Earnings summaries and quarterly performance for HAVERTY FURNITURE COMPANIES.

Executive leadership at HAVERTY FURNITURE COMPANIES.

SG

Steven G. Burdette

Detailed

President and Chief Executive Officer

CEO

CH

Clarence H. Smith

Detailed

Executive Chairman

HB

Helen B. Bautista

Detailed

Senior Vice President, Marketing and Digital

JL

John L. Gill

Detailed

Executive Vice President, Merchandising

RB

Richard B. Hare

Detailed

Executive Vice President, Chief Financial Officer, and Corporate Secretary

Board of directors at HAVERTY FURNITURE COMPANIES.

Research analysts who have asked questions during HAVERTY FURNITURE COMPANIES earnings calls.

Recent press releases and 8-K filings for HVT.

Havertys Furniture Companies Reports Strong Q4 2025 Results and Provides 2026 Outlook

HVT

Earnings

Guidance Update

Share Buyback

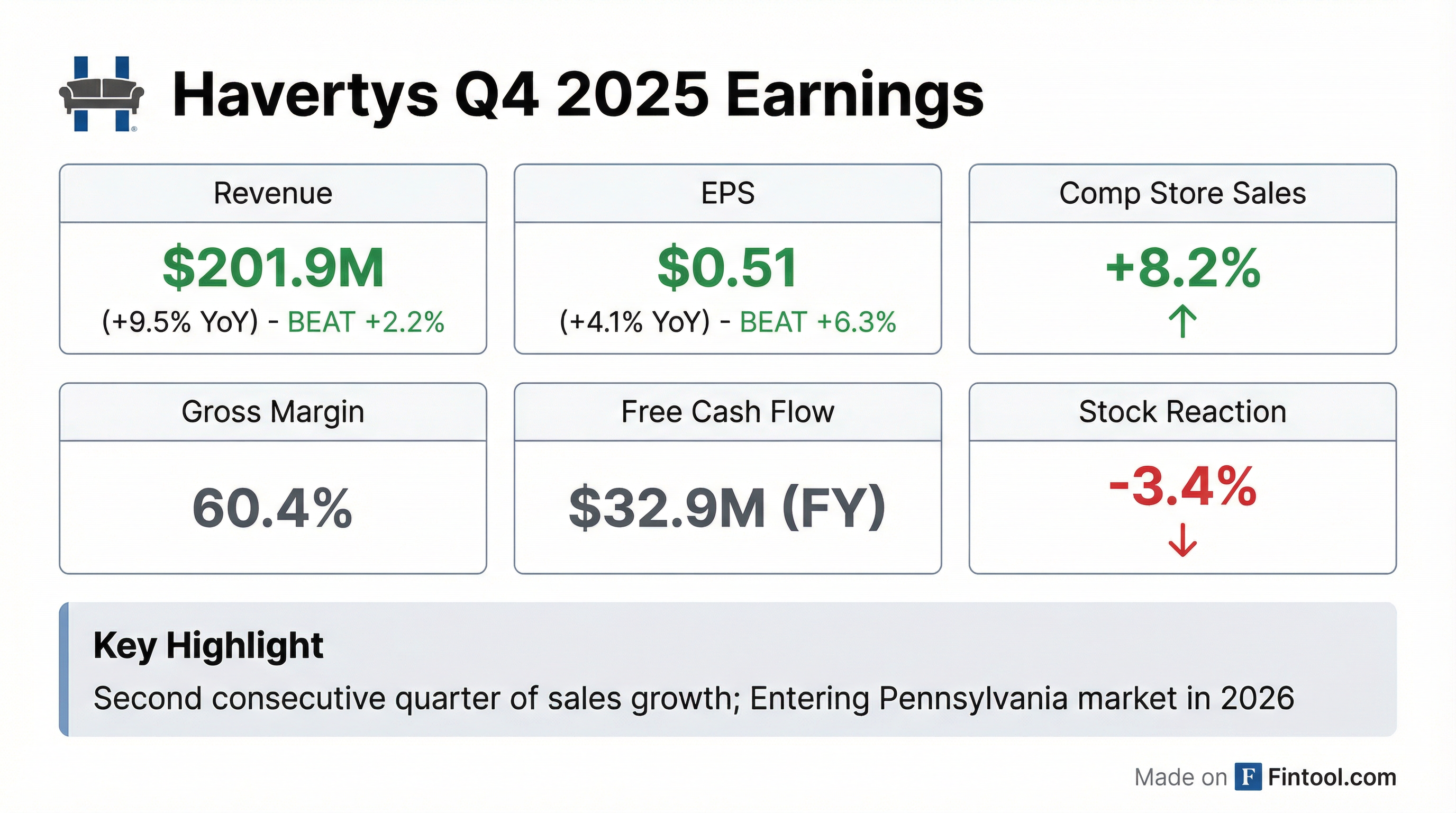

- Havertys Furniture Companies reported Q4 2025 net sales of $201.9 million, an increase of 9.5% over the prior quarter, with comparable-store sales up 8.2%. For the full year 2025, net sales reached $759 million, up 5%, and diluted earnings per share were $1.19.

- The company provided 2026 guidance, projecting gross margins between 60.5% and 61%, fixed and discretionary SG&A expenses in the $307 million-$309 million range, and planned capital expenditures of $33.5 million.

- Havertys ended Q4 2025 with a strong balance sheet, holding $125.3 million in cash and cash equivalents and no funded debt. The Board of Directors approved an additional $15 million for the share buyback program on February 20, 2026, supplementing the existing $18.3 million authorization.

- The company plans significant expansion in 2026, with 5 new stores scheduled to open, including locations in St. Louis, Nashville, Houston, and North Pittsburgh, Pennsylvania.

- New 10% worldwide tariffs were implemented on February 24, 2026, replacing previous tariffs, and Havertys' 2026 guidance already incorporates the estimated impact of these new tariffs.

4 days ago

Haverty Furniture Companies Reports Strong Q4 2025 Results and Provides 2026 Guidance

HVT

Earnings

Guidance Update

Share Buyback

- Haverty Furniture Companies reported strong Q4 2025 net sales of $201.9 million, an increase of 9.5%, with comparable-store sales up 8.2%, and diluted earnings per share of $0.51. For the full year 2025, net sales reached $759 million and diluted EPS was $1.19.

