Earnings summaries and quarterly performance for LEAR.

Executive leadership at LEAR.

Raymond E. Scott

Chief Executive Officer

Alicia J. Davis

Senior Vice President and Chief Strategy Officer

Frank C. Orsini

Executive Vice President and President, Seating

Harry A. Kemp

Senior Vice President and Chief Administrative Officer

Jason M. Cardew

Senior Vice President and Chief Financial Officer

Board of directors at LEAR.

Bradley M. Halverson

Director

Conrad L. Mallett, Jr.

Director

Greg C. Smith

Non-Executive Chairman of the Board

Jonathan F. Foster

Director

Julian G. Blissett

Director

Kathleen A. Ligocki

Director

Mary Lou Jepsen

Director

Patricia L. Lewis

Director

Rod A. Lache

Director

Roger A. Krone

Director

Research analysts who have asked questions during LEAR earnings calls.

Colin Langan

Wells Fargo & Company

6 questions for LEA

Dan Levy

Barclays PLC

5 questions for LEA

Mark Delaney

The Goldman Sachs Group, Inc.

5 questions for LEA

Emmanuel Rosner

Wolfe Research

4 questions for LEA

Joseph Spak

UBS Group AG

4 questions for LEA

John Murphy

Bank of America

3 questions for LEA

Itay Michaeli

TD Cowen

2 questions for LEA

James Picariello

BNP Paribas

2 questions for LEA

Joe Spak

UBS Group AG

2 questions for LEA

Trevor Young

Barclays

1 question for LEA

William Sachin

Morgan Stanley

1 question for LEA

Recent press releases and 8-K filings for LEA.

