Earnings summaries and quarterly performance for Lumen Technologies.

Executive leadership at Lumen Technologies.

Board of directors at Lumen Technologies.

Christopher Capossela

Director

Diankha Linear

Director

Hal Stanley Jones

Director

James Fowler

Director

Kevin P. Chilton

Director

Martha Helena Béjar

Director

Michelle J. Goldberg

Director

Quincy Allen

Director

Stephen McMillan

Director

T. Michael Glenn

Chairman of the Board

Research analysts who have asked questions during Lumen Technologies earnings calls.

Frank Louthan

Raymond James

6 questions for LUMN

Gregory Williams

TD Cowen

6 questions for LUMN

Michael Rollins

Citigroup

6 questions for LUMN

Batya Levi

UBS

5 questions for LUMN

Sebastiano Petti

JPMorgan Chase & Co.

5 questions for LUMN

James Schneider

Goldman Sachs

3 questions for LUMN

Jonathan Chaplin

New Street Research

3 questions for LUMN

Nicholas Del Deo

MoffettNathanson

3 questions for LUMN

Nick Del Deo

MoffettNathanson LLC

3 questions for LUMN

David Barden

Bank of America

2 questions for LUMN

Eric Luebchow

Wells Fargo

2 questions for LUMN

Michael Funk

Bank of America

2 questions for LUMN

Michael Ng

Goldman Sachs

2 questions for LUMN

Samuel McHugh

BNP Paribas

2 questions for LUMN

Batya Levy

UBS Investment Bank

1 question for LUMN

Sam McHugh

BNP Paribas S.A.

1 question for LUMN

Recent press releases and 8-K filings for LUMN.

