Earnings summaries and quarterly performance for ONEOK INC /NEW/.

Executive leadership at ONEOK INC /NEW/.

Pierce Norton II

President and Chief Executive Officer

Kevin Burdick

Executive Vice President and Chief Enterprise Services Officer

Lyndon Taylor

Executive Vice President, Chief Legal Officer and Assistant Secretary

Sheridan Swords

Executive Vice President and Chief Commercial Officer

Walter Hulse III

Chief Financial Officer, Treasurer and Executive Vice President, Corporate Development and Investor Relations

Board of directors at ONEOK INC /NEW/.

Research analysts who have asked questions during ONEOK INC /NEW/ earnings calls.

Jean Ann Salisbury

Bank of America

8 questions for OKE

Keith Stanley

Wolfe Research, LLC

8 questions for OKE

Manav Gupta

UBS Group

8 questions for OKE

Michael Blum

Wells Fargo & Company

8 questions for OKE

Theresa Chen

Barclays PLC

8 questions for OKE

Spiro Dounis

Citigroup Inc.

6 questions for OKE

Sunil Sibal

Seaport Global Holdings LLC

6 questions for OKE

Jason Gabelman

TD Cowen

4 questions for OKE

Jeremy Tonet

JPMorgan Chase & Co.

4 questions for OKE

John Mackay

Goldman Sachs Group, Inc.

4 questions for OKE

Brandon Bingham

Scotiabank

3 questions for OKE

Neal Dingmann

Truist Securities

2 questions for OKE

Robert Mosca

Mizuho Securities Co., Ltd.

2 questions for OKE

Vrath and Reddy

JPMorgan Chase & Co.

2 questions for OKE

A.J. O'Donnell

Tudor, Pickering, Holt & Co.

1 question for OKE

Andrew John O'Donnell

Tudor, Pickering, Holt & Co.

1 question for OKE

Brandon Reddy

JPMorgan Chase & Co.

1 question for OKE

Craig Shere

Tuohy Brothers

1 question for OKE

Vrathan Reddy

JPMorgan Chase & Co.

1 question for OKE

Recent press releases and 8-K filings for OKE.

- Fourth quarter net income of $977 million ($1.55/share) and full-year net income of $3.39 billion (12% YoY); Adjusted EBITDA of $2.15 billion in Q4 and $8.02 billion for full-year 2025.

- 2026 guidance targets net income of $3.45 billion (~$5.45/share) and Adjusted EBITDA of $8.1 billion.

- Returned $2.7 billion to shareholders in 2025 via dividends and share repurchases; retired $3.1 billion of long-term debt and raised quarterly dividend 4%.

- 2026 capital expenditures of $2.7 billion–$3.2 billion for growth and maintenance (including Shadowfax relocation, Delaware plant expansions, Denver pipeline and Medford fractionator rebuild); no meaningful cash taxes expected until 2029.

- Integrated platform delivering durable earnings power with ~90% fee-based mix; realized $500 million of synergies since Magellan acquisition (including $250 million in 2025) and forecasting $150 million of incremental synergies in 2026.

- 2025 net income of $3.462 B and adjusted EBITDA of $8.020 B, driven by 11% EPS growth and marking 12 consecutive years of EBITDA expansion

- Strengthened financial position with 3.8× leverage ratio (annualized Q4), $3.1 B of long-term debt extinguished and 4% dividend increase

- 2026 guidance of net income $3.19 B–$3.71 B and adjusted EBITDA $7.9 B–$8.3 B, underpinned by approximately 90% fee-based earnings across key segments

- Permian NGL processing volumes averaged 1.5 Bcf/d in 2025 (first full year), alongside record Rocky Mountain throughput

- In 2025, net income attributable to ONEOK rose 12% to $3.39 billion and Adjusted EBITDA grew 18% to $8.02 billion, marking 12 consecutive years of EBITDA growth and a 17% average annual earnings increase over 2.5 years.

- Q4 2025 net income was $977 million (EPS $1.55), bringing full-year EPS to $5.42; Q4 Adjusted EBITDA was $2.15 billion, and the company retired $3.1 billion of long-term debt and returned $2.7 billion to shareholders, including a 4% dividend increase.

- For 2026, ONEOK projects net income of $3.45 billion (EPS $5.45) and Adjusted EBITDA of $8.1 billion, with capital expenditures of $2.7 billion–$3.2 billion, expected incremental synergies of $150 million, and no meaningful cash taxes until 2029.

- Since closing the Magellan acquisition in 2023, ONEOK has realized $500 million of synergies (including $250 million in 2025) and maintains a high-quality earnings mix with approximately 90% fee-based revenues.

- In Q4 2025, ONEOK reported net income attributable of $977 million ( $1.55/share ) and full‐year net income of $3.39 billion, up 12%, with full‐year EPS of $5.42; Adjusted EBITDA was $2.15 billion in Q4 and $8.02 billion for the year.

