Earnings summaries and quarterly performance for Liberty Energy.

Executive leadership at Liberty Energy.

Board of directors at Liberty Energy.

Research analysts who have asked questions during Liberty Energy earnings calls.

Keith MacKey

RBC Capital Markets

7 questions for LBRT

Marc Bianchi

TD Cowen

7 questions for LBRT

Daniel Kutz

Morgan Stanley

6 questions for LBRT

Eddie Kim

Barclays

5 questions for LBRT

Saurabh Pant

Bank of America

5 questions for LBRT

Scott Gruber

Citigroup

5 questions for LBRT

Derek Podhaizer

Piper Sandler Companies

4 questions for LBRT

Jeffrey LeBlanc

Tudor, Pickering, Holt & Co.

4 questions for LBRT

Stephen Gengaro

Stifel Financial Corp.

4 questions for LBRT

Ati Modak

Goldman Sachs

3 questions for LBRT

Stephen Gengaro

Stifel

3 questions for LBRT

Thomas Patrick Curran

Seaport Research Partners

3 questions for LBRT

Waqar Syed

ATB Capital Markets

3 questions for LBRT

Arun Jayaram

JPMorgan Chase & Co.

2 questions for LBRT

Caitlin Donohue

Goldman Sachs

2 questions for LBRT

Edward Kim

TD Cowen

2 questions for LBRT

Jeff LeBlanc

TPH&Co.

2 questions for LBRT

John Daniel

Daniel Energy Partners

2 questions for LBRT

Josh Silverstein

UBS Group

2 questions for LBRT

Roger Read

Wells Fargo & Company

2 questions for LBRT

Tom Curran

Seaport Research Partners

2 questions for LBRT

Adi Modak

Goldman Sachs

1 question for LBRT

Grant Hynes

JPMorgan Chase & Co.

1 question for LBRT

Recent press releases and 8-K filings for LBRT.

- Liberty Energy Inc. initially proposed to offer $500 million aggregate principal amount of convertible senior notes due 2031 on February 2, 2026.

- The company subsequently upsized and priced its offering to $700.0 million aggregate principal amount of 0.00% convertible senior notes due 2031 on February 4, 2026.

- The notes will mature on March 1, 2031, and will not bear regular interest.

- The initial conversion rate is 28.9830 shares of Class A Common Stock per $1,000 principal amount, equivalent to an initial conversion price of approximately $34.50 per share, representing a 32.5% premium over the Class A Common Stock's last reported sale price of $26.04 on February 3, 2026.

- Estimated net proceeds from the offering are approximately $678.1 million, intended for funding Capped Call Transactions (approximately $99.4 million), repaying indebtedness, and general corporate purposes.

- Liberty Energy Inc. announced the pricing of an upsized $700.0 million aggregate principal amount of 0.00% convertible senior notes due 2031, which was increased from the previously announced $500.0 million.

- The notes have an initial conversion price of approximately $34.50 per share, representing a 32.5% premium over the Class A Common Stock's last reported sale price of $26.04 on February 3, 2026.

- The estimated net proceeds of approximately $678.1 million will be used to fund Capped Call Transactions, repay indebtedness under a Credit Agreement, and for general corporate purposes.

- Liberty entered into Capped Call Transactions to reduce potential dilution to its Class A Common Stock upon conversion of the notes, with an initial cap price of approximately $65.10 per share.

- Liberty Energy Inc. entered into a First Amendment to its Credit Agreement on February 3, 2026, modifying terms related to indebtedness and facility maturity.

- The amendment permits the incurrence of new bridge loan indebtedness up to $600,000,000, which must be incurred by June 30, 2026, and have a scheduled maturity date not later than 365 days from incurrence.

- The basket for permitted convertible indebtedness was increased from $300,000,000 to $600,000,000.

- The maturity date of the Revolving Credit Facility will be accelerated to 91 days prior to the stated maturity of any outstanding Permitted Bridge Indebtedness if such indebtedness is still outstanding.

- Liberty Energy Inc. (LBRT) proposes to offer $500 million aggregate principal amount of convertible senior notes due March 1, 2031, in a private offering.

- The notes will be general unsecured, senior obligations of Liberty, and the initial purchasers have an option to buy an additional $50.0 million aggregate principal amount of the notes.

- Net proceeds from the offering are intended to fund Capped Call Transactions, repay indebtedness under a Credit Agreement effective July 24, 2025, and for general corporate purposes.

- The Capped Call Transactions are expected to reduce potential dilution to the Class A Common Stock upon conversion of the notes and/or offset cash payments in excess of the principal amount of converted notes.

