Earnings summaries and quarterly performance for Fluence Energy.

Executive leadership at Fluence Energy.

Board of directors at Fluence Energy.

Axel Meier

Director

Chris Shelton

Director

Cynthia Arnold

Director

Elizabeth Fessenden

Director

Harald von Heynitz

Director

Herman Bulls

Chair of the Board

Peter Chi-Shun Luk

Director

Ricardo Falu

Director

Simon James Smith

Director

Tish Mendoza

Director

Research analysts who have asked questions during Fluence Energy earnings calls.

Brian Lee

Goldman Sachs Group, Inc.

8 questions for FLNC

Dylan Nassano

Wolfe Research

8 questions for FLNC

Christine Cho

Goldman Sachs Group

6 questions for FLNC

George Gianarikas

Canaccord Genuity

6 questions for FLNC

Mark W. Strouse

J.P. Morgan Chase & Co.

6 questions for FLNC

Ameet Thakkar

BMO Capital Markets

5 questions for FLNC

Julien Dumoulin-Smith

Jefferies

5 questions for FLNC

Andrew Percoco

Morgan Stanley

3 questions for FLNC

Ben Kallo

Robert W. Baird & Co.

3 questions for FLNC

Chris Dendrinos

RBC Capital Markets

3 questions for FLNC

David Arcaro

Morgan Stanley

3 questions for FLNC

Dimple Gosai

Bank of America

3 questions for FLNC

Justin Clare

Roth MKM

3 questions for FLNC

Kashy Harrison

Piper Sandler

3 questions for FLNC

Vikram Bagri

Citigroup Inc.

3 questions for FLNC

Zach Tuckwell

Jefferies

2 questions for FLNC

George Gianarikas

Canaccord

1 question for FLNC

Hannah Velásquez

Jefferies

1 question for FLNC

Jonathan Windham

UBS

1 question for FLNC

Jordan Levy

Truist Securities

1 question for FLNC

Tom Callagy

Barclays PLC

1 question for FLNC

Recent press releases and 8-K filings for FLNC.

