Earnings summaries and quarterly performance for InterDigital.

Executive leadership at InterDigital.

Board of directors at InterDigital.

Research analysts who have asked questions during InterDigital earnings calls.

SS

Scott Searle

ROTH MKM

6 questions for IDCC

Also covers: ADEA, AIOT, AIRG +22 more

AS

Anja Soderstrom

Sidoti & Company, LLC

4 questions for IDCC

Also covers: ATEN, BHE, DAKT +11 more

Arjun Bhatia

William Blair

4 questions for IDCC

Also covers: AMPL, BAND, BRZE +19 more

Tal Liani

Bank of America

3 questions for IDCC

Also covers: ANET, CHKP, CIEN +11 more

KG

Kevin Garrigan

WestPark Capital

2 questions for IDCC

Also covers: AIP, ASYS, CPTN +6 more

OL

Olinda Lee

William Blair

2 questions for IDCC

BC

Blayne Curtis

Jefferies Financial Group

1 question for IDCC

Also covers: ADI, AIP, ALAB +19 more

Recent press releases and 8-K filings for IDCC.

InterDigital Reports Strong Q4 and Full-Year 2025 Results, Provides 2026 Outlook, and Details Licensing Progress

IDCC

Earnings

Guidance Update

Legal Proceedings

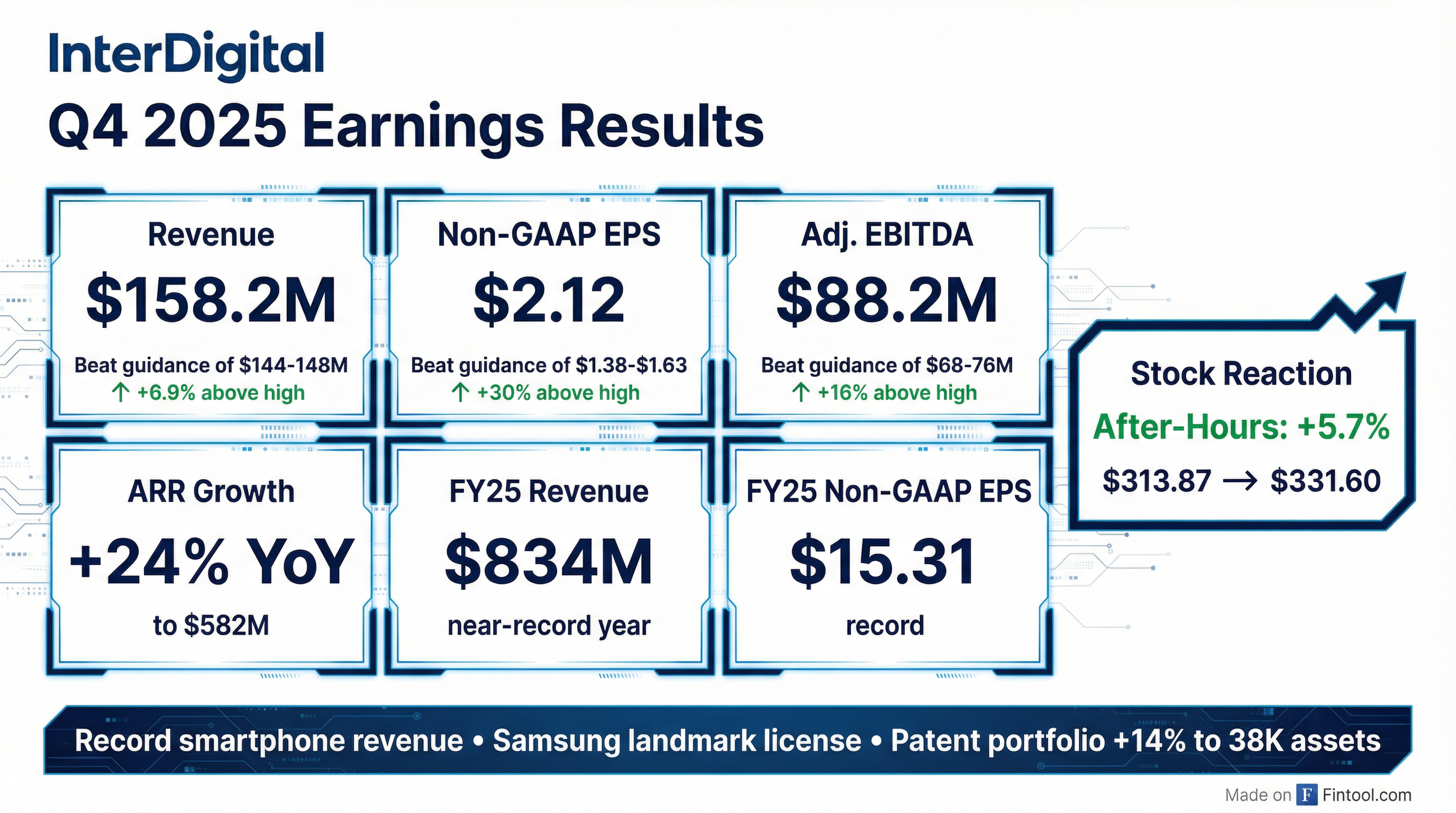

- InterDigital reported a strong finish to 2025, with Q4 revenue of $158 million and full-year revenue of $834 million, the second highest in its history. The company achieved record-high Adjusted EBITDA of $589 million and Non-GAAP EPS of $15.31 for the full year.

- The company significantly expanded its licensing footprint, signing new smartphone deals with Vivo and Honor, and renewing agreements with Samsung and Xiaomi at the start of 2026, now licensing 8 of the top 10 smartphone manufacturers. New CE and IoT agreements were also secured with HP and LG Electronics.

- InterDigital advanced its video service licensing program by initiating enforcement campaigns against streaming services, securing preliminary injunctions against Disney in Brazil and Germany, and launching proceedings against Amazon. The company also strengthened its AI research with the acquisition of Deep Render and continued leadership in 6G standards development.