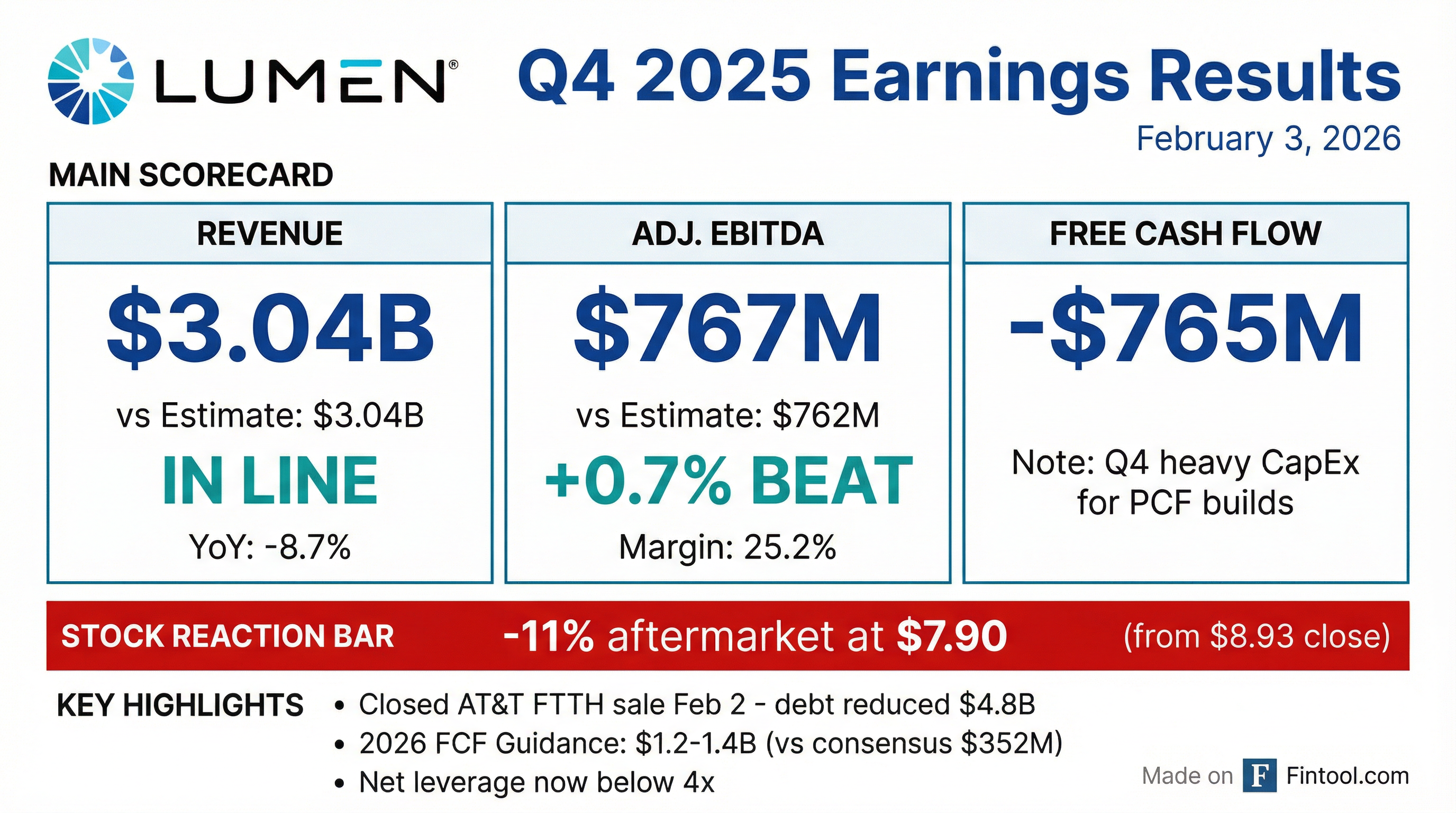

- Lumen Technologies reported Q4 2025 total revenue of $3.041 billion, an 8.7% decline, and Adjusted EBITDA of $767 million. Free cash flow was -$765 million, partly due to a $400 million delayed tax refund expected in the first half of 2026.

- For 2026, the company expects Adjusted EBITDA in the range of $3.1 billion to $3.3 billion, projecting an inflection to growth. Total capital expenditures are guided between $3.2 billion and $3.4 billion, and free cash flow between $1.2 billion and $1.4 billion.

- Lumen significantly improved its capital structure, reducing debt to under $13 billion after the $5.75 billion sale of its fiber to the home business to AT&T. This, along with other refinancing, reduced annual interest expense by nearly $500 million in the last 12 months.

- The company is on track for $1 billion in run rate cost reductions by the end of 2027, having achieved over $400 million in 2025. 52% of North American enterprise revenue now comes from growth products, supporting targets for business revenue growth by 2028 and total revenue growth by 2029.

- Lumen completed its AT&T FTTH transaction on February 2, 2026, which reduced debt by $4.8 billion, eliminated all Super Priority Bonds, and is expected to reduce Capex by over $1 billion annually and interest expense by an additional $300 million at close, bringing net leverage below 4x.

- For Q4 2025, Lumen reported Total Revenue of $3041 million and Adjusted EBITDA (excluding special items) of $767 million, with Free Cash Flow at -$765 million, which were in-line with expectations.

- The company provided a 2026 financial outlook, projecting Adjusted EBITDA between $3.1 billion and $3.3 billion and Free Cash Flow between $1.2 billion and $1.4 billion. Capital expenditures are expected to be $3.2 billion to $3.4 billion.

- Lumen achieved 29% quarter-over-quarter growth in Active NaaS Customers and reached nearly $13 billion in Private Connectivity Fabrics (PCF) Deals Signed to Date.

- Lumen Technologies completed its transaction with AT&T, utilizing $4.8 billion in net proceeds to pay off super priority bonds, reducing total debt to less than $13 billion and annual interest expense by nearly $500 million.

- For Q4 2025, the company reported total revenue of $3.041 billion, adjusted EBITDA of $767 million, and negative free cash flow of $765 million, with a $400 million tax refund anticipated in the first half of 2026.

- The 2026 financial outlook projects adjusted EBITDA between $3.1 billion and $3.3 billion, total capital expenditures between $3.2 billion and $3.4 billion, and free cash flow between $1.2 billion and $1.4 billion.

- Lumen achieved over $400 million in run rate cost reductions in 2025, targeting $700 million by year-end 2026, and expects business revenue growth by 2028, supported by nearly $13 billion in PCF deals.

- Lumen closed its fiber-to-the-home business transaction with AT&T on February 2, 2026, using $4.8 billion in net proceeds to pay off super priority bonds, reducing total debt to less than $13 billion and net leverage to below 4 times. This, combined with other debt refinancing, reduced annual interest expense by nearly $500 million from 2025 levels.

- For Q4 2025, Lumen reported total revenue of $3.041 billion and Adjusted EBITDA of $767 million, with a free cash flow of -$765 million. The company recognized $41 million in revenue from PCF deals in Q4 2025, contributing to $116 million for the full year 2025.

- Lumen provided a 2026 outlook, expecting Adjusted EBITDA in the range of $3.1 billion-$3.3 billion, total capital expenditures between $3.2 billion-$3.4 billion, and free cash flow of $1.2 billion-$1.4 billion. Net cash interest expense is projected to be $650 million-$750 million, a reduction of over $550 million from 2025.

- The company exceeded its 2025 cost reduction target, achieving over $400 million in run rate savings, and is targeting an additional $300 million in run rate savings by the end of 2026, aiming for a total of $700 million towards its $1 billion 3-year goal.