- The company extinguished $1.75 billion of senior notes in Q4 (totaling $3.1 billion in 2025) and returned $2.7 billion to shareholders via dividends and share repurchases, also raising its quarterly dividend by 4%.

- For 2026, ONEOK guided to net income of $3.45 billion (~$5.45/share), Adjusted EBITDA midpoint of $8.1 billion, and CapEx of $2.7–$3.2 billion, with no expected meaningful cash taxes until 2029.

- Management highlighted an 18% increase in Adjusted EBITDA, captured $500 million of synergies since the Magellan acquisition, and maintained ~90% fee‐based earnings to limit commodity exposure.

- ONEOK reported Q4 2025 net income of $978 million ($1.55/share) and adjusted EBITDA of $2.15 billion; for FY 2025, net income was $3.46 billion ($5.42/share) and adjusted EBITDA was $8.02 billion (18% increase).

- 2026 guidance includes net income midpoint of $3.45 billion, EPS of $5.45, adjusted EBITDA of $8.1 billion, and capital expenditures of $2.7 billion – $3.2 billion.

- In Q4 2025, Rocky Mountain region NGL raw feed throughput rose 15% and natural gas volumes processed increased 3% year-over-year.

- Through year-end 2025, ONEOK captured $475 million in acquisition-related synergies; in January 2026, the quarterly dividend was raised 4% to $1.07/share; 2025 capital return included $62 million of share repurchases and extinguishment of nearly $3.1 billion of debt.

- Infrastructure expansion: the Eiger Express Pipeline capacity was increased to 3.7 Bcf/d, fully subscribed under long-term contracts.

- ONEOK’s full-year 2025 net income attributable to ONEOK rose 12% to $3.39 billion ( $5.42 per diluted share ).

- Full-year adjusted EBITDA increased 18% to $8.02 billion (excluding transaction costs).

- 2026 guidance targets net income of $3.45 billion, EPS of $5.45, and adjusted EBITDA of $8.1 billion, with $2.7 billion–$3.2 billion in capex.

- Since mid-2021, ONEOK shifted from a supply-push to a demand-pull model through key acquisitions of Magellan (refined products), EnLink (Permian), Medallion (crude gathering) and Easton (pipeline connections), underpinning its “molecule strategy” to touch hydrocarbons multiple times for longer cycles.

- The Magellan deal has delivered roughly 80% of expected synergies, with additional high-return G&A cuts and small capital projects uncovered; final integration capital (Mount Belvieu–Houston and Mid-Continent connections) completed in Q3 2025.

- Portfolio growth in 2026 will be driven by contracted, non-drillbit-dependent projects: the Bison Express gas pipeline, Denver refined products pipeline, Easton/Mid-Continent network hookups and staged Medford fractionator phases, providing full-year EBITDA upside.

- With U.S. oil output near 13.5 MMbbl/d and rising LNG (“30 at 30”) plus AI data center demand, ONEOK is expanding its Blackcomb pipeline capacity from 2.4 to 3.5 Bcf/d to secure producer netbacks and alleviate Gulf Coast constraints.

- ONEOK executed a pivot since mid-2021 via major acquisitions—Magellan (refined products demand pull), EnLink (Permian intrastate gas/NGL), Medallion (crude gathering)—while reducing isolated interstate gas and increasing intrastate/storage exposure.

- The company has captured ~80% of targeted Magellan synergies, uncovered additional high-return projects, and completed the Easton pipeline integration in Q3, advancing its $700M–$1.1B synergy goal.

- Growth into 2026 is expected from full-year benefits of Easton and Mid-Continent connections, Bison Pipeline start-up (Q1’26), and Denver products expansion, although volume growth may be slightly tempered by lower crude prices curbing drill-bit activity.

- ONEOK remains patient and disciplined on further M&A, targeting opportunities that enhance cash flow and scale, with clear criteria shaped by recent Magellan, EnLink, Medallion and Easton deals.

