Earnings summaries and quarterly performance for KKR Real Estate Finance Trust.

Executive leadership at KKR Real Estate Finance Trust.

Board of directors at KKR Real Estate Finance Trust.

Research analysts who have asked questions during KKR Real Estate Finance Trust earnings calls.

Jade Rahmani

Keefe, Bruyette & Woods

6 questions for KREF

Richard Shane

JPMorgan Chase & Co.

5 questions for KREF

Steven Delaney

Citizens JMP Capital

5 questions for KREF

Rick Shane

JPMorgan Chase & Co.

4 questions for KREF

Donald Fandetti

Wells Fargo & Company

3 questions for KREF

Jason Sabshon

Keefe, Bruyette & Woods (KBW)

3 questions for KREF

Thomas Catherwood

BTIG

3 questions for KREF

Chris Miller

Citizens JMP

2 questions for KREF

Christopher Muller

Citizens JMP

2 questions for KREF

Gabriel Poggi

Raymond James Financial, Inc.

2 questions for KREF

John Nickodemus

BTIG

2 questions for KREF

Stephen Laws

Raymond James

2 questions for KREF

Tom Catherwood

BTIG

2 questions for KREF

William Catherwood

BTIG

2 questions for KREF

Recent press releases and 8-K filings for KREF.

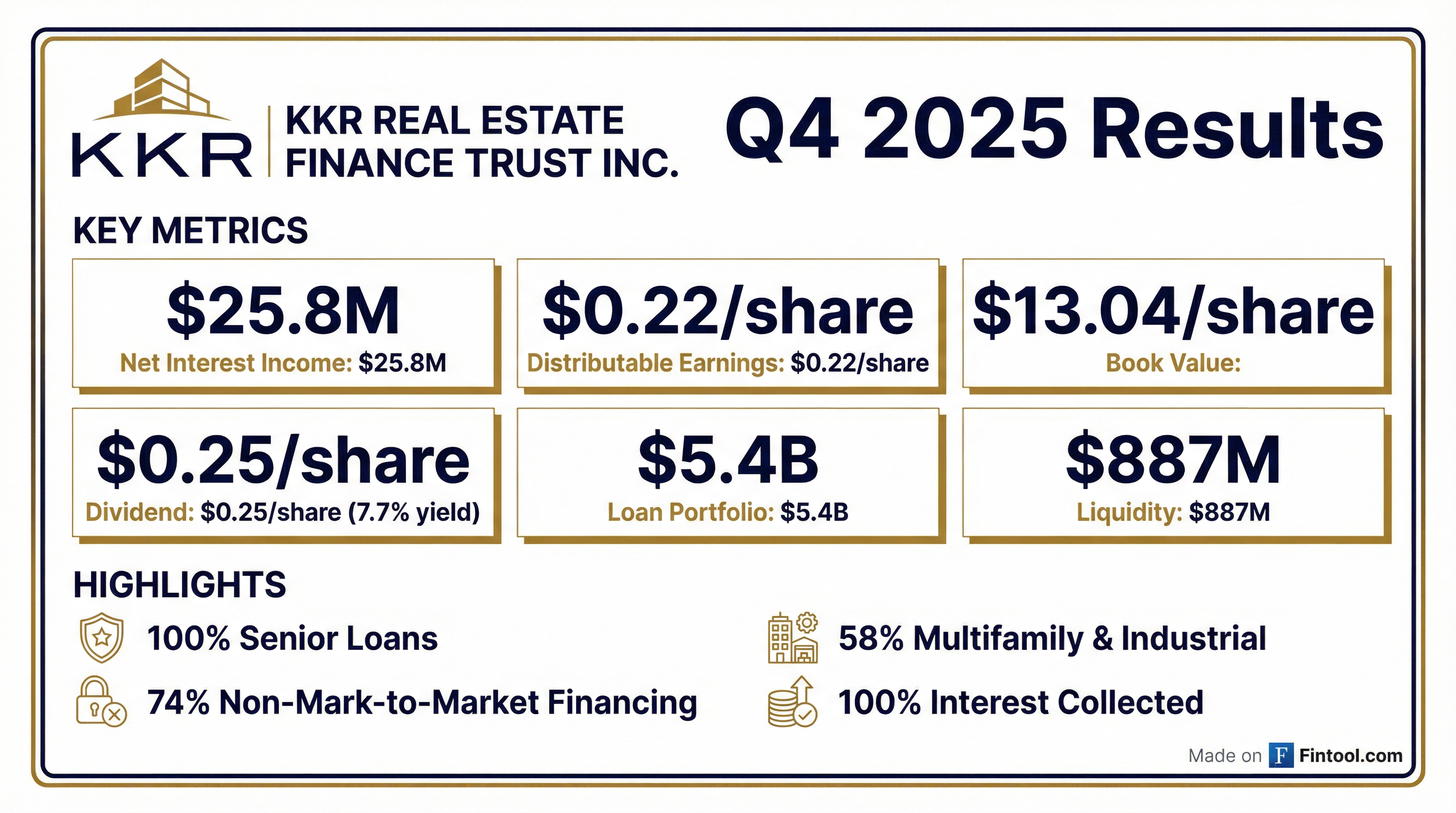

- KKR Real Estate Finance Trust (KREF) reported a GAAP net loss of -$32 million or -$0.49 per share and distributable earnings of -$0.22 per share for Q4 2025, while paying a $0.25 cash dividend.

- The company plans an aggressive resolution strategy for its REO portfolio, watchlist assets, and select office assets in 2026, aiming to unlock approximately $0.13 per share embedded in REO assets and compress the stock's discount to book value.

- KREF strengthened its liquidity in 2025 by upsizing its Term Loan B to $650 million and its corporate revolver to $700 million, ending Q4 2025 with over $880 million in liquidity.

- In Q4 2025, KREF recorded $44 million in CECL provisions due to downgrades of the Cambridge life science and San Diego multifamily loans, and anticipates further downgrades and CECL increases in Q1 2026 for its Boston life science loan.

- KREF repurchased $9 million of common stock in Q4 2025 at a weighted average share price of $8.24, contributing to $0.32 of accretion to book value per share for the full year 2025.

- KKR Real Estate Finance Trust reported a GAAP net loss of -$32 million or -0.49 per share and distributable earnings of $14 million or -0.22 per share for Q4 2025, with a book value of $13.04 as of December 31st.

- The company paid a $0.25 cash dividend for Q4 2025, and the board is actively evaluating the dividend for 2026, which is anticipated to be a transitional year with an aggressive resolution strategy for REO and watchlist assets to unlock approximately $0.13 per share embedded in REO assets.

