Earnings summaries and quarterly performance for MANHATTAN ASSOCIATES.

Executive leadership at MANHATTAN ASSOCIATES.

Eric A. Clark

President and Chief Executive Officer

Bruce S. Richards

Senior Vice President, Chief Legal Officer and Secretary

Dennis B. Story

Executive Vice President, Chief Financial Officer and Treasurer

Eddie Capel

Executive Chairman

J. Stewart Gantt

Executive Vice President, Professional Services

Robert G. Howell

Executive Vice President, Americas

Board of directors at MANHATTAN ASSOCIATES.

Research analysts who have asked questions during MANHATTAN ASSOCIATES earnings calls.

Brian Peterson

Raymond James Financial

8 questions for MANH

Dylan Becker

William Blair

8 questions for MANH

Mark Schappel

Loop Capital Markets

8 questions for MANH

Terrell Tillman

Truist Securities

8 questions for MANH

George Kurosawa

Citigroup Inc.

7 questions for MANH

Christopher Quintero

Morgan Stanley

5 questions for MANH

Joe Vruwink

Baird

5 questions for MANH

Guy Hardwick

Freedom Capital Markets

4 questions for MANH

Parker Lane

Stifel Financial Corp.

4 questions for MANH

Joseph Vruwink

Baird

3 questions for MANH

Lachlan Brown

Redburn Atlantic

3 questions for MANH

Clark Wright

D.A. Davidson & Co.

2 questions for MANH

George Michael Kurosawa

Citigroup

1 question for MANH

Quinton Gabrielli

Piper Sandler

1 question for MANH

Will Jellison

D.A. Davidson & Co.

1 question for MANH

Recent press releases and 8-K filings for MANH.

- Dennis Story will retire as Executive Vice President & Chief Financial Officer of Manhattan Associates, effective March 31, 2026.

- Linda Pinne will succeed Mr. Story, taking on the roles of Senior Vice President and Chief Financial Officer, Chief Accounting Officer, and Treasurer.

- Mr. Story has served as CFO since March 2006, and during his tenure, the company's revenue increased by approximately 275%, operating cash flow by approximately 785%, and market capitalization by more than 50 times.

- Manhattan Associates reaffirms its 2026 financial guidance provided on January 27, 2026.