- The company provided 2026 guidance, expecting gross margins between 60.5% and 61%, fixed and discretionary SG&A expenses in the $307 million-$309 million range, and variable SG&A costs between 18.6%-18.8% of sales.

- Haverty plans to open 5 new stores in 2026, including entering Pennsylvania, and anticipates CapEx of $33.5 million for the year.

- The board approved an additional $15 million for the share buyback program, adding to the existing $18.3 million authorization. The company also addressed new 10% worldwide tariffs effective February 24, 2026, which are expected to be worked through current inventory by the first half of the year.

4 days ago

Haverty Furniture Companies Reports Strong Q4 2025 Results and Provides 2026 Guidance

HVT

Earnings

Guidance Update

Share Buyback

- Haverty Furniture Companies reported Q4 2025 net sales of $201.9 million, up 9.5%, with comparable-store sales up 8.2%, marking the second consecutive quarter of positive comps. For the full year 2025, net sales reached $759 million, up 5%, and diluted EPS was $1.19.

- The company ended Q4 2025 with a strong balance sheet, including $125.3 million in cash and cash equivalents and no funded debt. The board authorized an additional $15 million for its share buyback program on February 20, 2026, adding to the existing $18.3 million authorization.

- For 2026, HVT expects gross margins to be between 60.5% and 61% and plans $33.5 million in capital expenditures, which includes opening 5 new stores and 4 remodels.

- A new 10% worldwide tariff was issued effective February 24, 2026, replacing previous tariffs, and is expected to last for 150 days. The company will take a deliberate approach to manage its impact.

- Year-end inventories were $96.2 million, an increase of $12.7 million from the prior year, due to proactive purchases ahead of tariffs, and are expected to decrease over the next six months.

4 days ago

Havertys Reports Q4 and Full-Year 2025 Results

HVT

Earnings

Share Buyback

Guidance Update

- Havertys reported Q4 2025 diluted earnings per common share of $0.51 and consolidated sales increased 9.5% to $201.9 million compared to Q4 2024. For the full year 2025, diluted EPS was $1.19 and consolidated sales increased 5.0% to $759.0 million.

- The company returned $25.6 million to shareholders in 2025, comprising $4.8 million in share repurchases and $20.8 million in quarterly dividends. The Board of Directors also approved an additional $15 million authorization for the stock repurchase program on February 20, 2026.

