Earnings summaries and quarterly performance for IMPERIAL OIL.

Research analysts who have asked questions during IMPERIAL OIL earnings calls.

Dennis Fong

CIBC World Markets

8 questions for IMO

Also covers: BTE, CNQ, CVE +2 more

MG

Manav Gupta

UBS Group

8 questions for IMO

Also covers: ADM, AMTX, BE +35 more

MH

Menno Hulshof

TD Cowen

8 questions for IMO

Also covers: BTE, CNQ, CVE +2 more

Patrick O'Rourke

ATB Capital Markets

5 questions for IMO

Also covers: CNQ, CVE, SU +1 more

GP

Greg Pardy

RBC Capital Markets

4 questions for IMO

Also covers: BTE, CNQ, CVE +4 more

Neil Mehta

Goldman Sachs

4 questions for IMO

Also covers: AESI, APA, AR +36 more

DG

Douglas George Blyth Leggate

Wolfe Research

2 questions for IMO

Also covers: APA, BP, COP +18 more

DL

Doug Leggate

Wolfe Research

2 questions for IMO

Also covers: APA, AR, BP +23 more

Adam Alexander Wijaya

Goldman Sachs

1 question for IMO

Also covers: CCJ, CLMT, CVI +1 more

Recent press releases and 8-K filings for IMO.

Imperial Oil Reports Strong Q4 and Full-Year 2025 Results, Declares Record Dividend Increase

IMO

Earnings

Dividends

New Projects/Investments

- Imperial Oil generated CAD 1.9 billion in cash flow from operations and nearly CAD 1.4 billion in free cash flow for Q4 2025, with full-year 2025 cash flow from operations reaching CAD 6.7 billion and free cash flow at CAD 4.8 billion.

- The company returned CAD 4.6 billion to shareholders in 2025, including CAD 1.4 billion in dividends and CAD 3.2 billion in share repurchases. A Q1 2026 dividend of CAD 0.87 per share was declared, representing the largest nominal dividend increase in company history.

- Imperial Oil achieved its highest annual production in over 30 years in 2025, averaging 438,000 oil equivalent barrels per day. The Cold Lake Leming SAGD project commenced production in November and is ramping up to 9,000 barrels per day.

- The company recorded two after-tax one-time charges in Q4 2025: CAD 320 million related to the accelerated cessation of production at the Norman Wells asset by Q3 2026, and CAD 156 million for the optimization of materials and supplies inventory. A restructuring plan is expected to yield CAD 150 million in annual savings starting in 2028.

Jan 30, 2026, 4:00 PM

Imperial Reports Strong Q4 2025 Financials and Shareholder Returns Amidst One-Time Charges

IMO

Earnings

Dividends

Share Buyback

- Imperial generated CAD 1.9 billion in cash flow from operations and CAD 1.4 billion in free cash flow for Q4 2025, with full-year 2025 figures reaching CAD 6.7 billion and CAD 4.8 billion respectively.

- The company returned CAD 2.1 billion to shareholders in Q4 2025 and CAD 4.6 billion for the full year 2025, including CAD 361 million in dividends and CAD 1.7 billion in share repurchases in Q4. A CAD 0.87 per share dividend was declared for Q1 2026, representing the largest nominal dividend increase in company history.