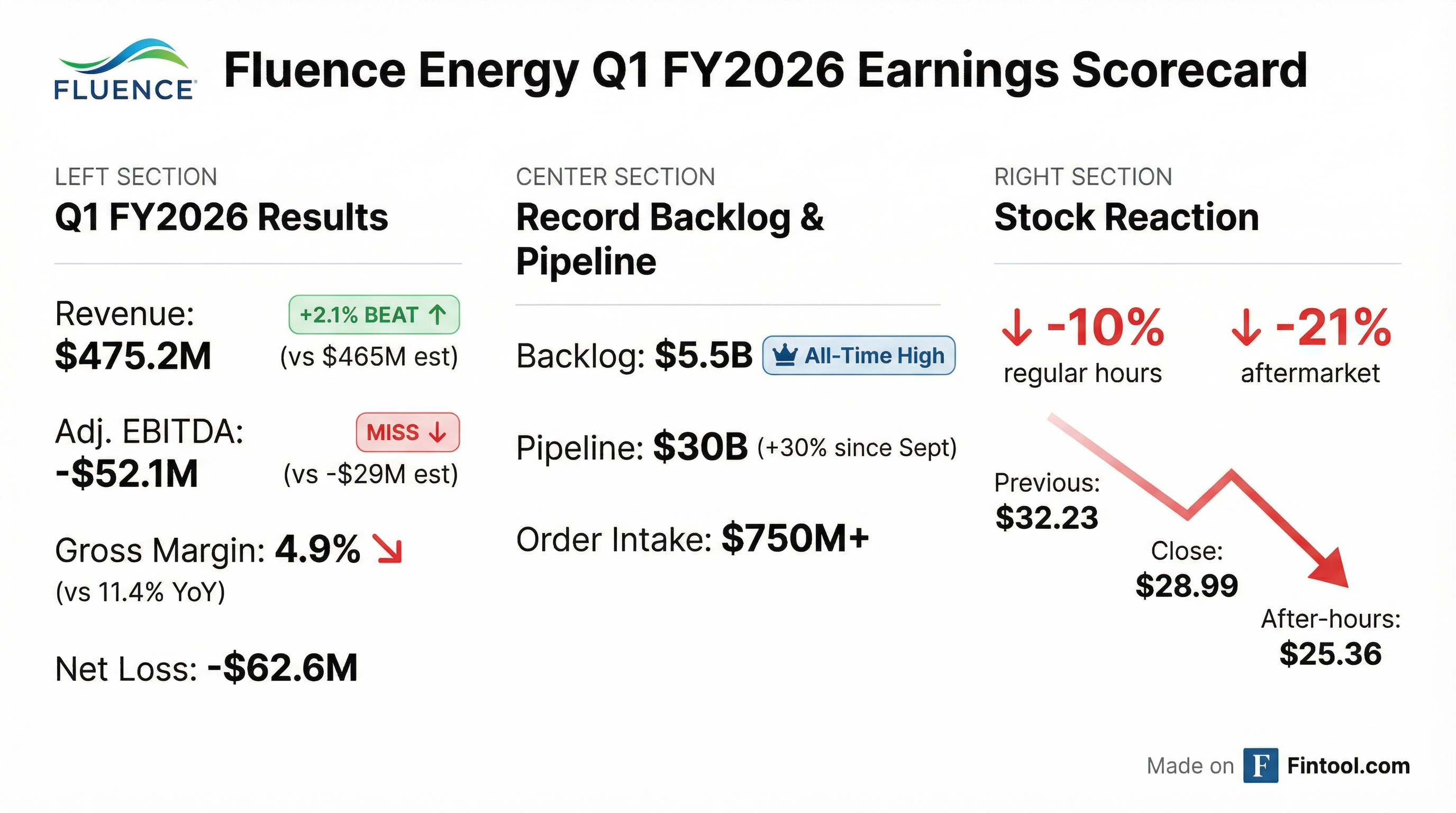

- Fluence Energy reported Q1 2026 revenue of $475 million and an Adjusted Gross Profit of $27 million, resulting in a net loss of ($63 million) and Adjusted EBITDA of ($52 million).

- The company achieved a record backlog of ~$5.5 billion and maintained total liquidity of ~$1.1 billion as of December 31, 2025, which includes ~$477 million of total cash.

- Q1 2026 order intake totaled $757 million, with $500 million originating from the U.S., indicating accelerating U.S. demand.

- Fluence reaffirmed its FY 2026 guidance, projecting revenue between $3,200 million and $3,600 million (midpoint $3,400 million) and Adjusted EBITDA between $40 million and $60 million (midpoint $50 million). The midpoint of the FY'26 revenue guidance is fully covered by orders in backlog.

- FLNC reported Q1 2026 revenue of $475 million and a negative adjusted EBITDA of $52 million, with an adjusted gross margin of 5.6%, which was below the full-year expectation of 11%-13%.

- The company's backlog reached a record $5.5 billion, driven by over $750 million in new global orders during Q1, with over $500 million from the U.S..

- FLNC reaffirmed its fiscal 2026 guidance, projecting revenue between $3.2 billion and $3.6 billion and Adjusted EBITDA between $40 million and $60 million, supported by approximately $1.1 billion in total liquidity.

- The pipeline grew by approximately $7 billion, or 30%, and the company is pursuing significant new opportunities, including 36 GWh of data center projects and 34 GWh of long-duration energy storage projects.

- Fluence Energy reported Q1 2026 revenue of $475 million and an adjusted gross profit of $27 million, resulting in an adjusted gross margin of 5.6%.

- The company's backlog reached a record $5.5 billion, and it secured over $750 million in new orders globally during Q1, with more than $500 million from the U.S..

- Fluence reaffirmed its fiscal 2026 guidance and ended the quarter with approximately $1.1 billion in total liquidity.

- The pipeline increased by approximately $7 billion, or 30%, driven by U.S. demand, with significant opportunities in data centers (discussions covering 36 GWh of projects) and long-duration energy storage (early discussions for 34 GWh of projects).

- The domestic supply chain is performing as needed, and Fluence has secured 100% of its domestic and international supply needs for the year, with a roughly half and half mix of U.S.-made versus imported cells.

- Fluence Energy reported Q1 2026 revenue of $475 million, an adjusted gross profit of $27 million (5.6% margin), and a negative $52 million Adjusted EBITDA. The lower gross margin was attributed to typical Q1 dynamics and approximately $20 million in project-specific costs, which are expected to be largely recovered over the remainder of the fiscal year.

- The company's backlog reached a record $5.5 billion, and it secured over $750 million in new orders globally during Q1, with more than $500 million from the U.S.. The overall pipeline increased by approximately $7 billion (30%), primarily from the U.S..

- Fluence Energy reaffirmed its fiscal year 2026 guidance, expecting revenue in the range of $3.2-$3.6 billion and Adjusted EBITDA between $40-$60 million, with the midpoint of revenue guidance fully covered by the backlog. The full-year adjusted gross margin is expected to be 11%-13%.

- The company is engaged in discussions covering 36 GWh of data center projects and 34 GWh of long-duration energy storage projects, many of which are not yet fully reflected in the pipeline. Fluence ended the quarter with approximately $1.1 billion in total liquidity, including $477 million in cash and $617 million available through credit facilities.

- Fluence Energy, Inc. reported revenue of approximately $475.2 million for the first quarter ended December 31, 2025, marking an increase of 154.4% from the same quarter last year.