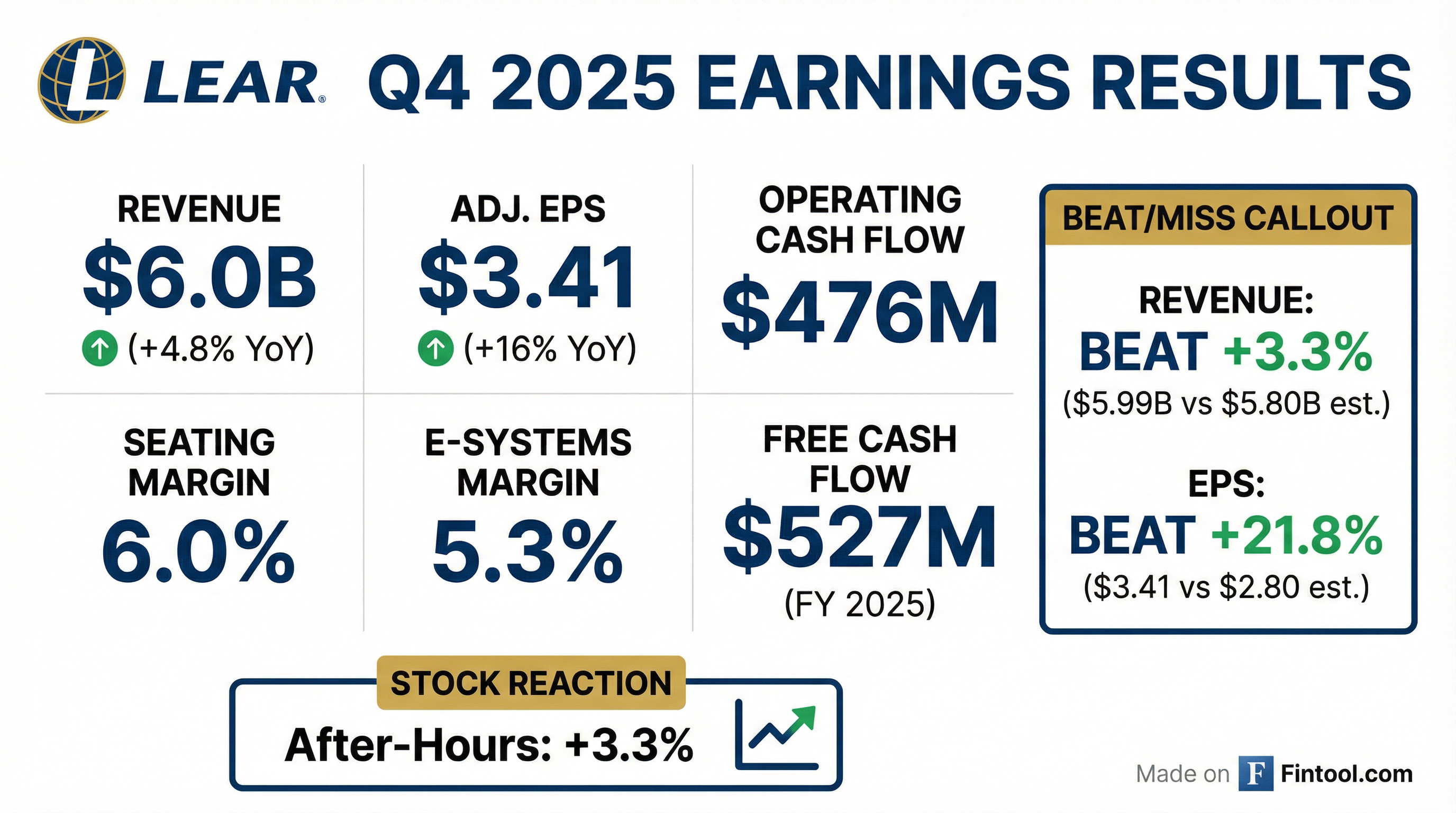

- Lear Corporation reported Q4 2025 sales of $6.0 billion and adjusted earnings per share of $3.41, marking a 5% increase in sales and a 16% increase in adjusted EPS year-over-year.

- For the full year 2025, the company achieved sales of $23.3 billion and adjusted EPS of $12.80, alongside $1.1 billion in operating cash flow.

- In 2025, Lear secured approximately $1.4 billion in E-Systems business awards, the largest annual total in over a decade, and repurchased $325 million in shares, exceeding its original target.

- The company provided a 2026 outlook targeting net sales between $23,210 million and $24,010 million and free cash flow between $550 million and $650 million, with plans for share repurchases greater than $300 million.

- Lear reported full-year 2025 revenue of $23.3 billion, adjusted earnings per share of $12.80, and free cash flow of $527 million.

- The company secured its largest Seating conquest award on record for a major truck program from an American automaker and over $1.4 billion in E-Systems business awards for the full year.

- Lear's two-year backlog (2026-2027) stands at $1.325 billion, an increase of $125 million from its initial estimate.

- For 2026, Lear expects revenue between $23.2 billion and $24 billion, core operating earnings between $1.03 billion and $1.2 billion, and free cash flow of $600 million at the midpoint of guidance.

- Lear plans to repurchase at least $300 million worth of stock in 2026, with approximately $775 million remaining on its share repurchase authorization through December 31, 2026.

- Lear reported full-year 2025 revenue of $23.3 billion and adjusted earnings per share of $12.80, a 1% increase from 2024. For Q4 2025, revenue increased 5% year-over-year to $6 billion, with adjusted EPS of $3.41.

- The company secured significant new business awards in 2025, including the largest Seating conquest award on record for a major truck program and over $1.4 billion in E-Systems business awards, marking its strongest performance in over a decade.

- Lear achieved a record net performance of $195 million for the full year 2025, significantly exceeding its initial target, and repurchased $325 million in shares during the year.

- For 2026, Lear expects revenue between $23.2 billion and $24 billion and core operating earnings between $1.03 billion and $1.2 billion. The company also targets more than $300 million in share repurchases for 2026.

- Lear reported full-year 2025 revenue of $23.3 billion, core operating earnings of $1.1 billion, and adjusted earnings per share of $12.80, a 1% increase from 2024. The company generated $527 million in free cash flow in 2025.

- The company achieved a record $195 million in net operating performance for 2025, contributing 60 basis points to Seating and 110 basis points to E-Systems margins, driven by IDEA by Lear initiatives and restructuring savings. Lear secured over $1.4 billion in E-Systems business awards for the full year and the largest Seating conquest award on record.

- Lear repurchased $325 million in shares during 2025, exceeding its initial target, and returned almost $500 million to shareholders. For 2026, the company expects revenue between $23.2 billion and $24 billion, core operating earnings between $1.03 billion and $1.2 billion, and targets at least $300 million in share repurchases. The two-year backlog for 2026-2027 stands at $1.325 billion.

- Lear Corporation reported Q4 2025 revenue of $6.0 billion, a 5% increase compared to Q4 2024, and full year 2025 revenue of $23.3 billion, which was flat compared to 2024.

- Adjusted earnings per share for Q4 2025 was $3.41, and for the full year 2025 was $12.80, marking the fifth consecutive year of adjusted EPS growth.

- The company repurchased $175 million of shares in Q4 2025 and $325 million for the full year, while also paying $39 million and $165 million in dividends, respectively.

- Lear secured approximately $1.4 billion in E-Systems business awards in 2025, the largest annual total in over a decade, and was awarded its largest seating conquest award in history on a major truck program.

- For the full year 2026, Lear forecasts net sales between $23.21 billion and $24.01 billion and free cash flow between $550 million and $650 million.

