Earnings summaries and quarterly performance for InterDigital.

Executive leadership at InterDigital.

Board of directors at InterDigital.

Research analysts who have asked questions during InterDigital earnings calls.

SS

Scott Searle

ROTH MKM

6 questions for IDCC

Also covers: ADEA, AIOT, AIRG +22 more

AS

Anja Soderstrom

Sidoti & Company, LLC

4 questions for IDCC

Also covers: ATEN, BHE, DAKT +11 more

Arjun Bhatia

William Blair

4 questions for IDCC

Also covers: AMPL, BAND, BRZE +21 more

Tal Liani

Bank of America

3 questions for IDCC

Also covers: ANET, CHKP, CIEN +11 more

KG

Kevin Garrigan

WestPark Capital

2 questions for IDCC

Also covers: AIP, ASYS, CPTN +7 more

OL

Olinda Lee

William Blair

2 questions for IDCC

BC

Blayne Curtis

Jefferies Financial Group

1 question for IDCC

Also covers: ADI, AIP, ALAB +20 more

Recent press releases and 8-K filings for IDCC.

InterDigital Renews Patent License Agreement with Sony

IDCC

New Projects/Investments

- InterDigital has signed a new patent license agreement with Sony.

- The agreement covers all of Sony's end-user devices under InterDigital’s global patent portfolio, including standard essential cellular, WiFi, and video patents.

- Julia Mattis, Chief Licensing Officer, stated that the renewal demonstrates how InterDigital's innovation drives the connected world across a wide range of devices.

Feb 17, 2026, 11:30 AM

InterDigital Awarded Fifth Injunction Against Disney

IDCC

Legal Proceedings

- InterDigital (IDCC) was awarded its fifth injunction against Disney by a German court on February 13, 2026, for infringement of a patent related to HEVC compression technology.

- This latest injunction follows previous rulings in Germany and Brazil concerning patents for HDR technology, dynamic video stream overlaying, and other HEVC and AVC compression technologies.

- InterDigital's Chief Legal Officer stated that it is time for Disney to sign an agreement that appropriately values InterDigital's innovation.

Feb 13, 2026, 8:30 AM

InterDigital Initiates Patent Litigation Against Hisense and TCL

IDCC

Legal Proceedings

- InterDigital (IDCC) initiated patent litigation against Hisense and TCL on February 10, 2026, alleging infringement of patents related to video compression formats (HEVC, VP9, AV1) and high-dynamic-range (HDR) technologies.

- The lawsuits, filed in multiple jurisdictions including Germany, Brazil, and India, are tied to InterDigital's joint TV licensing program with Sony.

- InterDigital's chief legal officer stated that Hisense and TCL, both top-five global TV manufacturers, have built their businesses on InterDigital's research, unlike many competitors who have taken licenses.

- Following the announcement, InterDigital shares were trading lower.

Feb 10, 2026, 2:05 PM

InterDigital Reports Strong Q4 and Full-Year 2025 Results, Provides 2026 Outlook, and Details Licensing Progress

