Earnings summaries and quarterly performance for FIRST BUSINESS FINANCIAL SERVICES.

Executive leadership at FIRST BUSINESS FINANCIAL SERVICES.

Board of directors at FIRST BUSINESS FINANCIAL SERVICES.

Research analysts who have asked questions during FIRST BUSINESS FINANCIAL SERVICES earnings calls.

Damon Del Monte

Keefe, Bruyette & Woods

6 questions for FBIZ

Daniel Tamayo

Raymond James Financial, Inc.

6 questions for FBIZ

Nathan Race

Piper Sandler & Co.

6 questions for FBIZ

Brian Martin

Janney Montgomery Scott

5 questions for FBIZ

Jeff Rulis

D.A. Davidson & Co.

4 questions for FBIZ

Jeff Rulis

D.A. Davidson

2 questions for FBIZ

Recent press releases and 8-K filings for FBIZ.

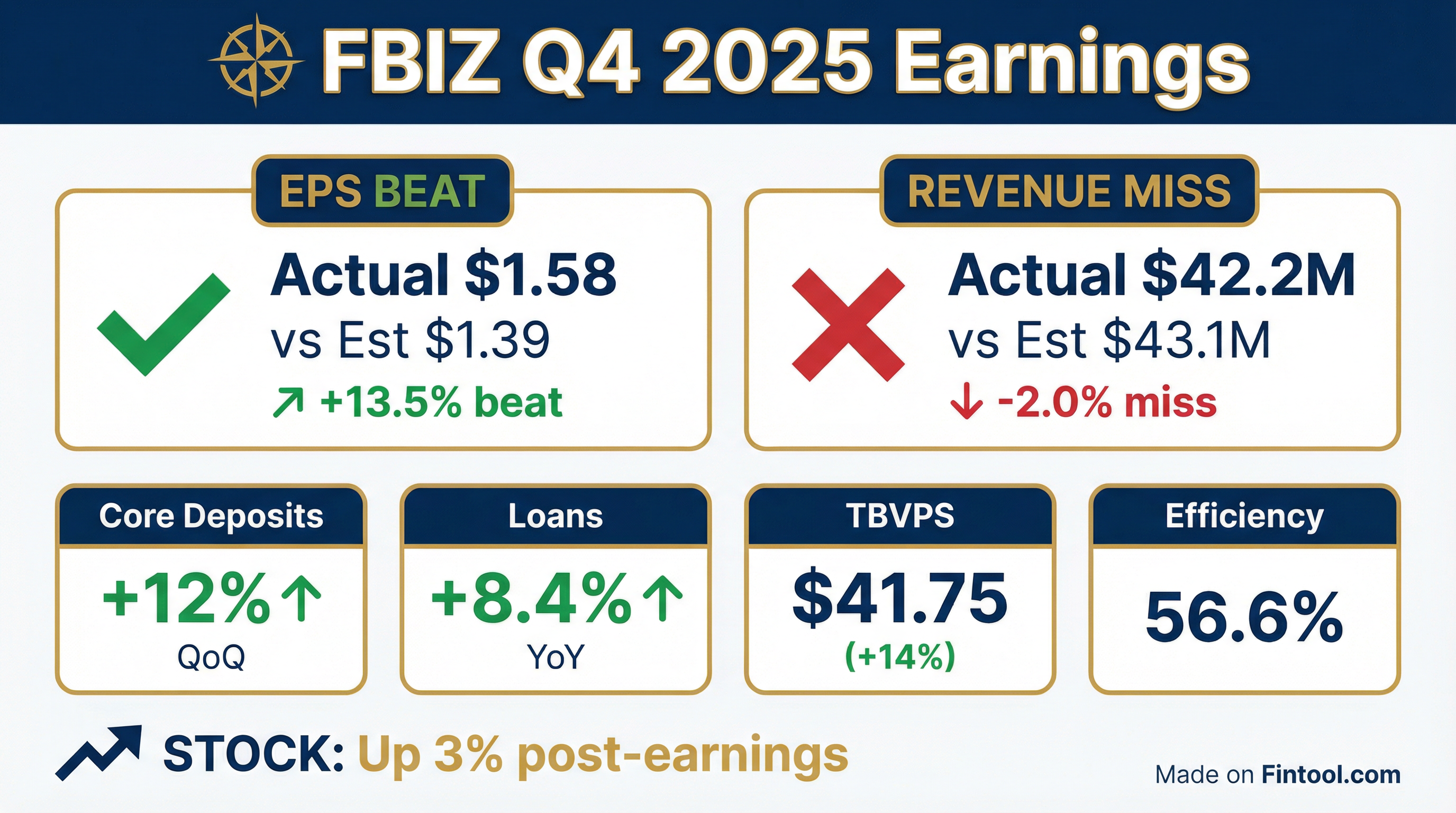

- First Business Financial Services, Inc. (FBIZ) reported strong financial results for Q4 and full year 2025, with pre-tax, pre-provision earnings growing 15% and net income growing 14% annually.