- The company recorded a net loss of approximately $62.6 million and an Adjusted EBITDA of approximately $(52.1) million for Q1 2026.

- Fluence signed over $750 million of order intake during the first quarter, bringing its backlog to a record approximately $5.5 billion as of December 31, 2025.

- The company reaffirmed its fiscal year 2026 guidance, expecting revenue between $3.2 billion and $3.6 billion (midpoint $3.4 billion) and Adjusted EBITDA between $40.0 million and $60.0 million (midpoint $50.0 million).

- Fluence Energy, Inc. has been recognized as one of the top three battery energy storage system providers worldwide in the S&P Global Commodity Insights 2025 Battery Energy Storage System Integrator Report, based on installed and contracted energy storage capacity.

- The company ranks in the top three globally for installed and contracted BESS capacity, both including and excluding China.

- Fluence holds the second-largest total capacity in the United States and is the second-largest provider for both installed and contracted capacity in Germany.

- Fluence also earned System Integrator of the Year for the third consecutive year and Product of the Year for Smartstack™ at the 2025 Energy Storage News Awards.

- Fluence Energy reported fiscal year 2025 revenue of approximately $2.3 billion, falling $300 million short of expectations due to manufacturing delays at its Arizona facility, but achieved a record adjusted gross margin of 13.7% and adjusted EBITDA of $19.5 million.

- The company secured record orders of $1.4 billion in Q4 2025, with approximately half from Australia, increasing its backlog to $5.3 billion.

- For fiscal year 2026, Fluence Energy provided guidance of $3.2 billion to $3.6 billion in revenue, an adjusted gross margin of 11%-13%, and adjusted EBITDA between $40 million and $60 million.

- Demand for energy storage is accelerating, with a growing pipeline including over 30 GWh from data center projects and the new SmartStack product expected to drive a majority of future orders.

- Fluence is strengthening its domestic supply chain by resolving production issues at its Arizona facility and adding a second domestic battery cell supplier to support growth and OBBA compliance.

- Fluence Energy reported fiscal year 2025 revenue of approximately $2.3 billion, which was below expectations due to manufacturing delays at its Arizona facility, but achieved a record 13.7% adjusted gross margin and $19.5 million adjusted EBITDA, at the top end of its guidance range.

- The company recorded $1.4 billion in orders during the fourth quarter of 2025, increasing its total backlog to $5.3 billion. The U.S. market is anticipated to be the largest contributor to order intake in fiscal year 2026.

- For fiscal year 2026, Fluence Energy forecasts revenue between $3.2 billion and $3.6 billion, with an adjusted gross margin of 11%-13%, and adjusted EBITDA between $40 million and $60 million. Annual recurring revenue is projected to reach approximately $180 million by the end of FY 2026.

- Fluence launched its new SmartStack product, which is expected to represent a majority of fiscal year 2026 orders, and announced a landmark 4 gigawatt-hour project with LEED in Europe. The company is also seeing significant demand from data center customers, with a pipeline representing over 30 gigawatt hours.

- The company has secured a second supplier for domestic battery cells and is making progress towards OBBBA compliance for its Tennessee manufacturing facility.

- Fluence Energy secured a record $1.4 billion in orders during Q4 2025, increasing its current backlog to $5.3 billion.

- For fiscal year 2025, the company reported approximately $2.3 billion in revenue, which was about $300 million below expectations due to manufacturing delays at its Arizona enclosure facility, but achieved a record adjusted gross margin of approximately 13.7% and adjusted EBITDA of approximately $19.5 million.

- Fluence Energy ended fiscal 2025 with $148 million in annual recurring revenue and approximately $1.3 billion in liquidity.

- The company introduced fiscal year 2026 guidance, projecting revenue between $3.2 billion and $3.6 billion, an adjusted gross margin of 11%-13%, and adjusted EBITDA of $40-$60 million.

- Strategic developments include a landmark 4 gigawatt hour project with LEED in Europe and securing a second supplier for domestic battery cells to enhance its domestic content strategy and meet future demand.

- Fluence Energy reported Q3 2025 revenue of $602.5 million, a 24.7% increase from the prior year, with net income of $6.9 million and Adjusted EBITDA of $27.4 million.

- The company reaffirmed its fiscal year 2025 revenue guidance of $2.6 billion to $2.8 billion, but now anticipates being at the lower end of the range due to slower than expected production ramp-up at its U.S. manufacturing facilities, which has shifted some anticipated revenue to fiscal year 2026.

- Fluence Energy's backlog as of June 30, 2025, reached approximately $4.9 billion, with an additional $1.1 billion in contracts signed in July and August.

- The company also reaffirmed its fiscal year 2025 Adjusted EBITDA guidance range of $0 to $20 million and Annual Recurring Revenue (ARR) guidance of approximately $145 million.

Quarterly earnings call transcripts for Fluence Energy.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more