Earnings summaries and quarterly performance for Fabrinet.

Executive leadership at Fabrinet.

Board of directors at Fabrinet.

Research analysts who have asked questions during Fabrinet earnings calls.

Karl Ackerman

BNP Paribas

8 questions for FN

Ryan Koontz

Needham & Company, LLC

8 questions for FN

Samik Chatterjee

JPMorgan Chase & Co.

8 questions for FN

Tim Savageaux

Northland Capital Markets

8 questions for FN

George Notter

Jefferies

7 questions for FN

Mike Genovese

Rosenblatt Securities

5 questions for FN

Steven Fox

Fox Research

4 questions for FN

Michael Genovese

Rosenblatt Securities Inc.

3 questions for FN

Christopher Rolland

Susquehanna Financial Group

2 questions for FN

Dong Wang

Nomura Instinet

2 questions for FN

Recent press releases and 8-K filings for FN.

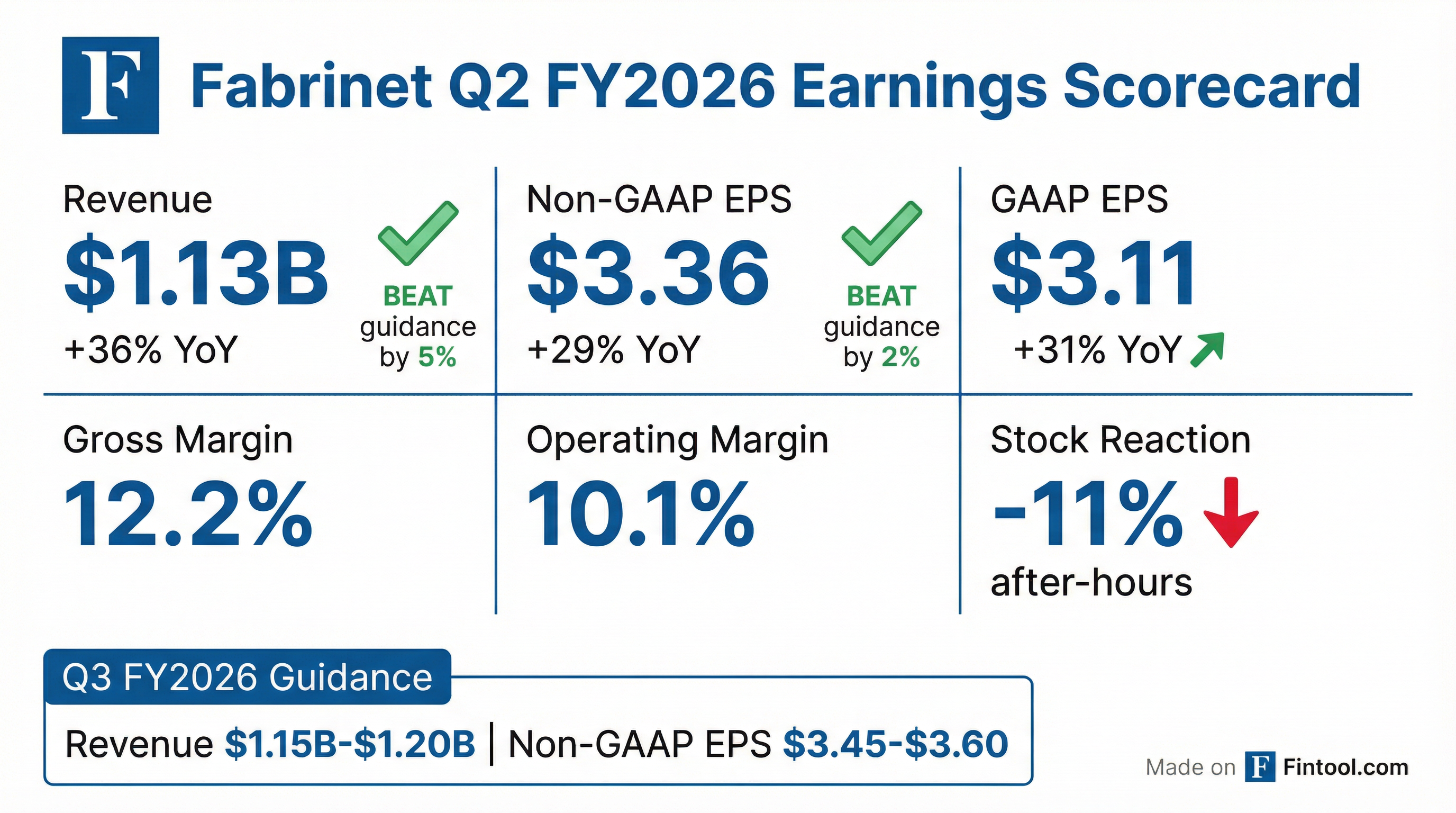

- Fabrinet achieved record Q2 fiscal year 2026 revenue of $1.13 billion, a 36% year-over-year increase, and non-GAAP EPS of $3.36, both exceeding guidance ranges.

- The company provided Q3 fiscal year 2026 guidance, expecting revenue between $1.15 billion and $1.2 billion and non-GAAP EPS ranging from $3.45 to $3.60.

- High-performance computing (HPC) revenue significantly increased to $86 million in Q2, with the first HPC program anticipated to reach over $150 million when fully ramped in the next couple of quarters.

- Optical Communications revenue grew 29% year-over-year to $833 million, primarily driven by Telecom revenue surging 59% to $554 million.

- To support anticipated growth, Fabrinet is expanding manufacturing capacity, including the construction of Building 10 (2 million sq ft), with 250,000 sq ft expected by mid-calendar year 2026.

- Fabrinet reported record Q2 2026 revenue of $1.13 billion, marking a 36% year-over-year increase and 16% sequential growth, with non-GAAP EPS also reaching a new record of $3.36 per share.

- High-performance computing (HPC) revenue surged to $86 million in Q2 2026, up from $15 million in Q1, and is expected to reach over $150 million when fully ramped in the next couple of quarters.

- The company is undertaking significant capacity expansion, including the construction of Building 10 (2 million sq ft) with 250,000 sq ft available by mid-calendar year 2026, and adding 120,000 sq ft at the Pinehurst campus.

