Earnings summaries and quarterly performance for FIDELITY D & D BANCORP.

Executive leadership at FIDELITY D & D BANCORP.

Daniel J. Santaniello

Detailed

President and Chief Executive Officer

CEO

MJ

Michael J. Pacyna, Jr.

Detailed

Executive Vice President and Chief Credit Officer

RG

Ruth G. Turkington

Detailed

Executive Vice President and Chief Consumer Banking Officer

SR

Salvatore R. DeFrancesco, Jr.

Detailed

Treasurer and Chief Financial Officer

Board of directors at FIDELITY D & D BANCORP.

Research analysts covering FIDELITY D & D BANCORP.

Recent press releases and 8-K filings for FDBC.

FIDELITY D & D BANCORP, INC. Reports Record Q4 and Strong Full-Year 2025 Financial Results

FDBC

Earnings

Revenue Acceleration/Inflection

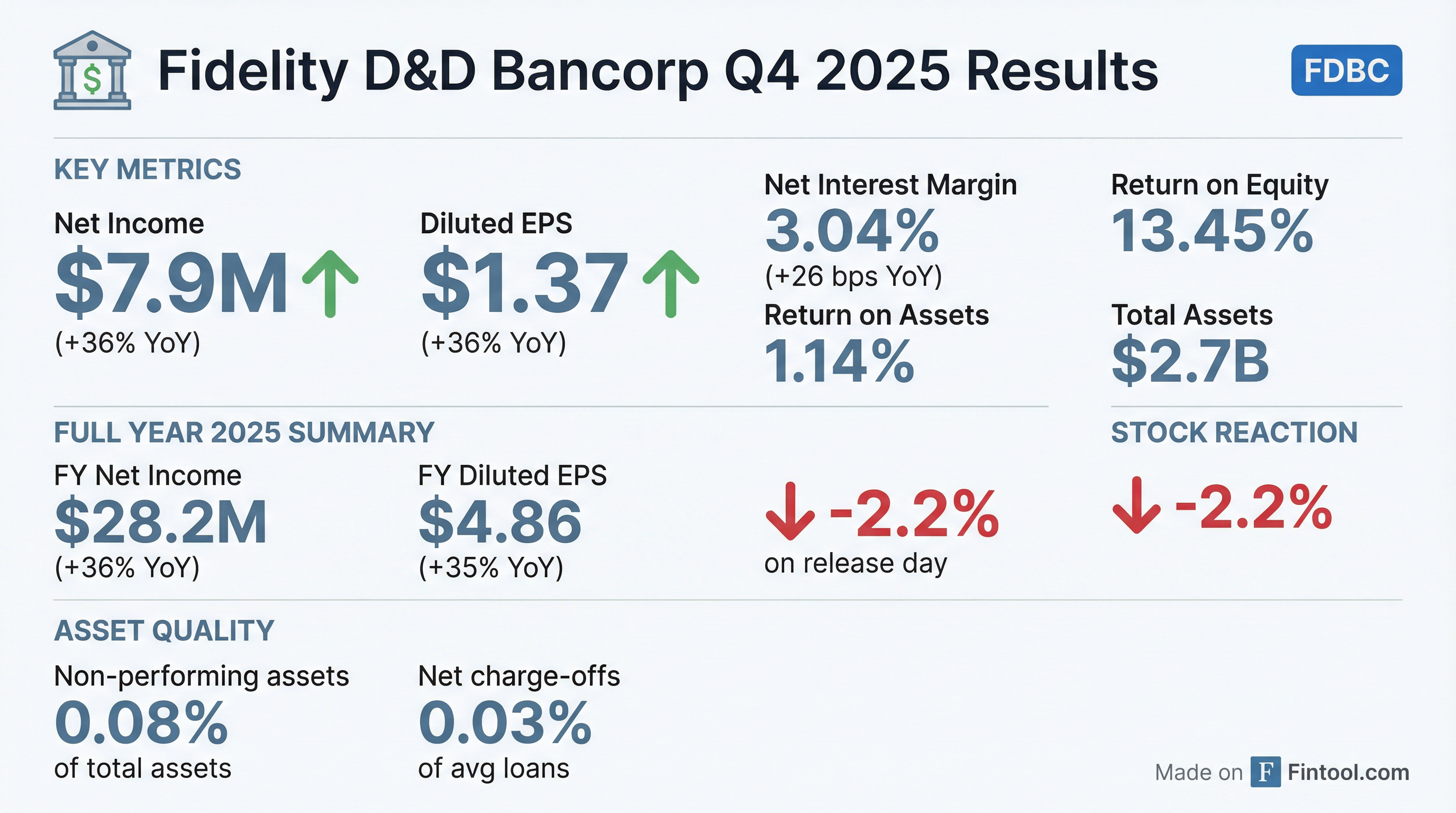

- FIDELITY D & D BANCORP, INC. (FDBC) announced record fourth quarter results and strong full-year 2025 financial performance.