- KREF recorded $44 million in incremental CECL provisions in Q4 2025 due to downgrades of certain life science and multifamily loans. The company ended 2025 with over $880 million in liquidity and repurchased $43 million of common stock during the full year, accreting approximately $0.32 to book value per share.

- KKR Real Estate Finance Trust Inc. (KREF) reported a net loss of ($0.49) per diluted share and Distributable Earnings of $0.22 per diluted share for Q4 2025.

- The company's predominantly senior loan portfolio stood at $5.4 billion, with 58% concentrated in multifamily and industrial assets, and KREF collected 100% of interest payments in Q4 2025.

- KREF maintained $887 million in current liquidity as of December 31, 2025, and executed share buybacks of 1.1 million shares for $9 million in Q4 2025.

- The loan portfolio's weighted average risk rating was 3.2, with five watch list loans totaling $572 million in principal being monitored in Q4 2025.

- KKR Real Estate Finance Trust (KREF) reported a GAAP net loss of -$32 million or -$0.49 per share and distributable earnings of $14 million or -$0.22 per share for Q4 2025, with a $0.25 cash dividend paid and book value at $13.04 as of December 31st.

- For 2026, KREF plans an aggressive resolution strategy for its REO portfolio, watchlist assets, and select office assets to unlock approximately $0.13 per share embedded in REO assets, though this strategy will put additional pressure on earnings until fully executed. The board is also actively evaluating the dividend as part of capital allocation.

- The company ended 2025 with over $880 million in liquidity and repurchased $43 million of common stock during the year at a weighted average share price of $9.35, resulting in $0.32 of accretion to book value per share.

- In Q4 2025, KREF downgraded the Cambridge life science and San Diego multifamily loans to risk rating 5, leading to $44 million in incremental CECL provisions.

- KKR Real Estate Finance Trust Inc. (KREF) reported a net loss attributable to common stockholders of ($0.49) per diluted share for the fourth quarter of 2025 and ($1.05) per diluted share for the full year 2025. Distributable Earnings were $0.22 per diluted share for Q4 2025 and $0.39 per diluted share for the full year 2025.

- As of December 31, 2025, KREF maintained a liquidity position of $886.6 million, which included $84.6 million of cash and $700.0 million of undrawn capacity on its corporate revolving credit agreement.

- KREF's loan portfolio totaled $5.4 billion as of December 31, 2025, with 99% floating rate and a weighted average unlevered all-in yield of 7.3%. Multifamily and industrial assets comprised 58% of the portfolio, and the weighted average risk rating was 3.2.