- Optical Communications revenue grew 29% year-over-year, driven by 59% growth in Telecom revenue and 42% growth in DCI module revenue, while Datacom supply constraints are easing with a new laser source.

- Fabrinet anticipates continued strong growth trends in Q3 2026 across most segments, with double-digit growth expected in HPC and faster growth in DCI.

- Fabrinet achieved record Q2 2026 revenue of $1.13 billion, marking a 36% year-over-year increase and the fastest growth since its IPO, with non-GAAP EPS of $3.36 per share.

- The company projects continued strong performance with Q3 2026 revenue guidance between $1.15 billion and $1.2 billion and non-GAAP EPS guidance of $3.45 to $3.60.

- Growth was significantly driven by Optical Communications revenue of $833 million (up 29% year-over-year) and Non-Optical Communications revenue of $300 million (up 61% year-over-year), notably from High-Performance Computing (HPC) products contributing $86 million.

- Fabrinet is expanding its manufacturing capacity, with Building 10 (2,000,000 sq ft) on track for completion by late 2026, and 250,000 sq ft available by mid-year, complemented by 120,000 sq ft of converted space at the Pinehurst campus.

- The company repurchased 12,000 shares for $5 million in Q2 2026, with $169 million remaining under its share repurchase program.

- Fabrinet reported record revenue of $1,132.9 million for the second fiscal quarter ended December 26, 2025, an increase from $833.6 million in the prior year period, and exceeding guidance ranges.

- GAAP net income per diluted share for Q2 FY2026 was $3.11, up from $2.38 in Q2 FY2025, while Non-GAAP net income per diluted share was $3.36, compared to $2.61 in the same period last year, both above guidance ranges.

- The company provided guidance for the third fiscal quarter ending March 27, 2026, expecting revenue between $1.15 billion and $1.20 billion.

- For Q3 FY2026, GAAP net income per diluted share is projected to be in the range of $3.22 to $3.37, and Non-GAAP net income per diluted share is expected to be between $3.45 and $3.60.

- Fabrinet reported record revenue of $1,132.9 million for the second fiscal quarter ended December 26, 2025, significantly exceeding guidance ranges and up from $833.6 million in the prior year period.