- For the full year ended December 31, 2025, net income increased 36% to $28.2 million, or $4.86 diluted earnings per share, compared to $20.8 million, or $3.60 diluted earnings per share, for 2024.

- Net income for the fourth quarter of 2025 was $7.9 million, or $1.37 diluted earnings per share, a significant increase from $5.8 million, or $1.01 diluted earnings per share, in Q4 2024.

- The company's total assets grew to $2.7 billion as of December 31, 2025, and tangible book value per share rose to $37.88 from $31.98 at December 31, 2024.

- Asset quality improved, with total non-performing assets decreasing to $2.2 million, or 0.08% of total assets, at December 31, 2025, compared to $7.8 million, or 0.30% of total assets, at December 31, 2024.

Jan 28, 2026, 9:24 PM

Fidelity D & D Bancorp, Inc. Reports Record 2025 Financial Results

FDBC

Earnings

Revenue Acceleration/Inflection

Dividends

- Fidelity D & D Bancorp, Inc. reported record net income of $28.2 million and $4.86 diluted earnings per share for the full year ended December 31, 2025, representing a 36% increase in net income and a 35% increase in diluted EPS compared to 2024.

- For the fourth quarter of 2025, net income was $7.9 million, or $1.37 diluted earnings per share, compared to $5.8 million and $1.01 diluted EPS for the same period in 2024.

- The significant increase in net income for 2025 was primarily driven by a $10.8 million increase in net interest income and a $1.6 million increase in non-interest income.

- The company's total assets grew to $2.7 billion as of December 31, 2025, with shareholders' equity increasing 17% to $238.9 million, and tangible book value per share reaching $37.88.

- Asset quality showed significant improvement, with total non-performing assets decreasing to $2.2 million, or 0.08% of total assets, at December 31, 2025, from $7.8 million, or 0.30% of total assets, at December 31, 2024.

Jan 28, 2026, 12:00 PM

Fidelity D & D Bancorp, Inc. Reports Strong Third Quarter 2025 Financial Results

FDBC

Earnings

Revenue Acceleration/Inflection

- Fidelity D & D Bancorp, Inc. reported net income of $7.3 million, or $1.27 per diluted share, for the third quarter ended September 30, 2025, representing a 48% increase compared to the same period in 2024. For the nine months ended September 30, 2025, net income reached $20.3 million, or $3.50 per diluted share, a 35% increase from the prior year.

- Net interest income for the third quarter of 2025 was $18.4 million, a 19% increase over the third quarter of 2024, primarily due to a $3.0 million increase.

- Asset quality improved, with total non-performing assets at $3.0 million, or 0.11% of total assets, as of September 30, 2025, down from $7.8 million or 0.30% at December 31, 2024.

- Tangible book value per share increased to $36.23 at September 30, 2025, compared to $31.98 at December 31, 2024.

Oct 22, 2025, 3:04 PM

Fidelity D & D Bancorp Reports Strong Third Quarter 2025 Financial Results

FDBC

Earnings

Revenue Acceleration/Inflection

- Fidelity D & D Bancorp, Inc. reported net income of $7.3 million, or $1.27 per diluted share, for the third quarter ended September 30, 2025, representing a 48% increase from $5.0 million, or $0.86 per diluted share, for the same period in 2024. This growth was primarily driven by a $3.0 million increase in net interest income.

- For the nine months ended September 30, 2025, net income was $20.3 million, or $3.50 per diluted share, a 35% increase compared to $15.0 million, or $2.59 per diluted share, for the nine months ended September 30, 2024.

- The company's total assets reached $2.7 billion as of September 30, 2025, an increase of $152.1 million from December 31, 2024, with deposit growth of $126.1 million contributing to this expansion.

Oct 22, 2025, 11:00 AM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more