Earnings summaries and quarterly performance for MERIT MEDICAL SYSTEMS.

Executive leadership at MERIT MEDICAL SYSTEMS.

Martha G. Aronson

President and Chief Executive Officer

Brian G. Lloyd

Chief Legal Officer and Corporate Secretary

Fred P. Lampropoulos

Executive Chairman of the Board

Michel J. Voigt

Chief Human Resources Officer

Neil W. Peterson

Chief Operating Officer

Raul Parra

Chief Financial Officer and Treasurer

Board of directors at MERIT MEDICAL SYSTEMS.

David K. Floyd

Director

F. Ann Millner

Lead Independent Director

Laura S. Kaiser

Director

Lonny J. Carpenter

Director

Lynne N. Ward

Director

Michael R. McDonnell

Director

Silvia M. Perez

Director

Stephen C. Evans

Director

Thomas J. Gunderson

Director

Research analysts who have asked questions during MERIT MEDICAL SYSTEMS earnings calls.

David Rescott

Baird

6 questions for MMSI

Jason Bednar

Piper Sandler Companies

6 questions for MMSI

Jayson Bedford

Raymond James

6 questions for MMSI

Michael Petusky

Barrington Research

6 questions for MMSI

John Young

Canaccord Genuity - Global Capital Markets

5 questions for MMSI

James Sidoti

Sidoti & Company

4 questions for MMSI

Steven Lichtman

Oppenheimer & Co. Inc.

4 questions for MMSI

Michael Matson

Needham & Company

3 questions for MMSI

Aidan Lahey

Bank of America Securities

2 questions for MMSI

Craig Bijou

Bank of America Securities

2 questions for MMSI

Gursimran Kaur

Wells Fargo & Company

2 questions for MMSI

Jim Sidoti

Sidoti & Company, LLC

2 questions for MMSI

Larry Biegelsen

Wells Fargo & Company

2 questions for MMSI

Mike Matson

Needham & Company, LLC

2 questions for MMSI

Robbie Marcus

JPMorgan Chase & Co.

2 questions for MMSI

Robert Marcus

JPMorgan Chase & Co.

2 questions for MMSI

Sam Eiber

BTIG, LLC

2 questions for MMSI

Joseph on for Mike Matson

Needham

1 question for MMSI

Lawrence Biegelsen

Wells Fargo

1 question for MMSI

Recent press releases and 8-K filings for MMSI.

