Earnings summaries and quarterly performance for Great Lakes Dredge & Dock.

Executive leadership at Great Lakes Dredge & Dock.

Lasse Petterson

President and Chief Executive Officer

Christopher Gunsten

Senior Vice President, Project Services and Fleet Engineering

David Johanson

Senior Vice President, Project Acquisition and Operations

Scott Kornblau

Senior Vice President and Chief Financial Officer

Vivienne Schiffer

Senior Vice President, Chief Legal Officer, Chief Compliance Officer and Corporate Secretary

Board of directors at Great Lakes Dredge & Dock.

Research analysts who have asked questions during Great Lakes Dredge & Dock earnings calls.

Julio Romero

Sidoti & Company, LLC

4 questions for GLDD

Adam Thalhimer

Thompson, Davis & Company, Inc.

3 questions for GLDD

Jonathan Tanwanteng

CJS Securities

3 questions for GLDD

Joseph Gomes

G.research, LLC

3 questions for GLDD

Jeremy Routh

CJS Securities

1 question for GLDD

Joe Gomes

Noble Capital Markets

1 question for GLDD

Kevin Gainey

Thompson, Davis & Company, Inc.

1 question for GLDD

Recent press releases and 8-K filings for GLDD.

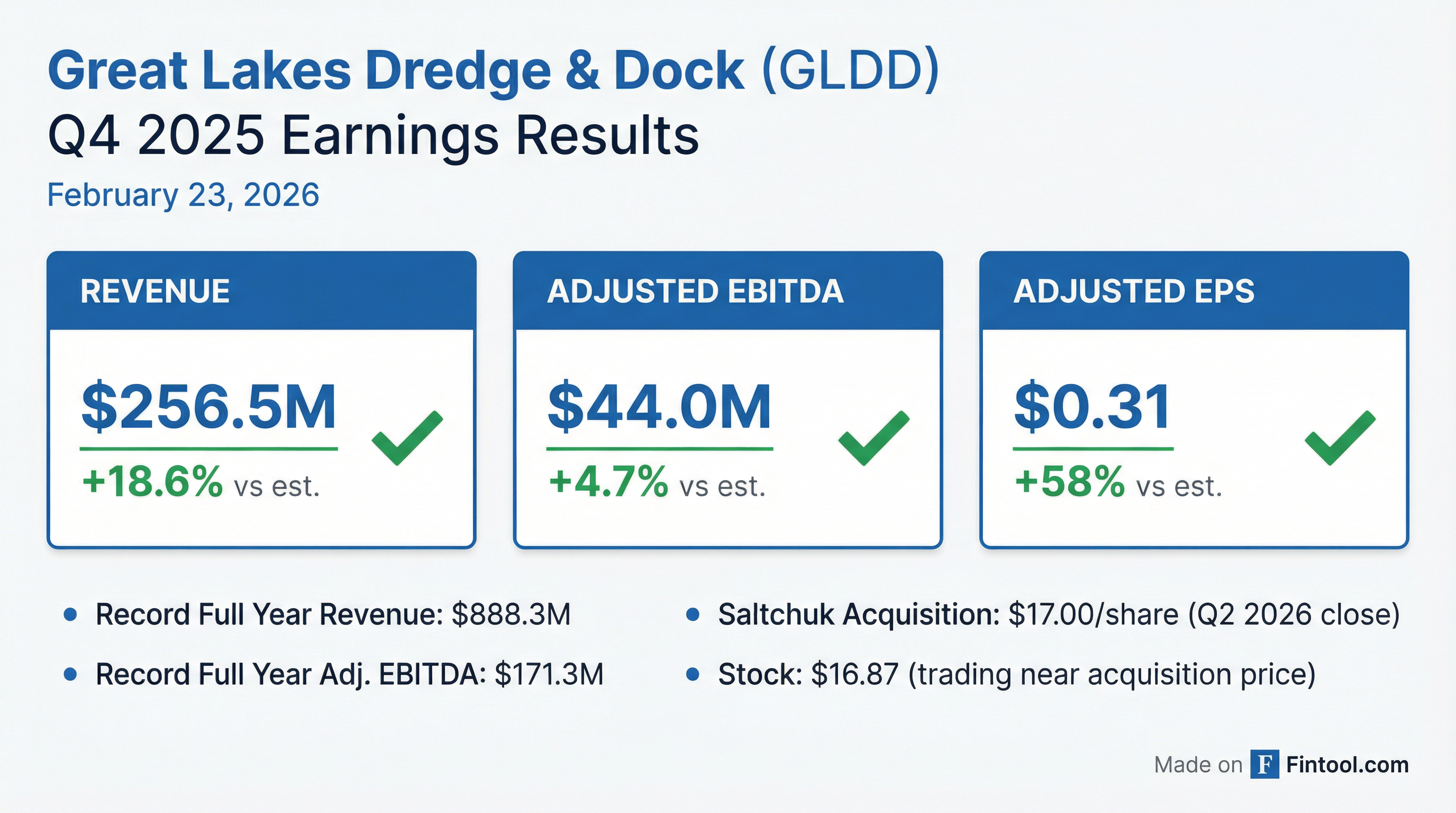

- Great Lakes Dredge & Dock Corporation reported record full year 2025 revenue of $888.3 million, an increase of $125.6 million from 2024, with net income of $73.5 million (Adjusted net income of $81.6 million) and record Adjusted EBITDA of $171.3 million.

- For the fourth quarter of 2025, the company achieved revenue of $256.5 million, net income of $12.6 million (Adjusted net income of $20.7 million), and Adjusted EBITDA of $44.0 million.

- The company announced a definitive agreement for Saltchuk Resources, Inc. to acquire Great Lakes, with the transaction expected to close in Q2 2026.

- Great Lakes signed two new international offshore energy contracts, which will utilize the Acadia in Europe for most of 2027.

- Total backlog as of December 31, 2025, was $888.1 million, a decrease from $1,239.1 million at December 31, 2024, though offshore energy backlog increased significantly to $124.8 million from $44.9 million.

