Earnings summaries and quarterly performance for MERCURY SYSTEMS.

Executive leadership at MERCURY SYSTEMS.

Board of directors at MERCURY SYSTEMS.

Research analysts who have asked questions during MERCURY SYSTEMS earnings calls.

Peter Arment

Robert W. Baird & Co.

6 questions for MRCY

Seth Seifman

JPMorgan Chase & Co.

6 questions for MRCY

Jonathan Ho

William Blair & Company

5 questions for MRCY

Kenneth Herbert

RBC Capital Markets

5 questions for MRCY

Michael Ciarmoli

Truist Securities, Inc.

5 questions for MRCY

Noah Poponak

Goldman Sachs

4 questions for MRCY

Peter Skibitski

Alembic Global Advisors

4 questions for MRCY

Conor Walters

Jefferies

3 questions for MRCY

Austin Moeller

Canaccord Genuity

2 questions for MRCY

Kyle Baker

Jefferies

2 questions for MRCY

Brian Gesuale

Raymond James & Associates, Inc.

1 question for MRCY

Ronald Epstein

Bank of America

1 question for MRCY

Samuel Struhsaker

Truist Securities, Inc.

1 question for MRCY

Sheila Kahyaoglu

Jefferies

1 question for MRCY

Recent press releases and 8-K filings for MRCY.

