Earnings summaries and quarterly performance for LiveOne.

Executive leadership at LiveOne.

Board of directors at LiveOne.

Research analysts who have asked questions during LiveOne earnings calls.

Brian Kinstlinger

Alliance Global Partners

8 questions for LVO

Also covers: AI, ALAR, ATER +25 more

SM

Sean McGowan

ROTH Capital Partners

7 questions for LVO

Also covers: CDXC, CELH, FTLF +8 more

BS

Barry Sine

Litchfield Research

6 questions for LVO

Also covers: PODC, UMAC, USIO +1 more

Jon Hickman

Ladenburg Thalmann

4 questions for LVO

Also covers: BLDE, BYRN, CLSK +10 more

SM

Sean McLaughlin

Ross Capital Partners

1 question for LVO

Recent press releases and 8-K filings for LVO.

LiveOne Announces Cost-Reduction Initiatives and Balance Sheet Strengthening

LVO

Layoffs

- LiveOne is executing strategic cost-reduction initiatives aimed at strengthening its balance sheet and improving operating leverage.

- The company reduced its headcount from 350 to 84, with over 12% of the reduction occurring this quarter.

- LiveOne eliminated approximately $14 million in liabilities, which included repaying $3 million of debt and converting over $11 million into equity at $7.50 per share.

- These initiatives are designed to position LiveOne for sustained profitability and long-term shareholder value creation.

3 days ago

LiveOne Reports Q3 Fiscal 2026 Results and Provides Audio Division Fiscal 2027 Guidance

LVO

Earnings

Guidance Update

Share Buyback

- LiveOne reported Q3 Fiscal 2026 revenue of $20.3 million and Adjusted EBITDA of $1.6 million, with the Audio Division contributing $18.6 million in revenue and $2.6 million in Adjusted EBITDA.

- For the first nine months of Fiscal 2026, the company's total revenue was $58.2 million.

- The company achieved a 52% year-over-year reduction in quarterly operating expenses through AI-driven efficiencies and streamlined staff.

- Management expanded share repurchases, with approximately $6 million remaining under the current board-authorized buyback program.

- Preliminary guidance for the Audio Division in Fiscal 2027 projects revenue of $85-$95 million+ and Adjusted EBITDA of $8-10 million+.

Feb 12, 2026, 9:30 PM

LiveOne Reports Q3 2026 Results and Provides Fiscal 2027 Guidance

LVO

Earnings

Guidance Update

Revenue Acceleration/Inflection

- LiveOne reported consolidated revenue of $20.3 million for Q3 fiscal 2026, with the audio division contributing $18.6 million. Consolidated Adjusted EBITDA for the quarter was $1.6 million, and the company posted a net loss of $4.1 million or 37 cents per diluted share. For the nine months, revenues exceeded $58 million, and the audio division generated $52.2 million with over $3.7 million in Adjusted EBITDA.

- The company provided preliminary fiscal guidance for the next year (fiscal 2027) of $85 million-$95 million in revenues and $8 million-$10 million in Adjusted EBITDA. Operating expenses were reduced by over 52% year-over-year, and the organization was streamlined from 350 to 88 team members with the help of AI.

- LiveOne's B2B pipeline is the largest in its history, up over 30% in the last 120 days, with over 100 active enterprise opportunities. The company expects to launch 3 major Fortune 500 partnerships this year, two of which have over 50 million monthly paying subscribers. Additionally, LiveOne is expanding its share repurchase program with approximately $6 million remaining under authorization and holds over $125 million in net operating loss carryforwards.

Feb 12, 2026, 3:00 PM

LiveOne Reports Q3 2026 Results and Fiscal Guidance

LVO

Earnings

Guidance Update

Revenue Acceleration/Inflection

- LiveOne reported Q3 2026 consolidated revenue of $20.3 million and adjusted EBITDA of $1.6 million, with a net loss of $4.1 million or $0.37 per diluted share.

- The company provided preliminary fiscal guidance for $85 million to $95 million in revenues and $8 million to $10 million in Adjusted EBITDA.

- Operational improvements include a 52% year-over-year reduction in operating expenses and a workforce streamlined to 88 team members. The company also paid off over $2.5 million of debt.

- Strategic growth is driven by the largest B2B pipeline in company history, up over 30% in the last 120 days, and the expectation to launch three major Fortune 500 partnerships this year, two of which have over 50 million monthly paying subscribers.

- LiveOne holds over $125 million in net operating loss carryforwards and has approximately $6 million remaining under its share repurchase program. A new president will be announced to focus on day-to-day operations, allowing the current speaker to concentrate on B2B, M&A, and AI initiatives.