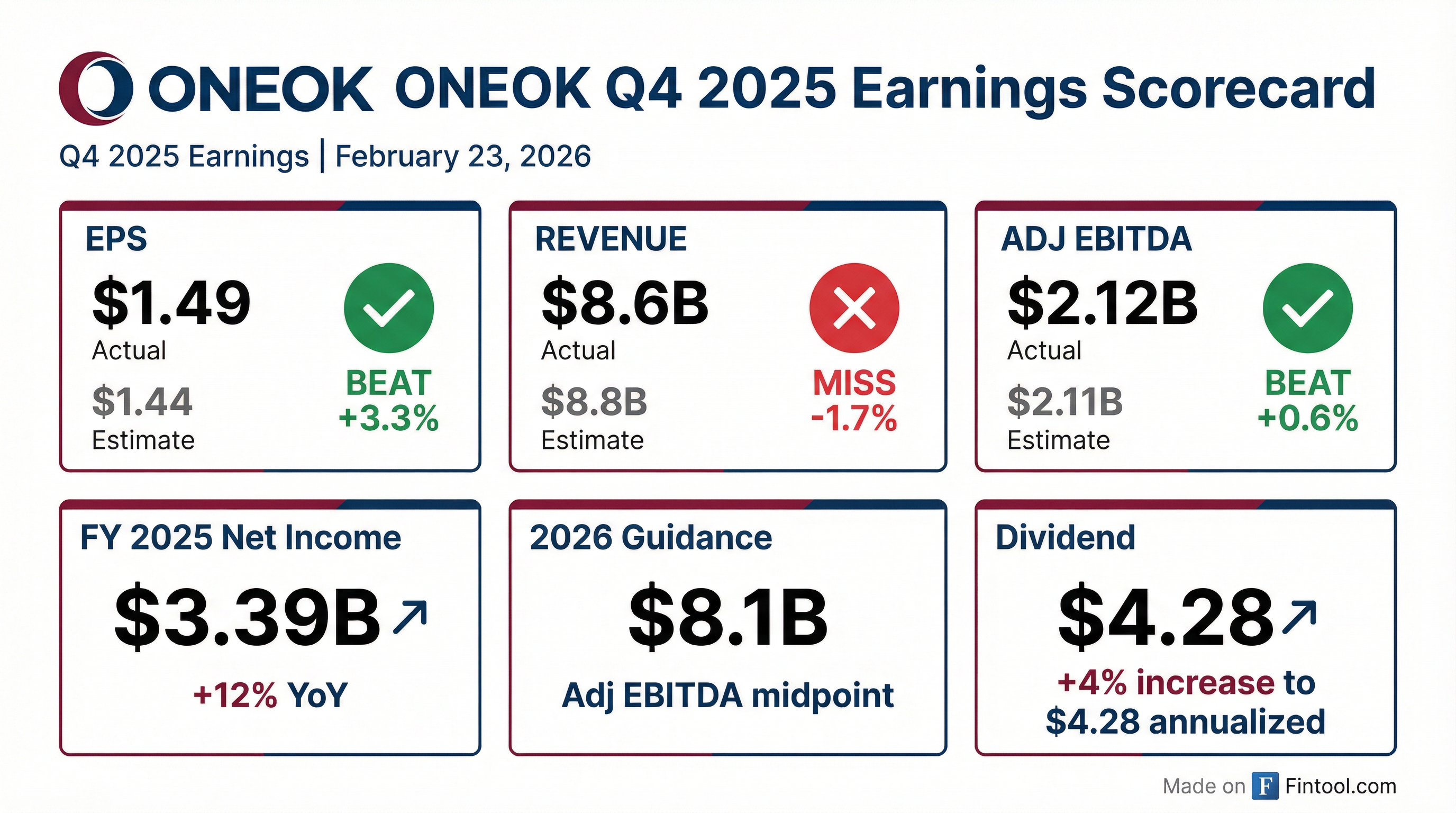

- ONEOK reported Q3 2025 net income of $940 million ($1.49/share) and adjusted EBITDA of $2.12 billion, up 10% and 7% sequentially, driven by volume growth and contributions from acquired NLink and Medallion assets.

- The company affirmed 2025 guidance with net income of $3.17 billion–$3.65 billion, adjusted EBITDA of $8.0 billion–$8.45 billion, and total capex of $2.8 billion–$3.2 billion, excluding $59 million of YTD transaction costs.

- Q3 capital allocation included repurchasing >600,000 shares and retiring >$500 million of senior notes, bringing YTD debt extinguishment to >$1.3 billion, while targeting a 3.5× leverage ratio by Q4 2026.

- Operational highlights included a record 490,000 bpd in the Rocky Mountain NGL region, Permian gas processing volumes of 1.55 Bcf/d, and continued progress on projects adding significant pipeline, fractionation, and processing capacity.

- In Q3 2025, ONEOK posted $940 million net income ($1.49/share), up 10% QoQ, and $2.12 billion adjusted EBITDA, including $7 million of one‐time costs; EnLink and Medallion contributed ~$470 million of EBITDA.

- The company repurchased over 600,000 shares and retired more than $500 million in senior notes during the quarter; year‐to‐date senior note retirements exceed $1.3 billion.

- Reaffirmed 2025 guidance: net income $3.17 B–$3.65 B, adjusted EBITDA $8.0 B–$8.45 B, and capex $2.8 B–$3.2 B; expects ~$250 million in synergies and deferred cash taxes until 2029.

- Gas gathering and processing volumes rose across all regions vs Q2: Permian +5% to 1.55 bcf/d, Mid‐Continent +6%, Rocky Mountain 1.7 bcf/d (+4%, record).

Quarterly earnings call transcripts for ONEOK INC /NEW/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more