Earnings summaries and quarterly performance for Lumentum Holdings.

Executive leadership at Lumentum Holdings.

Michael E. Hurlston

President and Chief Executive Officer

Jae Kim

Senior Vice President, General Counsel and Secretary

Vincent Retort

Executive Vice President, Modules R&D and New Product Design and Development

Wajid Ali

Executive Vice President, Chief Financial Officer

Wupen Yuen

President, Cloud and Networking

Board of directors at Lumentum Holdings.

Research analysts who have asked questions during Lumentum Holdings earnings calls.

Ryan Koontz

Needham & Company, LLC

8 questions for LITE

Simon Leopold

Raymond James

8 questions for LITE

Samik Chatterjee

JPMorgan Chase & Co.

7 questions for LITE

Karl Ackerman

BNP Paribas

5 questions for LITE

Meta Marshall

Morgan Stanley

5 questions for LITE

Christopher Rolland

Susquehanna Financial Group

4 questions for LITE

David Vogt

UBS Group AG

4 questions for LITE

George Notter

Jefferies

4 questions for LITE

Papa Sylla

Citi

4 questions for LITE

Ananda Baruah

Loop Capital Markets LLC

3 questions for LITE

Ruben Roy

Stifel Financial Corp.

3 questions for LITE

Thomas O’Malley

Barclays Capital

3 questions for LITE

Michael Genovese

Rosenblatt Securities Inc.

2 questions for LITE

Mike Genovese

Rosenblatt Securities

2 questions for LITE

Taran Katta

Wolfe Research

2 questions for LITE

Vijay Rakesh

Mizuho

2 questions for LITE

Alek Valero

Loop Capital Markets

1 question for LITE

Aren Nakpil

Susquehanna International Group, LLP

1 question for LITE

Blayne Curtis

Jefferies Financial Group

1 question for LITE

Ezra Weener

Jefferies LLC

1 question for LITE

Joseph Cardoso

JPMorgan Chase & Co.

1 question for LITE

Karan Juvekar

Morgan Stanley

1 question for LITE

Richard Shannon

Craig-Hallum Capital Group LLC

1 question for LITE

Vivek Arya

Bank of America Corporation

1 question for LITE

Recent press releases and 8-K filings for LITE.