- For the full year 2025, KREF originated and funded $1.1 billion and $1.0 billion in floating-rate loans, respectively, and repurchased 4,629,824 shares for a total of $43.3 million at an average price of $9.35 per share. The common book value was $13.04 per share as of December 31, 2025.

- KREF reported Net Income Attributable to Common Stockholders of $8,079 million and Net Income Per Share of Common Stock of $0.12 for Q3 2025.

- The watch list total principal decreased to $358 million in Q3 2025 from $443 million in Q2 2025, with one loan added due to a risk rating downgrade and one resolved.

- As of September 30, 2025, KREF maintained $933 million in total available liquidity, including $204 million in cash and $700 million in undrawn corporate revolver capacity.

- The total loan portfolio principal was $5,310 million in Q3 2025, with a weighted average loan risk rating of 3.1.

- KKR Real Estate Finance Trust Inc. (KREF) reported GAAP net income of $8 million or $0.12 per share for Q3 2025, alongside a distributable loss of $2 million, with distributable earnings prior to net realized losses at $0.18 per share.

- The company paid a $0.25 cash dividend for Q3 2025, which was not covered by distributable earnings, and its book value remained stable at $13.78 per share as of September 30, 2025.

- KREF ended the quarter with $933 million in liquidity and repurchased $4 million of common stock at a weighted average price of $9.41.

- While Q3 originations were slower, the company expects over $400 million in originations in Q4 2025, including its first European real estate credit loan, and anticipates greater than $1.5 billion in repayments in 2026.

- KKR Real Estate Finance Trust Inc. (KREF) reported GAAP net income of $8 million or $0.12 per share and a distributable loss of $2 million for the third quarter of 2025, with distributable earnings prior to net realized losses at $0.18 per share. The company paid a $0.25 cash dividend.

- Book value as of September 30, 2025, was $13.78 per share, remaining mostly unchanged quarter-over-quarter.

- The company ended the quarter with near record liquidity levels of $933 million, including over $200 million of cash and a $700 million corporate revolver, and successfully upsized its Term Loan B by $100 million to $650 million.

- KREF expects over $400 million in originations in the fourth quarter of 2025, having already closed $110 million across the U.S. and Europe, including its first European real estate credit loan. The company received $480 million in repayments during Q3 2025.

- KREF repurchased $4 million of shares in Q3 2025 at a weighted average price of $9.41, contributing to $34 million in year-to-date repurchases.

- KKR Real Estate Finance Trust Inc. reported GAAP net income of $8 million, or $0.12 per share, and a distributable loss of $2 million, or $0.03 per share, for the third quarter of 2025. Distributable earnings prior to net realized losses were $12 million, or $0.18 per share.

- The company's book value per share was $13.78 as of September 30, 2025, and it paid a $0.25 cash dividend for the third quarter.

- KREF achieved near record liquidity levels of $933 million at quarter-end, which includes over $200 million in cash and a $700 million corporate revolver. The Term Loan B was upsized by $100 million to $650 million.

- The company repurchased $4 million of common stock in Q3 2025 at a weighted average price of $9.41, bringing year-to-date repurchases to $34 million.

- For Q4 2025, KREF expects over $400 million in originations, with $110 million already closed, including its first European real estate credit loan. Q3 2025 saw $480 million in repayments, contributing to $1.1 billion year-to-date.

- KKR Real Estate Finance Trust reported GAAP net income of $8 million, or $0.12 per share, and a distributable loss of $2 million, or negative $0.03 per share, for Q3 2025. Distributable earnings prior to net realized losses were $12 million, or $0.18 per share. The company paid a $0.25 cash dividend for the quarter.

- The company maintained a strong liquidity position, ending Q3 2025 with $933 million in liquidity, including over $200 million in cash and a $700 million undrawn corporate revolver. KREF also upsized its Term Loan B by $100 million to $650 million and repriced it 75 basis points tighter to SOFR plus 250 basis points.

- KREF repurchased $4 million of common stock in Q3 2025 at a weighted average price of $9.41, bringing year-to-date repurchases to $34 million.

- The company received $480 million in repayments during Q3 2025 and expects over $400 million in originations in Q4 2025, with year-to-date originations totaling $719 million. KREF anticipates greater than $1.5 billion of repayments in 2026.

- KREF expanded its lending activities into Europe, closing its first European real estate loan in October 2025.

Quarterly earnings call transcripts for KKR Real Estate Finance Trust.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more