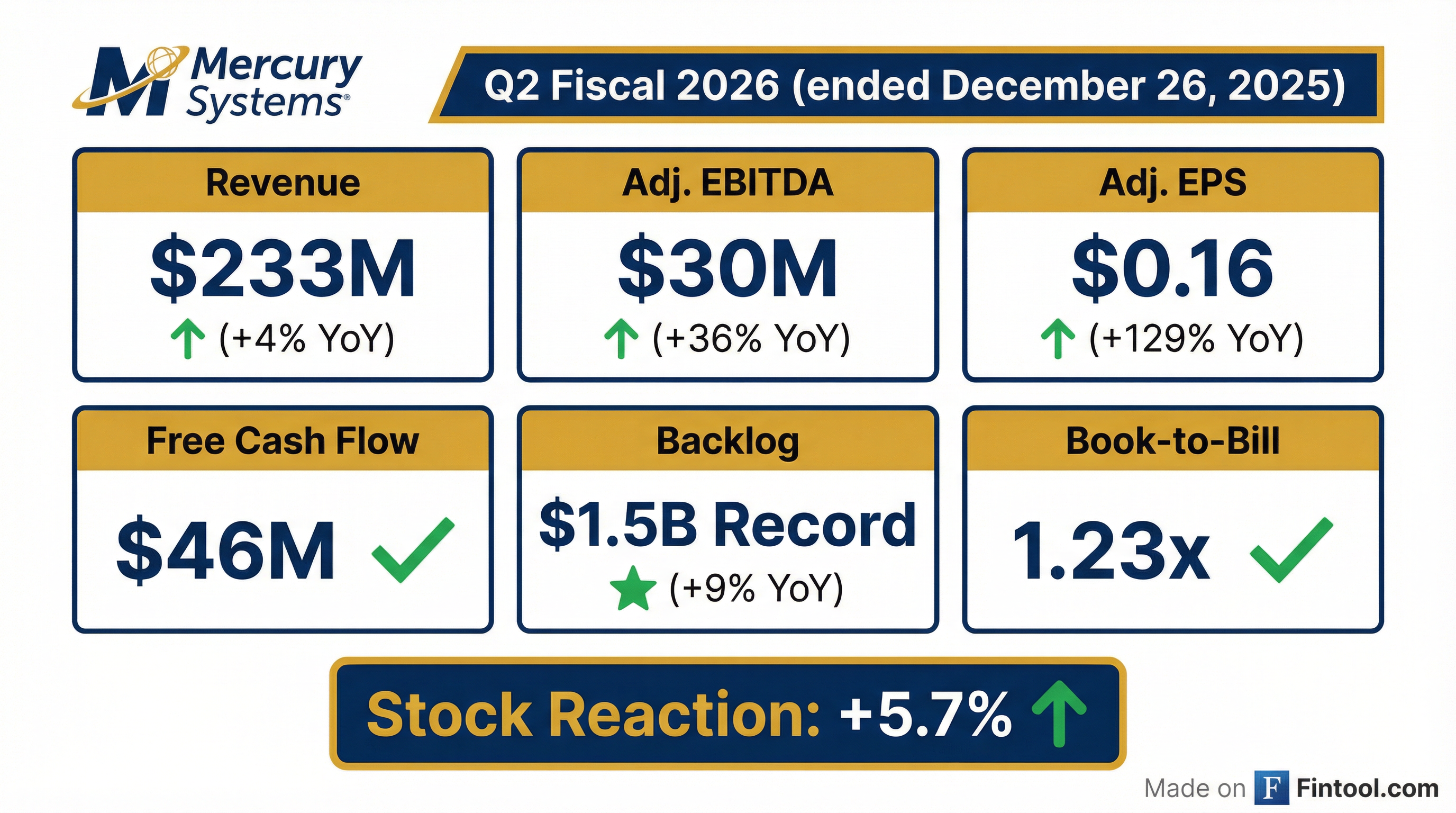

- Mercury Systems (MRCY) reported strong Q2 FY 2026 results, with revenue of $233 million, adjusted EBITDA of $30 million, and free cash flow of $46 million, exceeding expectations.

- Bookings reached $288 million with a 1.23 book-to-bill, contributing to a record backlog approaching $1.5 billion.

- The company achieved a 12.9% adjusted EBITDA margin in Q2, up 300 basis points year-over-year, partly driven by accelerating approximately $30 million of revenue and $30 million of cash from Q3 into Q2.

- Net working capital decreased $61 million year-over-year to $414 million, and net debt was reduced to $257 million, the lowest since Q1 FY 2022.

- For FY 2026, MRCY maintains its outlook for low single-digit annual revenue growth and adjusted EBITDA margin approaching mid-teens, though Q3 revenue and adjusted EBITDA margin are expected to be lower due to accelerations into the first half.

- Mercury (MRCY) reported Q2 FY 2026 bookings of $288 million with a 1.23 book-to-bill, contributing to a record backlog approaching $1.5 billion, an 8.8% increase year-over-year.

- For Q2 FY 2026, revenue was $233 million, up 4.4% year-over-year, and adjusted EBITDA was $30 million, a 36.3% increase year-over-year, resulting in an adjusted EBITDA margin of 12.9%.

- The company generated $46 million in free cash flow, ending the quarter with $335 million in cash on hand.

- Management maintained its full-year FY 2026 outlook, projecting low single-digit annual revenue growth, adjusted EBITDA margin approaching mid-teens, and positive free cash flow for the year. Q2 results included approximately $30 million of revenue and $10 million of adjusted EBITDA accelerated from Q3, which is expected to lead to lower Q3 revenue and a free cash flow outflow for Q3.

- Mercury Systems reported Q2 FY26 bookings of $287.5 million and a book-to-bill ratio of 1.23, leading to a record backlog approaching $1.5 billion.

- Q2 FY26 revenue was $232.9 million, contributing to a record first half revenue increase of 7.1% year-over-year. The company also achieved adjusted EBITDA of $30.0 million, representing a 36% increase year-over-year, with an adjusted EBITDA margin of 12.9%, up 300 basis points from the prior year.

- The company generated free cash flow of $45.7 million in Q2 FY26 and ended the quarter with $335 million of cash on hand. Net working capital was down $61 million year-over-year.

- For the full year FY26, Mercury Systems continues to expect low single-digit revenue growth and an adjusted EBITDA margin approaching mid-teens, with positive free cash flow.

- Mercury Systems (MRCY) reported strong Q2 FY 2026 results, including $233 million in revenue, $30 million in adjusted EBITDA (12.9% margin), and $46 million in free cash flow.

- The company achieved $288 million in bookings, leading to a 1.23 book-to-bill ratio and a record backlog approaching $1.5 billion.

- Q2 performance benefited from the acceleration of approximately $30 million of revenue, $10 million of adjusted EBITDA, and $30 million of cash primarily planned for the third quarter.

