Earnings summaries and quarterly performance for NAVIENT.

Executive leadership at NAVIENT.

David Yowan

President and Chief Executive Officer

David Green

Executive Vice President and Chief Executive Officer, Earnest

Joe Fisher

Chief Financial Officer and Principal Accounting Officer

Steve Hauber

Executive Vice President and Chief Administrative Officer

Troy Standish

Executive Vice President and Chief Operating Officer

Board of directors at NAVIENT.

Research analysts who have asked questions during NAVIENT earnings calls.

Jeffrey Adelson

Morgan Stanley

5 questions for NAVI

Moshe Orenbuch

TD Cowen

5 questions for NAVI

Richard Shane

JPMorgan Chase & Co.

5 questions for NAVI

Sanjay Sakhrani

Keefe, Bruyette & Woods (KBW)

5 questions for NAVI

William Ryan

Seaport Research Partners

5 questions for NAVI

Terry Ma

Barclays

4 questions for NAVI

Mark DeVries

Deutsche Bank

3 questions for NAVI

Nathaniel Richam-Odoi

Bank of America

3 questions for NAVI

John Hecht

Jefferies

2 questions for NAVI

Ryan Shelley

Bank of America

2 questions for NAVI

Recent press releases and 8-K filings for NAVI.

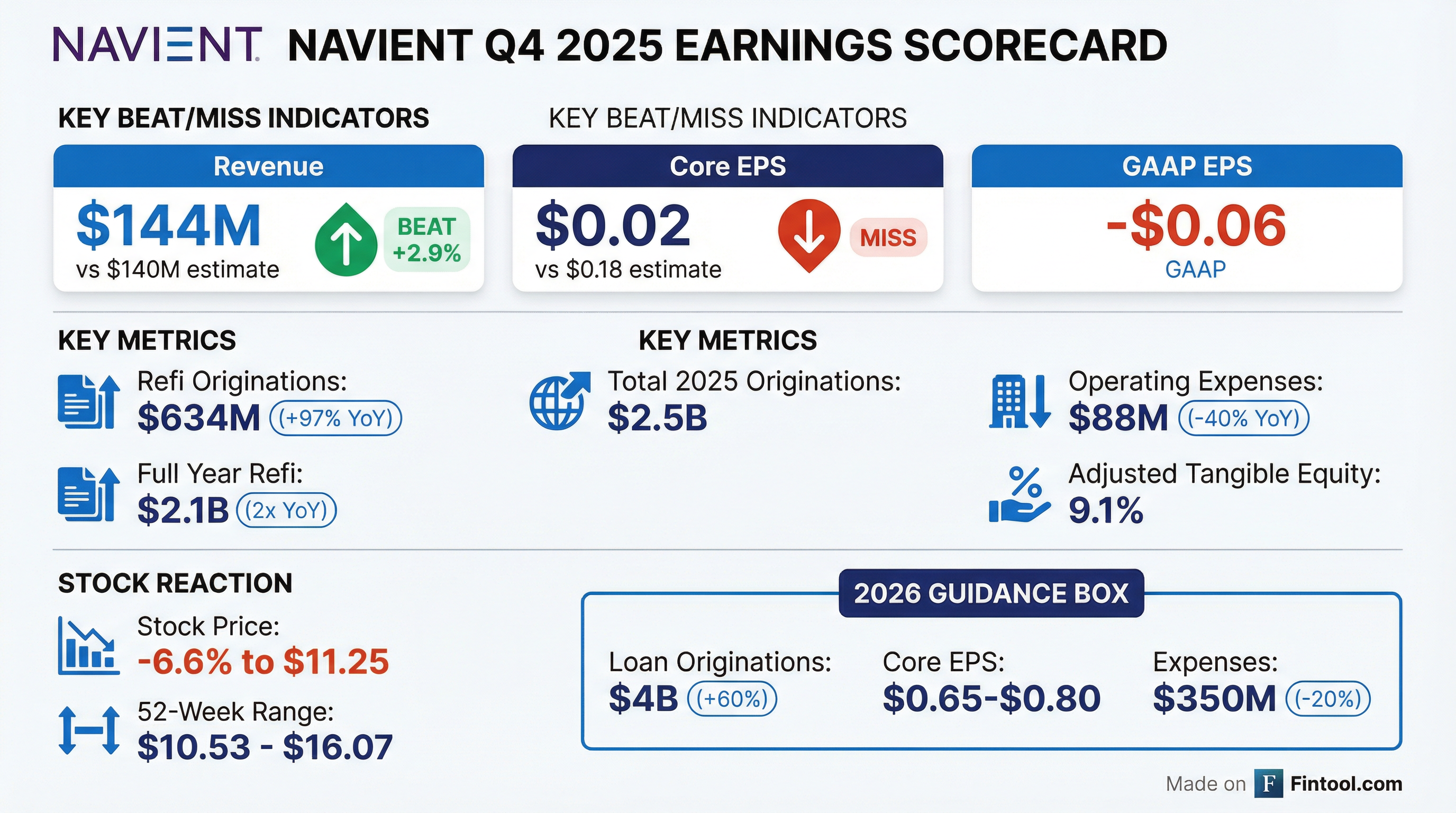

- Navient reported a GAAP net loss of $5 million ($0.06 diluted loss per share) and Core Earnings net income of $2 million ($0.02 diluted earnings per share) for the fourth quarter of 2025. For the full year 2025, the company reported a GAAP net loss of $80 million ($0.81 diluted loss per share) and a Core Earnings net loss of $35 million ($0.35 diluted loss per share).

- Fourth-quarter 2025 results included a $43 million provision for loan losses in the Consumer Lending segment, with $34 million primarily reflecting macroeconomic outlook and delinquency trends, and $14 million in regulatory and restructuring expenses.

- The Consumer Lending segment's net income was $25 million, driven by $680 million of Private Education Loan originations, an 87% increase compared to the fourth quarter of 2024.

- Operating expenses for Q4 2025 were $88 million, a $58 million decrease from Q4 2024, largely due to the sale of the government services business. During the quarter, Navient also repurchased $26 million of common shares and paid $15 million in common stock dividends.

- Navient Corporation published its "Phase 2 Strategy Update" presentation on November 19, 2025, outlining its strategy to grow its Earnest division.

- The company anticipates $119 million in pre-tax savings over the remaining 17-year life of its legacy portfolio due to restructuring.

- Earnest's annual originations are projected to increase from $971 million in 2023 to $2,400 million in 2025E, representing a 2.5x growth.

- Earnest plans to launch a Personal Loans pilot in 2026, with a full launch for high-value customers in 2027, and will originate In-School loans within Navient in 2028.

- For 2025E, Earnest's illustrative financial snapshot shows $219 million in Total Revenue and $75 million in Operating Profit.

- Navient reported a GAAP net loss of $86 million ($0.87 diluted loss per share) and a Core Earnings net loss of $83 million ($0.84 diluted loss per share) for Q3 2025, primarily driven by a $168 million provision for loan losses.

- The Consumer Lending segment, despite a $76 million net loss, saw Private Education Loan originations increase by 58% to $788 million.

- The company repurchased $26 million of common shares during the quarter and authorized a new $100 million share repurchase program.

- Navient has ceased providing Business Processing segment services after the sale of its government services business in February 2025.

Quarterly earnings call transcripts for NAVIENT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more