- For 2026, InterDigital provided guidance of total revenue between $675 million and $775 million, Adjusted EBITDA between $381 million and $477 million, and Non-GAAP diluted EPS between $8.74 and $11.84.

2 days ago

InterDigital Reports Record 2025 Financial Results and Provides Strong 2026 Outlook

IDCC

Earnings

Guidance Update

Legal Proceedings

- InterDigital finished 2025 with record-breaking financial results, achieving $834 million in full-year revenue, $589 million in Adjusted EBITDA, and $15.31 in non-GAAP EPS, all at all-time highs. For Q4 2025, revenue was $158 million, Adjusted EBITDA was $88 million, and non-GAAP EPS was $2.12, all exceeding the high end of their outlook.

- The company significantly expanded its smartphone licensing program in 2025, signing new deals with Vivo and Honor, and renewing agreements with Samsung, Sharp, Seiko, and Xiaomi (early 2026), now licensing eight of the top 10 largest smartphone manufacturers covering about 85% of the overall market. Annualized recurring revenue (ARR) increased 24% year-over-year to $582 million in Q4 2025.

- For full-year 2026, InterDigital expects total revenue between $675 million and $775 million, Adjusted EBITDA between $381 million and $477 million, and non-GAAP diluted EPS between $8.74 and $11.84. Q1 2026 revenue is projected to be $194 million to $200 million from existing contracts.

- InterDigital launched enforcement proceedings against Amazon in Q4 2025, following earlier actions against Disney+, Hulu, and ESPN+ which resulted in two preliminary injunctions in Brazil and two injunctions in Germany against Disney. The company also acquired AI startup Deep Render in Q4 2025 to strengthen its AI research and grew its patent portfolio by 14% year-over-year to over 38,000 granted patents and applications.

2 days ago

InterDigital Announces Strong Q4 and Full-Year 2025 Results, Provides 2026 Outlook

IDCC

Earnings

Guidance Update

- IDCC reported Q4 2025 revenue of $158.2 million, Adjusted EBITDA of $88.2 million, and Non-GAAP EPS of $2.12, all exceeding the top end of their guidance ranges.