IDCC

Earnings

Guidance Update

Legal Proceedings

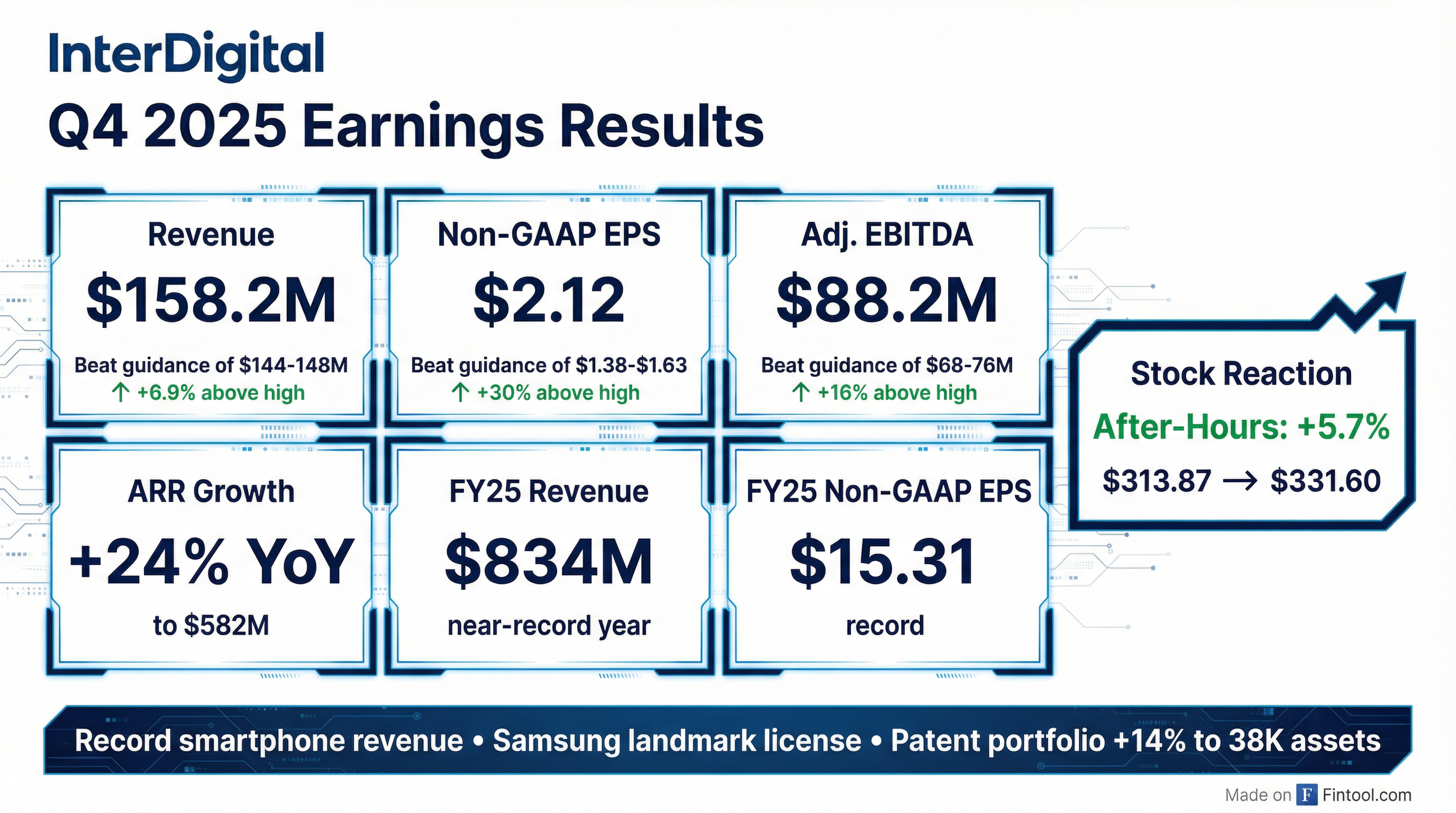

- InterDigital reported a strong finish to 2025, with Q4 revenue of $158 million and full-year revenue of $834 million, the second highest in its history. The company achieved record-high Adjusted EBITDA of $589 million and Non-GAAP EPS of $15.31 for the full year.

- The company significantly expanded its licensing footprint, signing new smartphone deals with Vivo and Honor, and renewing agreements with Samsung and Xiaomi at the start of 2026, now licensing 8 of the top 10 smartphone manufacturers. New CE and IoT agreements were also secured with HP and LG Electronics.

- InterDigital advanced its video service licensing program by initiating enforcement campaigns against streaming services, securing preliminary injunctions against Disney in Brazil and Germany, and launching proceedings against Amazon. The company also strengthened its AI research with the acquisition of Deep Render and continued leadership in 6G standards development.

- For 2026, InterDigital provided guidance of total revenue between $675 million and $775 million, Adjusted EBITDA between $381 million and $477 million, and Non-GAAP diluted EPS between $8.74 and $11.84.

Feb 5, 2026, 3:00 PM

InterDigital Reports Record 2025 Financial Results and Provides Strong 2026 Outlook

IDCC

Earnings

Guidance Update

Legal Proceedings

- InterDigital finished 2025 with record-breaking financial results, achieving $834 million in full-year revenue, $589 million in Adjusted EBITDA, and $15.31 in non-GAAP EPS, all at all-time highs. For Q4 2025, revenue was $158 million, Adjusted EBITDA was $88 million, and non-GAAP EPS was $2.12, all exceeding the high end of their outlook.

- The company significantly expanded its smartphone licensing program in 2025, signing new deals with Vivo and Honor, and renewing agreements with Samsung, Sharp, Seiko, and Xiaomi (early 2026), now licensing eight of the top 10 largest smartphone manufacturers covering about 85% of the overall market. Annualized recurring revenue (ARR) increased 24% year-over-year to $582 million in Q4 2025.

- For full-year 2026, InterDigital expects total revenue between $675 million and $775 million, Adjusted EBITDA between $381 million and $477 million, and non-GAAP diluted EPS between $8.74 and $11.84. Q1 2026 revenue is projected to be $194 million to $200 million from existing contracts.

- InterDigital launched enforcement proceedings against Amazon in Q4 2025, following earlier actions against Disney+, Hulu, and ESPN+ which resulted in two preliminary injunctions in Brazil and two injunctions in Germany against Disney. The company also acquired AI startup Deep Render in Q4 2025 to strengthen its AI research and grew its patent portfolio by 14% year-over-year to over 38,000 granted patents and applications.

