Earnings summaries and quarterly performance for GLAUKOS.

Executive leadership at GLAUKOS.

Board of directors at GLAUKOS.

Research analysts who have asked questions during GLAUKOS earnings calls.

Allen Gong

JPMorgan Chase & Co.

6 questions for GKOS

Larry Biegelsen

Wells Fargo & Company

6 questions for GKOS

Ryan Zimmerman

BTIG

6 questions for GKOS

Thomas Stephan

Stifel

6 questions for GKOS

Joanne Wuensch

Citigroup Inc.

5 questions for GKOS

Richard Newitter

Truist Securities

5 questions for GKOS

Adam Maeder

Piper Sandler Companies

4 questions for GKOS

Anthony Petrone

Mizuho Group

4 questions for GKOS

Mason Carrico

Stephens Inc.

4 questions for GKOS

Michael Sarcone

Jefferies

4 questions for GKOS

Danielle Antalffy

UBS Group AG

3 questions for GKOS

David Saxon

Needham & Company

3 questions for GKOS

Danielle Antalffy

UBS

2 questions for GKOS

David Roman

Goldman Sachs Group Inc.

2 questions for GKOS

David Saxon

Needham

2 questions for GKOS

Patrick Wood

Morgan Stanley

2 questions for GKOS

Steven Lichtman

Oppenheimer & Co. Inc.

2 questions for GKOS

K. Gong

JPMorgan Chase & Co.

1 question for GKOS

Macauley Kilbane

William Blair & Company

1 question for GKOS

Matthew O'Brien

Piper Sandler & Co.

1 question for GKOS

Ravi Misra

Truist Securities

1 question for GKOS

Steve Lichtman

William Blair

1 question for GKOS

Recent press releases and 8-K filings for GKOS.

- Glaukos Corporation reported 30% topline growth in 2025 and provided 2026 revenue guidance of $610 million, supported by a healthy balance sheet with $283 million in cash and equivalents and no debt as of December 31, 2025.

- The company recently received FDA approval for iDose TR re-administration in January 2026 and Epioxa (Epi-on) in 2025, with Epioxa's launch timing set for 2026.

- Glaukos is advancing a robust pipeline of 13 disclosed programs, including lead candidates in its iLution platform (Demodex Blepharitis in Phase 2) and Retina XR platform (IVT multi-kinase inhibitor in Phase 2a for AMD, DME, RVO).

