Earnings summaries and quarterly performance for Krystal Biotech.

Executive leadership at Krystal Biotech.

Board of directors at Krystal Biotech.

Research analysts who have asked questions during Krystal Biotech earnings calls.

Gavin Clark-Gartner

Evercore ISI

6 questions for KRYS

Yigal Nochomovitz

Citigroup Inc.

6 questions for KRYS

Alec Stranahan

Bank of America

5 questions for KRYS

Debjit Chattopadhyay

Guggenheim Securities

3 questions for KRYS

Joshua Fleishman

Cowen and Company, LLC

3 questions for KRYS

Ritu Baral

TD Cowen

3 questions for KRYS

Sami Corwin

William Blair

3 questions for KRYS

Andrea Newkirk

Goldman Sachs

2 questions for KRYS

Roger Song

Jefferies

2 questions for KRYS

Samantha Corwin

William Blair

2 questions for KRYS

Amit Corwin

William Blair

1 question for KRYS

Andrea Tan

Goldman Sachs

1 question for KRYS

Dae Gon Ha

Stifel

1 question for KRYS

Fiona Shang

Jefferies

1 question for KRYS

Jiale Song

Jefferies Financial Group Inc.

1 question for KRYS

Joseph Pantginis

H.C. Wainwright & Co.

1 question for KRYS

Josh Schimmer

Cantor Fitzgerald

1 question for KRYS

Joshua Schimmer

Evercore ISI

1 question for KRYS

Morgan Lamberti

Goldman Sachs

1 question for KRYS

Ry Forseth

Guggenheim Securities

1 question for KRYS

Recent press releases and 8-K filings for KRYS.

