Earnings summaries and quarterly performance for Fortive.

Executive leadership at Fortive.

James Lico

President and Chief Executive Officer

Mark Okerstrom

Senior Vice President and Chief Financial Officer

Olumide Soroye

President and Chief Executive Officer, Intelligent Operating Solutions

Stacey Walker

Senior Vice President and Chief Human Resource Officer

Tamara Newcombe

President and Chief Executive Officer, Precision Technologies and Advanced Healthcare Solutions

Board of directors at Fortive.

Research analysts who have asked questions during Fortive earnings calls.

Deane Dray

RBC Capital Markets

9 questions for FTV

Julian Mitchell

Barclays Investment Bank

9 questions for FTV

Scott Davis

Melius Research

9 questions for FTV

Nigel Coe

Wolfe Research, LLC

8 questions for FTV

Andrew Kaplowitz

Citigroup

7 questions for FTV

Christopher Snyder

Morgan Stanley

7 questions for FTV

Jeffrey Sprague

Vertical Research Partners

7 questions for FTV

Joseph Giordano

TD Cowen

7 questions for FTV

Jamie Cook

Truist Securities

4 questions for FTV

Joseph O'Dea

Wells Fargo

4 questions for FTV

Steve Tusa

JPMorgan Chase & Co.

4 questions for FTV

Andrew Buscaglia

BNP Paribas

3 questions for FTV

Andrew Obin

Bank of America

3 questions for FTV

Scott Graham

Seaport Research Partners

3 questions for FTV

Andy Kaplowitz

Citigroup Inc.

2 questions for FTV

C. Stephen Tusa

JPMorgan Chase & Co.

2 questions for FTV

Joseph O'Dea

Wells Fargo & Company

2 questions for FTV

Bradley Hewitt

Wolfe Research

1 question for FTV

Robert Mason

Robert W. Baird & Co.

1 question for FTV

Recent press releases and 8-K filings for FTV.

- Fortive exited 2025 with broad-based strength across both IOS and AHS segments, and January 2026 performance was solid and in line with expectations.

- Fluke’s growth is propelled by accelerated innovation, expansion into new geographies (e.g., India) and recurring revenue, which now represents 15% of Fluke sales.

- The FAL subsegment faced a tough comparison from ESSER-funded backlog but is set to accelerate via innovation, expanded commercial footprint and improving customer health scores.

- AHS’s ASP business saw subdued capital-equipment purchases in 2025, offset by software, consumables and services growth; equipment order tightness began easing in Q3–Q4 2025 and is expected to gradually release throughout 2026.

- Fortive reaffirmed its target of 50–100 bps annual margin expansion, with ~$50 million of stranded costs removed post-spin and disciplined capital allocation toward organic growth, bolt-on M&A and share buybacks.

- Q4 2025 organic growth exceeded expectations with broad-based strength across IOS and AHS; January 2026 performance aligns with full-year setup assuming stable macro and government spending conditions.

- Fluke’s growth ceiling is rising through accelerated innovation (e.g., Q4 launch of Certified FiberMax), targeted commercial expansion (notably in India), and 15% recurring revenue growing double digits.

- Software platforms benefit from proprietary data, network effects, regulatory barriers, and deep customer integration; Fortive has democratized AI across all businesses by integrating its AI Center of Excellence into the Fortive Business System.

- ASP capital equipment demand was subdued in 2025 despite solid software and consumables performance; expecting gradual release of pent-up orders through 2026 alongside enhanced innovation, sales capacity, and recurring customer engagement.

- Margin ambition of 50–100 bps expansion is underpinned by removal of US$50 m stranded costs and strong operating leverage; capital allocation prioritizes organic investment, bolt-on M&A, and US$1.3 bn share repurchase (~8% of share count in H2 2025).

- Fortive exited 2025 with broad-based core growth strength, as Q4 outperformed expectations and January started solidly; short-cycle industrial activity showed improvement in North America and sequential gains in EMEA.

- Fluke’s franchise has no apparent market ceiling, driven by accelerated innovation (e.g., Certified FiberMax), expanded geographic coverage, and 15% of revenue now from subscription services.

- Software platforms (ServiceChannel, Gordian, Provation) benefit from proprietary data assets, network effects, and regulatory moats, and Fortive has democratized AI capabilities via its AI Center of Excellence, now embedded in the Fortive Business System.

- The company targets 50–100 bps of annual operating-margin expansion—having eliminated $50 m of stranded costs post-spin—and maintains disciplined capital allocation, prioritizing organic investment, bolt-on M&A, and opportunistic share buybacks (e.g., $1.3 bn in H2 2025).

- Fortive introduced its “Accelerated Strategy” built on three pillars—accelerate profitable organic growth, disciplined capital allocation, and building investor trust—and reported momentum in the first two quarters as a standalone company while guiding 2 %–3 % organic growth in 2026 (ramping to 3 %–4 % in 2027).