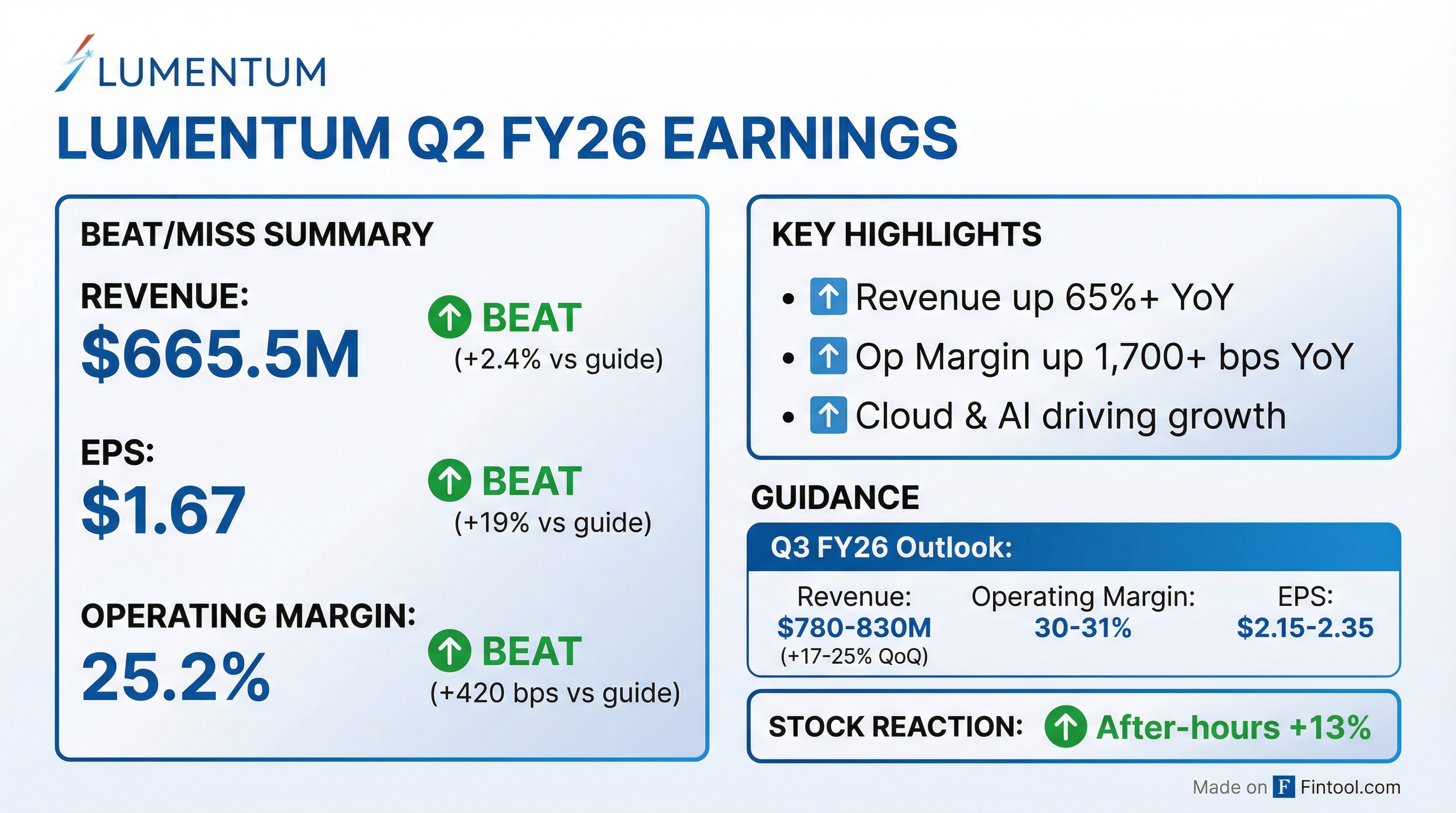

- Lumentum achieved record Q2 2026 revenue of $665.5 million, an over 65% year-over-year increase, with non-GAAP operating margin rising 1,730 basis points year-on-year to 25.2% and non-GAAP EPS of $1.67.

- The company provided strong Q3 2026 guidance, forecasting net revenue between $780 million and $830 million (midpoint $805 million), representing an 85%+ year-over-year increase, and diluted non-GAAP EPS in the range of $2.15 to $2.35.

- Key growth drivers are accelerating, with the Optical Circuit Switches (OCS) business backlog surging well past $400 million for H2 calendar 2026 shipments, and an additional $multi-hundred million purchase order for Co-Packaged Optics (CPO) ultra-high power lasers secured for H1 calendar 2027 shipments.

- Cloud transceiver revenue saw significant growth in Q2, positioning Lumentum as a leader for 1.6T speeds, which are accelerating faster than expected.

- To meet surging demand, Lumentum front-loaded over half of its 40% indium phosphide wafer fab expansion target in Q2 and is actively pursuing further capacity increases, including exploring new fabs and increasing reliance on contract manufacturers.

- Lumentum Holdings reported record second quarter fiscal year 2026 revenue of $665.5 million, representing over 65% year-over-year growth, with non-GAAP operating margin increasing by 1,730 basis points year-on-year to 25.2%, and non-GAAP EPS of $1.67.

- The company issued strong guidance for the third quarter fiscal year 2026, projecting net revenue between $780 million and $830 million (midpoint $805 million), non-GAAP operating margin of 30%-31%, and diluted non-GAAP EPS of $2.15-$2.35. The revenue midpoint indicates an 85%+ year-over-year increase.

- Growth drivers are accelerating, with the Optical Circuit Switches (OCS) business achieving its first $10 million quarter three months ahead of schedule and an order backlog surging well past $400 million for shipment in the second half of calendar year 2026.

- Lumentum also secured an additional multi-hundred million purchase order for ultra-high power lasers supporting Co-Packaged Optics (CPO), with shipments expected in the first half of calendar year 2027, and is seeing significant momentum in cloud transceivers.

- To meet surging demand, the company front-loaded its 40% indium phosphide wafer fab capacity expansion, delivering over half in Q2 2026, and has all EML capacity covered by long-term agreements (LTAs) through calendar year 2027.

- LITE reported strong Q2 FY26 non-GAAP results with revenue of $665.5 million and diluted EPS of $1.67, exceeding guided ranges.

- The Cloud and AI business significantly drove performance, leading to over 65% year-over-year total company revenue growth and over 1,700 basis points of operating margin expansion.

- Both Components and Systems segments showed substantial growth, with Components revenue up 68% year-over-year and Systems revenue up 60% year-over-year.

- For Q3 FY26, LITE provided non-GAAP guidance forecasting revenue between $780 million and $830 million, an operating margin of 30.0% to 31.0%, and diluted EPS between $2.15 and $2.35.

- Lumentum reported record Q2 2026 revenue of $665.5 million, representing over 65% year-over-year growth, and non-GAAP EPS of $1.67.

- The company issued strong Q3 2026 guidance, forecasting net revenue between $780 million and $830 million (midpoint $805 million) and diluted non-GAAP EPS between $2.15 and $2.35.

- Key growth drivers, including Optical Circuit Switches (OCS) and cloud transceivers, are performing strongly, with OCS exceeding internal expectations and an order backlog surpassing $400 million.

- Lumentum is expanding its indium phosphide wafer fab capacity, having achieved over half of its 40% expansion target in Q2 2026, despite a persistent 25%-30% supply-demand imbalance.

- All EML capacity is secured through long-term agreements (LTAs) until calendar 2027, and a favorable mix shift towards 200 gig lane speeds is expected to boost ASPs and margins.

- Lumentum reported net revenue of $665.5 million for the second quarter of fiscal year 2026, marking over 65 percent year-over-year revenue growth.