- For the full year FY 2026, the company maintains its outlook for low single-digit revenue growth and adjusted EBITDA margin approaching mid-teens, while expecting Q3 revenue to be down year-over-year and Q3 free cash flow to be an outflow due to the Q2 accelerations.

- Mercury Systems reported Q2 FY26 bookings of $288 million, an 18.6% increase year-over-year, with a 1.23 book-to-bill ratio, contributing to a record backlog of $1.5 billion.

- For Q2 FY26, revenue was $233 million, adjusted EBITDA increased 36.3% year-over-year to $30 million (12.9% adjusted EBITDA margin), and adjusted EPS was $0.16 per share, up from $0.07 in Q2 FY25.

- The company generated operating cash flow of $52 million and free cash flow of $46 million in Q2 FY26.

- For the full fiscal year 2026, Mercury Systems anticipates low single-digit revenue growth and an adjusted EBITDA margin approaching mid-teens, with Q3 revenue expected to be down year-over-year followed by a ramp in Q4.

- Mercury Systems reported Q2 FY26 bookings of $288 million, an 18.6% year-over-year increase, resulting in a record backlog of $1.5 billion.

- Q2 FY26 revenue reached $233 million, contributing to record first-half revenue with a 7.1% year-over-year increase.

- The company achieved adjusted EBITDA of $30 million in Q2 FY26, up 36.3% year-over-year, and reported adjusted EPS of $0.16.

- Operating cash flow was $52 million and free cash flow was $46 million for Q2 FY26.

- Mercury, a fintech company, has launched Mercury Personal, a premium consumer banking service for builders and founders, marking its expansion into the broader consumer market.

- This new service offers features such as shared access, high-yield savings, and investment options, available for an annual subscription fee of $240.

- Mercury Personal customers hold average balances over $80,000, which is more than one-third higher than the average U.S. balance.

- The service provides competitive yields on high-yield savings accounts, exceeding the national average by more than 5x, and offers access to up to $5M FDIC insurance through partner banks.

- Mercury Systems (MRCY) reported Q1 2026 revenue of $225.2 million, marking a 10.2% increase year-over-year.

- The company achieved Q1 adjusted EBITDA of $35.6 million, with an adjusted EBITDA margin of 15.8%, representing a 530 basis point improvement year-over-year.

- Bookings for Q1 reached $250.2 million, leading to a 1.11 book-to-bill ratio and a record backlog of $1.4 billion.

- Free cash outflow improved by $16.5 million year-over-year to $4.4 million in Q1, with $304.7 million of cash on hand at the end of the quarter.

- For fiscal year 2026, Mercury Systems anticipates low single-digit revenue growth, adjusted EBITDA margins approaching the mid-teens, and expects to be free cash flow positive.

- Mercury Systems reported Q1 FY2026 revenue of $225 million, up 10.2% year-over-year, and adjusted EBITDA of $35.6 million, up 66% year-over-year, with an adjusted EBITDA margin of 15.8%.

- The company achieved record bookings of $250 million and a book-to-bill ratio of 1.11, contributing to a record backlog of $1.4 billion. Free cash flow was an outflow of $4.4 million, a $16.5 million improvement year-over-year.

- For FY2026, the company maintains its outlook for low single-digit annual revenue growth and expects to be free cash flow positive for the year, with adjusted EBITDA margins approaching mid-teens. Q2 revenue and adjusted EBITDA margin are anticipated to be lower due to accelerated deliveries into Q1.

- A new $200 million share buyback authorization was announced, and the revolving credit facility was extended by five years to $850 million, enhancing financial flexibility.

- Mercury Systems reported strong Q1 FY26 results, with revenue up 10.2% year-over-year to $225 million and adjusted EBITDA increasing 66% year-over-year to $35.6 million, partly due to accelerated deliveries.

- The company achieved a record backlog of $1.4 billion with a 1.11 book-to-bill in Q1 FY26, reflecting solid bookings of $250 million.

- MRCY announced a new $200 million share buyback authorization, underscoring confidence in the business and improving fundamentals.

- For the full fiscal year 2026, the company maintains its outlook for low single-digit annual revenue growth and expects to be free cash flow positive, with margins expanding in the second half.

Quarterly earnings call transcripts for MERCURY SYSTEMS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more