Earnings summaries and quarterly performance for IREN.

Executive leadership at IREN.

Board of directors at IREN.

Research analysts who have asked questions during IREN earnings calls.

Brett Knoblauch

Cantor Fitzgerald & Co.

7 questions for IREN

Darren Aftahi

Roth Capital Partners

6 questions for IREN

Joseph Vafi

Canaccord Genuity - Global Capital Markets

6 questions for IREN

Nick Giles

B. Riley Securities

6 questions for IREN

Paul Golding

Macquarie Capital

6 questions for IREN

John Todaro

Needham & Company

5 questions for IREN

Michael Donovan

H.C. Wainwright & Co.

4 questions for IREN

Stephen Glagola

JonesTrading

4 questions for IREN

Ben Sommers

BTIG

2 questions for IREN

Dillon Heslin

ROTH MKM

2 questions for IREN

Joe Vafi

Canaccord Genuity Group Inc.

2 questions for IREN

Joseph Flynn

Compass Point Research & Trading, LLC

2 questions for IREN

Lucas Pipes

B. Riley Securities

2 questions for IREN

Michael Ng

Goldman Sachs

2 questions for IREN

Mike Colonnese

H.C. Wainwright & Co., LLC

2 questions for IREN

Reginald Smith

JPMorgan Chase & Co.

2 questions for IREN

Benjamin Sommers

BTIG, LLC

1 question for IREN

Charlie Pearce

JPMorgan Chase & Co.

1 question for IREN

Gregory Lewis

BTIG, LLC

1 question for IREN

Josh Siegler

Cantor Fitzgerald

1 question for IREN

Michael Colonnese

H.C. Wainwright & Co.

1 question for IREN

Recent press releases and 8-K filings for IREN.