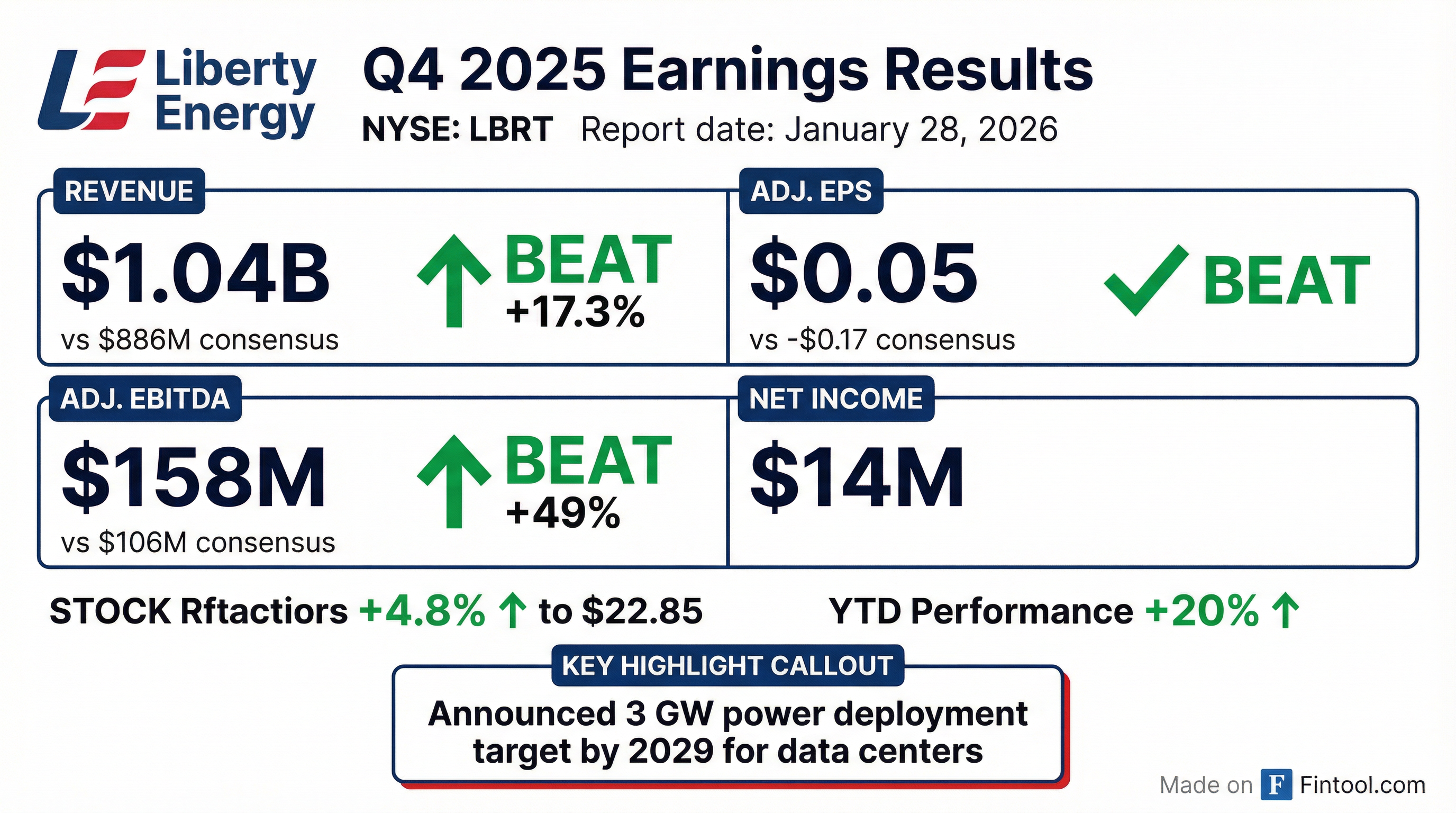

- Liberty Energy reported Q4 2025 revenue of $1 billion and adjusted EBITDA of $158 million, contributing to full year 2025 revenue of $4 billion and adjusted EBITDA of $634 million.

- For 2026, the company anticipates revenue to be approximately flat year-over-year and adjusted EBITDA to be lower due to pricing headwinds and increased development costs for its LPI Distributed Power Solutions business.

- Liberty Energy is expanding its LPI Distributed Power Solutions, targeting the deployment of 3 gigawatts of power projects by 2029, including agreements for 400 megawatts with Vantage Data Centers by 2027 and a 330-megawatt project in Texas. These projects are expected to yield high teens unlevered returns with a 5-6 year payback.