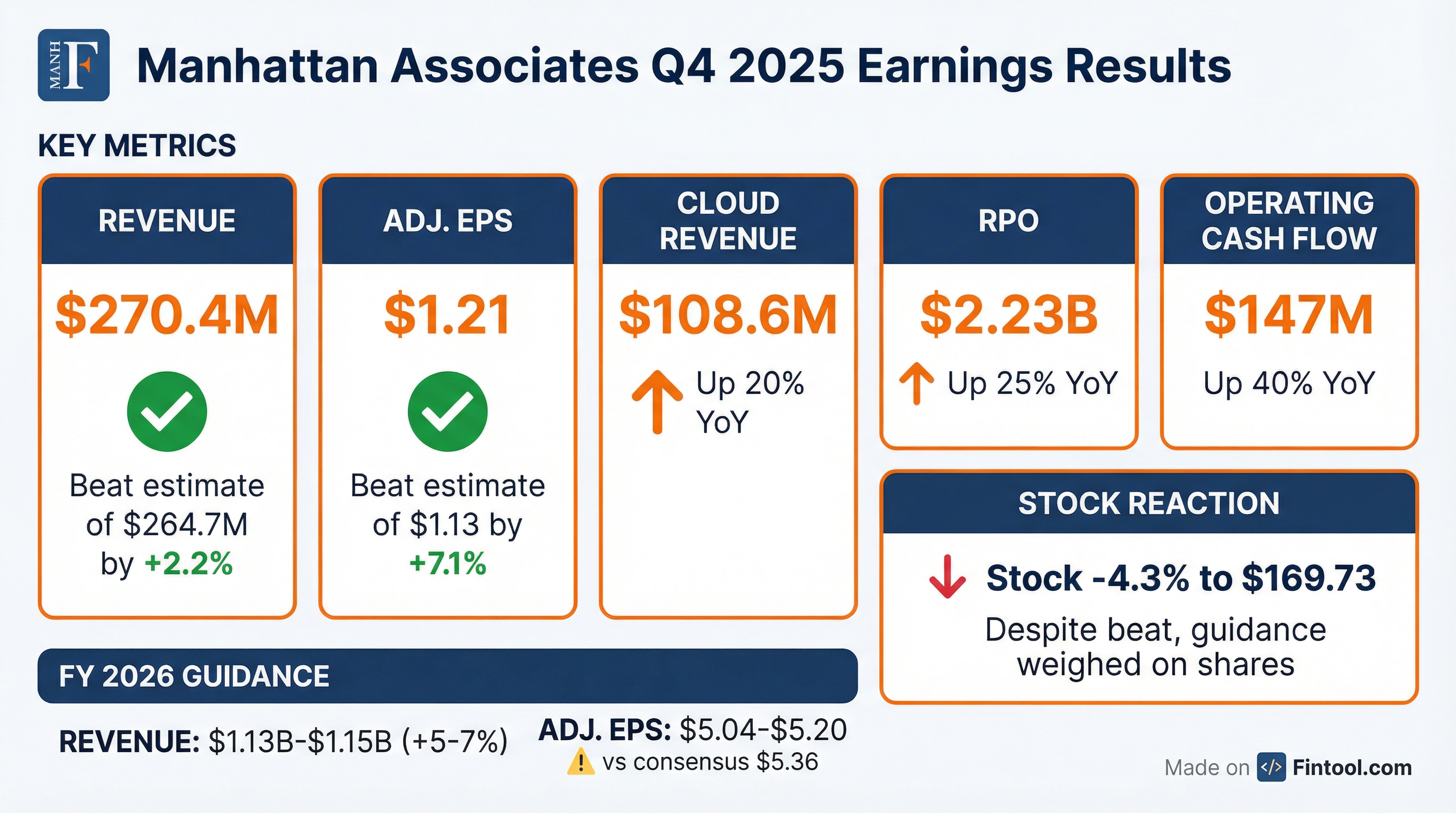

- Manhattan Associates (MANH) reported strong Q4 2025 results, with revenue increasing 6% to $270 million and adjusted earnings per diluted share rising to $1.21. For the full year 2025, total revenue was $1.08 billion, up 4%, and adjusted EPS was $5.06, up 7%.

- The company's cloud business showed significant growth, with Q4 cloud revenue up 20% to $109 million and full-year cloud revenue increasing 21% to $408 million. RPO grew 25% year-over-year to $2.2 billion, and ramped ARR exceeded $600 million, up 23% compared to the end of 2024.

- Manhattan Associates provided 2026 guidance, projecting total revenue of $1.133-$1.153 billion (midpoint $1.143 billion, representing 10% growth excluding license and maintenance attrition) and adjusted EPS of $5.04-$5.20. Cloud revenue is expected to increase 21% to $492 million in 2026.

- In 2025, the company launched new offerings, including AI agents and Agent Foundry, and Enterprise Promise & Fulfill, while also making key hires such as Katie Foote as Chief Marketing Officer and Greg Betts as Chief Operating Officer.

- Operating cash flow increased 40% to $147 million in Q4 2025, and 32% to $389 million for the full year 2025. The board approved the replenishment of a $100 million share repurchase authority, following $275 million in buybacks in 2025.

- Manhattan Associates achieved record financial results for full-year 2025, with total revenue of $1.08 billion (up 4%), cloud revenue of $408 million (up 21%), and adjusted earnings per share of $5.06 (up 7%). The company also reported record cloud bookings in Q4 2025 and ended the year with $2.2 billion in Remaining Performance Obligations (RPO), marking a 25% year-over-year increase.

- For 2026, the company provided guidance targeting total revenue of $1.133 billion-$1.153 billion (midpoint $1.143 billion), representing 10% growth excluding license and maintenance attrition, and adjusted EPS in the range of $5.04-$5.20. RPO is projected to grow 18%-20%, reaching $2.62 billion-$2.68 billion.

- Manhattan Associates commercially launched its initial set of AI agents and Agent Foundry in Q4 2025, designed to enhance productivity and customer satisfaction. Management noted that any contributions from these new AI products are considered incremental to the current 2026 RPO and SaaS revenue guidance.

- The company introduced a new financial metric, four-year annualized value of recurring revenue (Ramped ARR), which exceeded $600 million at the end of 2025, an increase of 23% compared to 2024. Additionally, Manhattan Associates invested $275 million in share repurchases during 2025.

- Manhattan Associates achieved record financial performance in 2025, with full-year total revenue reaching $1.08 billion, up 4%, and adjusted EPS increasing 7% to $5.06. Q4 2025 saw total revenue grow 6% to $270 million, cloud revenue increase 20%, and adjusted EPS rise to $1.21.

- Remaining Performance Obligations (RPO) increased 25% to $2.2 billion by the end of 2025. The company's ramped Annual Recurring Revenue (ARR) exceeded $600 million, up 23% compared to 2024.

