Earnings summaries and quarterly performance for HERC HOLDINGS.

Executive leadership at HERC HOLDINGS.

Lawrence Silber

President and Chief Executive Officer

Aaron Birnbaum

Chief Operating Officer

Christian Cunningham

Chief Human Resources Officer

Mark Humphrey

Chief Financial Officer

Tamir Peres

Chief Information Officer

Wade Sheek

Senior Vice President, Chief Legal Officer and Secretary

Board of directors at HERC HOLDINGS.

Research analysts who have asked questions during HERC HOLDINGS earnings calls.

Tami Zakaria

JPMorgan Chase & Co.

7 questions for HRI

Kenneth Newman

KeyBanc Capital Markets

6 questions for HRI

Mircea Dobre

Robert W. Baird & Co.

6 questions for HRI

Neil Tyler

Redburn Atlantic

5 questions for HRI

Rob Wertheimer

Melius Research LLC

5 questions for HRI

Sherif El-Sabbahy

Bank of America

4 questions for HRI

Steven Ramsey

Thompson Research Group

4 questions for HRI

Jerry Revich

Goldman Sachs Group Inc.

3 questions for HRI

Kyle Menges

Citigroup

3 questions for HRI

Robert Wertheimer

Melius Research

3 questions for HRI

Ken Newman

KeyBanc

2 questions for HRI

Kyle Mengas

CD Group

2 questions for HRI

Mig Dobre

Baird

2 questions for HRI

Alec M

JPMorgan Chase & Co.

1 question for HRI

Brian Sponheimer

Gabelli Funds

1 question for HRI

Jerry Rettig

Wells Fargo

1 question for HRI

Kyle Menghas

Citigroup

1 question for HRI

Sharif El-Sabbahy

Bank of America Corporation

1 question for HRI

Steven Fisher

UBS

1 question for HRI

Recent press releases and 8-K filings for HRI.

- Herc Holdings has achieved a nearly 10% CAGR growth in revenue over the last decade and has completed 54 acquisitions in the last five years, with the H&E Equipment acquisition being the largest.

- The H&E acquisition, completed in June, significantly expanded Herc's network by adding 162 locations and 45,000 new customers, accelerating the company's growth by four to five years.

- Herc successfully integrated the H&E acquisition, realizing $40 million in revenue synergy in the second half of 2025 and projecting an incremental $100 million-$120 million in revenue synergy for 2026.

- The company expects to achieve the full $125 million in cost synergies from the H&E acquisition in 2026, ahead of the initial two-year target.

- Herc aims to increase its specialty gear as a percentage of its overall fleet from 18% to 22%-23% within three years, with a long-term goal of 25%-30%, driven by the higher dollar utilization and improved margins of specialty offerings.

- Herc Holdings completed the acquisition of H&E Equipment in June (implied June 2025), which added approximately 30% size to its capabilities, 162 locations, and 45,000 new customers. The IT stack was integrated within 90 days, and branch network optimization is expected to be complete by the end of Q1 2026.

- The H&E acquisition resulted in an upfront 15% customer degradation (dyssynergy), higher than the modeled 10% over two years. However, cost synergies are expected to reach the full $125 million in EBITDA in 2026, ahead of schedule. Revenue synergies totaled $40 million in the back half of 2025 and are anticipated to be an incremental $100 million-$120 million in 2026, split roughly 50/50 between specialty and general rental.

- The company aims to increase its specialty gear as a percentage of the overall fleet from the current 18% to 22-23% initially, and then to 25-30% over time, noting that specialty business offers 800-1,000 basis points better dollar utilization and improved margins.

- For 2026, Herc anticipates Q1 to be down year-over-year on a pro forma basis, with growth expected to materialize in Q2 and Q3 as growth CapEx is injected and seasonal aspects ramp up, leading to improved metrics sequentially and year-on-year through the rest of the year. Local markets are generally muted, with vibrancy primarily around mega project activity, and broader local market impact from interest rate cuts is not expected until 2027.

- Herc Holdings (HRI) completed the acquisition of H&E Equipment in June 2025, significantly expanding its network by 162 locations and adding 45,000 new customers.

- Integration of H&E has been rapid, with the IT stack completed in 90 days and branch network optimization expected by the end of Q1 2026.

- While initial customer degradation post-acquisition was 15%, exceeding the 10% modeled , cost synergies are ahead of schedule, with the entire $125 million in EBITDA expected in 2026.

- HRI projects $100 million-$120 million in incremental revenue synergies from the H&E acquisition in 2026, building on $40 million achieved in the second half of 2025.

- The company anticipates a pro forma negative growth rate in Q1 2026, with growth expected to turn positive in Q2 and Q3 2026 as growth CapEx is deployed. Local market recovery is not expected until late 2026 or 2027.

