Earnings summaries and quarterly performance for NATIONAL FUEL GAS.

Executive leadership at NATIONAL FUEL GAS.

David P. Bauer

President and Chief Executive Officer

Elena G. Mendel

Controller and Principal Accounting Officer

Justin I. Loweth

President, Seneca Resources Company and National Fuel Gas Midstream Company

Lee E. Hartz

General Counsel and Secretary

Martin A. Krebs

Chief Information Officer

Michael D. Colpoys

President, National Fuel Gas Distribution Corporation

Ronald C. Kraemer

Chief Operating Officer

Timothy J. Silverstein

Chief Financial Officer

Board of directors at NATIONAL FUEL GAS.

Barbara M. Baumann

Director

David C. Carroll

Director

David F. Smith

Chairman of the Board

David H. Anderson

Director

Jeffrey W. Shaw

Lead Independent Director

Joseph N. Jaggers

Director

Rebecca Ranich

Director

Ronald J. Tanski

Director

Steven C. Finch

Director

Thomas E. Skains

Director

Research analysts who have asked questions during NATIONAL FUEL GAS earnings calls.

Noah Hungness

Firm Not Mentioned in Transcript

7 questions for NFG

John Freeman

Raymond James Financial

5 questions for NFG

Zach Parham

JPMorgan Chase & Co.

5 questions for NFG

Timothy Winter

Gabelli Funds

4 questions for NFG

Geoff Jay

Daniel Energy Partners

3 questions for NFG

Greta Drefke

Goldman Sachs

3 questions for NFG

Jeff Bellman

Daniel Energy Partners

2 questions for NFG

Margaret Drefke

Goldman Sachs

2 questions for NFG

Tim Schneider

Schneider Capital Group

2 questions for NFG

Ati Modak

Goldman Sachs

1 question for NFG

Gretta Drew

Goldman Sachs Group, Inc.

1 question for NFG

Recent press releases and 8-K filings for NFG.