- For 2026, Manhattan Associates provided guidance targeting total revenue of $1.133-$1.153 billion (midpoint $1.143 billion) and adjusted EPS of $5.04-$5.20. RPO is projected to be $2.62-$2.68 billion, representing 18%-20% growth.

- The company commercially launched its initial set of AI agents and Agent Foundry, an offering for customers to build or customize new agents within the Active platform.

- The board approved the replenishment of its $100 million share repurchase authority, following $275 million in buybacks in 2025.

- Manhattan Associates reported Q4 2025 revenue of $270.4 million and full-year 2025 revenue of $1,081.4 million, with RPO Bookings increasing 25% over the prior year.

- For Q4 2025, GAAP diluted EPS was $0.86 and adjusted diluted EPS was $1.21; for the full year 2025, these figures were $3.60 and $5.06, respectively.

- The company issued 2026 guidance, forecasting total revenue between $1,133 million and $1,153 million (5% to 7% growth) and adjusted diluted EPS between $5.04 and $5.20 (0% to 3% growth).

- Cash flow from operations for full-year 2025 reached $389.5 million, and the company repurchased $274.5 million of common stock in 2025, with an additional $100.0 million repurchase authority replenished in January 2026.

- Manhattan Associates reported Q4 2025 total revenue of $270.4 million and full-year 2025 total revenue of $1,081.4 million, reflecting growth over the prior year periods.

- GAAP diluted EPS for Q4 2025 was $0.86 and adjusted diluted EPS was $1.21. For the full year 2025, GAAP diluted EPS was $3.60 and adjusted diluted EPS was $5.06.

- The company's Remaining Performance Obligations (RPO) reached $2,232.2 million at December 31, 2025, with RPO bookings increasing 25% over the prior year. Cloud subscription revenue for Q4 2025 grew to $108.6 million.

- For full-year 2026, Manhattan Associates projects total revenue between $1,133 million and $1,153 million, GAAP EPS between $3.37 and $3.53, and adjusted EPS between $5.04 and $5.20.

- The company repurchased $75.0 million of common stock in Q4 2025, and its Board of Directors replenished the share repurchase authority by $100.0 million in January 2026. Cash flow from operations for FY 2025 was $389.5 million.

- Manhattan Associates (MANH) exceeded Q4 2025 expectations, reporting revenue of approximately $270.4 million and non-GAAP EPS of $1.21, which resulted in a stock increase in after-hours trading.

- The company achieved record cloud bookings in Q4 2025, with cloud subscription revenue growing approximately 20% to $108.6 million, contributing to full-year cloud revenue of approximately $408.1 million.

- For the full year 2025, total revenue reached approximately $1.08 billion and non-GAAP diluted EPS was $5.06.

- Management issued a 2026 outlook projecting RPO growth of 18–20% and total revenue between $1.133 billion and $1.137 billion, supported by ramped ARR exceeding $600 million.

- Pacsun successfully implemented Manhattan Active® Point of Sale (POS) across 300 plus stores in just eight weeks, following a five-month pilot phase.

- The cloud-native solution unifies commerce, enabling mobile checkout and seamless omnichannel fulfillment across various platforms like Instagram, Amazon, and TikTok.

- This implementation led to record breaking revenue for Pacsun during the peak holiday season and reduced logistics expenses by 25% by fulfilling 40% of online orders via stores.

- The system also improved operational efficiency, resolving unified orders 50% faster during peak demand.

- Manhattan Associates (MANH) has achieved FedRAMP authorization with FEMA for its Warehouse Management System (WMS), which expands its secure cloud offerings for U.S. government agencies and federal contractors.

- This milestone positions Manhattan as the only supply chain commerce provider with FedRAMP authorization, a government-wide program that standardizes security for cloud products and services used by federal agencies.

- The authorization highlights Manhattan's commitment to providing federal agencies with high levels of data security, compliance, and reliability, with these security enhancements also benefiting commercial customers.

- Manhattan Associates reported Q3 2025 revenue of $275.8 million, a 3.4% year-over-year increase, with cloud-based supply chain software revenue growing 21%.

- Adjusted earnings per share reached $1.36, beating estimates, although GAAP earnings per share decreased slightly to $0.96 from $1.03 in the previous year.

- The company raised its share buyback authorization to $100 million after repurchasing over 233,000 shares during the quarter.

- Current Chairman and CEO, Eddie Capel, is set to transition to a non-executive chairman position effective January 1, 2026.

Quarterly earnings call transcripts for MANHATTAN ASSOCIATES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more