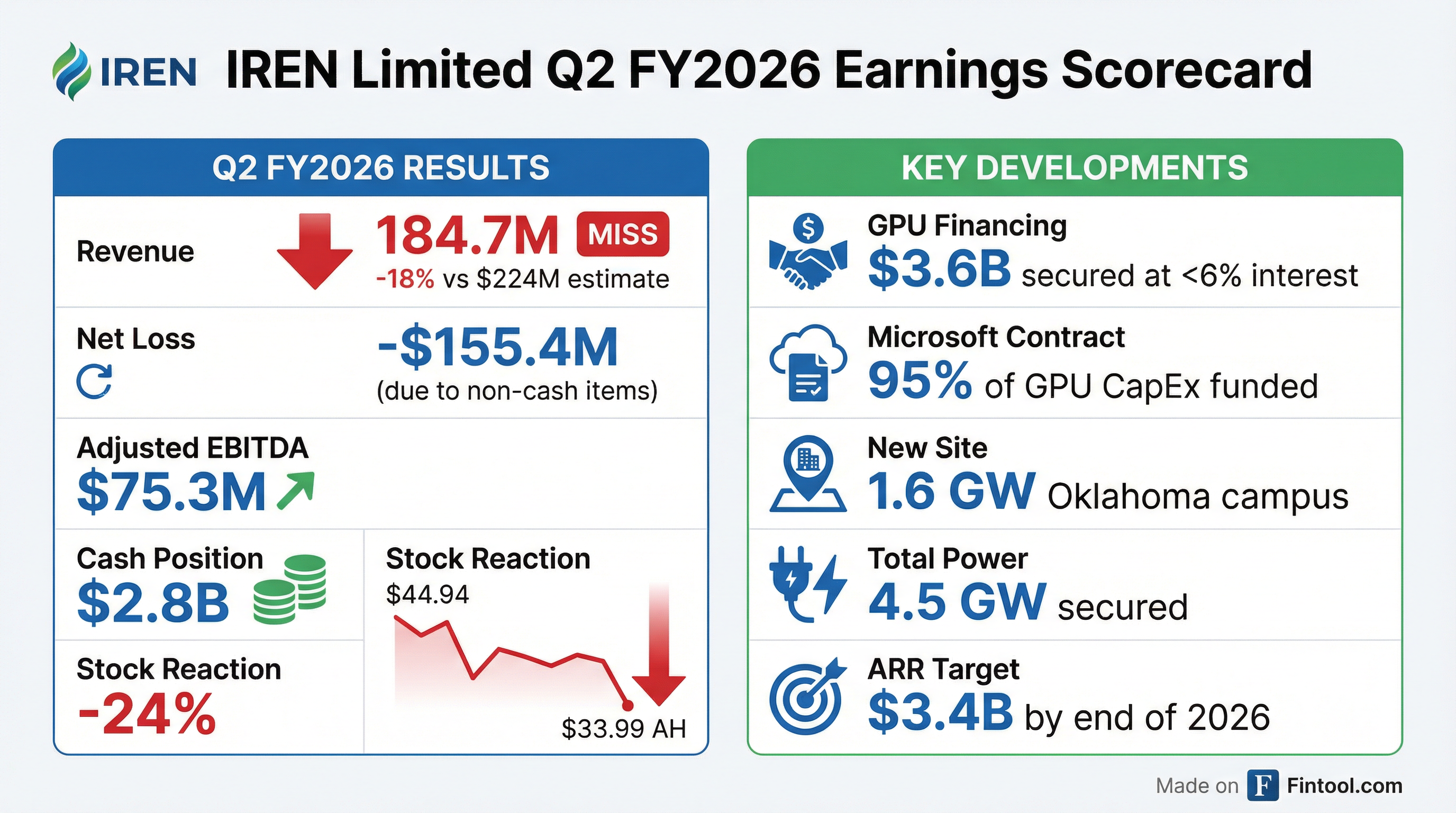

- IREN secured $3.6 billion in GPU financing at an interest rate of less than 6%, which, combined with $1.9 billion in Microsoft prepayments, covers 95% of the GPU-related CapEx for Horizons 1-4, supporting the $9.7 billion AI contract with Microsoft.

- The company expects to deliver 140,000 GPUs by the end of 2026, positioning it to achieve $3.4 billion in annualized run rate revenue.

- IREN expanded its total secured power to over 4.5 GW by securing a new 1.6 GW site in Oklahoma.

- Total revenue for Q2 2026 was $184.7 million, a 23% decrease from the prior quarter, primarily due to lower Bitcoin mining revenue, partially offset by AI cloud revenue growth. Net income was significantly impacted by $219.4 million in non-cash/non-recurring items and $31.8 million in mining hardware impairment.

- IREN reported total revenue of $184.7 million and a net loss of $(155.4) million for Q2 FY26, which ended December 31, 2025.

- The company secured $3.6 billion in GPU financing for its Microsoft contract at an interest rate of less than 6%.

- IREN is targeting a 140k GPU expansion to achieve $3.4 billion in AI Cloud Annualized Run-Rate (ARR) by the end of calendar year 2026, with $2.3 billion ARR already under contract.

- A new 1.6GW site in Oklahoma was secured, increasing the total secured grid-connected power to over 4.5GW.

- IREN secured $3.6 billion in GPU financing at an interest rate of less than 6%, which, combined with $1.9 billion in Microsoft prepayments, covers approximately 95% of the GPU-related capital expenditures for its $9.7 billion AI contract with Microsoft.

- For Q2 2026, total revenue was $184.7 million, a 23% decrease from the prior quarter, primarily due to lower Bitcoin mining revenue, partially offset by growth in AI cloud revenue.

- The company expects to deliver 140,000 GPUs by the end of 2026, positioning it to achieve $3.4 billion in annualized run rate revenue by that time, utilizing only about 10% of its over 4.5 GW of secured power capacity.

- IREN secured a new 1.6 GW site in Oklahoma, increasing its total secured power to over 4.5 GW, and reported a cash position of $2.8 billion at the end of January.

- IREN's Q2 2026 total revenue was $184.7 million, reflecting a 23% decrease from the prior quarter, mainly due to lower Bitcoin mining revenue, partially offset by AI cloud revenue growth.

- The company secured $3.6 billion in GPU financing at an interest rate below 6%, which, along with $1.9 billion in customer prepayments, covers 95% of the GPU-related CapEx for its $9.7 billion AI contract with Microsoft.

- IREN is on track to deliver 140,000 GPUs by the end of 2026, aiming for $3.4 billion in annualized run rate revenue (ARR), with approximately $2.3 billion of ARR currently under contract.

- A new 1.6GW site in Oklahoma was secured, increasing total power capacity to over 4.5GW, with its ramp schedule beginning in 2028.

