Earnings summaries and quarterly performance for HOULIHAN LOKEY.

Executive leadership at HOULIHAN LOKEY.

Board of directors at HOULIHAN LOKEY.

Research analysts who have asked questions during HOULIHAN LOKEY earnings calls.

Brendan O'Brien

Wolfe Research

8 questions for HLI

James Yaro

Goldman Sachs

7 questions for HLI

Ryan Kenny

Morgan Stanley

6 questions for HLI

Alex Bond

Keefe, Bruyette & Woods (KBW)

5 questions for HLI

Devin Ryan

Citizens JMP

5 questions for HLI

Brennan Hawken

UBS Group AG

4 questions for HLI

Nathan Stein

Deutsche Bank

4 questions for HLI

Brennan Hawkin

Bank of Montreal

2 questions for HLI

Brian Kleinhanzl

Citizens Bank

2 questions for HLI

James Mitchell

Seaport Global Holdings LLC

2 questions for HLI

Kenneth Worthington

JPMorgan Chase & Co.

2 questions for HLI

Aidan Hall

KBW

1 question for HLI

Alexander Bernstein

JPMorgan Chase & Co.

1 question for HLI

Alex Jenkins

Citizens

1 question for HLI

Ben Rubin

UBS

1 question for HLI

James Edwin Yaro

Goldman Sachs Group

1 question for HLI

Madeline Daleiden

JPMorgan Chase & Co.

1 question for HLI

Michael Brown

Wells Fargo Securities

1 question for HLI

Ryan Michael Kenny

Morgan Stanley

1 question for HLI

Recent press releases and 8-K filings for HLI.

