Earnings summaries and quarterly performance for High Tide.

Research analysts who have asked questions during High Tide earnings calls.

Frederico Gomes

ATB Capital Markets

11 questions for HITI

Andrew Semple

Echelon Capital Markets

10 questions for HITI

Matt Bottomley

Canaccord Genuity Group Inc.

7 questions for HITI

Michael Kim

Imperial Capital, LLC

5 questions for HITI

Bill Kirk

Roth Capital Partners, LLC

4 questions for HITI

Eric Xu

Canaccord Genuity Corp.

2 questions for HITI

Michael Regan

Excelsior Equities

2 questions for HITI

Neil Gilmer

Haywood Securities

2 questions for HITI

Neil Gomer

Haywood Securities

2 questions for HITI

Scott Fortune

ROTH MKM

2 questions for HITI

Brenna Cunnington

ATB Capital Markets

1 question for HITI

Doug Cooper

Beacon Securities

1 question for HITI

Neal Gilmer

Haywood Securities Inc.

1 question for HITI

Ty Collin

Eight Capital

1 question for HITI

William Joseph Kirk

ROTH Capital Partners, LLC

1 question for HITI

William Kirk

ROTH MKM

1 question for HITI

Recent press releases and 8-K filings for HITI.

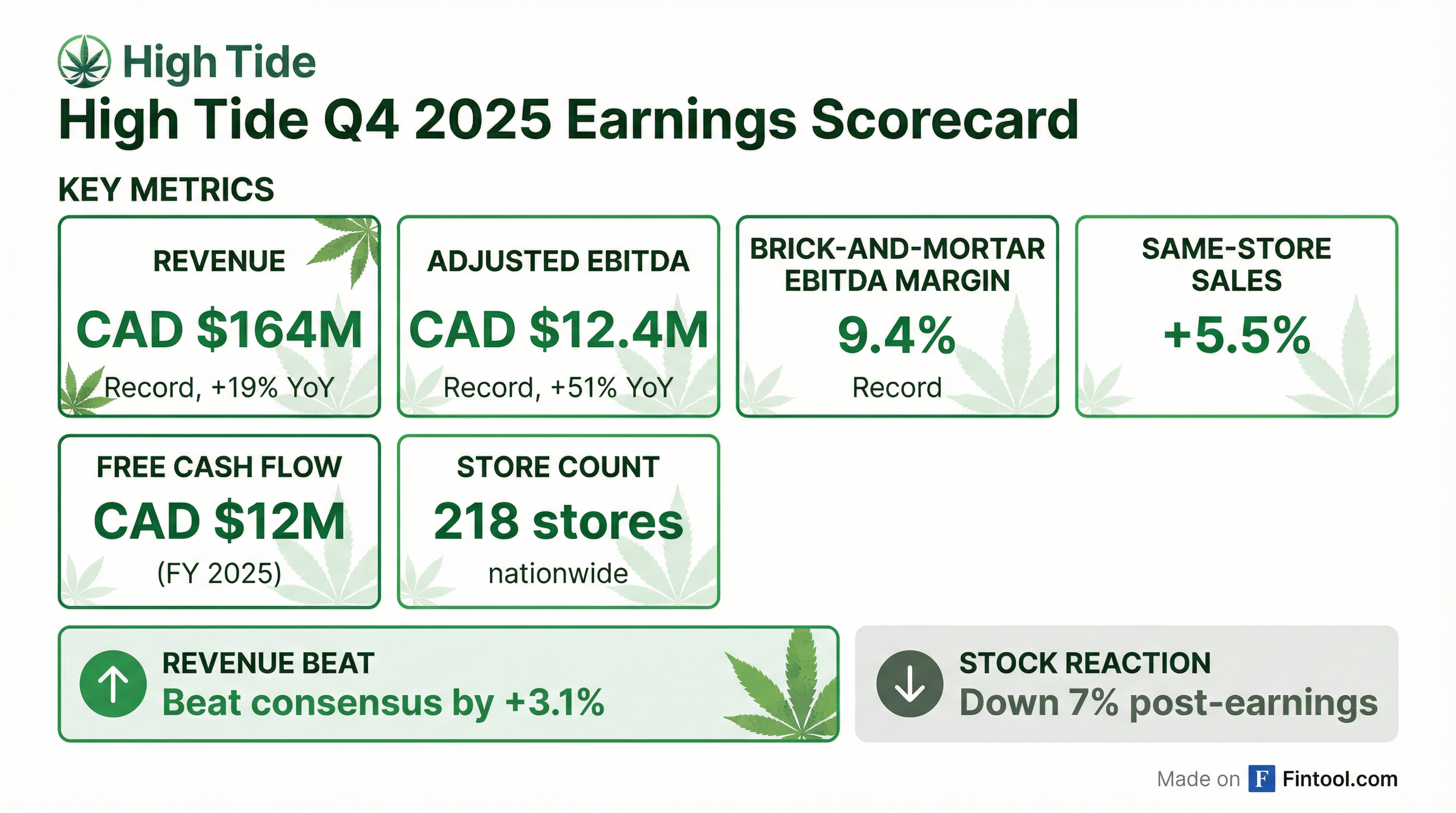

- High Tide Inc. (HITI) reported record financial results for Q4 2025, with revenue reaching CAD 164 million and Adjusted EBITDA at CAD 12.4 million, resulting in a record Adjusted EBITDA margin of 9.4%.

- The company demonstrated strong operational performance, including 5.5% same-store sales growth and an increase in its Cabana Club loyalty program to 2.5 million members, up 45% year-over-year.

- HITI generated CAD 12.12 million in Free Cash Flow for fiscal year 2025 and maintained a strong balance sheet with CAD 47.9 million in cash and cash equivalents at the end of Q4 2025.

- The recent Remaxion acquisition contributed almost $10 million in revenue in less than two months, and the company anticipates it will be a significant contributor in the second half of the fiscal year.

- High Tide plans to add 20-30 new stores organically in calendar 2026 and is actively exploring M&A opportunities in Canada, while also evaluating potential strategic partnerships in the U.S. market.