- For full-year 2025, the company achieved revenue of $834 million, record Adjusted EBITDA of $589 million, and record non-GAAP EPS of $15.31, with Annualized Recurring Revenue (ARR) up 24% year-over-year to $582 million.

- Significant business developments include the renewal of a license with Xiaomi and a new multi-year license with LG Electronics for digital TVs and computer display monitors, which will recognize $57 million in catch-up revenue in Q1 2026.

- The company provided a Q1 2026 revenue outlook of $194 million to $200 million and a FY26 revenue outlook of $675 million to $775 million.

2 days ago

InterDigital Reports Strong Q4 and Full Year 2025 Results, Provides 2026 Outlook

IDCC

Earnings

Guidance Update

Legal Proceedings

- InterDigital reported a strong finish to 2025, with Q4 revenue of $158 million and Non-GAAP EPS of $2.12, both exceeding the high end of their outlook. For the full year 2025, revenue reached $834 million, with Adjusted EBITDA of $589 million and Non-GAAP EPS of $15.31, both at all-time highs.

- The company saw significant progress in its licensing programs, renewing agreements with Xiaomi and Samsung for smartphones, and signing new deals with Vivo and Honor, now licensing 8 of the top 10 global smartphone vendors. New agreements were also secured in CE and IoT with HP and LG Electronics, and a social media company.

- InterDigital launched enforcement proceedings against Amazon in Q4 2025 and continued its campaign against Disney+, Hulu, and ESPN+, securing preliminary injunctions and injunctions against Disney in Brazil and Germany.

- The patent portfolio grew by 14% year-over-year in 2025, reaching over 38,000 granted patents and applications, and the company strengthened its AI research with the acquisition of Deep Render in Q4.

- For 2026, InterDigital provided full-year guidance of $675 million-$775 million in revenue, $381 million-$477 million in Adjusted EBITDA, and $8.74-$11.84 in Non-GAAP diluted EPS. Q1 2026 revenue is expected to be $194 million-$200 million, including $55 million-$60 million of catch-up sales.

2 days ago

InterDigital Reports Record Full Year 2025 Financial Results and Provides 2026 Outlook

IDCC

Earnings

Guidance Update

Legal Proceedings

- InterDigital reported record levels for full year 2025 net income of $406.6 million, adjusted EBITDA of $588.9 million, non-GAAP EPS of $15.31, and free cash flow of $473.9 million. Total revenue reached a near-record $834.0 million, with annualized recurring revenue (ARR) increasing 24% year-over-year to $582.4 million.

- The company completed its most valuable license in history with Samsung and secured new license agreements with top-ten smartphone vendors vivo and Honor, as well as HP. It also renewed its license with Xiaomi and signed a new agreement with LG Electronics in Q1 2026.

- InterDigital grew its patent portfolio 14% to approximately 38,000 granted patents and applications and acquired video AI start-up Deep Render. The company was also awarded injunctions against Disney video streaming services by courts in Brazil and Germany and launched enforcement proceedings against Amazon.

- For Q1 2026, InterDigital expects revenue between $194 million and $200 million, and for full year 2026, revenue is projected to be between $675 million and $775 million.

2 days ago

InterDigital Issues Full Year 2026 Outlook

IDCC

Guidance Update

Earnings

- InterDigital announced its full year 2026 outlook on January 20, 2026, projecting revenue between $675 million and $775 million.

- The company expects diluted EPS for full year 2026 to range from $5.77 to $8.51, and Non-GAAP EPS from $8.74 to $11.84.

- This outlook includes contributions from existing licenses and expected new agreements, such as a recent license with LG Electronics and a smartphone renewal with a major Chinese vendor.

Jan 20, 2026, 1:30 PM

InterDigital Signs New Patent License Agreement with LG Electronics

IDCC

New Projects/Investments

- InterDigital announced it has signed a new patent license agreement with LG Electronics.

