Earnings summaries and quarterly performance for FLUOR.

Executive leadership at FLUOR.

Board of directors at FLUOR.

Alan M. Bennett

Director

Charles P. Blankenship Jr.

Director

H. Paulett Eberhart

Director

James T. Hackett

Lead Independent Director

Lisa Glatch

Director

Matthew K. Rose

Director

Rosemary T. Berkery

Director

Teri P. McClure

Director

Thomas C. Leppert

Director

Research analysts who have asked questions during FLUOR earnings calls.

Jamie Cook

Truist Securities

6 questions for FLR

Michael Dudas

Vertical Research Partners

6 questions for FLR

Andrew J. Wittmann

Robert W. Baird & Co.

4 questions for FLR

Steven Fisher

UBS

4 questions for FLR

Andrew Kaplowitz

Citigroup

3 questions for FLR

Sangita Jain

KeyBanc Capital Markets

3 questions for FLR

Andrew Whittman

Baird

2 questions for FLR

Andy Kaplowitz

Citigroup Inc.

1 question for FLR

Brent Thielman

D.A. Davidson

1 question for FLR

Judah Aronovitz

UBS Group AG

1 question for FLR

Judah Grodin

UBS

1 question for FLR

Natalia Alvarez Iragorri

Citigroup

1 question for FLR

Sangeetha Jain

KeyBanc Capital Markets

1 question for FLR

Recent press releases and 8-K filings for FLR.

- Orbia reported full-year 2025 net revenues of $7,619 million, an increase of 2%, and EBITDA of $1,020 million, a decrease of 7% compared to 2024, resulting in a net majority loss of $457 million.

- For the fourth quarter of 2025, net revenues were $1,875 million, up 5%, and EBITDA was $227 million, up 2% compared to Q4 2024.

- The company generated operating cash flow of $645 million and free cash flow of $111 million for the full year 2025.

- Orbia anticipates full-year 2026 EBITDA in the range of $1,100 million – $1,200 million, with capital expenditures expected to be approximately $400 million.