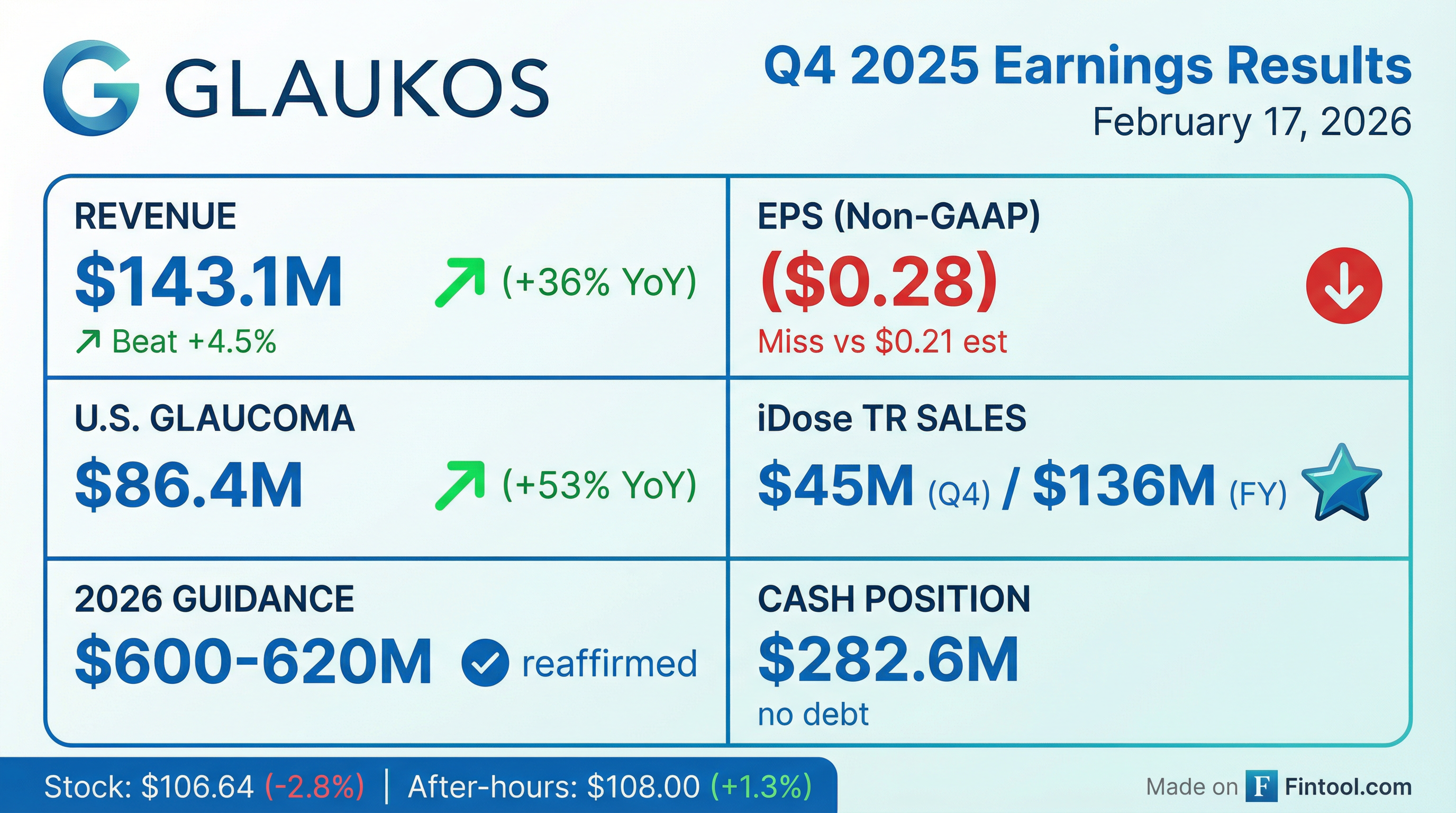

- Glaukos reported record fourth quarter 2025 consolidated net sales of $143.1 million, a 36% increase year-over-year, and full-year 2025 net sales of $507.4 million, up 32% from 2024.

- The company reaffirmed its full-year 2026 net sales guidance range of $600 million-$620 million, representing over 20% growth at the midpoint.

- iDose TR generated approximately $45 million in sales in Q4 2025 and $136 million for the full year 2025, with the U.S. FDA approving unlimited re-administration.

- Epioxa, a novel treatment for keratoconus, received FDA approval in Q4 2025, with drug availability expected late in Q1 2026 and a permanent J-code anticipated in July 2026.

- Operating expenses for 2026 are projected to be around $555 million-$560 million, reflecting mid-teen year-over-year growth off the 2025 base, while still showing operating leverage.

- Glaukos reported record fourth quarter 2025 consolidated net sales of $143.1 million, a 36% increase on a reported basis, and full-year 2025 consolidated net sales of $507.4 million, up 32% versus 2024.

- The company reaffirmed its full-year 2026 net sales guidance range of $600 million-$620 million, implying more than 20% year-over-year growth at the midpoint.

- The U.S. glaucoma franchise achieved record Q4 net sales of $86.4 million, significantly driven by iDose TR sales of approximately $45 million in Q4 and $136 million for the full year 2025.

- The U.S. FDA approved Epioxa for keratoconus, with drug availability expected late in Q1 2026 and a permanent J-code by July 2026. Additionally, the FDA approved a labeling supplement for iDose TR allowing for unlimited re-administration.

- Operating expenses are projected to increase by a mid-teen year-over-year percentage in 2026, reaching approximately $555 million-$560 million.

- Glaukos reported record Q4 2025 consolidated net sales of $143.1 million, a 36% increase year-over-year, and record full-year 2025 net sales of $507.4 million, up 32% from 2024.

- The company reaffirmed its full-year 2026 net sales guidance range of $600 million-$620 million, implying over 20% year-over-year growth at the midpoint.

- iDose TR sales reached approximately $45 million in Q4 2025 and $136 million for the full year 2025, contributing to a 53% year-over-year growth in the U.S. glaucoma franchise to $86.4 million in Q4 2025.

- The U.S. FDA approved an NDA labeling supplement for iDose TR, allowing unlimited re-administration; additionally, Epioxa is commercially available, with a permanent J-code anticipated in July 2026.

- Glaukos continues to advance a broad clinical pipeline, including patient enrollment in a PMA pivotal trial for iStent infinite and a phase 2B/3 clinical program for iDose T-Rex.

- Glaukos Corporation reported record net sales of $143.1 million in Q4 2025, an increase of 36% year-over-year, and $507.4 million for the full year 2025, up 32% year-over-year.

- The company's Non-GAAP gross margin was approximately 85% for Q4 2025 and 84% for the full year 2025.

