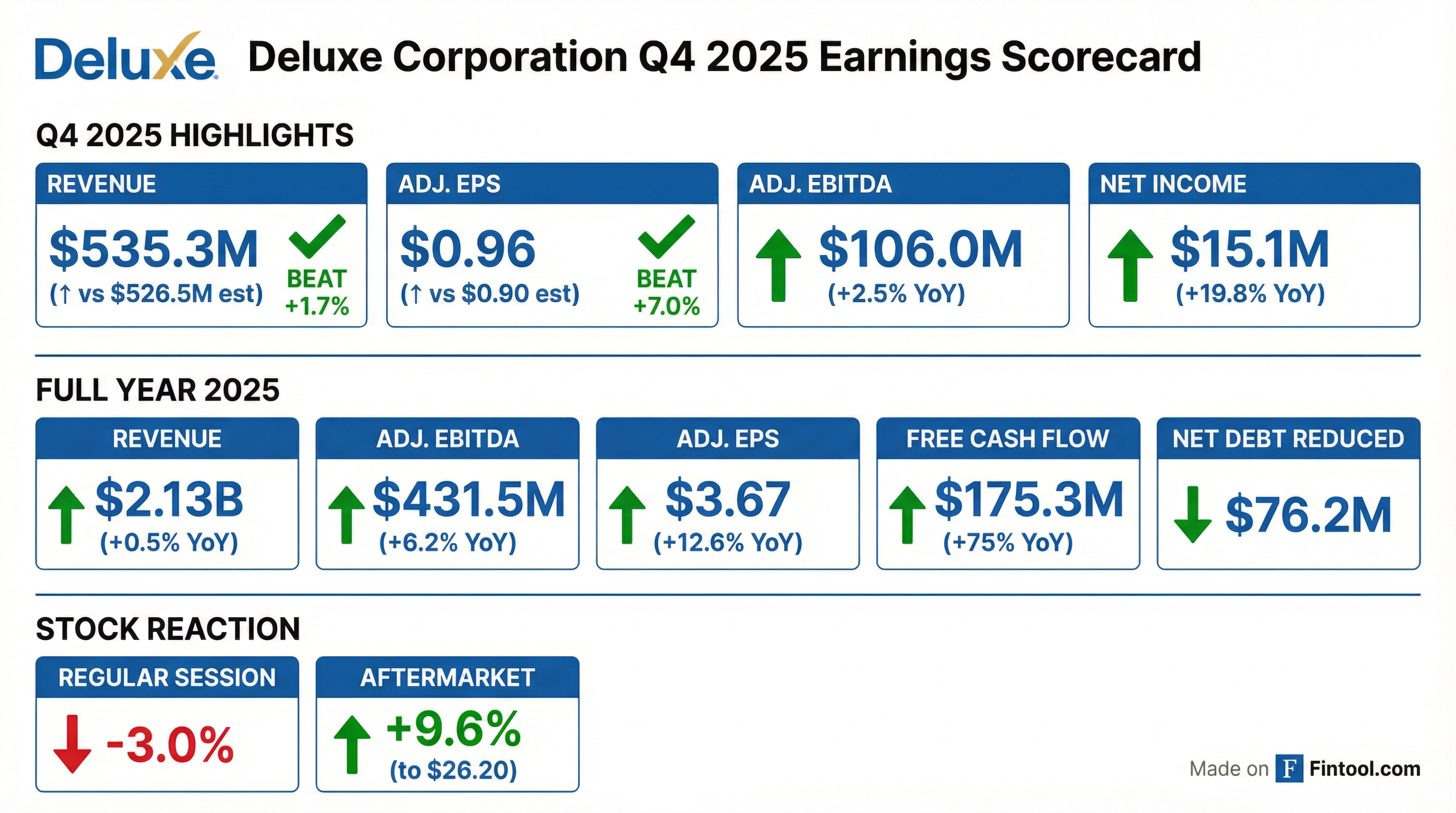

- Deluxe reported full-year 2025 revenue of $2.133 billion, with net income increasing 61.2% to $85.3 million and GAAP diluted EPS rising to $1.87.

- For Q4 2025, revenue was $535.3 million (up 2.8%) and net income was $15.1 million (up 19.8%), with adjusted EPS of $0.96.

- The company's balance sheet improved, with total debt reduced by $73.7 million and net debt lowered by $76.2 million.

- The Board approved a $0.30 quarterly dividend payable on February 23, 2026.

- Deluxe provided FY 2026 guidance, projecting revenue between $2.11 billion and $2.175 billion and adjusted EPS in the range of $3.90–$4.30.

- Deluxe reported strong full-year 2025 results, with comparable adjusted EBITDA expanding over 6%, organic revenue growing 1%, and comparable adjusted EPS increasing by 13%.

- The company generated $175 million in free cash flow for 2025, exceeding its 2026 goal a year early, and reduced net debt by $76 million, lowering the year-end leverage ratio to 3.2 times.

- The payments and data businesses now constitute 47% of total revenue, up from 43% a year ago, growing 10% for the full year and 12% in Q4 2025, with parity to print businesses expected in 2026.

