Earnings summaries and quarterly performance for OMNICELL.

Executive leadership at OMNICELL.

Randall Lipps

Chairman, President and Chief Executive Officer

Baird Radford

Executive Vice President and Chief Financial Officer

Corey Manley

Executive Vice President and Chief Legal and Administrative Officer

Nnamdi Njoku

Executive Vice President and Chief Operating Officer

Board of directors at OMNICELL.

Research analysts who have asked questions during OMNICELL earnings calls.

David Larsen

BTIG

6 questions for OMCL

Jessica Tassan

Piper Sandler

6 questions for OMCL

Gene Mannheimer

Freedom Capital Markets

5 questions for OMCL

Scott Schoenhaus

KeyBanc Capital Markets

5 questions for OMCL

Allen Lutz

Bank of America

4 questions for OMCL

Matthew Hewitt

Craig-Hallum Capital Group LLC

4 questions for OMCL

Bill Sutherland

The Benchmark Company LLC

3 questions for OMCL

Stan Berenshteyn

Wells Fargo Securities

3 questions for OMCL

Stanislav Berenshteyn

Wells Fargo

3 questions for OMCL

Dev Naik

Bank of America

2 questions for OMCL

Matt Hewitt

Craig-Hallum Capital Group

2 questions for OMCL

William Sutherland

The Benchmark Company

2 questions for OMCL

Anne Samuel

JPMorgan Chase & Co.

1 question for OMCL

Stephanie Davis

Barclays

1 question for OMCL

Recent press releases and 8-K filings for OMCL.