- The company’s AI Center of Excellence, founded in 2017, has been fully integrated into the Fortive Business System to drive internal productivity and enhance customer-facing hardware and software solutions, further strengthening existing competitive moats.

- Segment performance in Q4 2025 included 4 % growth at IOS, led by Fluke’s new product introductions (e.g., CertiFiber Pro for data-center testing), Environmental, Health & Safety, and FAL; the AHS segment saw stable consumables and software revenue while capital equipment deferrals eased.

- Fortive delivered 110 bps of adjusted EBITDA margin expansion in 2025, targets 50–100 bps annual margin improvement through reinvestment and cost discipline, and generates roughly $1 billion of free cash flow per year to support share buybacks and selective M&A.

- CEO Olumide Soroye reiterated Fortive’s three strategic pillars—accelerate profitable organic growth, allocate capital with discipline, and build investor trust—and noted strong alignment and momentum in the first two quarters post-spin.

- The company reaffirmed its organic revenue growth targets of 2–3% in 2026, ramping to 3–4% over 2026–2027 as part of its Fortive Accelerated Strategy.

- Fortive’s AI center of excellence (established in 2017) has been fully integrated into the Fortive Business System, driving both internal efficiency gains and enhanced, AI-enabled customer solutions, particularly within its software portfolio backed by proprietary data, network effects, and regulatory moats.

- In Q4 2025, the IOS segment grew 4%, led by product innovation, targeted commercial investments, and recurring offerings; North American point-of-sale trends remained robust, while AHS software brands Provation and Censis delivered solid ARR growth amid stabilizing consumables and recovering capital equipment demand.

- Fortive generates approximately $1 billion of free cash flow annually and continues disciplined capital allocation, prioritizing share repurchases and selective bolt-on acquisitions while excluding transformational M&A to maximize risk-adjusted returns.

- Fortive reinforced its Accelerated Strategy centered on three pillars—accelerating organic growth, disciplined capital allocation, and building investor trust—and guided 2–3% organic growth for 2026 (ramping to 3–4% in 2027).

- The company has leveraged its AI Center of Excellence (established in 2017) to embed AI across the Fortive Business System, driving productivity gains internally and enabling AI-powered enhancements in both hardware brands (e.g., Fluke) and software solutions.

- Fortive expects 50–100 bps of adjusted EBITDA margin expansion in 2026–27, generates ~$1 billion of free cash flow annually, and will maintain disciplined capital deployment—continuing share buybacks and pursuing bolt-on M&A while avoiding transformational deals.

- In Q4 2025, the Industrial & Service (IOS) segment grew 4%, with all subsegments contributing and 15% of Fluke revenue now recurring, underpinned by accelerated product innovation (e.g., CertiFiber Pro launch for data center fiber certification) ; the AHS segment saw strong software growth, stable consumables/services, and improving capital order trends.