- Great Lakes Dredge & Dock Corporation reported record full year revenue of $888.3 million and record full year Adjusted EBITDA of $171.3 million for the year ended December 31, 2025.

- On February 11, 2026, the company announced a definitive agreement for Saltchuk Resources, Inc. to acquire Great Lakes, with the transaction anticipated to close in Q2 2026.

- For the fourth quarter of 2025, revenue was $256.5 million, with net income of $12.6 million and Adjusted EBITDA of $44.0 million.

- Total backlog as of December 31, 2025, stood at $888.1 million, which includes an increase in offshore energy backlog to $124.8 million from $44.9 million at December 31, 2024.

- The company also secured two new international offshore energy contracts for its Acadia vessel, which will be utilized in Europe for the majority of 2027.

- Great Lakes Dredge & Dock Corporation (GLDD) has entered into a definitive agreement to be acquired by Saltchuk Resources, Inc. for $17.00 per share in cash.

- The transaction has an aggregate equity value of approximately $1.2 billion and a total transaction value of $1.5 billion.

- The $17.00 per share purchase price represents a 25% premium to Great Lakes’ 90-day volume-weighted average price as of February 10, 2026, and a 5% premium to the company’s all-time high closing price.

- The acquisition, which has been unanimously approved by the Boards of Directors of both companies, is expected to close in Q2 2026.

- Upon completion, Great Lakes will operate as a standalone business within Saltchuk, and its common stock will no longer be listed on the Nasdaq.

- Saltchuk Resources, Inc. will acquire Great Lakes Dredge & Dock Corporation for an aggregate equity value of approximately $1.2 billion and a total transaction value of $1.5 billion.

- The acquisition will proceed via a tender offer for $17.00 per share in cash, representing a 25% premium to Great Lakes' 90-day volume-weighted average price as of February 10, 2026.

- The transaction, unanimously approved by both companies' Boards of Directors, is expected to close in Q2 2026, after which Great Lakes will operate as a standalone business within Saltchuk and its common stock will no longer be listed on Nasdaq.