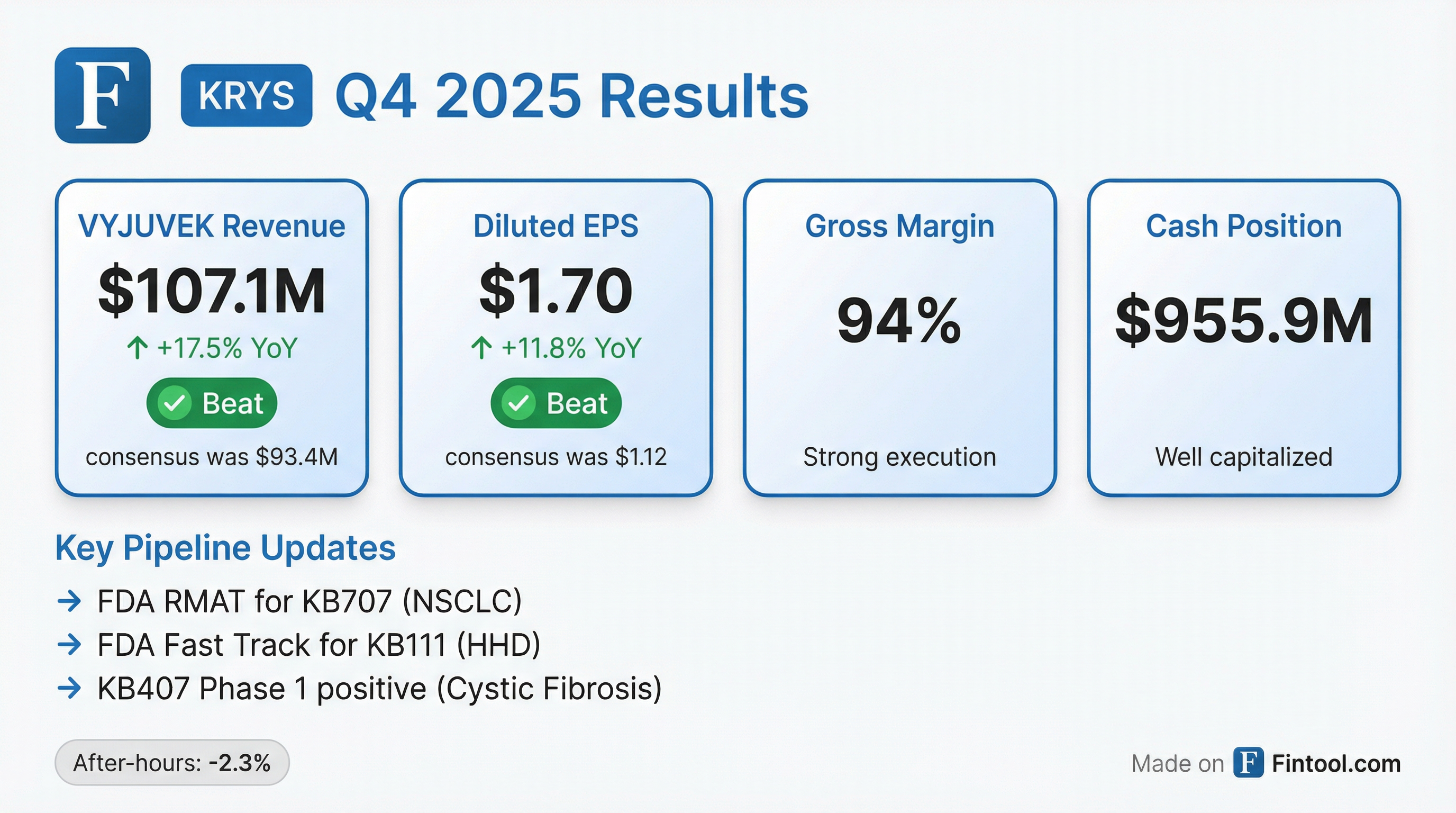

- Krystal Biotech reported net VYJUVEK revenue of $107.1 million for Q4 2025 and $389.1 million for the full year 2025, representing approximately 34% growth over full year 2024. The company concluded the year with $955.9 million in combined cash and investments.

- The company expects overseas expansion to be the predominant driver of revenue growth in 2026, with plans to broaden VYJUVEK access to over 40 countries and launch in Italy in the second half of 2026. Pricing negotiations are anticipated to finalize in Germany by H2 2026 and in France by H1 2027.

- Krystal Biotech provided 2026 non-GAAP operating expense guidance of $175 million to $195 million, an increase from $150.3 million in 2025, to support global commercialization efforts and pipeline development.

- Key pipeline advancements include expected data readouts for registrational studies of KB801 and KB803 by year-end 2026, initiation of repeat dosing for KB407 (Cystic Fibrosis) in H1 2026, and receipt of Fast Track designation for KB111 and RMAT designation for KB707.

- Krystal Biotech reported net VYJUVEK revenue of $107.1 million for Q4 2025, bringing the total net VYJUVEK revenue since launch to over $730 million. The gross margin for Q4 and full year 2025 was 94%, with expectations to remain in the 90%-95% range.

- For Q4 2025, the company achieved a net income of $51.4 million and diluted earnings per share of $1.70. The full year 2025 net income was $204.8 million, with diluted EPS of $6.84.

- The company ended 2025 with $955.9 million in combined cash and investments.

- Krystal Biotech provided 2026 non-GAAP R&D and SG&A expense guidance of $175-$195 million, an increase from $150.3 million in 2025, to support global launches and pipeline development.

- Global expansion of VYJUVEK is a key focus, with launches in Europe and Japan contributing to Q4 revenue, and plans to expand to over 40 countries in 2026, including Italy in the second half of the year. The pipeline is also advancing, with KB111 receiving Fast Track designation and KB707 receiving RMAT designation.

- Krystal Biotech reported net product revenue of $107.1 million for Q4 2025 and $389.1 million for the full year 2025, with diluted EPS of $6.84 for the full year.

- The company ended 2025 with $955.9 million in cash and investments as of December 31, 2025.

- For Full Year 2026, Krystal Biotech provided non-GAAP R&D and SG&A expense guidance of $175 million to $195 million.

- The global launch of VYJUVEK is progressing in Germany, France, and Japan, with plans to launch in Italy in 2H 2026 and expand its distributor network to cover over 40 countries in 2026.

- Key pipeline milestones for 2026 include registrational study starts for KB111 in HHD and KB407 in CF, along with clinical data readouts for inhaled KB707 in NSCLC and KB408 in AATD.

- Krystal Biotech reported net VYJUVEK revenue of $107.1 million for Q4 2025, contributing to a total of over $730 million since launch. For the full year 2025, net VYJUVEK revenue was $389.1 million, an increase of approximately 34% compared to full year 2024.

- The company achieved a gross margin of 94% for both Q4 and the full year 2025. Net income for Q4 2025 was $51.4 million ($1.70 diluted EPS), and for the full year 2025, it was $204.8 million ($6.84 diluted EPS).

- Krystal ended 2025 with $955.9 million in combined cash and investments and anticipates 2026 non-GAAP R&D and SG&A expenses to be between $175 million and $195 million.

- Global expansion of VYJUVEK is a key focus, with distributor agreements in over 20 countries and a goal to reach over 40 in 2026. Overseas expansion is expected to be the predominant driver of revenue growth in 2026, with an anticipated launch in Italy in the second half of 2026.

- The pipeline is advancing, with two registrational trials underway and two more planned for later in 2026, alongside recent Fast Track designation for KB111 and RMAT designation for KB707.

- Krystal Biotech reported $107.1 million in VYJUVEK net product revenue for the fourth quarter of 2025 and $389.1 million for the full year 2025, achieving a 94% gross margin for both periods.

