Earnings summaries and quarterly performance for FORWARD AIR.

Executive leadership at FORWARD AIR.

Shawn Stewart

Chief Executive Officer

Doug Smith

Chief People Officer

Eric Brandt

Chief Commercial Officer

Jamie Pierson

Chief Financial Officer

Jason Ringgenberg

Interim Chief Information Officer

Jerome Lorrain

Executive Chairman

Michael L. Hance

Chief Legal Officer and Secretary

Board of directors at FORWARD AIR.

Research analysts who have asked questions during FORWARD AIR earnings calls.

Scott Group

Wolfe Research

5 questions for FWRD

Bascome Majors

Susquehanna Financial Group

4 questions for FWRD

Christopher Kuhn

The Benchmark Company

4 questions for FWRD

Stephanie Moore

Jefferies

4 questions for FWRD

Andrew Baxter Cox

Stifel, Nicolaus & Company, Incorporated

2 questions for FWRD

Harrison Bauer

Susquehanna

2 questions for FWRD

J. Bruce Chan

Stifel

2 questions for FWRD

Joseph Lawrence Hafling

Jefferies

2 questions for FWRD

Bruce Chan

Stifel Financial Corp.

1 question for FWRD

Matthew Milask

Stifel Financial Corp.

1 question for FWRD

Recent press releases and 8-K filings for FWRD.