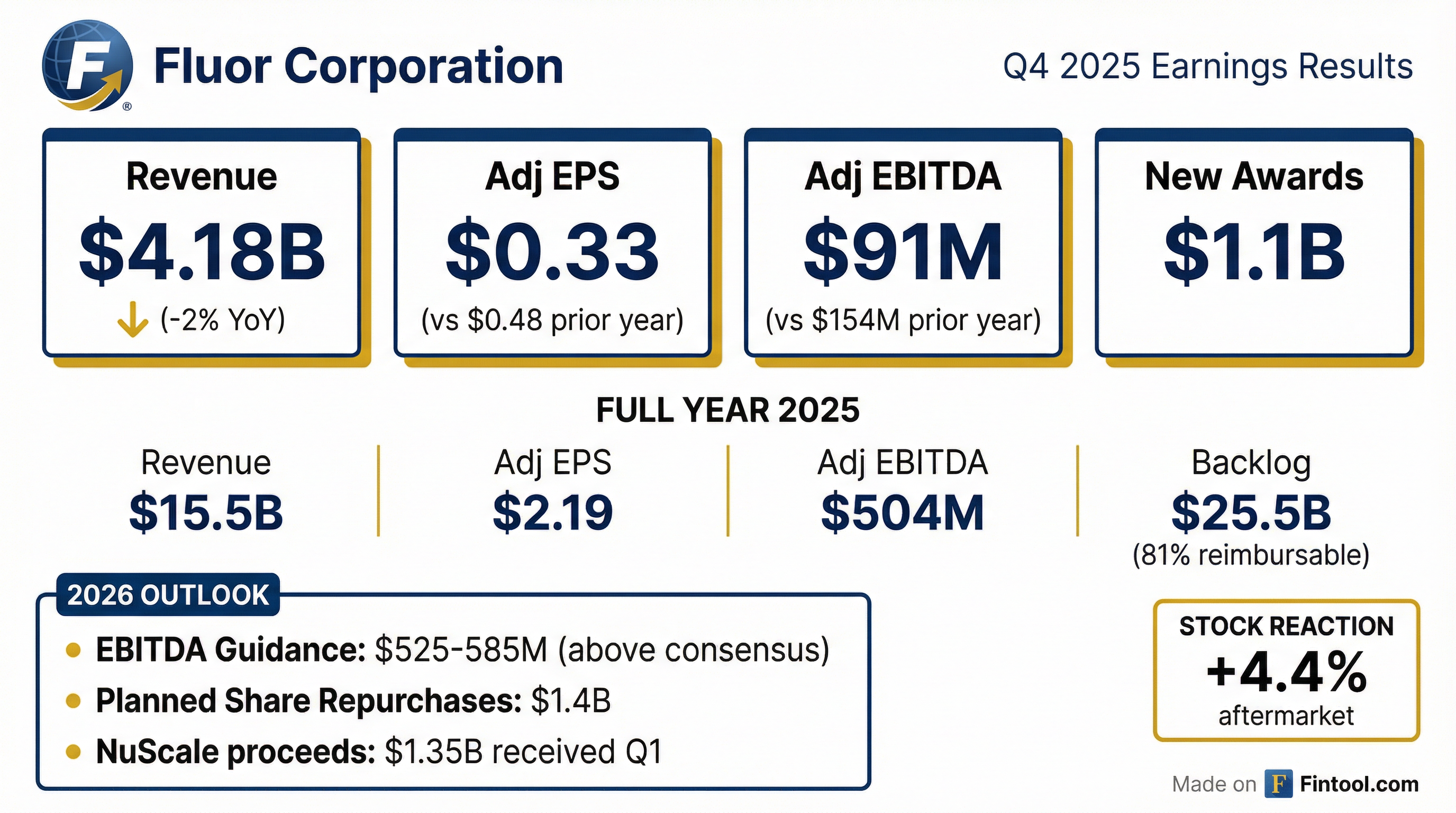

- Fluor reported $15.5 billion in revenue for fiscal year 2025, with a net loss attributable to Fluor of $(51) million and adjusted EPS of $2.19.

- The company completed $754 million in share repurchases in 2025, reducing share float by 11%, and has planned $1.4 billion in repurchases for 2026, including $400 million already executed in January-February.

- Fluor generated nearly $2 billion from NuScale monetization proceeds through February 13, 2026, with the full monetization anticipated by Q2 2026.

- For fiscal year 2026, Fluor provided guidance for Adjusted EBITDA between $525 million and $585 million and approximately $300 million in operating cash flow, expecting new awards book-to-burn in excess of 1.

- Fluor reported a consolidated segment loss of $109 million for 2025, with adjusted EBITDA of $504 million and adjusted EPS of $2.19. Operating cash flow was negative $387 million, primarily due to a $642 million payment related to Santos.

- For 2026, the company projects adjusted EBITDA between $525 million and $585 million and adjusted EPS in the range of $2.60-$3.00. Operating cash flow is expected to be approximately $300 million, excluding a $400 million tax bill from NuScale monetization.

- New awards for 2025 reached $12 billion, contributing to an ending backlog of $25.5 billion. Fluor anticipates significantly higher new awards in 2026 with a Book-to-Burn Ratio exceeding one.

- In 2025, Fluor executed $754 million in share repurchases and received $2 billion from NuScale monetization. The company plans approximately $1.4 billion in share repurchases for 2026 and expects to complete NuScale monetization by Q2.

- Fluor reported a consolidated segment loss of $109 million and adjusted EBITDA of $504 million for 2025, with adjusted EPS at $2.19. Operating cash flow was negative $387 million, largely due to a $642 million payment to Santos.

- For 2026, the company forecasts adjusted EBITDA between $525 million and $585 million and adjusted EPS in the range of $2.60 to $3.00. New awards are expected to be significantly higher than in 2025, with a Book-to-Burn Ratio exceeding 1.

- The company executed $754 million in share repurchases in 2025 and plans an additional $1.4 billion for 2026. Fluor also monetized its NuScale investment, receiving $2 billion since September 2025, with further proceeds anticipated in Q2 2026.

- Fluor's backlog ended 2025 at $25.5 billion, with 81% reimbursable, and 50%-60% of this backlog is expected to convert to revenue in the next 12 months.

- Fluor reported $12 billion in new awards and ended 2025 with a backlog of $25.5 billion. The company anticipates significantly higher new awards in 2026, with a Book-to-Burn Ratio in excess of 1.

- For full year 2025, Fluor's adjusted EBITDA was $504 million and adjusted EPS was $2.19. Segment results included a $205 million profit for Urban Solutions, a $414 million loss for Energy Solutions (impacted by the Santos ruling), and a $94 million profit for Mission Solutions.