- High Tide Inc. reported record revenue of CAD 164 million and record Adjusted EBITDA of CAD 12.4 million for Q4 2025, achieving an Adjusted EBITDA margin of 9.4%. The company generated CAD 1.3 million in Free Cash Flow for the quarter, contributing to CAD 12 million for the fiscal year.

- The brick-and-mortar segment showed strong performance with 5.5% same-store sales growth and the organic addition of 27 stores in calendar 2025. The Cabana Club loyalty program grew to 2.5 million members, a 45% year-over-year increase, and ELITE members reached 151,000, up 107% year-over-year.

- High Tide is actively pursuing M&A opportunities in Canada and plans to add 20-30 new stores organically in calendar 2026. The company is also evaluating potential partnerships and regulatory changes for expansion into the U.S. market and is focused on the integration and growth of Remaxion in Germany.

- An impairment of CAD 23.6 million was recorded for goodwill and intangible assets related to the e-commerce segment.

- High Tide Inc. reported record Q4 2025 revenue of CAD 164 million and record Adjusted EBITDA of CAD 12.4 million, achieving an annual revenue run rate exceeding CAD 650 million.

- The company demonstrated strong operational performance with 5.5% same-store sales growth and the organic addition of 27 new stores in calendar 2025, expanding its Canadian footprint to 218 stores and increasing its market share to 12%.

- High Tide generated CAD 12 million in Free Cash Flow for fiscal year 2025, which fully financed its organic store expansion, and reported an adjusted net income of CAD 1.4 million for Q4 2025 after accounting for non-cash charges.

- The acquisition of a 51% stake in German medical cannabis distributor Remaxion contributed almost $10 million in revenue in less than two months, with the company also exploring further European expansion and potential U.S. market entry.

- High Tide Inc. reported record revenue of $164.0 million for the three months ended October 31, 2025 (Q4 2025), and $593.986 million for the fiscal year ended October 31, 2025 (FY 2025). The company also achieved record Adjusted EBITDA of $12.4 million in Q4 2025 and $38.208 million for FY 2025.

- The company successfully remained free cash flow positive for fiscal year 2025, generating $12.0 million.