- Lear Corporation reported revenue of $6.0 billion for the fourth quarter of 2025, a 5% increase from the prior year, and $23.3 billion for the full year 2025, which was flat compared to 2024.

- Adjusted earnings per share (EPS) for Q4 2025 was $3.41, up from $2.94 in Q4 2024, and full-year 2025 adjusted EPS was $12.80, an increase from $12.62 in 2024, marking the fifth consecutive year of adjusted EPS growth.

- The company generated $281 million in free cash flow during Q4 2025 and $527 million for the full year 2025, while repurchasing $325 million of shares and paying $165 million in dividends for the full year.

- Lear provided a 2026 financial outlook projecting net sales between $23.21 billion and $24.01 billion and free cash flow between $550 million and $650 million.

- Lear expects Q4 2025 results to be between the midpoint and high end of its guidance, with full-year revenues of $23 billion, operating income of $1.25 billion, and free cash flow of $500 million. Seating operating margins are projected to be 6% or higher, and eSystems in the low fours.

- The company anticipates higher revenues, earnings, and overall operating margins in 2026 compared to 2025, despite S&P Global expecting a 1% lower global production on a Lear sales-weighted basis.

- Lear has seen significant new business awards, with $1.3 billion or more in annual sales for eSystems this year. The seating business has secured $150 million in conquest awards this year, with a current pipeline of $2 billion in new opportunities for the next 12 months.

- Digital transformation efforts, particularly with Palantir's Foundry tool, are expected to contribute $65 million-$75 million in annual savings in 2026 and 2027, building on $70 million in savings achieved in 2025.

- E-Systems faces headwinds from reduced EV demand and program cancellations, leading to a negative $100 million backlog in 2026 (compared to a prior positive $170 million outlook). The wind-down of non-core electronics products is expected to result in a $350 million revenue headwind between 2026 and 2027.

- Lear anticipates its fourth quarter 2025 performance to be between the midpoint and high end of its guidance, with full-year revenues of $23 billion, operating income of $1.25 billion, and free cash flow of $500 million. The company also expects to buy back more than $300 million in stock for the full year.

- For 2026, Lear projects higher revenues, earnings, and overall operating margins, despite an anticipated 1% decline in global production on a Lear sales-weighted basis.

- Lear has significantly advanced its presence in the Chinese market, already exceeding its 2027 target of 50% of China revenue from domestic automakers.

- The E-Systems segment faces a negative $100 million backlog for 2026 (a $270 million change from previous outlook) due to reduced EV demand and program cancellations, alongside a $350 million revenue headwind from the wind-down of non-core electronics business between 2026 and 2027. However, the segment secured $1.3 billion in new business awards and aims for 80 basis points of net performance improvement in 2026 and 2027.

- Lear expects Q4 2025 performance to track favorably between the midpoint and high end of its guidance, with full-year revenues of $23 billion, operating income of $1.25 billion, and free cash flow of $500 million. The company anticipates buying back more than $300 million in stock for the full year.

- For 2026, Lear projects higher revenues, earnings, and overall operating margins for the company, despite S&P expecting global production to be lower by about 1% on a Lear sales-weighted basis.

- The E-Systems segment experienced a $270 million change in its 2026 backlog due to reduced EV demand and program cancellations, and expects a $350 million revenue headwind from 2026 to 2027 from the wind-down of non-core electronics products, with $160 million to $165 million in 2026.

- Lear's IDEA by Lear initiatives, including automation and the Palantir partnership, contributed $70 million in savings in 2025 and are projected to generate $65 million to $75 million in savings in 2026 and 2027.

- In its Seating business, Lear has secured $150 million in conquest awards this year and has a pipeline of $2 billion in new opportunities. The company is also exceeding its target for China revenue from domestic automakers, currently at 40% and already above its 50% target for 2027.

- The total global market value for Telematics Control Units (TCUs) is projected to grow from €8.6 billion in 2024 to €11.5 billion in 2029.

- Global shipments of TCUs are estimated at 74.4 million units in 2024, with a forecast to reach 95.0 million units in 2029, driven by increased adoption in new vehicles (78% in 2024) and a shift towards 5G TCUs, which are expected to comprise 70% of shipments by 2029.

- LG Electronics is identified as the leading TCU vendor by shipments, with Aumovio and Harman as runners-up; Lear is also listed among other major TCU vendors.

- The automotive connectivity ecosystem is characterized by significant leverage from Vehicle OEMs and SoC suppliers (dominated by Qualcomm), positioning NAD and TCU vendors in a constrained middle ground.

Quarterly earnings call transcripts for LEAR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more