- In 2025, $77 million was returned to shareholders through cash dividends and share buybacks. Capital expenditures for 2026 are projected to include approximately $250 million for completions and $725 million-$900 million for the power business (split between long lead time deposits and project-related expenditures, with the latter funded by project financing).

- Liberty reported full year 2025 revenue of $4 billion and adjusted EBITDA of $634 million, achieving a 13% CROCI.

- The company is aggressively expanding its LPI power infrastructure platform, planning to deploy approximately 3 gigawatts of power projects by 2029, including a firm reservation of 400 megawatts for Vantage Data Centers by 2027 and a 330-megawatt data center expansion starting Q4 2027.

- For Q1 2026, Liberty expects lower sequential revenue and adjusted EBITDA due to pricing headwinds and winter weather, with full year 2026 EBITDA projected to be down, mainly from the completions business, as the power business's EBITDA is anticipated to significantly contribute starting in 2027.

- Despite recent pricing pressures, Q4 2025 completions activity surpassed expectations, and demand is projected to hold firm in 2026, with the company anticipating stabilization in completions markets.

- Liberty Energy reported Q4 2025 revenue of $1 billion, a 10% sequential increase, and adjusted EBITDA of $158 million. For the full year 2025, revenue was $4 billion and adjusted EBITDA was $634 million.

- The company's LPI power infrastructure platform secured agreements with Vantage Data Centers for at least 1 GW (including a firm reservation of 400 MW delivered during 2027) and another data center developer for 330 MW (expected to begin operations in Q4 2027 and Q2 2028).

- Liberty plans to deploy approximately 3 GW of power projects by 2029, primarily focused on data centers, expecting high teens unlevered returns.

- For 2026, revenue is anticipated to be approximately flat year-over-year, with adjusted EBITDA expected to be lower due to completions pricing headwinds and increased LPI development costs. Capital expenditures for 2026 are projected to be approximately $250 million for completions and $725 million-$900 million for the power business, with the latter partially funded by project financing.

- Liberty Energy Inc. reported full year 2025 revenue of $4.0 billion and net income of $148 million, or $0.89 fully diluted earnings per share. For the fourth quarter of 2025, revenue was $1.0 billion and net income was $14 million, or $0.08 fully diluted earnings per share.

- The company distributed $77 million to shareholders in 2025 through quarterly cash dividends and share repurchases, and raised its quarterly cash dividend by 13% to $0.09 per share beginning in the fourth quarter of 2025.

- Liberty Energy is significantly expanding its power infrastructure platform, announcing a 1 GW power development agreement with Vantage Data Centers and a 330 MW power reservation with another data center developer, accelerating its distributed power projects deployment plan to 3 GW by 2029.

- Management expects lower sequential revenue and Adjusted EBITDA for Q1 2026 due to pricing headwinds and winter weather disruption, but anticipates stabilization in completions markets and strong demand for its digiTechnologies platform.

- Liberty Energy Inc. reported its fourth quarter and full year 2025 financial results, with key metrics detailed in the table below.

- The company distributed $77 million to shareholders in 2025 through quarterly cash dividends and share repurchases, and raised its quarterly cash dividend by 13% to $0.09 per share beginning in the fourth quarter of 2025.

- Liberty Power Innovations (LPI) secured a 1 GW power development agreement with Vantage Data Centers, anchored by a 400 MW firm reservation, and a 330 MW power reservation with another leading data center developer. The company also accelerated its deployment plan for distributed power projects to 3 GW by 2029.

- Liberty anticipates lower sequential revenue and Adjusted EBITDA for Q1 2026 due to expected pricing headwinds and winter weather disruption.

| Metric | Q4 2024 | Q4 2025 | FY 2024 | FY 2025 |

|---|---|---|---|---|

| Revenue ($USD Millions) | $943.57 | $1,038.74 | $4,315.16 | $4,006.12 |

| Net Income ($USD Millions) | $51.89 | $13.69 | $316.01 | $147.87 |

| EPS ($USD) | $0.31 | $0.08 | $1.87 | $0.89 |

- Liberty Energy (LBRT) and Vantage Data Centers have formed a strategic partnership to develop and deliver up to one gigawatt (1GW) of power solutions for Vantage's North American data centers within the next five years.

- This collaboration includes a reservation of 400 megawatts (MW) of 2027 power generation capacity.

- The power solutions will be owned and operated by Liberty Power Innovations (LPI), a Liberty Energy company, and are intended to support cloud and AI infrastructure, particularly in markets with constrained grid capacity.

Quarterly earnings call transcripts for Liberty Energy.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more