- The company ended the fourth quarter of 2025 with $955.9 million in cash and investments.

- Net income for the fourth quarter of 2025 was $51.4 million (or $1.70 diluted EPS) and for the full year 2025 was $204.8 million (or $6.84 diluted EPS).

- In early 2026, the FDA granted Regenerative Medicine Advanced Therapy (RMAT) designation to KB707 for advanced NSCLC and Fast Track Designation to KB111 for Hailey-Hailey disease.

- Krystal Biotech provided FY 2026 Non-GAAP R&D and SG&A expense guidance of $175.0 - $195.0 million.

- Krystal Biotech reported $107.1 million in VYJUVEK revenue for the fourth quarter of 2025 and $389.1 million for the full year 2025, with total VYJUVEK revenue reaching $730.3 million since its U.S. launch.

- The company maintained a strong financial position, ending the quarter with $955.9 million in cash and investments as of December 31, 2025.

- Krystal Biotech provided FY 2026 guidance for non-GAAP Research and Development and Selling, General and Administrative expenses, projecting them to be between $175.0 million and $195.0 million.

- Key pipeline advancements include the FDA granting Regenerative Medicine Advanced Therapy (RMAT) designation to KB707 for advanced NSCLC and Fast Track Designation to KB111 for Hailey-Hailey disease in January and February 2026, respectively.

- The company is actively expanding VYJUVEK's global commercialization, with ongoing pricing discussions in Germany and France, and a potential launch in Italy in 2H 2026.

- Krystal Biotech announced that the United States Food and Drug Administration (FDA) granted Regenerative Medicine Advanced Therapy (RMAT) designation to KB707.

- KB707 is an immunotherapy designed to treat advanced or metastatic non-small cell lung cancer (NSCLC).

- This marks the second RMAT designation granted to a Krystal program, which is expected to accelerate development and potentially shorten the path to approval.

- The designation was supported by promising early clinical evidence of efficacy from the ongoing KYANITE-1 study, demonstrating antitumor activity in patients with heavily pre-treated advanced NSCLC.

- Krystal Biotech reported almost 10 consecutive quarters of positive EPS since the launch of VYJUVEK and a strong balance sheet, with no plans for financing for many years. The company aims for four marketed rare disease products within five years, with four registrational trials planned or ongoing in 2026 for KB803, KB801, KB407, and KB111.

- iRhythm exceeded its 2025 revenue guidance with over $740 million, achieving first-time profitability and becoming free cash flow positive. For 2026, the company expects $870 million-$880 million in revenue (17%-18% growth) and adjusted EBITDA of 11.5%-12.5%.

- PTC Therapeutics reported 2025 revenue of $823 million, surpassing guidance, with $112 million in Sephience revenue since its launch. The company closed 2025 with over $1.94 billion in cash and projects potential for cash flow breakeven in 2026, supported by $700 million-$800 million revenue guidance and reduced operating expenses.

- Krystal Biotech reported a strong financial position with nearly 10 consecutive quarters of positive EPS and a robust balance sheet, outlining a vision for four marketed rare disease products with plans to self-launch in the US, EU4, and Japan. The company is advancing a pipeline including KB803 for DEB eye lesions, KB801 for Neurotrophic Keratitis, KB407 for Cystic Fibrosis, and KB111 for Hailey-Hailey, with most registrational studies starting or planned for 2026.

- iRhythm announced a tremendous 2025, marking its first year of profitability from an adjusted EBITDA perspective and free cash flow positive. For 2026, the company projects revenue of $870 million to $880 million (17%-18% growth) and adjusted EBITDA of 11.5% to 12.5%. Key growth drivers include new product launches, international expansion, and successful penetration into the primary care segment, with over a third of its business now from primary care.

- PTC Therapeutics provided updates on its clinical pipeline, including positive dose-dependent clinical effects for Vodoplam in Huntington's disease, with FDA support for a potential accelerated approval pathway and a Novartis-funded Phase 3 study. The company also highlighted its strong R&D platforms in RNA splicing and inflammation/ferroptosis, and a robust financial position with over $1.9 billion in cash and potential to reach cash flow break-even in 2026.

- Krystal Biotech launched its genetic medicine, Vyjuvek, in the U.S. around September 2023, and subsequently in Europe (France and Germany) and Japan in 2025.

- The company plans to launch Vyjuvek in Italy mid-2026 and is working towards additional European launches, while also securing distributors for other international markets like Eastern Europe, South America, and Canada.

- Krystal anticipates initiating four registrational trials in 2026 for its programs 803, 801, 407, and 111.

- The company leverages its platform technology for manufacturing and process validations, capitalizing on the work done for Vyjuvek to accelerate its pipeline programs.

Quarterly earnings call transcripts for Krystal Biotech.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more