- GAAP diluted earnings per share for Q2 FY2026 was $3.11, compared to $2.38 in Q2 FY2025, while non-GAAP diluted earnings per share reached $3.36, up from $2.61 in the same period last year.

- The company issued guidance for its third fiscal quarter ending March 27, 2026, projecting revenue between $1.15 billion and $1.20 billion, with non-GAAP diluted earnings per share expected to be in the range of $3.45 to $3.60.

- Chairman and CEO Seamus Grady noted the "exceptional second quarter" performance and expressed confidence that the same business drivers would extend into the third quarter.

- Fabrinet is experiencing robust and increasing demand in its Data Center Interconnect (DCI) business, driven by 400ZR and 800ZR products, with five key customers.

- The company has successfully entered the High-Performance Compute (HPC) market, securing AWS as a customer and generating $15 million in revenue last quarter from initial qualification volumes, with expectations for significant future growth.

- To support anticipated growth, Fabrinet is expanding its manufacturing capacity with Building 10, which will add an estimated $2.5 billion in revenue capacity, with a portion of the space expected to be ready by June.

- Fabrinet maintains a strong financial position with approximately $1 billion in cash and no debt, allowing it to fund its $130 million capacity expansion for Building 10 from internal resources.

- Fabrinet reports robust and increasing demand in Data Center Interconnect (DCI) for 400ZR and 800ZR products, serving five customers, and strong overall Datacom demand, especially for transceivers driven by AI data centers, with NVIDIA as a key customer.

- The company has entered the High-Performance Compute (HPC) market with AWS, generating $15 million in qualification volumes last quarter, and anticipates ramping to a first plateau of revenue by the June quarter as additional production lines are qualified.

- To meet demand, Fabrinet is expanding capacity with Building 10, a 2 million sq ft facility adding $2.5 billion in revenue capacity, with 250,000 sq ft available by June; the $130 million CapEx is funded internally from its $1 billion cash reserve and no debt.

- Fabrinet maintains strong financials with gross margins in the 12.5%-13% range and low OpEx at 1.6%-1.7% of revenue, expecting operating margin improvement through operational leverage.

- Fabrinet is experiencing robust demand and growth in its Data Center Interconnect (DCI) and Datacom businesses, driven by AI data centers and new products like 400ZR, 800ZR, and 1.6 terabit transceivers.

- The company's new High-Performance Compute (HPC) business with AWS generated $15 million in qualification-type revenue last quarter and is expected to ramp to a "first plateau of revenue" by the June quarter.

- To support growth, Fabrinet is expanding capacity with Building 10, which will add $2.5 billion in revenue capacity and is being funded by the company's $1 billion cash reserves with no debt.

- Fabrinet maintains a strong financial position with gross margins in the 12.5%-13% range and very low OpEx (around 1.6%-1.7% of revenue), allowing for significant operating margin leverage with incremental revenue growth.

- Fabrinet reported record Q1 2026 revenue of $978.1 million, surpassing guidance and marking a 22% year-over-year increase.

- The company achieved a record non-GAAP diluted EPS of $2.92 for Q1 2026, also exceeding guidance.

- Profitability remained strong with a non-GAAP operating margin of 10.6% and a non-GAAP gross margin of 12.3% in Q1 2026.

- As of September 26, 2025, Fabrinet maintained a strong balance sheet with $968.8 million in cash and cash equivalents and no total debt.

- Fabrinet reported record revenue of $978 million and record non-GAAP earnings per share of $2.92 for the first quarter of fiscal year 2026, which ended September 26, 2025.

- The company introduced a new high-performance computing (HPC) product category, which contributed $15 million to revenue in Q1 2026 and is expected to scale considerably over the coming quarters.

- For the second quarter of fiscal year 2026, Fabrinet anticipates revenue to be in the range of $1.05 billion to $1.1 billion and earnings per diluted share between $3.15 and $3.30.

- To support rapid growth, construction of Building 10, a 2 million sq ft facility, is on track for completion by the end of calendar 2026, with a portion accelerated for mid-2026, expected to add approximately $2.4 billion in revenue capacity.

Quarterly earnings call transcripts for Fabrinet.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more