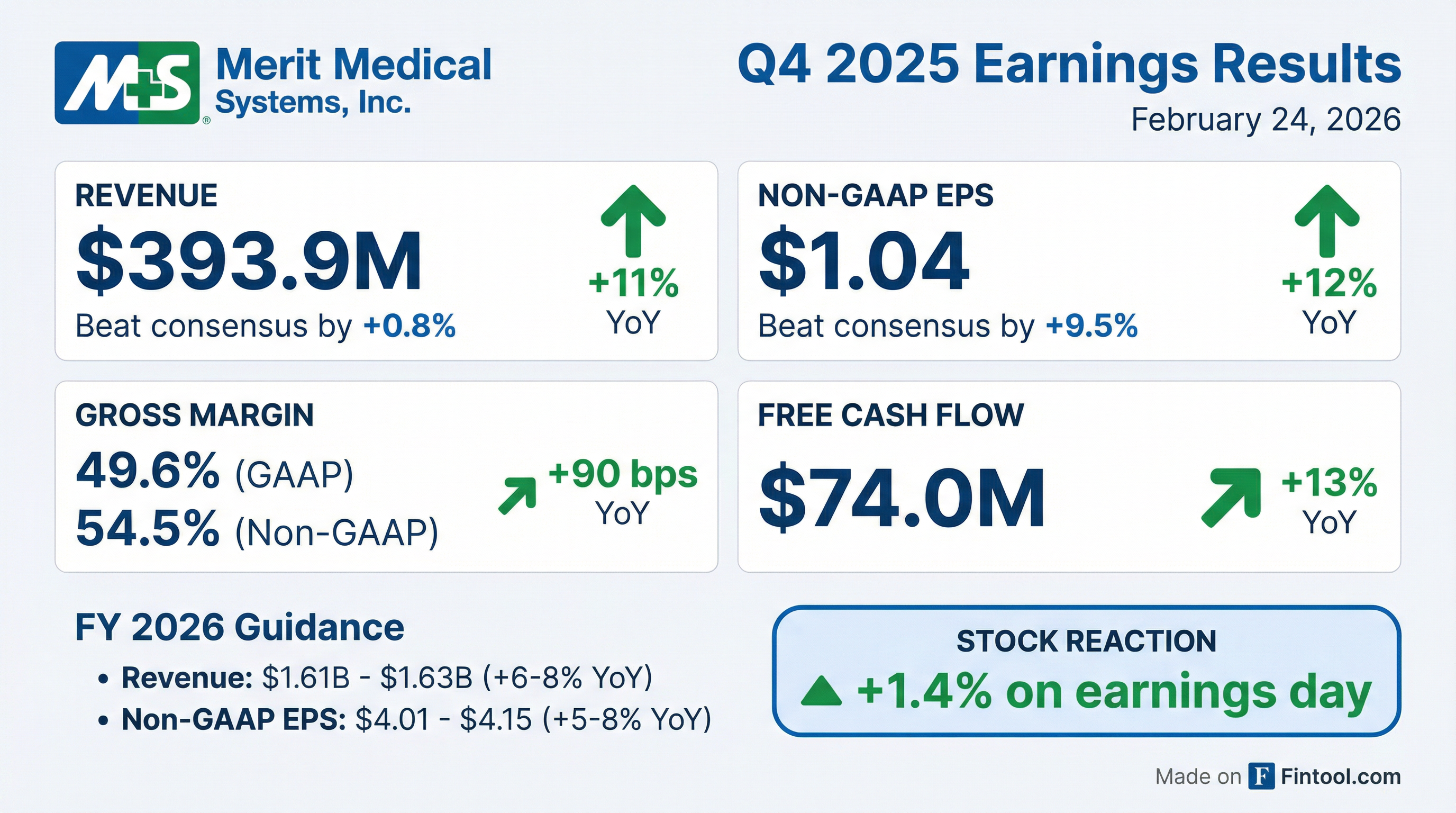

- Merit Medical Systems reported GAAP revenue of $393.9 million and GAAP diluted earnings per share of $0.63 for the fourth quarter of 2025.

- For the full fiscal year 2025, GAAP revenue reached $1,515.9 million and GAAP diluted earnings per share was $2.13.

- The company generated operating cash flow of $98.5 million in Q4 2025 and $297.4 million for the full fiscal year 2025.

- Merit Medical Systems issued Fiscal Year 2026 guidance, forecasting total revenue between $1.610 billion and $1.630 billion and non-GAAP earnings per share between $4.01 and $4.15.

- Merit Medical Systems (MMSI) reported Q4 2025 total revenue of $393.9 million, an 11% year-over-year GAAP increase, and 12% growth in non-GAAP diluted EPS. For the full year 2025, the company achieved 11% total constant currency revenue growth and more than $215 million in free cash flow, exceeding original guidance ranges.

- The company provided financial guidance for 2026, projecting total GAAP net revenue growth of 6%-8% and non-GAAP diluted EPS in the range of $4.01-$4.15, representing a 5%-8% year-over-year increase.

- MMSI is tracking towards its Continued Growth Initiatives (CGI) targets for the three-year period ending December 31, 2026, aiming for an organic constant currency revenue CAGR of 5%-7%, a non-GAAP operating margin of 20%-22%, and cumulative free cash flow generation of more than $400 million.

- As of December 31, 2025, MMSI's balance sheet showed $446.4 million in cash and cash equivalents, $747.5 million in total debt, and a net leverage ratio of 1.6 times. The company also expressed an appetite for slightly larger than tuck-in acquisitions.

- Merit Medical Systems (MMSI) reported strong Q4 2025 financial results, with total revenue of $393.9 million, up 11% year-over-year on a GAAP basis, and non-GAAP EPS of $1.04, an increase of 12% year-over-year, both exceeding expectations.

- For the full year 2025, the company delivered 11% total constant currency revenue growth, a 20.3% non-GAAP operating margin, and generated nearly $216 million of free cash flow, all surpassing the high end of original guidance.

- MMSI introduced 2026 financial guidance, projecting 5%-7% year-over-year constant currency revenue growth, non-GAAP diluted EPS in the range of $4.01-$4.15, and at least $200 million in free cash flow.

- The company completed the divestiture of its DualCap product line for $28 million, which contributed approximately $20 million in revenue in 2025 and is anticipated to be a 140 basis point headwind to total constant currency revenue growth in 2026.

- Merit Medical Systems reported Q4 2025 total revenue of $393.9 million, up 11% GAAP and 10% constant currency, with 6.6% organic constant currency growth. The company achieved a non-GAAP operating margin of 21% and generated a record $74 million in free cash flow.

- For the full year 2025, the company delivered 11% total constant currency revenue growth, a 20.3% non-GAAP operating margin, and nearly $216 million of free cash flow, all exceeding the high end of its original guidance.

- The company issued fiscal year 2026 guidance, projecting total GAAP net revenue growth of 6%-8% (or 5%-7% constant currency) and non-GAAP diluted EPS of $4.01-$4.15, representing 5%-8% year-over-year growth.

- Merit Medical completed the divestiture of its DualCap product line for $28 million in February 2026, which contributed approximately $20 million in 2025 revenue and is expected to be a 140 basis point headwind to 2026 constant currency revenue growth.