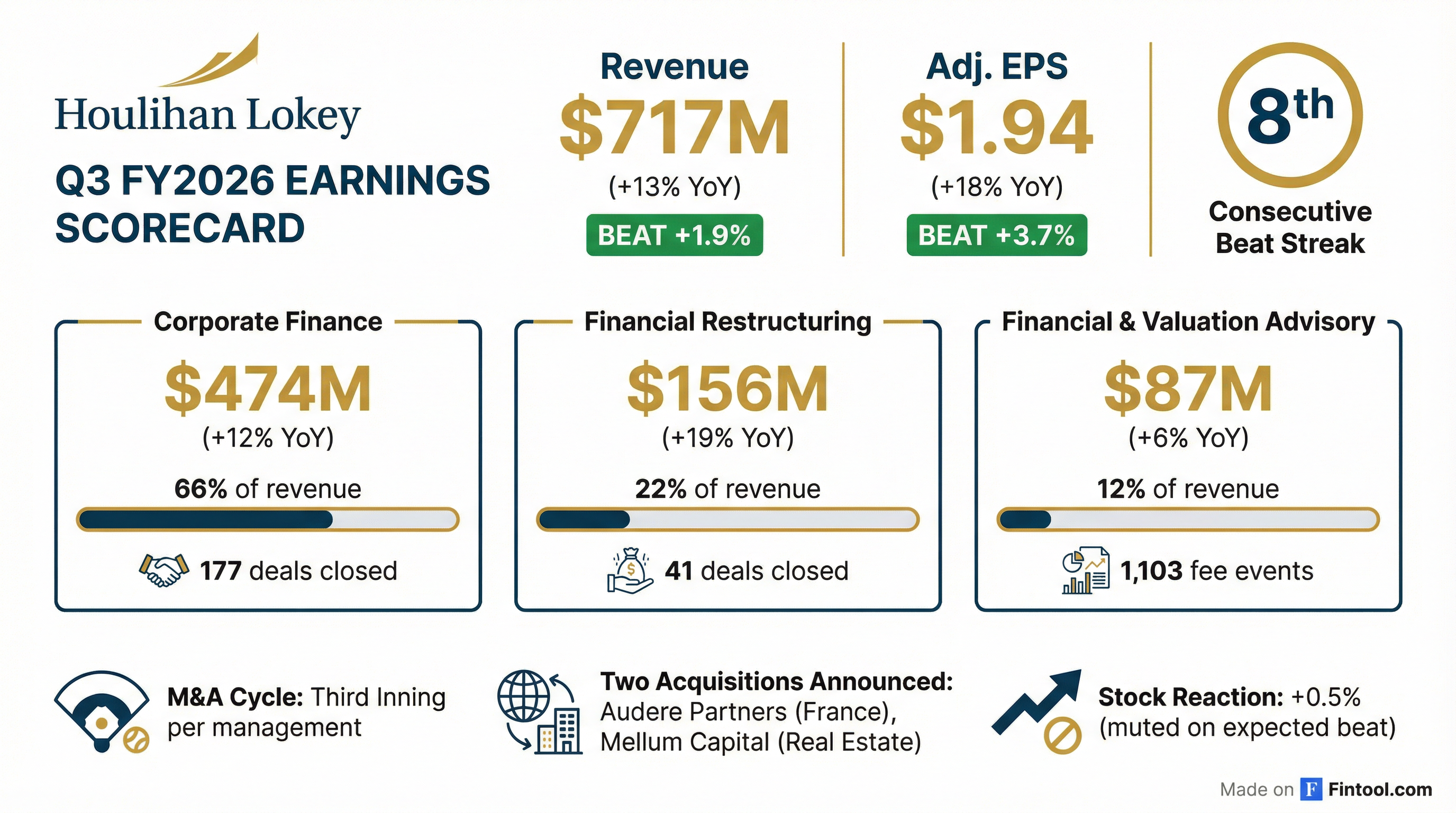

- Houlihan Lokey, Inc. reported revenues of $717 million and diluted earnings per share of $1.70 for the third quarter ended December 31, 2025.

- The company announced a dividend of $0.60 per share for the fourth quarter fiscal 2026, payable on March 15, 2026, to stockholders of record as of March 2, 2026.

- Approximately 418,000 shares were repurchased during the third quarter.

- As of December 31, 2025, the company held $1.18 billion in unrestricted cash and cash equivalents and investment securities.

- Houlihan Lokey reported Q3 fiscal year 2026 revenues of $717 million, a 13% increase year-over-year, and adjusted earnings per share of $1.94, up 18% from the prior year period.

- Corporate Finance revenue grew 12% to $474 million, and Financial Restructuring revenue increased 19% to $156 million for Q3 fiscal year 2026. The company anticipates its Q3 restructuring results will be stronger than Q4 due to accelerated transaction timelines.

- The company made strategic acquisitions, including the real estate advisory business of Mellum Capital and an agreement for a 51% controlling interest in Audere Partners, a French corporate finance firm, which is expected to close in Q4.

- Management noted an improving M&A climate and accelerating private equity activity, with Corporate Finance expected to continue strengthening. The Capital Solutions business is described as being in its "very early innings" of growth.

- Houlihan Lokey ended the quarter with approximately $1.2 billion in cash and investments and repurchased 418,000 shares as part of its share repurchase program, with a preference for strategic acquisitions for capital deployment.

- Houlihan Lokey reported revenues of $1,982 million and an Adjusted Pre-tax Margin of 26.2% for the nine months ended December 31, 2025.

- The company maintained its position as the Top Global M&A Firm and Top Global Restructuring Firm by deal count in calendar year 2025.

- HLI continues its growth strategy through acquisitions, having completed 20 acquisitions over the last 15 years, including Mellum Capital in January 2026.

- The business is highly diversified across clients, industries, geographies, transactions, and financial professionals, with no single transaction fee or financial professional representing more than 2% of revenues for FY 2025.

- Houlihan Lokey (HLI) reported Q3 fiscal year 2026 revenues of $717 million, a 13% increase year-over-year, and adjusted earnings per share of $1.94, up 18%.

- Segment revenues saw Corporate Finance grow 12% to $474 million, Financial Restructuring increase 19% to $156 million, and Financial and Valuation Advisory rise 6% to $87 million.

- The company repurchased approximately 418,000 shares during the quarter and ended with approximately $1.2 billion in cash and investments.

- Strategic expansion included hiring six new managing directors, acquiring Mellum Capital's real estate advisory business, and an agreement for a controlling interest in Audere Partners, a French corporate finance firm, expected to close in Q4.

- Management noted an improving M&A climate, particularly in private equity, with Corporate Finance activity expected to continue strengthening, while Financial Restructuring is anticipated to face some revenue pressures in fiscal 2027.

- Houlihan Lokey reported Q3 fiscal year 2026 revenues of $717 million, a 13% increase compared to the same period last year, and adjusted earnings per share of $1.94, up 18% year-over-year.

- Corporate Finance revenue grew 12% to $474 million, while Financial Restructuring revenue increased 19% to $156 million. The company anticipates its Q3 restructuring results to be stronger than Q4, reversing its typical seasonal pattern, and expects restructuring to face some revenue pressures in fiscal 2027.

- Financial and Valuation Advisory revenue increased 6% to $87 million.

- The company ended the quarter with approximately $1.2 billion of cash and investments and repurchased approximately 418,000 shares as part of its share repurchase program.