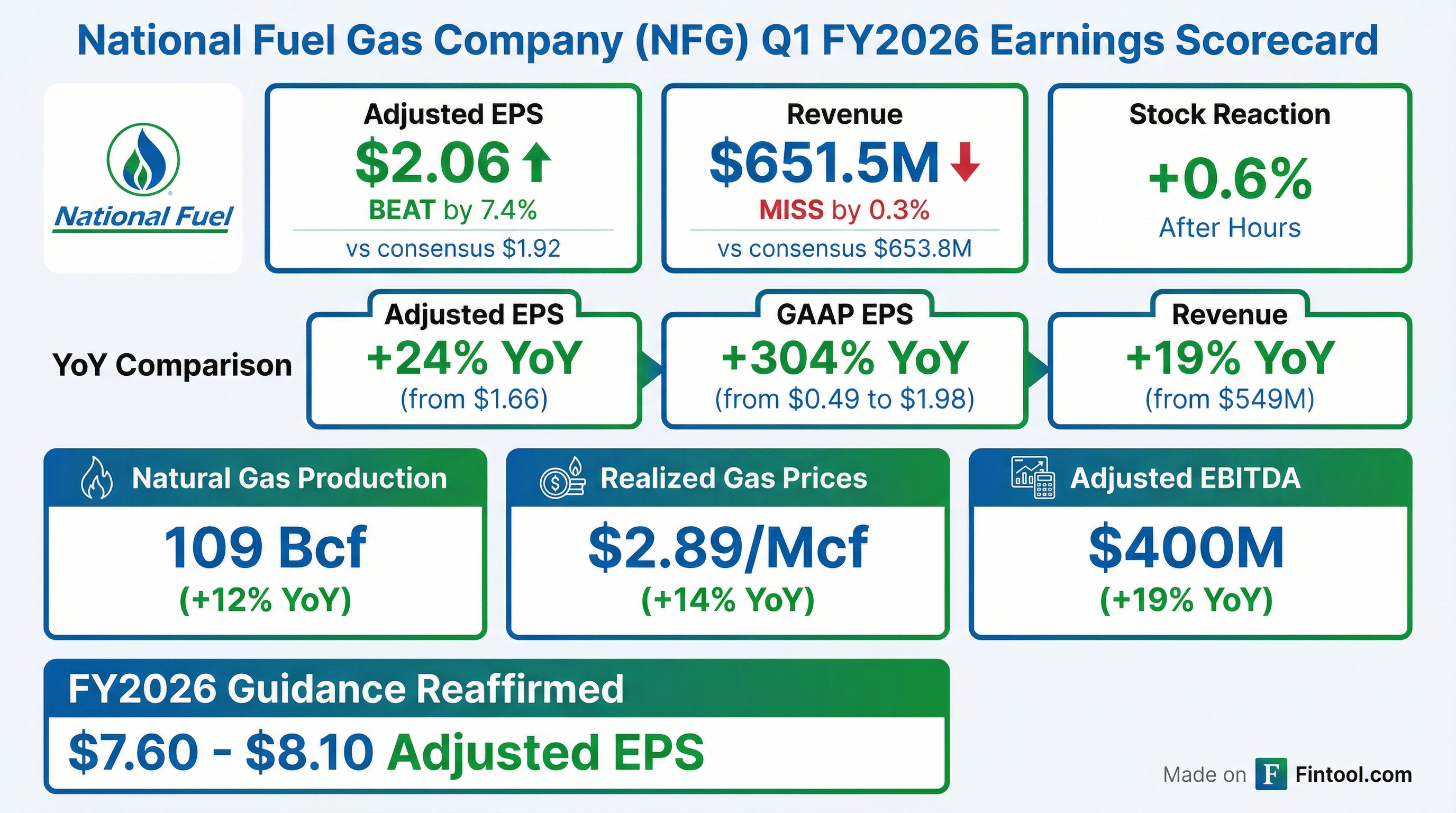

- National Fuel Gas Company reported adjusted earnings per share of $2.06 for Q1 Fiscal 2026, which was in line with expectations and keeps the company on track for its full-year guidance.

- The integrated upstream and gathering business saw a 29% increase in adjusted EBITDA compared to the prior year, driven by higher production and natural gas prices.

- The acquisition of CenterPoint's Ohio LDC is progressing towards a Q4 calendar 2026 close, with a $350 million private placement of common stock completed in December to cover equity needs. The Ohio regulatory environment is also improving with a modernized rate-making process.

- Fiscal 2026 guidance was reaffirmed, with projected production of 440-455 BCF and capital expenditures of $560 million-$610 million. The company anticipates 14% adjusted EPS growth for fiscal 2026 over the previous year.

- National Fuel Gas Company reported adjusted earnings per share of $2.06 for the first quarter of fiscal 2026, which was in line with expectations.

- The company reaffirmed its full-year adjusted EPS guidance range of $7.60-$8.10, with a midpoint of $7.85.

- The acquisition of CenterPoint's Ohio LDC is on track to close in the fourth quarter of calendar 2026, with $350 million in common equity raised in December and an expected $1.5 billion in long-term debt issuance.

- The integrated upstream and gathering business achieved Q1 net production of 109 BCF, marking a 12% increase over the first quarter of fiscal 2025, and reaffirmed fiscal 2026 production guidance of 440-455 BCF.

- National Fuel Gas Company reported adjusted earnings per share of $2.06 for Q1 2026, in line with expectations, and reaffirmed fiscal 2026 guidance, projecting 14% adjusted EPS growth over last year.

- The integrated upstream and gathering business saw a 29% increase in adjusted EBITDA compared to the prior year, driven by higher production and natural gas prices, and is on track for a 30% gain in capital efficiency since 2023.

- The acquisition of CenterPoint's Ohio LDC is expected to close in Q4 calendar 2026, with the $350 million equity need for the transaction satisfied through a private placement of common stock. The Ohio Commission set the ROE at 9.79% for CenterPoint's rate case.

- Key pipeline projects, including the Tioga Pathway project and Shippingport Lateral project, are progressing, with the latter targeting a late calendar 2026 in-service date. The Pennsylvania utility filed a new rate case requesting an approximately $20 million increase in rates.

- The company maintains a strong outlook for natural gas, expecting prices in the $3-$5 range, and is focused on operational excellence, including expanding Seneca's inventory, with Upper Utica delineation essentially doubling its core Tioga inventory estimate.

- National Fuel Gas Company reported adjusted earnings per share (EPS) of $2.06 for the first quarter of fiscal 2026, an increase of 24% compared to $1.66 in the prior year.

- The company reaffirmed its fiscal 2026 adjusted EPS guidance range of $7.60 to $8.10 per share.