- As of December 31, 2025, Havertys had $131.9 million in cash, cash equivalents, and restricted cash equivalents with no debt outstanding.

- For 2026, the company expects gross profit margins to be between 60.5% to 61.0% and planned capital expenditures to be approximately $33.5 million.

4 days ago

Haverty Furniture Companies, Inc. Reports Q3 2025 Results and Provides 2025 Outlook

HVT

Earnings

Guidance Update

Dividends

- Haverty Furniture Companies, Inc. reported consolidated sales of $194.5 million for Q3 2025, an increase of 10.6%, and achieved its first positive same-store sales quarter (7.1%) in several years.

- Year-to-date 3Q25, consolidated sales increased 3.4% to $557.1 million, with gross profit margins improving by 50 basis points to 60.8%, while diluted EPS was $0.68.

- The company maintains a strong balance sheet with approximately $137 million in cash and restricted cash as of Q3 2025 and no funded debt.

- For 2025, gross profit margins are expected to be between 60.4% and 60.7%, with fixed and discretionary SG&A expenses projected at $296 to $298 million.

- The board approved a 3.1% increase in the quarterly common share dividend to $0.33/share in November 2025, continuing a 90-year track record of consistent dividend payments.

Jan 12, 2026, 2:30 PM

Haverty Furniture Companies, Inc. Reports Q3 2025 Results with Sales Growth and Updated 2025 Guidance

HVT

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Haverty Furniture Companies, Inc. reported Q3 2025 net sales of $194.5 million, an increase of 10.6%, with comparable store sales up 7.1%.

- The company's gross profit margin was 60.3% and diluted EPS was $0.28 for Q3 2025, with selling, general, and administrative (SG&A) expenses increasing 11.3% to $112.3 million.

- Haverty's ended Q3 2025 with a strong balance sheet, holding $130.5 million in cash and cash equivalents and no funded debt.

- For full-year 2025, the company expects gross margins between 60.4% and 60.7% and fixed and discretionary SG&A expenses in the range of $296 million to $298 million. New tariffs of 25% on certain imported furniture began October 14, increasing to 30% on January 1, 2026, with price adjustments already implemented.

Oct 30, 2025, 2:00 PM

Haverty Furniture Companies, Inc. Reports Q3 2025 Operating Results and Updates 2025 Guidance

HVT

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Haverty Furniture Companies, Inc. (HVT) reported diluted earnings per common share of $0.28 for Q3 2025, a slight decrease from $0.29 in Q3 2024.

- Consolidated sales for Q3 2025 increased by 10.6% to $194.5 million, with comparable store sales growing 7.1%, marking the first quarter of positive written and delivered comparable store sales in several years.

- The company maintained strong profitability with a gross profit margin of 60.3% in Q3 2025, compared to 60.2% in the prior year period.

- HVT ended Q3 2025 with $137.0 million in cash, cash equivalents, and restricted cash equivalents and no debt outstanding. During the nine months ended September 30, 2025, the company repurchased $2.0 million of common stock and paid $15.5 million in dividends.

- For the full year 2025, the company updated its guidance, expecting gross profit margins between 60.4% to 60.7% and fixed and discretionary SG&A expenses in the $296.0 to $298.0 million range.

Oct 29, 2025, 8:24 PM

Haverty Furniture Companies Outlines Growth Strategy and Operational Efficiencies at Sidoti Conference

HVT

Guidance Update

New Projects/Investments

Share Buyback

- Haverty Furniture Companies (HVT) is a debt-free company operating 129 stores across 17 states, targeting an upper-middle market customer.

- The company aims to achieve $1 billion in revenue and a double-digit operating margin, supported by operational efficiencies, including a reduction in staffing from 3,500 to under 2,400 since the pandemic.

- HVT plans to open three new stores this year, maintaining a net of 129 stores, with a strategic focus on growth in Florida and Texas.

- Capital allocation for the year is $24 million, with a long-standing dividend policy and $2 million in share buybacks completed this year, with an additional $4 million to $6 million authorized.

- E-commerce, currently in the low single digits, is targeted to reach 10% of business, and recent website upgrades have led to double-digit organic growth in Q1 and Q2.

Sep 17, 2025, 5:00 PM

Quarterly earnings call transcripts for HAVERTY FURNITURE COMPANIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more