Feb 12, 2026, 3:00 PM

LiveOne Reports Q3 2026 Results, Provides Fiscal Guidance, and Details Strategic Initiatives

LVO

Earnings

Guidance Update

Revenue Acceleration/Inflection

- LiveOne reported Q3 2026 consolidated revenue of $20.3 million and consolidated Adjusted EBITDA of $1.6 million, with a net loss of $4.1 million or $0.37 per diluted share.

- The company provided preliminary fiscal guidance of $85 million to $95 million in revenues and $8 million to $10 million in Adjusted EBITDA, noting this is a conservative baseline.

- Operational improvements include a 52% year-over-year reduction in operating expenses and streamlining staff from 350 to 88 team members using AI.

- LiveOne has paid off over $2.5 million of debt and holds over $125 million in net operating loss carryforwards (NOLs).

- The B2B pipeline is the largest in company history, with over 100 active enterprise opportunities, and the company expects to launch three major Fortune 500 partnerships this year, two of which have over 50 million monthly paying subscribers.

Feb 12, 2026, 3:00 PM

LiveOne, Inc. Provides Preliminary Q3 Fiscal 2026 Financial Results

LVO

Earnings

Guidance Update

Revenue Acceleration/Inflection

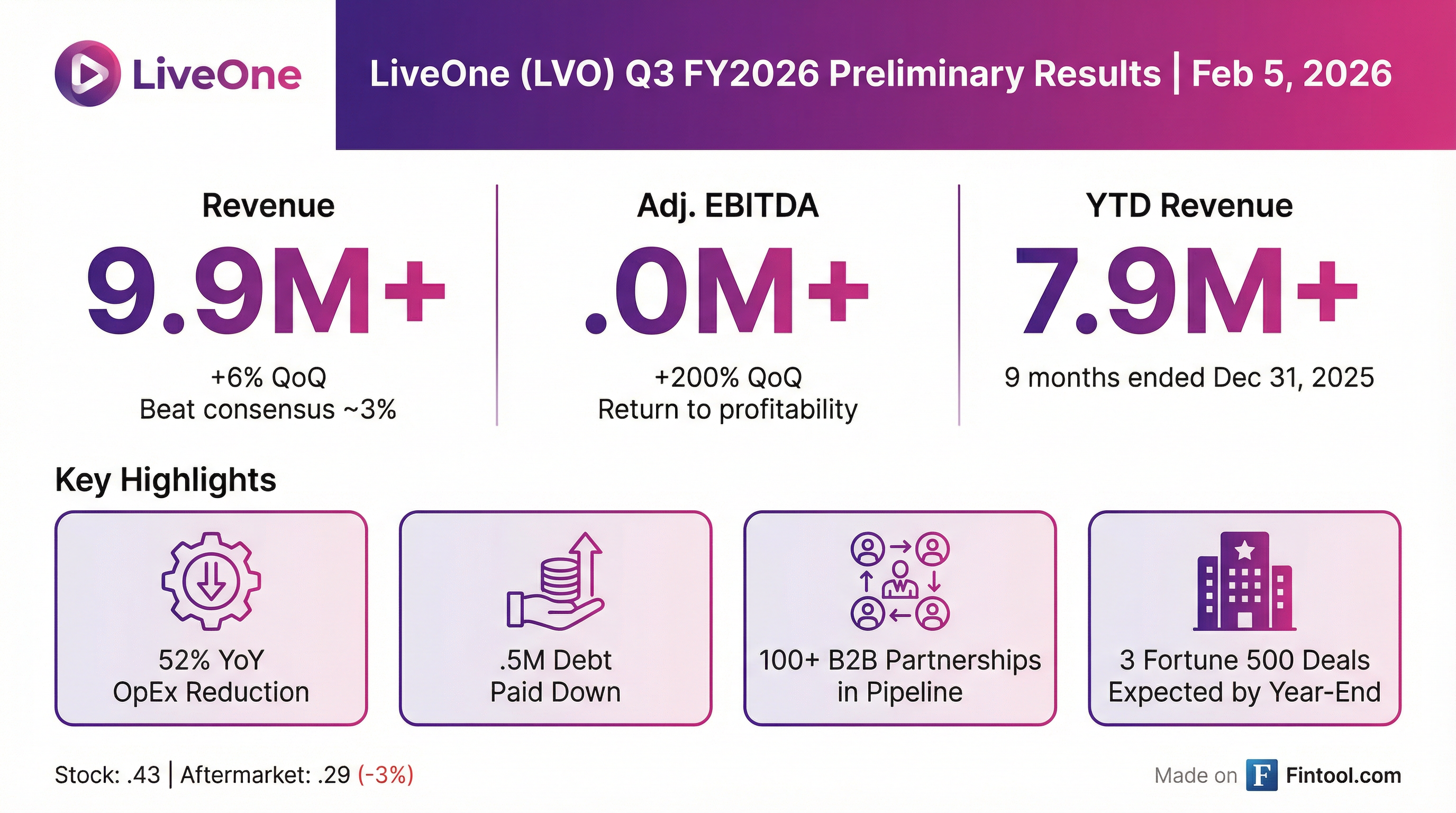

- LiveOne, Inc. expects preliminary revenue of over $19.9 million for Q3 Fiscal 2026 and over $57.9 million year-to-date for Fiscal 2026.

- The company anticipates preliminary Adjusted EBITDA of over $1.0 million for Q3 Fiscal 2026, representing an approximate 200% quarter-over-quarter increase.

- LiveOne, Inc. achieved a 52% year-over-year OpEx reduction and is targeting a 34% year-over-year headcount reduction by year-end, projected to save $4M - $5M.

- The company also paid off $2.5 million of debt.

- These financial results are preliminary and unaudited, based on currently available information as of February 5, 2026, and are subject to change upon finalization.

Feb 5, 2026, 1:30 PM

LiveOne Announces Anticipated Q3 Fiscal 2026 Results and Operational Updates

LVO

Earnings

Guidance Update

Revenue Acceleration/Inflection

- LiveOne anticipates Q3 Fiscal 2026 revenue of over $19.9 million and year-to-date Fiscal 2026 revenue of over $57.9 million.

- The company expects Q3 Fiscal 2026 Adjusted EBITDA to exceed $1.0 million, representing an increase of approximately 200% quarter-over-quarter.

- LiveOne achieved a 52% year-over-year OpEx reduction.