- Strategic acquisitions included the real estate advisory business of Mellum Capital and an agreement for a controlling interest in Audere Partners, a French corporate finance firm, which is expected to close in Q4. Management expressed optimism for fiscal year 2027, citing increasing M&A activity, particularly in Private Equity, and believes the M&A cycle is in its "very early innings".

- Houlihan Lokey reported revenues of $717 million for the third quarter ended December 31, 2025, an increase from $634 million in the prior year's third quarter.

- Diluted EPS was $1.70 and adjusted diluted EPS was $1.94 for the third quarter ended December 31, 2025, compared to $1.39 and $1.64, respectively, for the third quarter ended December 31, 2024.

- The company announced a dividend of $0.60 per share for the fourth quarter fiscal 2026 and repurchased approximately 418,000 shares during the third quarter.

- As of December 31, 2025, Houlihan Lokey had $1.18 billion in unrestricted cash and cash equivalents and investment securities.

- Houlihan Lokey reported revenues of $659 million for the second quarter ended September 30, 2025, compared with $575 million for the second quarter ended September 30, 2024.

- For the second quarter ended September 30, 2025, diluted earnings per share (EPS) was $1.63, and adjusted diluted EPS was $1.84. This compares to diluted EPS of $1.37 and adjusted diluted EPS of $1.46 for the second quarter ended September 30, 2024.

- The company's Board of Directors declared a regular quarterly cash dividend of $0.60 per share for the third quarter fiscal 2026, payable on December 15, 2025.

- Segment revenues for the second quarter ended September 30, 2025, were $438.661 million for Corporate Finance (up 21%), $133.803 million for Financial Restructuring (up 2%), and $86.988 million for Financial and Valuation Advisory (up 10%), all compared to the prior year period.

- HLI reported $2,389 million in revenues for fiscal year 2025, with an Adjusted Pre-tax Margin of 24.7% and Adjusted Net Income of $434 million. For the six months ended September 30, 2025, revenues were $1,265 million with an Adjusted Pre-tax Margin of 25.9% and Adjusted Net Income of $275 million.

- The company is a market leader in its three business segments, ranking No. 1 globally in M&A deals (415 deals in CY 2024), distressed debt and bankruptcy restructuring deals (88 deals in CY 2024), and M&A fairness opinions (1,243 deals from CY 2000 to CY 2024).

- HLI's business is highly diversified across clients, industries, and geographies, serving 2,000+ clients annually. For FY 2025, no single transaction fee, financial professional, or employee shareholder represented more than 2% of revenues or shares outstanding. The client mix for the LTM ended September 30, 2025, was 54% Financial Sponsors, 27% Private Non-Sponsor, and 19% Public Companies.

- The company demonstrates robust growth through increasing its Managing Director headcount to 339 in 2025 and executing 20 acquisitions over the last 15 years to expand coverage and services.

- HLI is committed to growing its quarterly dividend as the business grows, using excess cash for strategic acquisitions, and returning excess cash to shareholders.

- Houlihan Lokey reported Q2 Fiscal Year 2026 revenues of $659 million, a 15% increase year-over-year, with adjusted earnings per share of $1.84, up 26% compared to the same period last year.

- Corporate Finance revenues grew 21% to $439 million, driven by improving M&A markets and the highest number of completed transactions since late 2021. Financial Restructuring revenues increased 2% to $134 million, and Financial and Valuation Advisory revenues rose 10% to $87 million.

- The company has a positive outlook for the second half of fiscal 2026, expecting a strong Q4 for Corporate Finance, departing from typical seasonality, and continues to see strong growth in its capital solutions business. They also highlighted strong performance in their non-U.S. business and a robust acquisition pipeline.

- HLI ended the quarter with approximately $1.1 billion in unrestricted cash and investment securities and repurchased approximately 210,000 shares during the quarter.

- Houlihan Lokey (HLI) reported Q2 Fiscal Year 2026 revenues of $659 million, a 15% increase year-over-year, and adjusted earnings per share of $1.84, up 26% from the prior year.

- The Corporate Finance business saw a 21% revenue increase to $439 million, while Financial Restructuring revenues grew 2% to $134 million, and Financial and Valuation Advisory revenues rose 10% to $87 million.

- The company maintains a positive outlook for the second half of fiscal 2026, expecting continued year-over-year growth, and noted that capital markets are wide open and plentiful, increasing deal-making appetite.

- HLI ended the quarter with approximately $1.1 billion in unrestricted cash and investment securities and repurchased approximately 210,000 shares.

Quarterly earnings call transcripts for HOULIHAN LOKEY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more