- Herc Rentals has completed the integration of the H&E acquisition, which accelerated its growth plans by 4-5 years and involved a rapid 90-day IT integration.

- The company projects $125 million in cost synergies impacting 2026 from an EBITDA perspective and an additional $100 million-$120 million in incremental revenue synergy for 2026 from the H&E customer base.

- For 2026, Herc's gross CapEx is estimated at approximately $1 billion , with projected free cash flow between $400 million and $600 million.

- Management aims to achieve a debt leverage ratio at the top end of the 2-3 times range by the end of 2027.

- Herc anticipates sequential and year-over-year improvements in utilization in 2026, particularly in the second half, while expecting rental rates to remain stable. The market is stable but challenging locally, with strong activity in mega projects.

- Herc Rentals has made swift progress on the H&E acquisition integration, completing IT integration in 90 days and optimizing sales territories and fleet.

- The company anticipates $125 million in cost synergies and $100 million-$120 million in incremental revenue synergies from the H&E customer base in 2026, building on $40 million achieved in Q4 2025.

- For 2026, Herc projects gross CapEx of approximately $1 billion and free cash flow between $400 million and $600 million, with a goal to reduce debt to the top end of the 2-3 times range by the end of 2027.

- The rental market is characterized by stable rates and expected sequential and year-over-year utilization improvements in the latter half of 2026. While the local market remains challenging, mega projects are driving activity.

- Herc Rentals completed the IT integration of the H&E acquisition in a record 90 days and expects $35 million in cost synergies for 2025 and $125 million for 2026 from an EBITDA perspective.

- The company projects gross revenue synergies of $390 million over a three-year period from the H&E acquisition, with $40 million realized in the back six months of 2025 and an incremental $100 million-$120 million expected in 2026.

- Herc's gross CapEx for 2026 is guided at approximately $1 billion at the midpoint, with fleet disposal expected to be $700 million in 2026, down from $1.2 billion in 2025 due to the younger H&E fleet.

- The company aims to return to a net debt to EBITDA range of two to three times by the end of 2027 and projects free cash flow between $400 million and $600 million for 2026, expecting it to be a sustainable 10%-15% of total revenue.

- Management anticipates rate stability and sequential and year-over-year improvements in utilization for 2026, noting a stable but tough local market environment offset by active megaprojects.