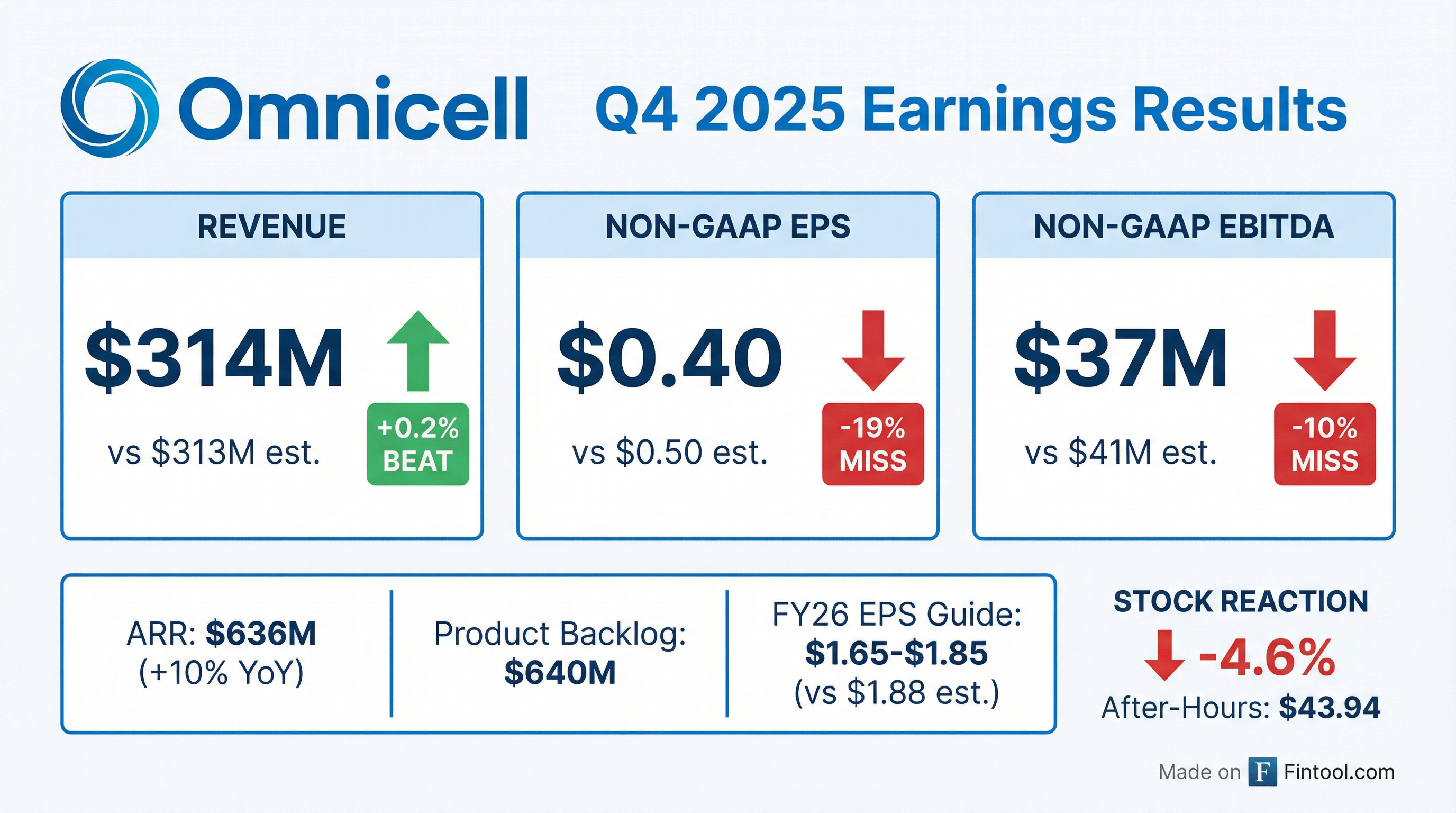

- Omnicell reported a solid finish to 2025, with Q4 2025 total revenue of $314 million and full-year 2025 total revenue of $1.185 billion, both in the upper range of guidance.

- Non-GAAP earnings per share for Q4 2025 was $0.40 and $1.62 for the full year 2025. The company exited 2025 with Annual Recurring Revenue (ARR) of $636 million, a 10% increase from the 2024 exit rate.

- The company introduced Titan XT, a new transformational enterprise-wide automated dispensing system, and continues to advance its OmniSphere cloud-based medication management platform.

- For Q1 2026, Omnicell anticipates total revenue between $300-$310 million and non-GAAP EPS between $0.26-$0.36.

- Full-year 2026 guidance includes total revenue of $1.215 billion-$1.255 billion, non-GAAP EPS of $1.65-$1.85, and year-end ARR of $680 million-$700 million.

- Omnicell reported Q4 2025 total revenue of $314 million, an increase of 2% from Q4 2024, and full year 2025 total revenue of $1.185 billion, compared to $1.112 billion in 2024. The company's annual recurring revenue (ARR) exited Q4 2025 at an annualized run rate of $636 million, a 10% increase from the 2024 exit rate.

- For Q4 2025, non-GAAP earnings per share was $0.40, compared to $0.60 in Q4 2024, and non-GAAP EBITDA was $37 million, compared to $46 million in Q4 2024. Full year 2025 non-GAAP EPS was $1.62, compared to $1.71 in 2024, and non-GAAP EBITDA was $140 million, up from $136 million in 2024.

- Omnicell introduced Titan XT, a new enterprise-wide automated dispensing system, at the ASHP annual meeting in December 2025, designed to unify automation and intelligence for medication management. This product launch is part of a replacement cycle opportunity estimated to be in excess of $2.5 billion.

- For Q1 2026, Omnicell expects total revenue between $300 million and $310 million, non-GAAP EBITDA between $27 million and $33 million, and non-GAAP EPS between $0.26 and $0.36 per share.

- The company's full year 2026 guidance includes total revenue in the range of $1.215 billion to $1.255 billion, non-GAAP EBITDA between $145 million and $160 million, and non-GAAP EPS between $1.65 and $1.85 per share. Year-end 2026 ARR is expected to be in the range of $680 million to $700 million.

- Omnicell reported total revenues of $314 million for the fourth quarter of 2025, a 2% increase from the prior year, and $1.185 billion for the full year 2025, up 7% from 2024.

- For Q4 2025, the company recorded a GAAP net loss of $2 million ($0.05 per diluted share) and non-GAAP net income of $18 million ($0.40 per diluted share).

- The company launched its next-generation dispensing system, Titan XT, in December 2025, designed to enhance medication management.

- Omnicell provided 2026 guidance, projecting total revenues between $1.215 billion and $1.255 billion and non-GAAP earnings per share between $1.65 and $1.85.

- Omnicell reported Q4 2025 total revenues of $314 million, a 2% increase from Q4 2024, and full year 2025 total revenues of $1.185 billion, up 7% from 2024.

- For Q4 2025, the company had a GAAP net loss of $2 million ($0.05 per diluted share) and non-GAAP net income of $18 million ($0.40 per diluted share). Full year 2025 GAAP net income was $2 million ($0.04 per diluted share) and non-GAAP net income was $75 million ($1.62 per diluted share).

- Annual Recurring Revenue (ARR) grew to $635.555 million as of December 31, 2025, from $580.025 million in 2024, while product bookings for FY 2025 were $535 million, a 4% decrease year-over-year.

- The company launched its next-generation dispensing system, Titan XT, in December 2025, aiming to enhance medication management.