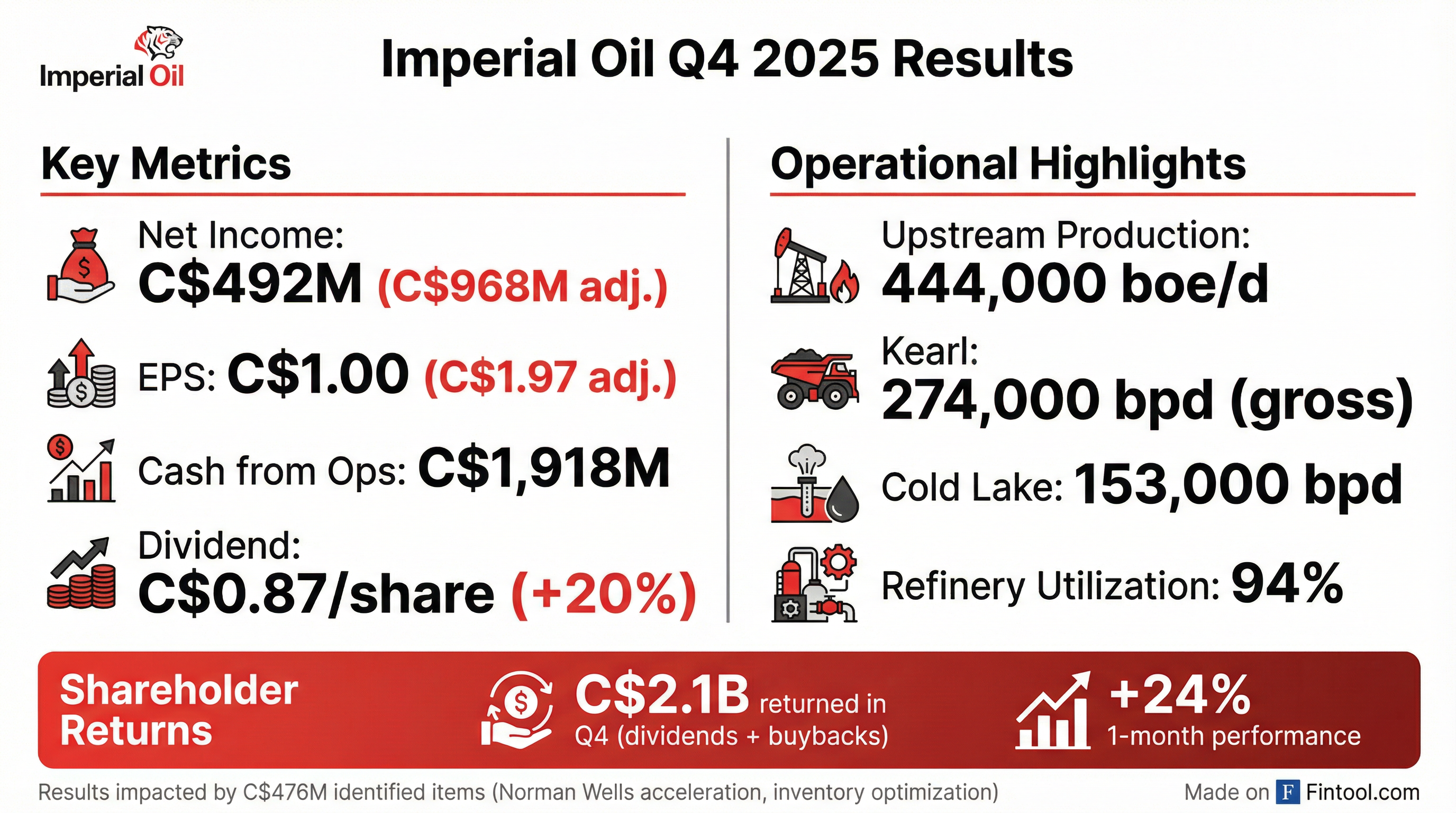

- Net income for Q4 2025 was $492 million, which included one-time after-tax charges totaling CAD 476 million (CAD 320 million for the cessation of production at Norman Wells and CAD 156 million for inventory optimization). Excluding these identified items, net income was $968 million.

- Upstream production averaged 444,000 oil equivalent barrels per day in Q4 2025, contributing to the highest annual production in over 30 years at 438,000 oil equivalent barrels per day for FY 2025.

- Imperial is implementing a restructuring plan to reduce above-field staff by 20%, projected to result in CAD 150 million in annual savings starting in 2028.

Jan 30, 2026, 4:00 PM

Imperial Oil Reports Strong Q4 2025 Financials and Announces Dividend Increase

IMO

Earnings

Dividends

Share Buyback

- Imperial Oil generated CAD 1.9 billion in cash flow from operations and CAD 1.4 billion in free cash flow during Q4 2025, contributing to CAD 4.8 billion in free cash flow and CAD 4.6 billion returned to shareholders for the full year 2025.

- The company's Q4 2025 net income of $492 million was impacted by two after-tax charges: CAD 320 million for the cessation of production at Norman Wells and CAD 156 million for inventory optimization.

- Imperial Oil announced a first quarter 2026 dividend of CAD 0.87 per share, reflecting an increase of just over 20%.

- Upstream production averaged 444,000 oil equivalent barrels per day in Q4 2025, leading to the highest annual production in over 30 years at 438,000 oil equivalent barrels per day for 2025, with new projects like Cold Lake Leming SAGD ramping up and Mahican SA-SAGD anticipated for 2029.

Jan 30, 2026, 4:00 PM

Imperial Oil Reports Q4 Profit Decline and Raises Dividend

IMO

Earnings

Dividends

Demand Weakening

- Imperial Oil reported Q4 net income of C$492 million (C$1.00/share) and revenues of C$11.28 billion, a significant decrease from the prior year, primarily due to lower crude prices and a wider discount on Canadian heavy oil. However, adjusted earnings of C$1.97 per share surpassed analyst expectations.

- The company announced a 20% increase in its quarterly dividend to C$0.87 per share, payable April 1, 2026.