- Glaukos reported a Non-GAAP net loss of $16.4 million, or ($0.28) per diluted share, for Q4 2025, and a Non-GAAP net loss of $51.7 million, or ($0.90) per diluted share, for the full year 2025.

- The company reaffirmed its 2026 net sales guidance of $600 million to $620 million and ended Q4 2025 with approximately $282.6 million in cash and cash equivalents, short-term investments, and restricted cash.

- Key operational updates include U.S. FDA approval for Epioxa (Epi-on) in October 2025, with commercial availability expected in Q1 2026, and U.S. FDA approval for unlimited re-administration of iDose TR in January 2026.

- Glaukos reported record net sales of $143.1 million in the fourth quarter of 2025, an increase of 36% year-over-year, and $507.4 million for the full year 2025, up 32% compared to 2024.

- The company provided 2026 net sales guidance in the range of $600 million to $620 million.

- For the fourth quarter of 2025, Glaukos reported a net loss of $133.7 million, or ($2.32) per diluted share, which included a one-time, non-cash impairment charge of $112.9 million related to an acquired intangible asset.

- The full year 2025 net loss was $187.7 million, or ($3.28) per diluted share, also impacted by the $112.9 million impairment charge.

- Glaukos ended the fourth quarter of 2025 with approximately $282.6 million in cash and cash equivalents, short-term investments, and restricted cash, with no debt.

- The FDA approved a labeling supplement for Glaukos's iDose TR, permitting repeat administration of the intracameral travoprost implant.

- This decision is supported by clinical evidence demonstrating favorable long-term corneal safety and sustained intraocular pressure reductions, with approximately 70% of iDose TR patients remaining well-controlled at 36 months.

- The market reacted positively, with Glaukos shares rising and Wells Fargo maintaining an Overweight rating with a $122 price target; Glaukos currently has a market capitalization of around $7.32 billion and reported approximately $469.8 million in revenue, though it faces profitability challenges with a negative operating margin of around -18.82%.

- Glaukos has invested $800 million in R&D since 2018, resulting in 12 commercially available products and 13 in development, and has achieved over 20% CAGR every year for 10 years with over 30% market growth in the past year. The company maintains an 84% gross margin profile and a healthy balance sheet of $283 million.

- The company is focused on transforming glaucoma and keratoconus treatment paradigms. For glaucoma, the iDose TR product demonstrated 81% of patients off all medications at one year in Phase III trials , and the next-generation iDose TREX, currently in Phase II-B/III clinical trials, is expected to last six years with a single injection.

- For keratoconus, Epioxa, a new topical drug that arrests sight-threatening disease, has met FDA requirements and is anticipated to replace Photrexa, with a manageable reimbursement process expected.

- In the most recent quarter, Glaukos reported $45 million in iDose revenue, reflecting good sequential growth despite a deceleration from prior quarters. The company is also encouraged by recent constructive dialogue with the FDA regarding the PDUFA date for iDose readministration.

- GKOS has invested $800 million in R&D since 2018, yielding 12 commercially available products and 13 in various phases of development, contributing to over 30% market growth in the most recent quarter and a 20% CAGR over the past 10 years.

- The company is focused on transforming glaucoma treatment with iDose TR, which demonstrated 81% of patients off all medications at one year in Phase 3 trials, and is developing next-generation products like iDose TREX, targeting six years of therapy.

- GKOS is launching Epioxa for keratoconus, strategically discontinuing Photrexa, and anticipates a "hand-to-hand combat" approach for reimbursement with commercial payers, a process different from iDose.

- The company is exiting the year with iDose on a $180-$190 million run rate and aims for continued model leverage and cash flow break-even in the midterm, while reinvesting in its pipeline and the Epioxa launch.

- Glaukos emphasizes its innovation-driven strategy, having invested $800 million in R&D since 2018, leading to 12 commercial products and 13 in development, and has achieved over 20% CAGR for the past decade.

- The company is focused on two key areas: interventional glaucoma with products like iDose TR, which has demonstrated sustained efficacy and is awaiting a PDUFA date for repeat administration at the end of January 2026, and iStent Infinite, targeting an expanded claim by the end of 2027.

- Glaukos is also building a new market in interventional keratoconus with Epioxa, an oxygen-infused topical drug, with a J-code targeted for July 2027 to increase patient access.

- Financially, Glaukos expects continued leverage in 2026 and aims for midterm profitability, with a near-term focus on cash flow break-even and generation, while continuing significant investments in product launches and its pipeline.

Quarterly earnings call transcripts for GLAUKOS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more