- Operationally, High Tide opened 27 new Canna Cabana locations in calendar 2025, bringing the total to 218 stores, and completed the acquisition of a majority stake in Remexian Pharma GmbH, marking its entry into the German medical cannabis market.

- Same-store sales increased by 5.5% year over year in Q4 2025 and 4.1% for fiscal year 2025, while Canadian Cabana Club membership grew by 45% year over year to over 2.5 million members. The company reported a net loss of $46.7 million in Q4 2025, but adjusted net income for the quarter was $1.4 million, or $0.02 per fully diluted share, after accounting for one-time items.

- High Tide reported record revenue of $164.0 million for the three months ended October 31, 2025, an increase of 19% year over year, and $594.0 million for the fiscal year ended October 31, 2025.

- The company achieved record Adjusted EBITDA of $12.4 million in Q4 2025, up 51% year over year, and $38.2 million for the full fiscal year 2025.

- High Tide remained free cash flow positive for fiscal year 2025, generating $12.0 million.

- The company expanded its Canadian retail footprint to 218 Canna Cabana locations and entered the German medical cannabis market by acquiring a majority stake in Remexian Pharma GmbH.

- Same-store sales increased by 5.5% year over year in the fourth fiscal quarter and 4.1% for the full fiscal year 2025.

- High Tide Inc. entered the German medical cannabis market in 2025 by acquiring a majority stake in Remexian Pharma GmbH, becoming one of the largest importers and distributors of medical cannabis in Germany.

- The company reported an annualized revenue run-rate of $600 million (before Remexian contributions) and an annualized Adjusted EBITDA run-rate exceeding $42 million, driven by 7.4% year-over-year same-store sales increases in the third fiscal quarter of 2025.

- High Tide expanded its Canna Cabana network by adding 27 new locations in Canada in 2025, bringing the total to 218 stores, and grew its Cabana Club membership to over 2.4 million.

- The company remained free cash flow positive throughout 2025 while achieving strong growth.

- High Tide Inc. achieved significant growth in 2025, expanding its global presence by entering the German medical cannabis market through the acquisition of a majority stake in Remexian Pharma GmbH.

- The company reported an annualized revenue run-rate of $600 million (before Remexian contributions) and an annualized Adjusted EBITDA run-rate of over $42 million as of its last reported quarter.

- High Tide expanded its retail footprint by adding 27 new Canna Cabana locations in Canada, reaching 218 stores, and grew its Cabana Club loyalty program to over 2.4 million members.

- The company maintained its leadership in the Canadian retail cannabis market with a 12% share and achieved 7.4% year-over-year same-store sales increases in the third fiscal quarter of 2025.

- High Tide Inc. welcomed an Executive Order advancing cannabis rescheduling and an announcement regarding a pilot program for Medicare reimbursements for CBD products.

- The company is assessing the feasibility of expanding its Canna Cabana retail brand into the United States through a licensing model.

- High Tide's U.S. CBD brands, NuLeaf Naturals and FAB CBD, are evaluating Medicare-aligned product categories for potential inclusion in Medicare Advantage supplemental benefits.

- Effective December 19, 2025, High Tide reengaged IR Agency to provide investor relations services for a term of up to one year, with a fee of USD$140,000 per month for months the company decides to use the agency.

- High Tide Inc. welcomed the Executive Order advancing cannabis rescheduling and an announcement regarding a Medicare pilot program for CBD treatments.

- The company's U.S. CBD brands, NuLeaf Naturals and FAB CBD, are developing Medicare-aligned product categories to support potential inclusion within Medicare Advantage supplemental benefits.

- High Tide is assessing the feasibility of expanding its Canna Cabana retail brand into the U.S. through a licensing model.

- High Tide Inc. has opened its first international Canna Cabana in Berlin, Germany, marking its formal bricks-and-mortar entry into Europe and the German market.

- The new store, located in Berlin-Mitte, focuses on cannabis accessories and consumer lifestyle goods.

- This makes High Tide the first publicly traded North American cannabis operator to establish a bricks-and-mortar presence in Europe's largest cannabis market.

- This opening is a key part of High Tide's broader European retail strategy, following its recent acquisition of Remexian Pharma GmbH, a licensed medical cannabis importer and distributor in Germany.

Quarterly earnings call transcripts for High Tide.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more