- The company issued 2026 guidance, projecting adjusted EBITDA between $525 million and $585 million and adjusted EPS between $2.60 and $3.00.

- Fluor plans approximately $1.4 billion in share repurchases for 2026 and expects to conclude its NuScale monetization efforts in Q2 2026, having already received $2 billion since September 2025. Operating cash flow for 2025 was negative $387 million, largely due to a $642 million payment to Santos.

- Fluor Corporation reported full year 2025 revenue of $15.5 billion, a GAAP net loss attributable to Fluor of $51 million, adjusted EBITDA of $504 million, and adjusted EPS of $2.19.

- For the fourth quarter of 2025, the company reported a net loss attributable to Fluor of $1.6 billion (or ($9.87) per diluted share) and adjusted EPS of $0.33.

- Full year new awards totaled $12.0 billion and the ending backlog was $25.5 billion as of December 31, 2025.

- The company expended $754 million in 2025 to repurchase 18 million shares and plans $1.4 billion for 2026; it also received $605 million in 2025 and an additional $1.35 billion in Q1 2026 for NuScale share sales.

- Fluor is establishing adjusted EBITDA guidance for 2026 of $525 million to $585 million.

- Fluor sold 71 million shares of NuScale Power Corporation, generating $1.35 billion in gross sales proceeds.

- The company plans to monetize its remaining 40 million NuScale shares by the second quarter of 2026, with total proceeds from NuScale sales reaching nearly $2 billion to date.

- From the beginning of the fourth quarter of 2025 through February 13, 2026, Fluor repurchased nearly 17 million shares of its common stock, deploying over $700 million.

- Fluor's Board of Directors approved an increase of 30 million shares for its share repurchase program, leaving approximately 32.4 million shares currently available for repurchase.

- Fluor reported full year 2025 revenue of $15.5 billion, adjusted EBITDA of $504 million, and adjusted EPS of $2.19, alongside a GAAP net loss of $51 million.

- The fourth quarter of 2025 saw a net loss of $1.6 billion, or ($9.87) per diluted share, largely due to a $2 billion reduction in the valuation of its NuScale investment.

- The company executed $754 million in share repurchases in 2025 and plans $1.4 billion for 2026. It also received $605 million from NuScale share sales in 2025 and an additional $1.35 billion in Q1 2026, with full monetization expected by the end of Q2 2026.

- New awards for 2025 totaled $12.0 billion, contributing to an ending backlog of $25.5 billion.

- Fluor provided adjusted EBITDA guidance for 2026 ranging from $525 million to $585 million.

- Fluor Corporation has been awarded a multi-year contract by Centrus Energy’s subsidiary, American Centrifuge Operating, LLC, to serve as the integrated engineering, procurement, and construction (EPC) partner.

- The contract involves expanding Centrus’ low-enriched uranium (LEU) and high-assay low-enriched uranium (HALEU) enrichment facility in Piketon, Ohio.

- Fluor's role includes leading engineering and design, managing supply chain and procurement, overseeing construction, and supporting the commissioning of the new capacity.

- This project is part of a multi-billion dollar public and private investment plan to add thousands of centrifuges, aiming to re-establish domestic uranium enrichment capability and create over 1,300 Ohio jobs.

- The expansion will establish Centrus as a leading LEU provider and expand HALEU production, which is crucial for powering a new generation of advanced reactors and supporting national security.

- USA Rare Earth (USAR) announced a non-binding Letter of Intent (LOI) with the U.S. Department of Commerce’s CHIPS Program for $1.6 billion in proposed funding, which includes $277 million in federal funding and a $1.3 billion senior secured loan.

- Concurrently, USAR raised $1.5 billion through a common stock PIPE transaction, anchored by Inflection Point, involving the issuance of 69.8 million shares at $21.50 per share.

- This combined $3.1 billion capital is expected to accelerate USAR’s growth objectives across mining, processing, metal-making, and magnet manufacturing, aiming to establish the largest domestic heavy rare earth, critical mineral, metal, and magnet production by 2030.

- Key targets by 2030 include extracting 40,000 metric tons per day from the Round Top deposit (with commercial production expected to begin in 2028) and increasing neodymium-iron-boron (NdFeB) magnet-making capacity to 10,000 tpa.

Quarterly earnings call transcripts for FLUOR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more