- Lumen continues to expand its Network-as-a-Service (NaaS) business, with active customers growing 29% quarter-over-quarter, NaaS fiber ports deployed growing 31%, and services sold growing 26%. The company has signed nearly $13 billion in PCF deals to date, including $2.5 billion in Q4 2025.

- Lumen Technologies completed its $5.75 billion transaction with AT&T, significantly strengthening its balance sheet by reducing total debt by over $4.8 billion and net leverage to below 4x.

- For Q4 2025, the company reported revenues of $3.041 billion and Adjusted EBITDA (excluding Special Items) of $767 million, with full-year 2025 revenues reaching $12.402 billion and Adjusted EBITDA (excluding Special Items) at $3.360 billion.

- Operational execution saw Lumen exceed its cost reduction target with over $400 million in run-rate savings by year-end 2025, while also seeing NA Enterprise grow revenue hit 52% in Q4 and NaaS customers grow 29%.

- The company issued its full-year 2026 financial outlook, projecting Adjusted EBITDA between $3.1 billion and $3.3 billion and Free Cash Flow between $1.2 billion and $1.4 billion.

- Lumen Technologies completed its $5.75 billion AT&T transaction, which reduced total debt by over $4.8 billion and net leverage to below 4x, and is expected to decrease annual interest expense by nearly 45% compared to 2025 levels.

- For the full year ended December 31, 2025, Lumen reported revenues of $12.402 billion, Adjusted EBITDA (excluding Special Items) of $3.360 billion, and Free Cash Flow (excluding Special Items) of $1.041 billion.

- The company exceeded its 2025 cost reduction target, achieving over $400 million in run-rate savings, and is on track for $700 million in savings exiting 2026 and $1 billion exiting 2027.

- Lumen provided its full-year 2026 financial outlook, projecting Adjusted EBITDA of $3.1 to $3.3 billion and Free Cash Flow of $1.2 to $1.4 billion.

- Lumen Technologies, Inc. completed the sale of its Mass Markets fiber-to-the-home business, including Quantum Fiber, to AT&T for $5.75 billion in cash on February 2, 2026.

- The company plans to apply approximately $4.8 billion of the transaction proceeds and cash on hand to retire all super priority debt, which is expected to reduce annual interest expense by approximately $300 million.

- This transaction is anticipated to reduce Lumen's debt to less than $13 billion and its net debt to adjusted EBITDA ratio to below 4x.

- The divestiture positions Lumen as a pure-play enterprise-focused technology infrastructure company, while it retains its national, regional, state, and metro fiber backbone network infrastructure and copper-based consumer services.

- Lumen Technologies completed the sale of its Mass Markets fiber-to-the-home business to AT&T for $5.75 billion in cash.

- The company plans to apply approximately $4.8 billion of the proceeds to retire super priority debt, which is expected to reduce annual interest expense by approximately $300 million and lower total debt to less than $13 billion.

- This divestiture strategically transforms Lumen into a pure-play enterprise-focused technology infrastructure company.

- Lumen's growth strategy includes expanding its fiber network, with 17 million intercity fiber miles deployed by the end of 2025 and a goal of 47 million miles by the end of 2028.

- Lumen Technologies secured ISO 42001 certification for its Artificial Intelligence Management System, a first-of-its-kind award from Schellman Compliance, underscoring its commitment to responsible AI and reinforcing its position for AI-heavy workloads.

- The announcement contributed to a recent short-term rebound in shares, with a 1-day return of ~7.65% and a 30-day return of ~20.81%.

- Despite this, the company faces financial headwinds, including a recent net loss of $1,652 million on $12,690 million in revenue, margin pressure, and a challenged financial-strength profile.

- Lumen's Level 3 Financing unit plans an additional offering of $600 million of 8.5% senior notes due 2036 to fund debt purchases tied to tender offers.

- The company is strategically shifting away from legacy consumer voice businesses towards higher-margin enterprise and digital segments, which now account for roughly 75% of revenue.

- The Global Optical Fiber Switch Market is projected to expand significantly, rising from a valuation of USD 4.29 Billion in 2025 to USD 8.72 Billion by 2031, reflecting a compound annual growth rate of 12.55%.

- This market growth is primarily driven by the urgent need for energy-efficient data center management, the global increase in high-bandwidth applications, and the modernization of telecommunications infrastructure, including the accelerated deployment of 5G networks and AI workloads.

- Lumen Technologies secured $5 billion in new business fueled by the surging need for AI-driven connectivity, as reported in an August 2024 press release, underscoring the critical role of advanced optical networking in sustaining next-generation digital services.

- A significant challenge for the market is the substantial initial capital investment required for advanced optical systems, which can impede rapid adoption, particularly among smaller network operators or within developing economies.

Fintool News

In-depth analysis and coverage of Lumen Technologies.

Quarterly earnings call transcripts for Lumen Technologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more