Earnings summaries and quarterly performance for DigitalOcean Holdings.

Executive leadership at DigitalOcean Holdings.

Board of directors at DigitalOcean Holdings.

Research analysts who have asked questions during DigitalOcean Holdings earnings calls.

Gabriela Borges

Goldman Sachs

6 questions for DOCN

Josh Baer

Morgan Stanley

6 questions for DOCN

James Fish

Piper Sandler Companies

5 questions for DOCN

Mark Zhang

Citigroup

5 questions for DOCN

Raimo Lenschow

Barclays

5 questions for DOCN

Patrick Walravens

Citizens JMP

4 questions for DOCN

Thomas Blakey

Cantor Fitzgerald

4 questions for DOCN

Mike Cikos

Needham & Company, LLC

3 questions for DOCN

Wamsi Mohan

Bank of America Merrill Lynch

3 questions for DOCN

Jason Ader

William Blair & Company

2 questions for DOCN

Kingsley Crane

Canaccord

2 questions for DOCN

Michael Cikos

Needham & Company

2 questions for DOCN

Param Singh

Oppenheimer

2 questions for DOCN

Pinjalim Bora

JPMorgan Chase & Co.

2 questions for DOCN

Radi Sultan

UBS Group AG

2 questions for DOCN

Brad Reback

Stifel

1 question for DOCN

Joseph Hickey

UBS

1 question for DOCN

Ruplu Bhattacharya

Bank of America

1 question for DOCN

William Kingsley Crane

Canaccord Genuity

1 question for DOCN

Recent press releases and 8-K filings for DOCN.