Feb 5, 2026, 3:00 PM

InterDigital Announces Strong Q4 and Full-Year 2025 Results, Provides 2026 Outlook

IDCC

Earnings

Guidance Update

- IDCC reported Q4 2025 revenue of $158.2 million, Adjusted EBITDA of $88.2 million, and Non-GAAP EPS of $2.12, all exceeding the top end of their guidance ranges.

- For full-year 2025, the company achieved revenue of $834 million, record Adjusted EBITDA of $589 million, and record non-GAAP EPS of $15.31, with Annualized Recurring Revenue (ARR) up 24% year-over-year to $582 million.

- Significant business developments include the renewal of a license with Xiaomi and a new multi-year license with LG Electronics for digital TVs and computer display monitors, which will recognize $57 million in catch-up revenue in Q1 2026.

- The company provided a Q1 2026 revenue outlook of $194 million to $200 million and a FY26 revenue outlook of $675 million to $775 million.

Feb 5, 2026, 3:00 PM

InterDigital Reports Strong Q4 and Full Year 2025 Results, Provides 2026 Outlook

IDCC

Earnings

Guidance Update

Legal Proceedings

- InterDigital reported a strong finish to 2025, with Q4 revenue of $158 million and Non-GAAP EPS of $2.12, both exceeding the high end of their outlook. For the full year 2025, revenue reached $834 million, with Adjusted EBITDA of $589 million and Non-GAAP EPS of $15.31, both at all-time highs.

- The company saw significant progress in its licensing programs, renewing agreements with Xiaomi and Samsung for smartphones, and signing new deals with Vivo and Honor, now licensing 8 of the top 10 global smartphone vendors. New agreements were also secured in CE and IoT with HP and LG Electronics, and a social media company.

- InterDigital launched enforcement proceedings against Amazon in Q4 2025 and continued its campaign against Disney+, Hulu, and ESPN+, securing preliminary injunctions and injunctions against Disney in Brazil and Germany.

- The patent portfolio grew by 14% year-over-year in 2025, reaching over 38,000 granted patents and applications, and the company strengthened its AI research with the acquisition of Deep Render in Q4.

- For 2026, InterDigital provided full-year guidance of $675 million-$775 million in revenue, $381 million-$477 million in Adjusted EBITDA, and $8.74-$11.84 in Non-GAAP diluted EPS. Q1 2026 revenue is expected to be $194 million-$200 million, including $55 million-$60 million of catch-up sales.

Feb 5, 2026, 3:00 PM

InterDigital Reports Record Full Year 2025 Financial Results and Provides 2026 Outlook

IDCC

Earnings

Guidance Update

Legal Proceedings

- InterDigital reported record levels for full year 2025 net income of $406.6 million, adjusted EBITDA of $588.9 million, non-GAAP EPS of $15.31, and free cash flow of $473.9 million. Total revenue reached a near-record $834.0 million, with annualized recurring revenue (ARR) increasing 24% year-over-year to $582.4 million.

- The company completed its most valuable license in history with Samsung and secured new license agreements with top-ten smartphone vendors vivo and Honor, as well as HP. It also renewed its license with Xiaomi and signed a new agreement with LG Electronics in Q1 2026.

- InterDigital grew its patent portfolio 14% to approximately 38,000 granted patents and applications and acquired video AI start-up Deep Render. The company was also awarded injunctions against Disney video streaming services by courts in Brazil and Germany and launched enforcement proceedings against Amazon.

- For Q1 2026, InterDigital expects revenue between $194 million and $200 million, and for full year 2026, revenue is projected to be between $675 million and $775 million.

Feb 5, 2026, 1:32 PM

InterDigital Issues Full Year 2026 Outlook

IDCC

Guidance Update

Earnings

- InterDigital announced its full year 2026 outlook on January 20, 2026, projecting revenue between $675 million and $775 million.

- The company expects diluted EPS for full year 2026 to range from $5.77 to $8.51, and Non-GAAP EPS from $8.74 to $11.84.

- This outlook includes contributions from existing licenses and expected new agreements, such as a recent license with LG Electronics and a smartphone renewal with a major Chinese vendor.

Jan 20, 2026, 1:30 PM

InterDigital Signs New Patent License Agreement with LG Electronics

IDCC

New Projects/Investments

- InterDigital announced it has signed a new patent license agreement with LG Electronics.

- The agreement licenses LG’s digital TVs and computer display monitors under InterDigital’s joint licensing program with Sony.

- The licensed technologies include ATSC 3.0, Wi-Fi, and video codecs.

Jan 20, 2026, 9:30 AM

Quarterly earnings call transcripts for InterDigital.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more