- Non-GAAP diluted net income per share was $1.67 , and the non-GAAP operating margin expanded to 25.2% for Q2 FY2026.

- The company ended the quarter with $1,155.3 million in total cash, cash equivalents, and short-term investments.

- For the third quarter of fiscal year 2026, Lumentum forecasts net revenue in the range of $780 million to $830 million and non-GAAP diluted earnings per share of $2.15 to $2.35.

- The backlog for optical circuit switches (OCS) is well beyond $400 million, and an incremental multi-hundred-million-dollar order for co-packaged optics (CPO) is expected to be delivered in the first half of calendar 2027.

- Lumentum reported net revenue of $665.5 million for the second quarter of fiscal year 2026, marking a 65.5% year-over-year increase.

- The company achieved a non-GAAP diluted net income per share of $1.67 and a non-GAAP operating margin of 25.2% for Q2 FY2026.

- Lumentum ended the second quarter of fiscal year 2026 with $1,155.3 million in total cash, cash equivalents, and short-term investments.

- For the third quarter of fiscal year 2026, Lumentum expects net revenue in the range of $780 million to $830 million and non-GAAP diluted earnings per share of $2.15 to $2.35.

- The CEO highlighted a backlog exceeding $400 million for optical circuit switches (OCS) and an incremental multi-hundred-million-dollar order for co-packaged optics (CPO) deliverable in the first half of calendar 2027.

- On December 19, 2025, Lumentum Holdings Inc. entered into a senior secured revolving credit facility for an aggregate principal amount of $400.0 million with Wells Fargo Bank, National Association as administrative agent.

- The facility, which matures on December 19, 2030, includes a $23.0 million sublimit for letters of credit and allows for incremental revolving commitments and/or term loans up to an unlimited amount. The proceeds are designated for working capital and general corporate purposes.

- Borrowings will bear interest at either a base rate plus a margin of 0.50% to 1.50% or a term Secured Overnight Financing Rate (SOFR) plus a margin of 1.50% to 2.50%, with a quarterly commitment fee of 0.15% to 0.35% on unused availability, all dependent on the Company's secured net leverage ratio.

- The Credit Agreement contains financial covenants requiring the Company to maintain a secured net leverage ratio of less than or equal to 3.25:1.00 and an interest coverage ratio of no less than 3.00:1.00, tested at the end of each fiscal quarter.

- Lumentum is experiencing unprecedented demand and capacity constraints across its entire product portfolio, with EML lasers sold out for 2026 and largely booked through 2027.

- The company is increasing prices and securing longer-term commitments from larger customers due to the seller's market, and is on track to increase EML capacity by 40% over the next couple of quarters.

- The OCS (Optical Cross-Connect Switch) business is projected to grow significantly, aiming for approximately $100 million per quarter by December 2026, and CPO (Co-Packaged Optics) adoption is anticipated to reach 40%-50% of switches for the first user by late 2027/2028.

- Total optical ports for hyperscalers are estimated to grow from 40-50 million in the current year to 70-75 million in 2026, with 1.6T ports accounting for 15-20 million of that total.

- Lumentum's primary challenge in meeting demand is capacity, and the company is focusing on serving its three main hyperscaler customers.

- Lumentum is experiencing widespread demand exceeding supply across its product portfolio, with capacity constraints and demand visibility extending through 2027 for certain products like EML lasers.

- The company is leveraging this seller's market by implementing elevated pricing for longer-term customer commitments.

- Lumentum projects Optical Circuit Switches (OCS) revenue to reach approximately $100 million per quarter by December 2026, driven by strengthening demand and increased customer engagement.

- The company estimates the total optical port count for hyperscalers to be around 75 million in 2026, with 55-60 million for 100G or 800G and 15-20 million for 1.6T.

- Lumentum anticipates significant adoption of Co-Packaged Optics (CPO, projecting that 40%-50% of switches for the first user will be CPO-based by late 2027 to 2028.

- Lumentum, a leading optical infrastructure provider for data centers, projects its 200 gig per lane Externally Modulated Lasers (EMLs) to increase from 10% of volumes in calendar Q1 2026 to 25% in calendar Q4 2026, driving a two-times ASP bump and higher gross margins.

- The company is significantly behind demand for EMLs, reporting 20% at fiscal year-end and forecasting 30% by mid-2026, despite plans to add 40% additional capacity by June 2026 (relative to September 2025 quarter close), with supply-demand equilibrium not expected until at least 2027.

- Lumentum expects substantial growth from its Optical Circuit Switches (OCS) business, targeting an increase from $10 million in calendar Q1 2026 to $100 million of incremental revenue by calendar Q4 2026, and anticipates material revenue from co-packaged optics in the second half of calendar 2026.

- The CEO identifies OCS, optical scale-out, and optical scale-up as "huge growth drivers" that are currently "underappreciated" and not yet factored into financial numbers, indicating that 2026 will be a very good year for the company as these contributions materialize.

Quarterly earnings call transcripts for Lumentum Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more