- The company is on track to meet its Continued Growth Initiative targets for the three-year period ending December 31, 2026, including an organic constant currency revenue CAGR of 5%-7%, a non-GAAP operating margin of 20%-22%, and cumulative free cash flow generation of more than $400 million.

- Merit Medical reported Q4 2025 revenue of $393.9 million, an 11% increase, and GAAP EPS of $0.63, up 37%, with Non-GAAP EPS of $1.04, up 12%.

- For the full year 2025, the company reported revenue of $1.516 billion, up 12%, and GAAP EPS of $2.13, up 5%, with Non-GAAP EPS of $3.83, up 11%.

- Merit Medical generated free cash flow of $74.0 million in Q4 2025 and $215.7 million for the full year 2025.

- The company issued Fiscal Year 2026 guidance for total revenue between $1.610 billion and $1.630 billion (up 6% - 8% reported) and Non-GAAP EPS between $4.01 and $4.15 (up 5% - 8%).

- Martha Aronson was appointed CEO on October 3, 2025, succeeding the company's founder, and F. Ann Millner transitioned to Chairman of the Board.

- Merit Medical achieved $1.5 billion in revenues for 2025, an 11% increase, and pre-announced preliminary Q4 2025 revenue between $389 million-$395 million with 8%-10% constant currency growth.

- The company is tracking towards its Continued Growth Initiatives (CGI) targets for FY23-2026, aiming for a 5%-7% revenue CAGR, 20%-22% non-GAAP operating margin, and more than $400 million in cumulative free cash flow.

- Merit Medical plans to continue its M&A strategy, focusing on strategic tuck-in acquisitions, potentially slightly larger, but not transformational deals, supported by a strong balance sheet.

- The company's first PMA-approved therapeutic product, WRAPSODY, has an initial U.S. addressable market of approximately 95,000 stent units annually, and despite reimbursement adjustments, it remains margin accretive.

- Martha Aronson was appointed CEO on October 3, 2025, succeeding founder Fred Lampropoulos, with F. Ann Millner becoming Chairman of the Board, indicating a shift to a founder-inspired organization.

- Merit Medical delivered $1.5 billion in revenue for full-year 2025, up 11%, and preliminary Q4 2025 revenue of $389 million-$395 million with 8%-10% constant currency growth. The company is on track for its FY23-2026 Continued Growth Initiatives, targeting a 5%-7% revenue CAGR, 20%-22% non-GAAP operating margin, and over $400 million in cumulative free cash flow.

- The company plans to continue its M&A strategy, having invested over $1 billion since 2016, focusing on strategic tuck-ins and potentially slightly larger deals, supported by a strong balance sheet with leverage just under two times. M&A remains the primary use of cash.

- Therapeutic products, which comprise one-third of global revenues, are a key growth driver, achieving a 19% compound annual growth rate over the last three years, significantly outpacing foundational products at 6% CAGR.

- Merit Medical Systems, Inc. appointed F. Ann Millner, Ed.D. as Chair of the Board, effective January 5, 2026, following the resignation of Fred P. Lampropoulos on January 4, 2026.

- The company reported preliminary unaudited revenue for the fourth quarter of 2025 as follows :

| Metric | Q4 2025 |

|---|---|

| Reported Revenue ($USD Millions) | $389 - $395 |

| Reported Revenue Year-over-Year Growth (%) | 10% - 11% |

| Constant Currency Revenue ($USD Millions) | $384.6 - $390.6 |

| Constant Currency Revenue Year-over-Year Growth (%) | 8% - 10% |

- Merit plans to announce its full financial results for the quarter and year ended December 31, 2025, and issue fiscal year 2026 guidance on Tuesday, February 24, 2026.

- F. Ann Millner was appointed Chair of the Board of Merit Medical Systems, Inc. effective January 5, 2026, succeeding Fred P. Lampropoulos who resigned on January 4, 2026.

- The company reported preliminary unaudited revenue for the fourth quarter of 2025 in the range of approximately $389 million to $395 million, representing a year-over-year increase of approximately 10% to 11%.

- Merit Medical Systems plans to announce its full financial results for the quarter and year ended December 31, 2025, and issue fiscal year 2026 guidance on February 24, 2026.

- MMI (Medical Microinstruments, Inc.) will participate in the 44th Annual J.P. Morgan Healthcare Conference from January 12-15, 2026, marking its fourth consecutive year presenting in the private company track.

- CEO Mark Toland will provide a company update on Monday, January 12 at 9:00 AM PT, focusing on commercial progress, platform innovation, and clinical advancement of the Symani® Surgical System.

- In 2025, MMI achieved significant milestones, including FDA clearance and first U.S. clinical use of robotic microsurgical dissection instruments, and the establishment of the first reimbursement code for surgical lymphatic procedures.

- The company also initiated major U.S. clinical trials, such as PRECISE and two neurosurgery studies, expanding its clinical advancement efforts.

Quarterly earnings call transcripts for MERIT MEDICAL SYSTEMS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more