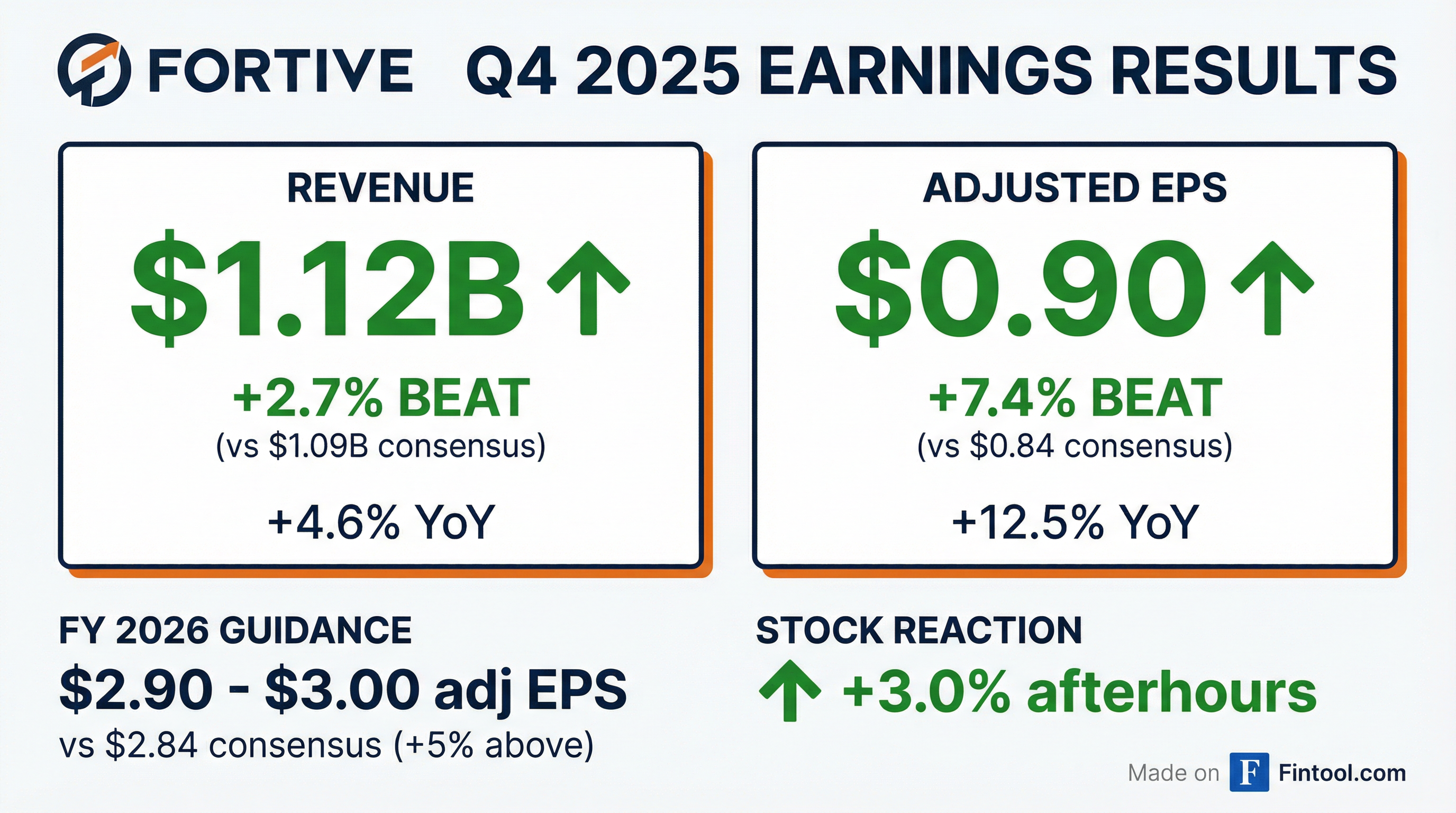

- Fortive delivered Q4 2025 revenue of $1.123 billion, up 4.6% YoY (+3.3% core).

- Q4 adj. EPS was $0.90, up 12.5% YoY, driven by EBITDA growth and share repurchases.

- Free cash flow in Q4 was $314 million, representing 109% conversion on adj. net income.

- Deployed $265 million in Q4 share repurchases (~5 million shares) and $1.3 billion in 2H 2025, supporting disciplined capital allocation.

- Initiated FY 2026 adj. EPS guidance of $2.90–$3.00, up from $2.71 in FY 2025.

- Q4 revenue of $1.1 billion (+4.5% reported; +3% core) and Adjusted EPS of $0.90 (+13%); FY 2025 Adjusted EPS of $2.71 (+12%)

- Q4 Adjusted EBITDA of $358 million (+8%); Q4 Free Cash Flow of $315 million and FY FCF of $930 million with >100% conversion

- Share repurchases: $265 million in Q4, totaling $1.3 billion in H2 2025

- 2026 guidance: Adjusted EPS of $2.90–$3.00 (~9% growth at midpoint), core revenue growth of 2%–3%, mid-teens tax rate, net interest expense ~$120 million; ~315 million diluted shares

- In Q4 2025, Fortive delivered $1.1 billion in revenue, up 4.5% year-over-year on a reported basis and 3% on a core basis; IOS segment core growth was 4%, and AHS core growth was 1.6%.

- Q4 adjusted EBITDA was $358 million, up 8% year-over-year, with margins expanding about 100 bps to nearly 32%, and adjusted EPS was $0.90, up 13%; full-year adjusted EPS came in at $2.71, exceeding guidance.

- The company generated $315 million of free cash flow in Q4 and $930 million for the full year, with free cash flow conversion north of 100%; Fortive repurchased $265 million of shares in Q4 (totaling $1.3 billion in H2 2025) and had 315 million diluted shares outstanding as of the call.

- Fortive initiated 2026 adjusted EPS guidance of $2.90–$3.00, implying approximately 9% year-over-year growth at the midpoint, expects 50–100 bps of margin expansion, and assumes 315 million shares outstanding.

- Fortive delivered Q4 2025 total revenue of $1.1 billion (+4.5% y/y reported; +3% core), Adjusted EBITDA of $358 million (+8%; 32% margin), and Adjusted EPS of $0.90 (+13%).

- Full-year 2025 Adjusted EPS was $2.71 (+12%), with free cash flow of $930 million (conversion >100%) and $265 million of share repurchases in Q4 (H2 total of $1.3 billion).

- Segment results: IOS revenue grew just over 5% reported (4% core) with $288 million Adjusted EBITDA (+8%; 37% margin); AHS revenue was $353 million (+3% reported; 1.6% core) with $92 million Adjusted EBITDA (26% margin).

- Fortive initiated 2026 guidance for Adjusted EPS of $2.90–$3.00 (≈9% y/y growth at midpoint) and core revenue growth of 2–3%, assuming current FX and tariff levels.

Fintool News

In-depth analysis and coverage of Fortive.

Quarterly earnings call transcripts for Fortive.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more