- IREN reported Q2 FY26 financial results for the three months ended December 31, 2025, with total revenue decreasing to $184.7 million and a net loss of $(155.4) million.

- The company secured $3.6 billion in GPU financing for its Microsoft contract, with an interest rate of less than 6% per annum.

- A targeted 140k GPU expansion is on track to deliver $3.4 billion in Annual Recurring Revenue (ARR) by the end of calendar year 2026.

- IREN announced a new 1.6 GW data center campus in Oklahoma, which increases secured grid-connected power to over 4.5 GW, with power scheduled to ramp from 2028.

- As of January 31, 2026, IREN held $2.8 billion in cash and cash equivalents.

- IREN Limited closed an offering of $2.3 billion in convertible senior notes on December 8, 2025, comprising $1.15 billion of 0.25% notes due 2032 and $1.15 billion of 1.00% notes due 2033, which included a $300 million greenshoe.

- Concurrently, IREN repurchased approximately $544.3 million aggregate principal amount of existing convertible notes, specifically $316.6 million of 3.50% notes due 2029 and $227.7 million of 3.25% notes due 2030, for an aggregate repurchase price of approximately $1,632.4 million.

- The repurchase was funded by a registered direct placement of approximately 39.7 million ordinary shares at a price of $41.12 per share, completed on December 8, 2025, generating estimated proceeds of approximately $1,631.5 million from the equity offering.

- The combined transactions yielded net proceeds of approximately $2.27 billion, lowered average annualized cash coupons, and extended maturities on outstanding convertible notes.

- IREN Limited priced a $2 billion offering of convertible senior notes, comprising $1 billion of 0.25% notes due 2032 and $1 billion of 1.00% notes due 2033, with settlement expected on December 8, 2025.

- The new notes feature an initial conversion price of approximately $51.40 per ordinary share, representing a 25% premium over the December 2, 2025, closing price of $41.12 per share.

- The estimated net proceeds of approximately $1,973.8 million from the offering are intended for funding capped call transactions, repurchasing existing convertible notes, and general corporate purposes.

- Concurrently, IREN announced a registered direct offering of 39,699,102 ordinary shares at $41.12 per share to fund the repurchase of approximately $544.3 million aggregate principal amount of existing convertible notes for an aggregate repurchase price of approximately $1,632.4 million.

- IREN Limited announced its intention to offer $1 billion aggregate principal amount of convertible senior notes due 2032 and $1 billion aggregate principal amount of convertible senior notes due 2033.

- The company also plans a registered direct offering of ordinary shares to fund the repurchase of existing convertible notes.

- The proceeds from both offerings will be used to fund capped call transactions, repurchase existing 3.25% convertible senior notes due 2030 and 3.50% convertible senior notes due 2029, and for general corporate purposes and working capital.

- IREN reported Q1 FY 2026 revenue of $240 million, marking its fifth consecutive quarterly increase and representing a 28% quarter-over-quarter and 355% year-over-year increase, alongside adjusted EBITDA of $92 million.

- The company announced a five-year, $9.7 billion AI Cloud contract with Microsoft, which is expected to generate approximately $1.94 billion in annual recurring revenue with an estimated 85% project EBITDA margin.

- This contract involves deploying NVIDIA GB300 GPUs across 200 MW of data centers at the Childress campus and includes a 20% upfront prepayment to support capital expenditures.

- IREN plans to expand its GPU fleet from 23,000 to 140,000 GPUs by the end of 2026, projecting approximately $3.4 billion in annualized run rate revenue once fully deployed.

- IREN achieved record revenues of $240 million in Q1 FY26, marking a 28% quarter-over-quarter and 355% year-over-year increase, with Adjusted EBITDA reaching $92 million.

- The company secured a $9.7 billion AI cloud partnership with Microsoft, which is anticipated to deliver approximately $1.9 billion in annual revenue with an estimated 85% project EBITDA margin once all four phases are operational.

- This partnership involves a $5.8 billion CapEx for 76,000 GPUs and is expected to generate a levered IRR of 25-30%, potentially rising to 35-50% with a 20% GPU residual value assumption.

- Funding for the Microsoft deal includes $1.9 billion in customer prepayments and a target of $2.5 billion in additional secured financing.

Quarterly earnings call transcripts for IREN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more