- Great Lakes Dredge & Dock Corp. reported strong Q3 2025 financial results with revenues of $195.2 million and adjusted EBITDA of $39.3 million.

- The company's dredging backlog remains robust at $935 million, with an additional $194 million in awards and options pending, providing revenue visibility into 2026.

- GLDD completed its hopper dredge new build program with the delivery of the Amelia Island and expects delivery of the Acadia, its subsea rock installation vessel, in Q1 2026.

- The company refinanced and upsized its revolver credit facility to $430 million and repaid its $100 million second lien term loan, reducing interest expense.

- Management expects 2025 to be the highest EBITDA year in company history and anticipates being significantly free cash flow positive starting in 2026.

- Great Lakes Dredge & Dock Corporation reported Q3 2025 revenues of $195.2 million and adjusted EBITDA of $39.3 million, with net income of $17.7 million.

- The company's dredging backlog remains strong at $935 million, with an additional $194 million in awards and options pending, providing revenue visibility into 2026.

- GLDD completed its dredging newbuild program with the delivery of the Amelia Island and expects the Arcadia subsea rock installation vessel to be delivered in 2026, with its utilization fully booked for that year.

- GLDD refinanced and upsized its revolver credit facility to $430 million, extending maturity to 2030, and repaid its $100 million second lien term loan, reducing annual interest expense by almost $6 million.

- The company anticipates 2025 to be its highest EBITDA year in history and expects to be significantly free cash flow positive starting in 2026.

- Great Lakes Dredge & Dock Corporation reported net income of $17.7 million and Adjusted EBITDA of $39.3 million for the third quarter ended September 30, 2025.

- Revenue for Q3 2025 was $195.2 million, an increase of $4.0 million from the third quarter of 2024.

- The company's dredging backlog stood at $934.5 million as of September 30, 2025, with an additional $193.5 million in low bids and options pending award.

- Great Lakes completed an amendment to its revolving credit facility, upsizing it by $100 million to a total of $430 million, extending maturity to 2030, and paying off a $100 million second lien term loan, which is expected to reduce annual interest expense by almost $6 million.

- The newest hopper dredge, the Amelia Island, was delivered in August 2025, and the subsea rock installation vessel, the Acadia, was launched in July 2025 with expected completion in Q1 2026 and secured full utilization for 2026.

- Great Lakes Dredge & Dock (GLDD) reported Q3 2025 revenue of $195.2 million and adjusted EBITDA of $39.3 million, an increase from $27.0 million in Q3 2024. The gross profit margin also improved to 22.4% for Q3 2025, up from 19.0% in Q3 2024.

- The company ended Q3 2025 with a dredging backlog of $935 million, with 93% of this backlog coming from capital and coastal protection projects.

- In October 2025, GLDD upsized its revolving credit facility to $430 million and extended its maturity to October 2030, using the funds to pay off $100 million in second lien notes, which is expected to save $6 million annually in interest.

- GLDD repurchased 1.3 million shares of stock at an average price of $8.81 in 2025. The company also took delivery of the Amelia Island in August 2025 and launched the Acadia in July 2025, with expected delivery next year.

- Great Lakes Dredge & Dock Corporation amended its Revolving Credit Facility on October 24, 2025, upsizing it by $100 million to $430 million and extending its maturity to October 2030.

- The company utilized the increased revolver capacity to fully repay the $100 million second lien notes issued in 2024.

- This transaction is expected to save an estimated $6 million per year in interest.

- The company now has no debt maturities until 2029 and a weighted average interest rate under 6%.

- Great Lakes Dredge & Dock (GLDD) announced on October 27, 2025, that it amended its Revolving Credit Facility, upsizing it by $100 million to $430 million and extending its maturity to October 2030.

- The company utilized the increased revolver capacity to fully repay $100 million in second lien notes that were issued in 2024.

- This transaction is expected to result in an estimated $6 million per year in interest savings and strengthens the company's balance sheet, with no debt maturities until 2029 and a weighted average interest rate under 6%.

Quarterly earnings call transcripts for Great Lakes Dredge & Dock.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more