- Omnicell provided Q1 2026 total revenue guidance of $300 million - $310 million and full year 2026 total revenue guidance of $1.215 billion - $1.255 billion, with non-GAAP EPS guidance of $1.65 - $1.85 for the full year.

- Omnicell has launched Titan XT, a new enterprise platform designed for growing health systems, featuring new hardware, software, and a cloud-based approach with AI capabilities for real-time medication management.

- Titan XT is now bookable, with hardware shipments anticipated in the second half of 2026 and general availability of the Omnisphere software platform in the first half of 2027.

- The company estimates the market opportunity for Titan XT to be around $2.5 billion.

- While hardware will continue to be offered as a capital purchase, Omnicell will also introduce leasing models and expects a premium price; software will follow a subscription model.

- Modest incremental revenue from Titan XT is expected in 2026.

- Omnicell has launched Titan XT, a new enterprise platform featuring updated hardware, software, and cloud-based analytics designed to address the complex medication management needs of growing health systems.

- Hardware shipments for Titan XT are anticipated to begin in the second half of 2026, with the Omnisphere software platform becoming generally available in the first half of 2027.

- The company plans to offer leasing options in addition to capital purchases for hardware, and expects the software to transition to a subscription model.

- Omnicell estimates the market opportunity for Titan XT to be approximately $2.5 billion.

- Incremental revenue from Titan XT in 2026 is expected to be modest due to the sales and implementation cycle.

- Omnicell, Inc. (OMCL) announced the launch of Omnicell Titan XT, its next-generation, automated dispensing system, on December 8, 2025.

- The Titan XT is an enterprise version of automated dispensing systems, designed to empower autonomous medication management and is powered by the OmniSphere cloud-based platform.

- This new system aims to provide greater pharmacy control through features like dynamic restock, centralized inventory management, and AI-enabled intelligence for stock risk prediction, while also enhancing nursing confidence with simplified dispensing and embedded safeguards.

- Omnicell Titan XT is now available for purchase in the United States. International availability is anticipated for later in 2026, with ongoing OmniSphere releases beginning in early 2027.

- Omnicell's new CFO, Baird Radford, joined in August 2025, and is focused on transitioning the company to a more flexible, recurring revenue model, moving away from the traditional 10-year capital purchase cycle.

- For 2025, Omnicell has raised its revenue guidance twice, projecting 5%-6% top-line growth at the midpoint, and an adjusted EBITDA guidance of $143 million.

- The company successfully navigated tariff impacts through supply chain optimization and pricing adjustments, contributing to a strong 3Q performance where revenue beat flowed through to Adjusted EBITDA.

- 2025 bookings are guided to $525 million at the midpoint, a modest year-over-year decrease, with management identifying 2025 as a "trough year" for bookings and a period for cost resets aimed at driving 2026 growth.

- Omnicell is expanding its product offerings with XT Extend and the OmniSphere cloud platform, which enables immediate updates and aims to reduce costs while improving customer experience and margins.

- Omnicell's new CFO, Baird Radford, joined in August 2025 and brings experience in both capital and recurring revenue models, aligning with the company's strategic shift towards more predictable, recurring revenue.

- The company has raised its 2025 revenue guidance twice year-to-date, with a current outlook of 5%-6% top-line growth at the midpoint and $143 million in Adjusted EBITDA.

- 2025 is considered a "trough year" for bookings, guided to $525 million at the midpoint (down from $558 million in 2024), but the company anticipates a good growth profile and expanding margin profile in 2026.

- Omnicell is transitioning its revenue model from 10-year capital purchases to more flexible leasing models (e.g., 5 years) and is launching OmniSphere, a new cloud-based platform accessible to all customers from January 1, with a utilization-based pricing model.

- The market is entering a significant replacement cycle for aging equipment, creating new opportunities for Omnicell, which has expanded its sales force to address this demand.

- Omnicell's new CFO, Baird Radford, who joined in August 2025, is focused on transitioning the company to a more recurring revenue model with flexible leasing options, aiming for more predictable revenues and earnings.

- The company has raised its 2025 revenue guidance twice year-to-date, with a current outlook of 5%-6% top-line growth at the midpoint and $143 million in Adjusted EBITDA, demonstrating resilience despite tariff headwinds.

- While 2025 bookings are guided to $525 million (a modest decrease from $558 million in 2024), management views this as a "trough year", anticipating a significant equipment replacement cycle and expanding sales efforts for new opportunities.

- Omnicell is launching OmniSphere, an internally developed, high-security certified cloud-based enterprise solution, which will be accessible to all customers starting January 1. This platform aims to provide immediate updates, easier deployment, and will feature a new utilization-based service fee pricing model.

Quarterly earnings call transcripts for OMNICELL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more