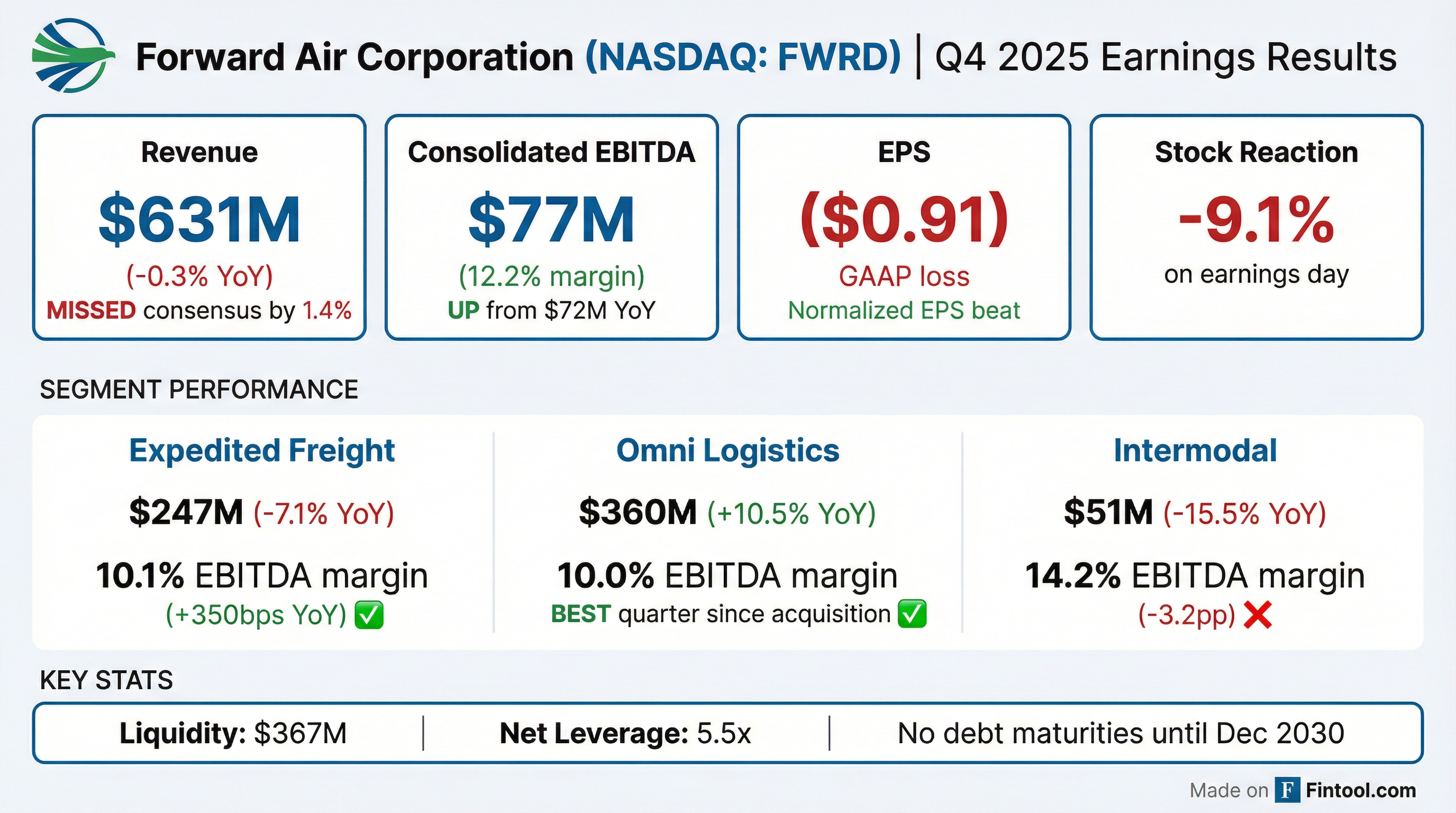

- Forward Air reported Q4 2025 consolidated revenue of $631 million and Consolidated EBITDA of $77 million with a 12.2% margin.

- The Omni Logistics segment achieved its best results since acquisition in Q4 2025, with revenue of $360 million and Reported EBITDA of $36 million.

- The Expedited Freight segment's Q4 2025 results improved significantly year over year, reporting revenue of $247 million and Reported EBITDA of $25 million.

- As of Q4 2025, the company maintained a solid liquidity position of $367 million and an LTM Net Leverage of 5.5x.

- Forward Air reported $77 million in consolidated EBITDA for Q4 2025, an increase from $72 million in Q4 2024, and full-year 2025 adjusted EBITDA improved $40 million year-over-year to $293 million.

- The Omni Logistics segment achieved its highest revenue, reported EBITDA of $36 million, and reported EBITDA margin of 10% in Q4 2025 since its acquisition, with full-year reported EBITDA (excluding goodwill impairment) almost doubling to $124 million.

- The company generated $44 million in cash from operating activities for the full year 2025, marking a $113 million improvement compared to 2024, and ended the year with $367 million in liquidity.

- Forward Air is nearing the conclusion of its strategic alternatives review and is focused on profitable long-term growth, expanding synergistic service offerings, and upgrading its tech stack with initiatives like the One ERP system and global HRIS system consolidation in 2026.

- Forward Air reported Q4 2025 consolidated EBITDA of $77 million and full-year 2025 consolidated EBITDA of $307 million, with adjusted EBITDA improving $40 million year-over-year to $293 million in 2025.

- The Omni Logistics segment achieved its highest revenue, reported EBITDA ($36 million), and reported EBITDA margin (10%) in Q4 2025 since its acquisition, with full-year 2025 reported EBITDA almost doubling to $124 million.

- The company's cash generated from operating activities improved by $113 million in 2025 to $44 million, and it ended the year with $367 million in liquidity.

- Forward Air is nearing the conclusion of its strategic alternatives review process and implemented key initiatives in 2025, including unifying U.S. domestic operations into a One Ground Network and establishing a new Latin America regional structure.

- Despite a "multi-year freight recession," management noted recent spikes in TL spot rates and tender rejections as potential signs of an inflection point for market recovery, though sustained improvement is needed.

- Forward Air reported Q4 2025 consolidated EBITDA of $77 million, an increase from $72 million in Q4 2024, and full year 2025 consolidated EBITDA of $307 million, compared to $311 million in 2024.

- The Omni Logistics segment achieved its highest revenue, reported EBITDA ($36 million), and reported EBITDA margin (10%) in Q4 2025 since its acquisition, with full year 2025 reported EBITDA almost doubling to $124 million from $67 million in 2024.

- Cash generated from operating activities improved significantly to $44 million for the full year 2025, representing a $113 million year-over-year improvement from consuming $69 million in 2024.

- The company is nearing the conclusion of its strategic alternatives review process and has made key leadership appointments, including Presidents for Latin America and Asia Pacific, and a new Chief Information Officer.

- Management noted no meaningful positive signs for market recovery at the end of 2025, but recent spikes in TL spot rates and tender rejections offer hope for an inflection point, pending sustained improvements.

- Forward Air Corporation reported consolidated revenue of $631 million and Consolidated EBITDA of $77 million for the fourth quarter of 2025. For the full year 2025, Consolidated EBITDA was $307 million.