- The company achieved an efficiency ratio of 58.78% for full year 2025, an improvement from 60.61% in 2024, and saw EPS grow 14% over 2024.

- FBIZ demonstrated robust balance sheet expansion, with loans increasing 8.4% year-over-year and core deposits growing 11.5% from Q4 2024.

- Shareholder value was enhanced by a 17% increase in the quarterly cash dividend to $0.34 per share, marking the 14th consecutive annual increase, and tangible book value per share grew 13.7% from Q4 2024.

- As of December 31, 2025, FBIZ maintained a strong capital base with a Total Capital Ratio of 12.24% and a Tier 1 Ratio of 9.79%.

- First Business Financial Services (FBIZ) reported strong full-year 2025 results, with earnings per share growing 14% over 2024, exceeding its long-term annual goal of 10%, and operating revenue growing 10%.

- The company achieved positive operating leverage for the fourth consecutive year in 2025, with operating expense growth of approximately 6.5%.

- Q4 2025 net interest margin (NIM) was 3.53%, which included a 10 basis point compression from an $892,000 non-accrual interest reversal related to a $20.4 million downgraded CRE loan. The full-year 2025 NIM was 3.64%.

- Loan balances grew 8% year-over-year in 2025, and core deposit balances increased 12% in Q4 2025 from both the linked and prior year quarters. Management expects double-digit loan and core deposit growth to continue in 2026.

- The board of directors approved a 17% increase to the quarterly cash dividend.

- First Business Bank (FBIZ) reported 14% annual EPS growth for 2025, surpassing its long-term goal of 10%, and achieved a full-year efficiency ratio of 58.78%, an improvement from 60.61% in 2024.

- The company demonstrated strong balance sheet growth with 11.5% core deposit growth from Q4 2024 and 8.4% year-over-year loan growth in Q4 2025. FBIZ also increased its quarterly cash dividend by 17% to $0.34 per share, marking the 14th consecutive annual increase.

- FBIZ maintained a robust capital base, with tangible book value per share growing 13.7% from Q4 2024 to $41.75 in Q4 2025, and a Common Equity Tier 1 ratio of 9.45% as of December 31, 2025. Credit quality remained strong, with 99% of loans current as of 12/31/25, despite a $20.4 million CRE loan downgrade for a single borrower in Q4 2025, which was noted to have strong collateral.

- First Business Financial Services reported strong financial performance for Q4 and full year 2025, with pre-tax, pre-provision earnings growing nearly 15% over 2024, 2025 EPS up 14%, and tangible book value per share increasing 14%. The board also approved a 17% increase to the quarterly cash dividend.

- The net interest margin (NIM) for Q4 2025 was 3.53%, which included a 10 basis point compression due to a non-accrual interest reversal. For the full year 2025, NIM was 3.64%, and the company maintains its target range of 3.60%-3.65% for 2026.

- Loan balances grew 8% over the prior year, and core deposit balances increased 12% in Q4 2025, with management expecting double-digit loan and deposit growth to continue in 2026.

- An isolated credit situation involved downgrading $20.4 million of Commercial Real Estate (CRE) loans, but no specific reserve was recorded as land value appraisals exceed the carrying value.

- First Business Financial Services reported strong financial performance for Q4 and full year 2025, with 2025 EPS growing 14% over 2024, exceeding their 10% annual goal, and tangible book value per share growing 14% from a year ago.

- The company achieved a Return on average tangible common equity over 15% for the year and pre-tax, pre-provision earnings grew nearly 15% over 2024. The board approved a 17% increase to the quarterly cash dividend.

- Loan balances grew 8% over the prior year, and core deposit balances were up 12% from both the linked and prior year quarters in Q4 2025. The company expects loan growth to rebound to a typical double-digit pace in 2026 and double-digit growth in core deposits to continue.

- Net interest margin (NIM) for Q4 2025 was 3.53%, impacted by a 10 basis point non-accrual interest reversal, but would have been 3.63% otherwise. The full year 2025 NIM was 3.64%, and the target range remains 3.60%-3.65%.