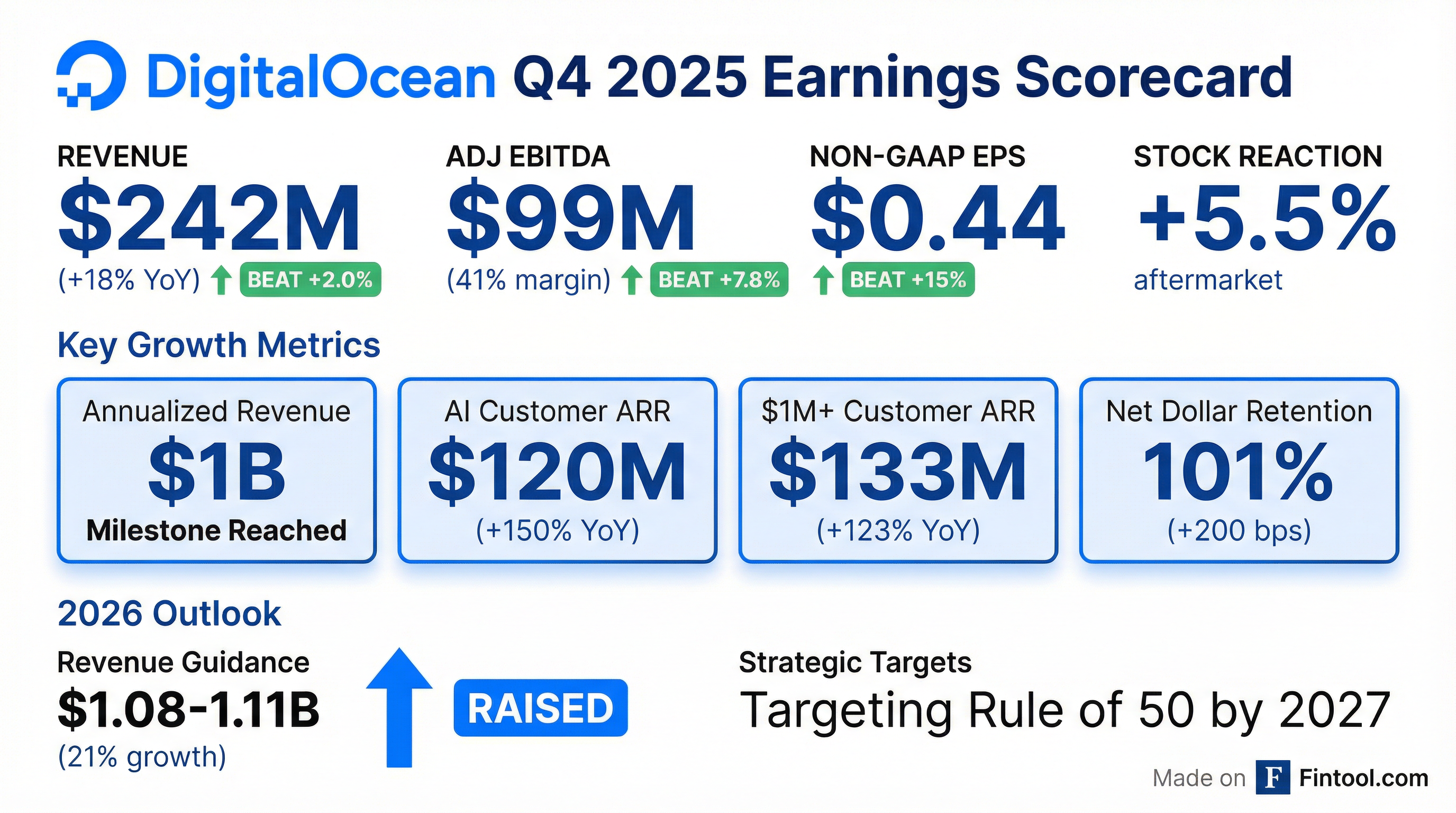

- DigitalOcean reported Q4 2025 revenue of $242 million, an 18% year-over-year increase, and full year 2025 revenue of $901 million, achieving 42% adjusted EBITDA margins and 19% adjusted free cash flow margins for the year.

- The company's AI customer Annual Recurring Revenue (ARR) reached $120 million in Q4 2025, growing 150% year-over-year, highlighting the success of its Agentic Inference Cloud strategy.

- For Q1 2026, DigitalOcean expects revenue between $249 million and $250 million, representing 18%-19% year-over-year growth, and projects full year 2026 revenue growth of 19% to 23%.

- DigitalOcean anticipates exiting 2026 with 25%+ revenue growth and projects achieving 30% revenue growth in 2027, supported by the addition of 31 megawatts of new data center capacity in 2026.

- In 2025, the company repurchased 2.4 million shares for $82 million and is sunsetting a legacy bare metal CPU offering, which is expected to result in $13 million of ARR rolling off by the end of Q1 2026.

- DigitalOcean Holdings reported Q4 2025 revenue of $242.4 million, an 18% year-over-year increase, and full-year 2025 revenue of $901 million, exceeding guidance. The company achieved an Annual Run-rate Revenue (ARR) of $970 million in Q4 2025, up 18% year-over-year, and a 19% adjusted free cash flow margin for FY 2025.

- Growth was significantly driven by Digital Native Enterprises (DNEs), which grew 30% year-over-year to 21.4K customers and accounted for 62% of total ARR in Q4 2025. $1M+ Customer ARR increased 123% year-over-year to $133 million, and AI Customer ARR grew 150% to $120 million in 2025.

- The company is raising its 2026 revenue growth outlook to 21%, with expectations to accelerate to 25%+ by Q4 2026 and ~30% in 2027, while targeting a weighted rule of 50 in 2027. This outlook includes an anticipated ~$13 million ARR decrease and $5M-$8M in wind-down costs in 2026 from discontinuing a legacy offering.

- DigitalOcean reported Q4 2025 revenue of $242 million, an 18% year-over-year increase, contributing to a full-year 2025 revenue of $901 million and 42% adjusted EBITDA margins.

- The company's AI customer ARR reached $120 million in Q4 2025, growing 150% year-over-year, with 70% derived from inference services or general-purpose cloud products.

- Top Digital Native customers (DNEs) are a key growth engine, with ARR from DNEs reaching $604 million in Q4, representing 62% of total ARR and growing 30% year-over-year. Million-dollar customers grew 123% year-over-year to $133 million in ARR.

- DigitalOcean provided strong guidance, expecting full-year 2026 revenue growth between 19% and 23% (21% at midpoint) and projecting to exit Q4 2026 at 25%+ revenue growth, with a clear path to 30% growth in 2027.

- The company is investing in 31 MW of new data center capacity in 2026 to support its Agentic Inference Cloud strategy, focusing on AI-native companies and production AI workloads without chasing the GPU training arms race.

- DigitalOcean reported Q4 2025 revenue of $242 million, an 18% increase year-over-year, and fiscal year 2025 revenue of $901 million, up 15% year-over-year. The company reached $1 billion in annualized monthly run-rate revenue in December 2025.