- The Omni segment achieved its highest revenue of $360 million, highest Reported EBITDA of $36 million, and highest Reported EBITDA margin of 10 percent since its acquisition, with revenue increasing by $34 million year-over-year in Q4 2025.

- The Expedited Freight segment's Reported EBITDA for Q4 2025 improved by $7 million to $25 million compared to Q4 2024, and its Reported EBITDA margin increased by 350 basis points to 10.1 percent.

- The company ended 2025 with a liquidity position of $367 million, including $106 million in cash. Cash provided by operating activities for the full year 2025 was $44 million, representing a $113 million improvement over 2024.

- Forward Air Corporation reported full-year 2025 operating income of $36 million and Consolidated EBITDA of $307 million, which was in line with $311 million in 2024.

- For the fourth quarter of 2025, consolidated revenue was $631 million, and Consolidated EBITDA increased to $77 million from $72 million in the prior year period.

- The Omni segment achieved its highest revenue ($360 million), Reported EBITDA ($36 million), and Reported EBITDA margin (10 percent) since its acquisition in January 2024.

- The Expedited Freight segment's fourth-quarter Reported EBITDA improved by $7 million to $25 million, with its margin increasing by 350 basis points to 10.1 percent compared to Q4 2024.

- The company ended 2025 with $367 million in liquidity, including $106 million in cash, and saw a $113 million year-over-year improvement in cash provided by operating activities for the full year.

- Forward Air (FWRD) reported consolidated revenue of $632 million and Consolidated EBITDA of $78 million with a 12.3% margin for Q3 2025.

- The company maintained $413 million in liquidity and recorded an LTM Net Leverage of 5.5x as of Q3 2025.

- The Omni Logistics segment achieved its highest revenue and Reported EBITDA since acquisition, with Q3 2025 revenue at $340 million and Reported EBITDA at $33 million (9.6% margin).

- The Expedited Freight segment's Q3 2025 revenue was $259 million with a Reported EBITDA of $30 million (11.5% margin), reflecting continued pricing and margin improvement.

- FWRD has realized over $100 million in annualized cost savings, contributing to a rationalized cost structure.

- Forward Air reported Q3 2025 consolidated EBITDA of $78 million and adjusted EBITDA of $75 million, maintaining consistent performance compared to the prior quarter and year-ago period. The company also generated $53 million in cash from operations in Q3 2025, contributing to a $113 million year-over-year improvement in year-to-date cash from operations to $67 million.

- The Expedited Freight segment delivered $30 million in reported EBITDA with an 11.5% margin, marking its second-highest margin since Q4 2023, while the Omni Logistics segment's reported EBITDA increased 22% year-over-year to $33 million on $340 million in revenue.

- The strategic alternatives review process is ongoing with continued discussions with multiple interested parties. Concurrently, the company is advancing its operational transformation, including the OneGround network and a one ERP initiative, alongside cost reduction efforts that have yielded approximately $12 million in annualized savings.

- Forward Air Corporation reported consolidated revenue of $632 million for the three months ended September 30, 2025, a decrease from $656 million in the same period a year ago, in the face of an extended freight recession.

- For Q3 2025, operating income was $15 million and Consolidated EBITDA was $78 million, compared to $23 million and $86 million, respectively, in Q3 2024.

- The Omni segment's revenue increased by $5 million to $340 million in Q3 2025, achieving its highest revenue and reported EBITDA since acquisition, while the Expedited Freight segment's reported EBITDA margin was 11.5 percent.

- The company's liquidity increased to $413 million at the end of Q3 2025 from $368 million at the end of Q2 2025, with cash provided by operations totaling $67 million through the first three quarters of 2025.

- Forward Air Corporation reported consolidated revenue of $632 million and operating income of $15 million for the third quarter of 2025.

- Consolidated EBITDA for Q3 2025 was $78 million, with the last twelve months (LTM) Consolidated EBITDA reaching $299 million as of September 30, 2025.

- The company's liquidity stood at $413 million at the end of Q3 2025, an increase from $368 million at the end of the second quarter.

- The Omni segment posted its highest revenue and reported EBITDA since its acquisition, with revenue increasing by $5 million to $340 million and reported EBITDA rising by $6 million to $33 million compared to the prior year.

- The Expedited Freight segment achieved a reported EBITDA margin of 11.5 percent, which is its second highest since the fourth quarter of 2023.

Quarterly earnings call transcripts for FORWARD AIR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more