- The company achieved positive operating leverage for the fourth consecutive year, with operating expense growth of about 6.5% for 2025, and expects 10% revenue growth and continued positive operating leverage in 2026.

- For the fourth quarter of 2025, First Business Financial Services reported net income available to common shareholders of $13.1 million, or $1.58 diluted earnings per share (EPS). Full year 2025 EPS grew 14% over 2024.

- The company increased its quarterly cash dividend by 17% to $0.34 per share, marking its 14th consecutive annual increase.

- Core deposits grew 12.5% annualized from the linked quarter and 11.5% from Q4 2024, while loans increased 4.6% annualized from Q3 2025 and 8.4% from Q4 2024.

- The efficiency ratio improved to 56.61% in Q4 2025, with the full year efficiency ratio at 58.78% compared to 60.61% in 2024.

- Non-performing assets increased to $43.855 million in Q4 2025, primarily due to a downgrade of a single client relationship.

- First Business Financial Services reported net income available to common shareholders of $13.1 million and earnings per share (EPS) of $1.58 for the fourth quarter of 2025.

- The company announced a 17% increase in its quarterly cash dividend to $0.34 per share, marking its 14th consecutive annual increase.

- The efficiency ratio improved to 56.61% in Q4 2025, compared to 57.44% in the linked quarter and 56.94% in the prior-year quarter.

- Non-performing assets increased to $43.9 million, or 1.07% of total assets, primarily due to the downgrade of $20.4 million of commercial real estate (CRE) loans from a single client relationship.

- Corey Chambas will retire as Chief Executive Officer on May 2, 2026, and will be succeeded by David R. Seiler.

- First Business Bank (FBIZ) is a $4 billion business bank specializing in commercial banking and private wealth management, operating in four key markets and through five national niche C&I lending businesses.

- The bank's strategic plan, which began in 2024, targets over 10% annual revenue growth (currently 12.3%), an efficiency ratio below 60 (currently 59.51), and a return on average tangible common equity greater than 15% (currently 17.3%).

- FBIZ emphasizes organic growth and has consistently grown tangible book value per share every year since going public, with credit costs approximately one-third of the industry average.

- The company employs a disciplined asset liability management approach to mitigate interest rate risk and maintain a stable net interest margin, translating balance sheet growth into predictable earnings.

- Despite strong historical performance, including outperforming peers over the last five years, the stock is currently trading at a discount to its peer group based on the last 12 months' earnings per share.

- First Business Bank (FBIZ) operates as a $4 billion business bank with an additional $4 billion in assets under management through its private wealth group, focusing on commercial banking, niche C&I lending, and financial planning for individuals.

- The company's 2024 strategic plan targets include over 10% annual revenue growth (currently 12.3%), an efficiency ratio below 60 (currently 59.51), and a return on average tangible common equity greater than 15% (currently 17.3%).

- FBIZ emphasizes organic growth, consistently growing tangible book value per share every year since going public, and maintains credit costs at approximately one-third of the industry average.

- Management notes that the company is currently trading at a discount to its peer group despite strong historical performance and consistent double-digit EPS growth.

- First Business Financial Services, Inc. (FBIZ) reported strong Q2 2025 results, with pre-tax, pre-provision earnings up 18% and net income up 17% for the first six months of 2025 compared to the prior-year period.

- The company achieved robust growth in Q2 2025, with loans growing 8.4% annualized from the linked quarter and 8.9% from Q2 2024, while core deposits grew 11.4% annualized from the linked quarter and 9.7% from Q2 2024. Private Wealth management assets under management and administration reached a record $3.731 billion.

- For Q2 2025, the net interest margin (NIM) was 3.67% , and year-to-date operating revenue increased 10.3% over the first six months of 2024. The company's 2024-2028 strategic plan targets an efficiency ratio of <60% by 2028, with a YTD June 2025 efficiency ratio of 60.63%.

- Tangible book value per share (TBVPS) grew 10.2% annualized from the linked quarter and 13.6% from Q2 2024. FBIZ also increased its quarterly cash dividend to $0.29 per share, representing a 16% increase over December 31, 2024 , and maintained solid regulatory capital ratios, including a Total Capital Ratio of 12.25% and a Tier 1 Ratio of 9.66% as of June 30, 2025.

Quarterly earnings call transcripts for FIRST BUSINESS FINANCIAL SERVICES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more