- For Q4 2025, net income attributable to common stockholders was $26 million (11% margin) and Adjusted EBITDA was $99 million (41% margin). For fiscal year 2025, net income was $259 million (29% margin) and Adjusted EBITDA was $375 million (42% margin).

- The company delivered a record $51 million in incremental organic ARR and reported million+ dollar customer ARR of $133 million, growing 123% year-over-year. The Net Dollar Retention Rate increased to 101% in Q4 2025 from 99% in Q4 2024.

- DigitalOcean raised its 2026 revenue guidance to 21% growth, projecting total revenue of $1.075 to $1.105 billion, and expects to reach 30% growth in 2027. The company also provided Q1 2026 revenue guidance of $249 to $250 million.

- DigitalOcean reported Q4 2025 revenue of $242 million, an 18% increase year-over-year, contributing to fiscal year 2025 revenue of $901 million, up 15% year-over-year.

- For fiscal year 2025, net income grew 207% year-over-year to $259 million with a 29% margin, and Adjusted EBITDA increased 14% year-over-year to $375 million with a 42% margin.

- The company raised its 2026 revenue outlook to $1.075 to $1.105 billion, projecting 21% growth, and expects to achieve 30% growth in 2027.

- Operational highlights include reaching $1 billion in annualized monthly revenue in December 2025, with million+ dollar customers driving $133 million ARR (up 123% year-over-year) and AI customer ARR growing 150% year-over-year to $120 million.

- DigitalOcean (NYSE: DOCN) announced the appointment of Vinay Kumar as Chief Product and Technology Officer (CPTO).

- In this role, Vinay Kumar will be responsible for leading product strategy, product development, cloud infrastructure, and security, with a focus on defining and executing DigitalOcean’s platform roadmap to scale its AI inference cloud and core cloud offerings.

- Vinay Kumar brings over a decade of senior leadership experience, having been a founding member of Oracle Cloud Infrastructure (OCI) and holding product leadership roles at Amazon Web Services.

- His appointment highlights DigitalOcean's continued ability to attract talent and its commitment to investing in leadership and execution as it develops a differentiated AI inference cloud.

- DigitalOcean has announced a multi-year, eight-figure average per annum strategic partnership with Persistent Systems to make Artificial Intelligence (AI) more affordable, scalable, and secure for Digital Native Enterprises and developers.

- As part of this collaboration, Persistent has selected DigitalOcean as its exclusive cloud and AI infrastructure provider for SASVA™, Persistent’s AI-powered platform, which will leverage DigitalOcean Gradient™ AI Agentic Cloud for its AI workloads and customer deployments.

- The partnership aims to reduce AI infrastructure and operational costs by over 50%, combining Persistent’s AI engineering expertise with DigitalOcean’s robust agentic cloud infrastructure and AI platform.

- DigitalOcean (DOCN) has accelerated its growth outlook, now projecting 18%-20% growth for next year, a full year ahead of its previous guidance, driven by strong performance in its core cloud and AI businesses.

- The company's AI cloud business is a significant growth driver, achieving 100%+ year-over-year growth for five consecutive quarters and is expected to contribute mid to high teens of total revenue by the end of next year, primarily from inferencing workloads.

- To support this growth, DigitalOcean is adding 30 megawatts of new data center capacity for AI deployments, financed through equipment leases, while aiming to maintain mid to high teens free cash flow margins.

- DigitalOcean is also seeing an uptick in customer migrations from hyperscalers, enabled by product enhancements and an improved go-to-market strategy, attracting larger customers with $100K+ spend growing 41% and $1M+ customers growing 72% last quarter.

- DigitalOcean has provided an 18%-20% growth outlook for next year, pulling forward its 2027 guidance by a full year, driven by addressing core product gaps and strong cloud business incubation.

- The company reported significant customer growth, with 100K+ customers increasing by 41% and million-dollar+ customers growing by 72% last quarter.

- Its AI business has experienced 100%+ year-over-year growth for five consecutive quarters and is projected to reach mid to high teens of total run rate by the end of next year, primarily from inferencing workloads.

- DigitalOcean plans to add 30 MW of new data center capacity to accelerate AI deployments, financing this expansion through equipment leases and other capital sources while aiming to maintain mid to high teens free cash flow margins.

- The company is seeing an uptick in workload migrations from hyperscalers due to product enhancements and an improved go-to-market strategy, positioning itself as a key multi-cloud option.

Quarterly earnings call transcripts for DigitalOcean Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more