- The company is targeting a 34% year-over-year headcount reduction, which is expected to result in $4 million to $5 million in savings by year-end through AI-driven cost optimization.

- LiveOne paid off $2.5 million of debt and anticipates launching three Fortune 500 partnerships by year-end.

Feb 5, 2026, 1:00 PM

LiveOne Announces Major Milestones

LVO

New Projects/Investments

Guidance Update

Revenue Acceleration/Inflection

- LiveOne announced major financial and strategic milestones on January 8, 2026.

- The company identified $4–5 million in incremental cost savings through expanded AI initiatives.

- LiveOne has surpassed 1.4 million total members and ad-supported subscribers, including Tesla customers.

- The company reported a record B2B pipeline with over 100 partnerships.

Jan 8, 2026, 1:00 PM

LiveOne Renews Audio Advertising Partnership with DAX

LVO

New Projects/Investments

Revenue Acceleration/Inflection

- LiveOne (NASDAQ: LVO) has renewed its exclusive audio advertising partnership with DAX, a digital advertising platform owned by Global.

- The contract, originally signed in 2015, has been expanded to include DAX US selling new in-car audio advertising opportunities.

- LiveOne is projecting a 30% year-over-year increase in programmatic audio ad revenue in 2026 due to this renewed partnership.

Dec 18, 2025, 2:26 PM

LiveOne, Inc. Reports Q2 FY2026 Results and Raises PodcastOne's FY2026 Guidance

LVO

Earnings

Guidance Update

Share Buyback

- LiveOne, Inc. reported consolidated revenue of $18.8M and Adjusted EBITDA of -$1.0M for Q2 Fiscal Year 2026 (ended September 30, 2025).

- For the full Fiscal Year 2025 (ended March 31, 2025), the company reported consolidated revenue of $114.4M and Adjusted EBITDA of $8.4M.

- LiveOne's subsidiary, PodcastOne (PODC), raised its Fiscal 2026 guidance to $56 - 60 million in revenue and $4.5 - 6 million in Adjusted EBITDA.

- As of November 15, 2024, the company had repurchased 4.4 million shares of common stock, with approximately $6.2M worth of shares remaining for repurchase under its program.

- LiveOne's Slacker Radio renewed its annual agreement with Tesla through May 2026, contributing to a 78% increase in direct-billed Premium subscribers and a 130% increase in overall direct-billed subscribers since October 2024.

Nov 26, 2025, 1:30 PM

Quarterly earnings call transcripts for LiveOne.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more