- Cash flow from operations increased 7.2% year-over-year to C$1.92 billion, providing funding for capital plans and the higher dividend.

Jan 30, 2026, 1:36 PM

Imperial Oil Ltd Announces Q4 2025 Financial and Operating Results

IMO

Earnings

Dividends

Share Buyback

- Imperial Oil Ltd reported net income of $492 million and diluted earnings per common share of $1.00 for the fourth quarter of 2025.

- Cash flows from operating activities were $1,918 million in Q4 2025.

- The company returned $2,072 million to shareholders in the fourth quarter of 2025, which included $361 million in dividend payments and $1,711 million of share repurchases.

- Upstream production averaged 444,000 gross oil-equivalent barrels per day in Q4 2025.

- Capital and exploration expenditures totaled $651 million for the fourth quarter of 2025.

Jan 30, 2026, 1:07 PM

Imperial Oil Limited Provides 2026 Corporate Guidance Outlook

IMO

Guidance Update

New Projects/Investments

- Imperial Oil Limited forecasts capital and exploration expenditures for 2026 to be between $2.0 and $2.2 billion.

- Upstream production is projected to be between 441,000 and 460,000 gross oil equivalent barrels per day for 2026.

- Downstream throughput is forecasted to be between 395,000 and 405,000 barrels per day, with a 91% to 93% utilization rate in 2026.

- The company's 2026 plan focuses on strengthening profitability, maximizing existing assets, and progressing high-value growth opportunities to increase cash flow and deliver shareholder returns.

Dec 15, 2025, 9:57 PM

Imperial Oil provides 2026 corporate guidance outlook

IMO

Guidance Update

New Projects/Investments

- Imperial Oil (IMO) has issued its 2026 corporate guidance outlook, forecasting capital and exploration expenditures between $2.0 and $2.2 billion.

- The company projects 2026 upstream production to be between 441,000 and 460,000 gross oil equivalent barrels per day.

- Downstream throughput for 2026 is forecasted between 395,000 and 405,000 barrels per day, with a refinery utilization rate of 91% to 93%.

- The 2026 plan focuses on strengthening profitability, increasing cash flow, and delivering industry-leading shareholder returns by maximizing existing assets and progressing high-value growth opportunities.

Dec 15, 2025, 9:30 PM

Imperial Oil Announces Q3 2025 Financial and Operating Results

IMO

Earnings

Share Buyback

Dividends

- Imperial Oil reported net income of $539 million (or $1.07 per common share, assuming dilution) for the third quarter of 2025, a decrease from $1,237 million (or $2.33 per share) in Q3 2024, primarily due to a $306 million after-tax non-cash impairment of the Calgary Imperial Campus and a $249 million after-tax restructuring charge.

- Cash flows from operating activities increased to $1,798 million in Q3 2025, up from $1,487 million in Q3 2024. The company returned $1,835 million to shareholders, comprising $366 million in dividend payments and $1,469 million in share repurchases.

- Upstream operations achieved the highest quarterly production in over 30 years at 462,000 gross oil-equivalent barrels per day, with Kearl recording its highest-ever quarterly production of 316,000 total gross oil-equivalent barrels per day (224,000 barrels Imperial's share). Downstream operations maintained strong performance with refinery capacity utilization of 98 percent.

Oct 31, 2025, 12:10 PM

Imperial Brands Announces New Share Buyback Program

IMO

Share Buyback

Dividends

Guidance Update

- Imperial Brands Plc announced a new £1.45 billion ($1.9 billion) share buyback program, which will run until October 2026, contributing to a total capital return of over £2.7 billion to shareholders for the next fiscal year, including dividends.

- The company's performance was in line with expectations, with revenue growth in both tobacco products and next-generation products, the latter growing between 12% and 14% at constant currency.

- Imperial Brands expects mid-single-digit growth in adjusted operating profit and anticipates market share gains in the US, Germany, and Australia.

- Lukas Paravicini became CEO in October, following Stefan Bomhard’s retirement.

Oct 6, 2025, 6:45 PM

Imperial Oil Announces Workforce Reduction and Cost Savings Plan

IMO

Layoffs

Guidance Update

- Imperial Oil plans to reduce its workforce by approximately 20%, which could result in around 1,000 job losses from its 5,100 employees as of late 2024, by the end of 2027.

- This restructuring is expected to achieve annual cost savings of C$150 million starting in 2028.

- A one-time pre-tax restructuring charge of about C$330 million is anticipated in the third quarter of 2025.

Sep 29, 2025, 11:25 PM

Quarterly earnings call transcripts for IMPERIAL OIL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more