- For 2026, Deluxe anticipates revenue between $2.11 billion and $2.175 billion, adjusted EBITDA of $445 million to $470 million, adjusted EPS of $3.90 to $4.30, and free cash flow of approximately $200 million.

- Deluxe reported strong full-year 2025 results, with comparable adjusted EBITDA expanding 6.2% to $431.5 million and comparable adjusted EPS growing 12.6% to $3.67.

- The company generated $175.3 million in free cash flow, surpassing its 2026 goal a year early, and reduced net debt by $76.2 million, lowering the year-end leverage ratio to 3.2x.

- The Payments and Data businesses, which now account for 47% of total revenue, grew 10% for the full year 2025, with the Data segment expanding 31.3% year-over-year. Deluxe anticipates these segments will achieve revenue parity with the Print business in 2026.

- For 2026, Deluxe provided guidance projecting revenue between $2.11 billion and $2.175 billion, adjusted EBITDA of $445 million to $470 million, adjusted EPS of $3.90 to $4.30, and approximately $200 million in free cash flow. The company also expects to achieve a sub-3x leverage target in the first half of 2026.

- Deluxe reported strong full-year 2025 results, with comparable adjusted EBITDA expanding more than 6% and comparable adjusted EPS growing 13%.

- The company generated $175 million in free cash flow in 2025, achieving its 2026 goal a year early, and reduced net debt by $76 million, lowering the year-end leverage ratio to 3.2 times.

- The strategic shift towards payments and data continued, with these segments now accounting for 47% of total revenue (up from 43% in 2024) and growing 10% for the full year. The data segment alone expanded revenue by over 30% in 2025.

- For 2026, Deluxe provided guidance including revenue of $2.11 billion-$2.175 billion, adjusted EBITDA of $445 million-$470 million, adjusted EPS of $3.90-$4.30, and approximately $200 million in free cash flow.

- The company expects payments and data revenues to reach parity with legacy print in 2026 and aims to achieve a sub-3x leverage target in the first half of 2026.

- Deluxe Corporation reported full-year 2025 net income of $85.3 million, an increase from $52.9 million in 2024, with diluted EPS of $1.87 compared to $1.18 in 2024.

- For the full year 2025, revenue increased by 0.5% to $2,133.2 million, and comparable adjusted EBITDA grew 6.2% to $431.5 million.

- The company generated $175.3 million in free cash flow in 2025, an increase of $75.3 million, and reduced net debt by $76.2 million.

- Deluxe provided its full-year 2026 outlook, expecting revenue between $2.11 and $2.175 billion, adjusted EBITDA between $445 and $470 million, adjusted diluted EPS between $3.90 and $4.30, and approximately $200 million in free cash flow.

- The Board of Directors approved a regular quarterly dividend of $0.30 per share, payable on February 23, 2026.

- Deluxe reported strong third-quarter 2025 results with comparable adjusted revenue growth of 2.5% and total revenue of $540.2 million.

- Adjusted EBITDA increased by 13.8% to $118.9 million, with margins expanding to 22% of revenue. Adjusted EPS grew by nearly 30% to $1.09 per share.

- The company achieved its targeted year-end leverage ratio of 3.3 times a quarter ahead of schedule, reducing net debt by over $20 million during the quarter to a net debt level of $1.42 billion. Year-to-date free cash flow expanded by over 49%.

- The revenue mix continued to shift towards payments and data, which now account for 47% of total company revenue, driven by 46% year-over-year growth in the data segment.

- Deluxe raised its full-year 2025 adjusted EPS outlook to a range of $3.45-$3.60 while affirming guidance for revenue, adjusted EBITDA, and free cash flow.

- Deluxe Corporation reported Q3 2025 revenue of $540.2 million, an increase of 2.2% from the previous year, with comparable adjusted revenue increasing 2.5%.

- Net income for Q3 2025 was $33.7 million, significantly up from $8.9 million in Q3 2024, and comparable adjusted EBITDA increased 13.8% to $118.9 million.

- GAAP diluted EPS for Q3 2025 was $0.74, compared to $0.20 in Q3 2024, while comparable adjusted diluted EPS improved 29.8% to $1.09.

- The company raised its full-year 2025 guidance for adjusted diluted EPS to a range of $3.45 to $3.60, and affirmed its outlook for revenue, adjusted EBITDA, and free cash flow.

- The Board of Directors approved a regular quarterly dividend of $0.30 per share, payable on December 1, 2025.

- Deluxe reported full-year 2024 comparable adjusted EBITDA of $406 million, an increase of 3.9% from the prior year, with comparable adjusted EPS growing 8% to $3.26 per share.

- The company reduced net debt by more than $52 million to $1.47 billion and refinanced its 2026 debt maturities, extending all remaining maturities to 2029.

- Strategic initiatives, including the North Star program, contributed to a nearly 14% reduction in corporate SG&A for 2024, and new products were launched across all four business lines.

- Deluxe provided 2025 guidance including revenue of $2.09-$2.155 billion, adjusted EBITDA of $415-$435 million, adjusted EPS of $3.25-$3.55, and free cash flow of $120-$140 million.

Quarterly earnings call transcripts for DELUXE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more