- The Integrated Upstream and Gathering segment's adjusted EPS increased $0.42, or 45%, driven by a 14% increase in natural gas price realizations and 12% growth in natural gas production.

- National Fuel successfully issued $350 million in common equity to fund the CenterPoint Ohio gas utility acquisition, which is anticipated to close in the fourth quarter of calendar 2026.

- The Shippingport Lateral Project and Tioga Pathway Project remain on track for a late calendar 2026 in-service date.

- National Fuel Gas Company (NFG) reaffirmed its FY26 Adjusted EPS guidance of $7.60 - $8.10, with a midpoint of $7.85, representing a 14% increase from FY25. The company also projects a consolidated 3-Year Adjusted EPS CAGR of greater than 10% (FY24-27E).

- The acquisition of CenterPoint's Ohio gas utility business for $2.62 billion is on track to close in Q4 calendar 2026, expected to enhance regulated earnings growth and be accretive to long-term EPS.

- To help finance the acquisition and maintain its investment-grade credit rating, NFG issued $350 million in common equity through a private placement.

- Consolidated capital expenditures for FY26 are projected to be between $955 million and $1,065 million.

- National Fuel Gas Company reported GAAP earnings of $181.6 million ($1.98 per share) and adjusted earnings of $187.7 million ($2.06 per share) for the first quarter of fiscal 2026, marking a 24% increase in adjusted EPS compared to the prior year.

- The Integrated Upstream and Gathering segment's adjusted EPS increased 45%, driven by a 14% increase in natural gas price realizations and 12% production growth. The Utility segment's net income also grew 5%.

- The company reaffirmed its fiscal 2026 adjusted EPS guidance range of $7.60 to $8.10 per share, based on an average NYMEX natural gas price assumption of $3.75 per MMBtu for the remaining nine months.

- National Fuel successfully issued $350 million in common equity through a private placement to fund the CenterPoint Ohio gas utility acquisition, which is expected to close in the fourth quarter of calendar 2026 and is not anticipated to impact fiscal 2026 guidance.

- The Shippingport Lateral Project received FERC authorization and, along with the Tioga Pathway Project, remains on track for a late calendar 2026 in-service date.

- National Fuel Gas Company announced a successful private placement of common stock.

- The company expects to receive gross proceeds of $350 million from the sale of 4,402,513 shares at a purchase price of $79.50 per share.

- The offering is expected to close on December 17, 2025.

- Net proceeds from the offering will be used for general corporate purposes, including to finance a portion of the purchase price for the previously announced acquisition of CenterPoint's Ohio regulated gas utility business.

- National Fuel Gas Company (NFG) announced a private placement of common stock, expected to generate $350 million in gross proceeds.

- Approximately 4.4 million shares of common stock were sold at a purchase price of $79.50 per share.

- The offering is anticipated to close on December 17, 2025.

- The net proceeds will be used for general corporate purposes, including financing a portion of the previously announced acquisition of CenterPoint's Ohio regulated gas utility business, which satisfies the common equity needs for that transaction and aims to maintain the company's current investment grade credit rating.

- Initial results from New Found Gold's 2025 grade control drilling program at the Keats zone within the Queensway Gold Project confirmed high-grade, near-surface gold mineralization, with significant intervals such as 219 g/t over 9.35 meters and 160 g/t over 10.30 meters.

- These results, covering 16 of 84 drill holes, are intended to validate resource models and support mine planning for the Preliminary Economic Assessment Phase 1 open pits.

- Following the drill results, New Found Gold's shares surged, and the company is strategically merging with Maritime Resources to form a multi-asset gold producer.

- Analysts categorize New Found Gold as a speculative buy with high risk and potential reward, noting its strong equity position and promising exploration results despite typical challenges for exploration firms.

- National Fuel Gas Company (NFG) entered into a Securities Purchase Agreement on October 20, 2025, to acquire Vectren Energy Delivery of Ohio, LLC, CenterPoint Energy Resources Corp.'s Ohio natural gas local distribution company business.

- A portion of the acquisition's purchase price will be financed through a $1.2 billion unsecured term loan credit facility provided by a Seller Note Agreement.

- On November 6, 2025, NFG executed amendments to its existing Term Loan Agreement and Credit Agreement to modify the definition of "Consolidated Indebtedness," which will facilitate the defeasance of obligations under the Seller Note Agreement after the transaction closes.

Quarterly earnings call transcripts for NATIONAL FUEL GAS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more