- The agreement licenses LG’s digital TVs and computer display monitors under InterDigital’s joint licensing program with Sony.

- The licensed technologies include ATSC 3.0, Wi-Fi, and video codecs.

Jan 20, 2026, 9:30 AM

InterDigital Outlines Growth Strategy and Financial Performance at Needham Conference

IDCC

Legal Proceedings

New Projects/Investments

Revenue Acceleration/Inflection

- InterDigital, a global research and development company focused on wireless, video, and AI technologies, operates an IP as a service licensing model with recurring revenue and high margins, aiming for profitability growth faster than revenue.

- The company targets growing its annualized recurring revenue (ARR) from over $400 million to $1 billion by 2030, with smartphone recurring revenue already reaching $490+ million by Q3 2025, ahead of schedule.

- InterDigital has signed over $4 billion worth of contracts in the last four-plus years (up to September 2025) and collected over $1 billion in catch-up payments.

- The company successfully litigated against Disney, with four out of four asserted patents found valid and infringed in Brazil and Germany, and is currently involved in litigation with Amazon.

- InterDigital maintains a target of 60% adjusted EBITDA margin, increased its dividend by approximately 50%, and has repurchased over $1 billion in shares over the last decade.

Jan 14, 2026, 4:00 PM

InterDigital Provides Business Update and Strategic Outlook at Needham Growth Conference

IDCC

Revenue Acceleration/Inflection

Dividends

Legal Proceedings

- InterDigital operates an "IP as a service" licensing model for its foundational wireless, video, and AI technologies, generating recurring revenue from a large, evergreen patent portfolio that adds an average of six new patents daily.

- The company has demonstrated strong financial momentum, signing over $4 billion in contracts since 2021 (as of September 2025) and achieving a 25% CAGR in Annualized Recurring Revenue (ARR) over the last four to five years. Profitability, measured by adjusted EBITDA, is growing faster than revenue, and the company increased its quarterly dividend by 50% to $0.70 last year.

- InterDigital is ahead of schedule on its long-term growth strategy, with smartphone recurring revenue reaching over $490 million by Q3 2025, nearly achieving its $500 million target for 2030. The company aims for $1 billion in total recurring revenue by 2030, including a $300 million+ opportunity in online streaming.

- The company recently secured a significant legal victory against Disney, with courts in Brazil and Germany finding four out of four asserted patents valid and infringed, and ordering Disney to pay a license or cease infringement. InterDigital is also involved in ongoing litigation with Amazon.

Jan 14, 2026, 4:00 PM

InterDigital Provides Business Update and Long-Term Strategy

IDCC

Revenue Acceleration/Inflection

Legal Proceedings

Guidance Update

- InterDigital, a global research and development company focused on wireless, video, and AI technologies, provided a financial and business development snapshot as of Q3 2025, with Q4 and full year 2025 results expected in approximately one month. The company's business model is centered on licensing its evergreen patent portfolio, which generates recurring revenue.

- The company has demonstrated strong financial performance, achieving a 25% revenue CAGR over the last 4-5 years and signing more than $4 billion in license agreements since 2020. Additionally, it has collected over $1 billion in one-time catch-up payments from past infringements.

- InterDigital is progressing towards its long-term goal of $1 billion in annualized recurring revenue (ARR) by 2030, aiming for 10%+ double-digit year-over-year ARR growth and maintaining a 60% adjusted EBITDA margin. As of Q3 2025, smartphone recurring revenue reached $490+ million, ahead of its 2024 target.

- The company recently won a litigation battle against Disney, with courts in Brazil and Germany finding four of its patents valid and infringed. InterDigital is also engaged in ongoing litigation with Amazon, asserting patents in multiple jurisdictions.

- Capital allocation strategies include a 50% dividend increase (from $0.45 to $0.70 per quarter) and over $1 billion in share buybacks over the last decade, alongside strategic investments in R&D and selective M&A.

Jan 14, 2026, 4:00 PM

Quarterly earnings call transcripts for InterDigital.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more