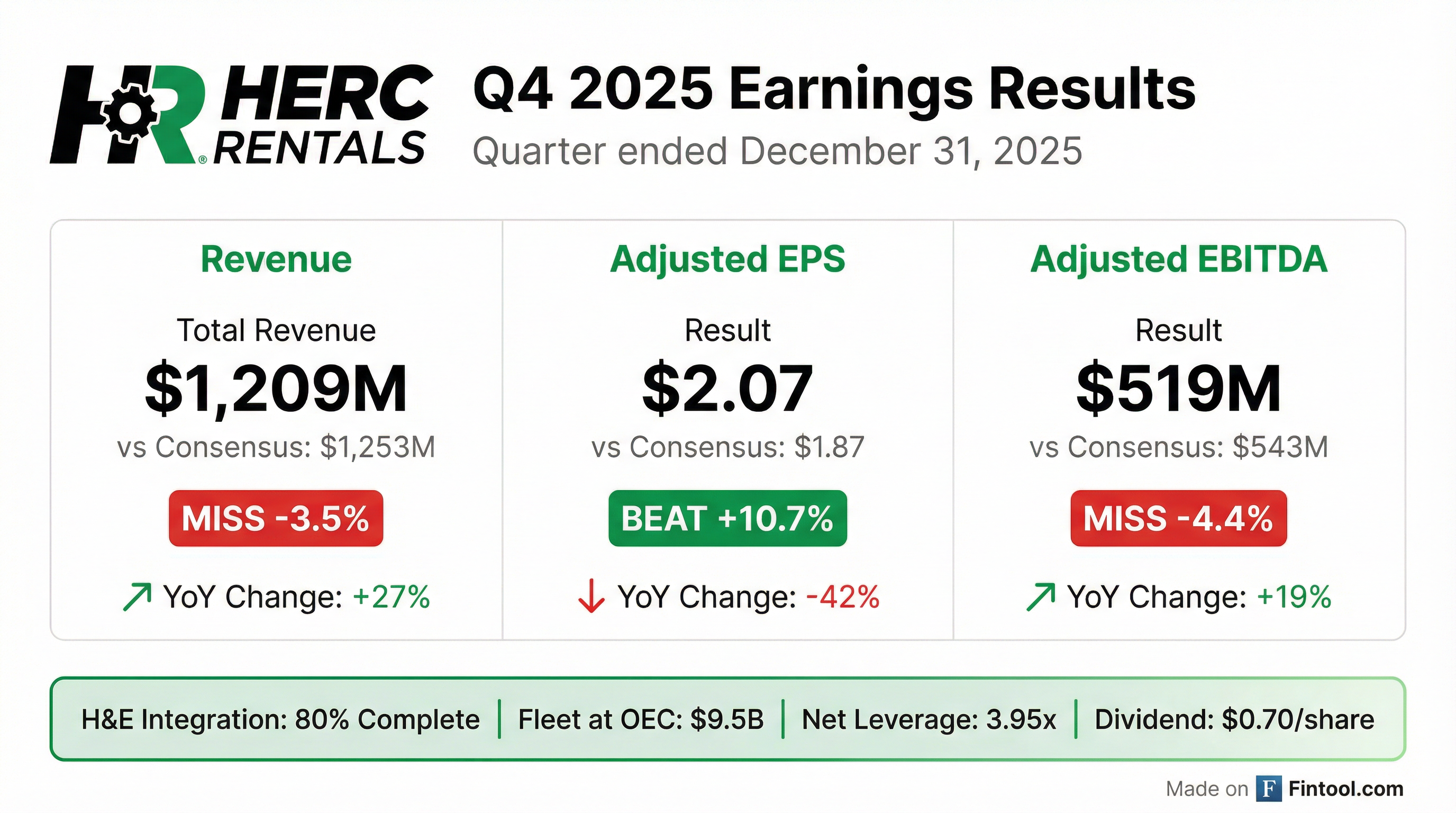

- HERC HOLDINGS reported Q4 2025 equipment rental revenue increased approximately 24% year-over-year, with Adjusted EBITDA up 19% and Adjusted Net Income of $69 million or $2.07 per share, benefiting from the H&E acquisition.

- The company provided 2026 guidance, forecasting rental revenue growth of 13%-17%, Adjusted EBITDA between $2.0 billion and $2.1 billion, and Free Cash Flow between $400 million and $600 million.

- Integration of the H&E acquisition, completed in June 2025, is progressing well, with 80% of planned branch optimization completed by Q4 2025 and full integration expected by the end of Q1 2026.

- HERC HOLDINGS expects to recognize $125 million in total cost synergies and $100-$120 million in incremental revenue synergies for 2026, contributing to EBITDA growth.

- Herc Holdings reported Q4 2025 equipment rental revenue up 24% year-over-year and Adjusted EBITDA up 19%, with Adjusted Net Income of $69 million or $2.07 per share.

- The company provided 2026 guidance, forecasting rental revenue growth of 13%-17%, Adjusted EBITDA between $2.0 billion and $2.1 billion, and Free Cash Flow between $400 million and $600 million.

- Integration of the H&E acquisition is progressing, with 80% of planned branch optimization completed by Q4 2025 and cost synergies tracking ahead of plan, with $125 million of total cost synergies expected in 2026.

- Herc is targeting $100-$120 million in incremental revenue synergies for 2026, driven by expanding specialty solutions and leveraging the acquired network, aiming to increase standalone or co-located specialty branches by approximately 25%.

- Herc Rentals reported Q4 2025 equipment rental revenue up approximately 24% year-over-year, with Adjusted EBITDA increasing 19% and adjusted net income reaching $69 million or $2.07 per share.

- The company completed the largest acquisition in its industry's history (H&E) in June 2025, with significant integration progress including 80% of planned branch optimization completed by Q4 2025.

- For the full year 2025, Herc Rentals generated $521 million of free cash flow net of transaction costs, and its pro forma leverage ratio stood at 3.9x-3.95x.

- Herc Rentals provided 2026 guidance, forecasting rental revenue growth of 13%-17%, Adjusted EBITDA between $2.0 billion and $2.1 billion, and free cash flow in the range of $400 million-$600 million.

- The company expects to realize $100 million-$120 million in incremental revenue synergies and $125 million in total cost synergies in 2026, while also focusing on leveraging opportunities from mega projects, which are projected to have $573 billion in new starts for 2026.

- Herc Holdings reported Q4 2025 total revenues of $1,209 million, a 27.1% increase year-over-year, and full-year 2025 total revenues of $4,376 million, up 22.6% from the prior year.

- For the full year 2025, net income was $1 million, a 99.5% decrease compared to 2024, while Adjusted EBITDA increased 14.8% to $1,818 million.

- The company maintained ample liquidity of $1.9 billion and reported a net leverage of 3.95x as of December 31, 2025, with adjusted free cash flow of $521 million for the full year.

- Herc Holdings provided 2026 guidance, forecasting Equipment Rental Revenue between $4.275 billion and $4.4 billion and Adjusted EBITDA between $2.0 billion and $2.1 billion.

- Key strategic actions in 2025 included completing the largest acquisition in the industry, increasing branch locations by approximately 30% year-over-year, and selling the Cinelease studio entertainment business.

Quarterly earnings call transcripts for HERC HOLDINGS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more