Earnings summaries and quarterly performance for OneMain Holdings.

Executive leadership at OneMain Holdings.

Board of directors at OneMain Holdings.

Research analysts who have asked questions during OneMain Holdings earnings calls.

Mark DeVries

Deutsche Bank

6 questions for OMF

Moshe Orenbuch

TD Cowen

6 questions for OMF

John Hecht

Jefferies

5 questions for OMF

Mihir Bhatia

Bank of America

5 questions for OMF

Richard Shane

JPMorgan Chase & Co.

5 questions for OMF

Michael Kaye

Wells Fargo & Company

3 questions for OMF

Terry Ma

Barclays

3 questions for OMF

Arren Cyganovich

Truist

2 questions for OMF

Kyle Joseph

Jefferies

2 questions for OMF

Vincent Caintic

Stephens Inc.

2 questions for OMF

David Scharf

Citizens Capital Markets and Advisory

1 question for OMF

John Pancari

Evercore ISI

1 question for OMF

John Rowan

Janney Montgomery Scott

1 question for OMF

Recent press releases and 8-K filings for OMF.

- CEO Doug Shulman states that the non-prime consumer is resilient, and OneMain has maintained a tight credit box since 2022, applying a 30% stress overlay to loss predictions to ensure a 20% return on equity on loans.

- The company's ILC application is viewed as a "nice to have" for potential funding diversification and operational simplification, with no current updates on its status.

- OneMain is actively growing its auto and credit card businesses, which are considered complementary, with the credit card business offering same or higher ROE than personal loans and serving as a cost-effective customer acquisition channel.

- OneMain maintains a conservative, diversified balance sheet with a two-year liquidity runway. Capital priorities include investing in the business, a healthy dividend (around 7%), and share repurchases, with a $1 billion buyback program through 2028 recently approved.

- OneMain Holdings highlights the resilience of its non-prime customer base, noting that income has caught up with inflation and unemployment remains historically low.

- The company maintains a disciplined underwriting strategy with a minimum 20% return on equity threshold for all loans and applies a 30% stress overlay to loss models, ensuring portfolio resilience against economic downturns.

- OneMain's funding strategy prioritizes a conservative balance sheet with a long liquidity runway, utilizing diversified sources including ABS, unsecured bonds, and over $7 billion in bank lines from 14 different banks.

- The company is growing its auto and credit card businesses, which offer complementary risk and return profiles to its core personal loan segment, with the credit card portfolio currently representing less than 4% of the total $26 billion portfolio.

- Capital allocation focuses on investing in the business, maintaining a healthy dividend (approximately 7% yield), and returning excess capital through share repurchases, with a $1 billion buyback program authorized through 2028.

- OMF reported strong full-year 2025 performance with C&I earnings per share of $6.66, a 36% increase year-over-year, and capital generation of $913 million, up 33%.

- In Q4 2025, C&I adjusted earnings per share were $1.59, up 37% from the prior year, and total revenue grew 8% to $1.6 billion.

- Managed receivables increased 6% to over $26 billion in 2025, driven by growth in personal loans, auto finance, and credit card businesses.

- For 2026, OMF expects managed receivables growth of 6%-9% and C&I net charge-offs in the range of 7.4%-7.9%.

- The company returned $639 million to shareholders in 2025, a 20% increase from 2024, through dividends and accelerated share repurchases, with a stated bias towards share repurchases for future capital allocation.

- OneMain Financial reported Q4 2025 C&I Adjusted Diluted EPS of $1.59 and FY 2025 Adjusted Diluted EPS of $6.66, with Q4 2025 C&I Total Revenue at $1.6 billion and FY 2025 C&I Total Revenue at $6.214 billion.

- The company's Managed Receivables reached $26.3 billion in Q4 2025, reflecting 6.4% growth for FY 2025, and originations totaled $3.6 billion in Q4 2025.

- For 2026, OneMain Financial projects Managed Receivables Growth of 6%-9%, C&I Net Charge-offs between 7.4% and 7.9%, and an Operating Expense Ratio of approximately 6.6%.

- The Board declared a regular quarterly dividend of $1.05 per share, increased share repurchases to $70 million in Q4 2025, and authorized a $1 billion share repurchase program through 2028. Additionally, the company issued a $1 billion unsecured bond in Q4 2025.

- OneMain Financial reported strong full-year 2025 results, with C&I earnings per share of $6.66, up 36% year-over-year, and capital generation of $913 million, an increase of 33%.

- For Q4 2025, C&I adjusted earnings were $1.59 per share, a 37% increase, with revenue growing 8% to $1.6 billion and managed receivables up 6% to $26.3 billion.

- Full-year 2025 revenue grew 9%, and C&I net charge-offs declined by 46 basis points to 7.7%.

- The company expects 2026 managed receivables growth of 6%-9% and C&I net charge-offs in the range of 7.4%-7.9%, with an improved full-year OpEx ratio of approximately 6.6%.

- Total capital returned to shareholders in 2025 increased 20% to $639 million, with an accelerated pace of share repurchases in Q4.

- OneMain Financial reported strong full-year 2025 performance with C&I earnings per share of $6.66, an increase of 36% year-over-year, and capital generation of $913 million, up 33%.

- For Q4 2025, C&I adjusted earnings were $1.59 per share, up 37% from the prior year, with revenue growing 8% and managed receivables increasing 6% to $26.3 billion.

- The company saw improved credit performance in 2025, with full-year C&I net charge-offs at 7.7%, down 46 basis points from 2024, and Q4 credit card net charge-offs improving to 17.1%.

- Looking into 2026, OneMain Financial expects managed receivables to grow 6%-9% and projects C&I net charge-offs in the range of 7.4%-7.9%, with a full-year OpEx ratio of approximately 6.6%.

- Capital allocation included a $1 billion share repurchase program approved through 2028, with $70 million repurchased in Q4 2025, and a regular annual dividend of $4.20 per share.

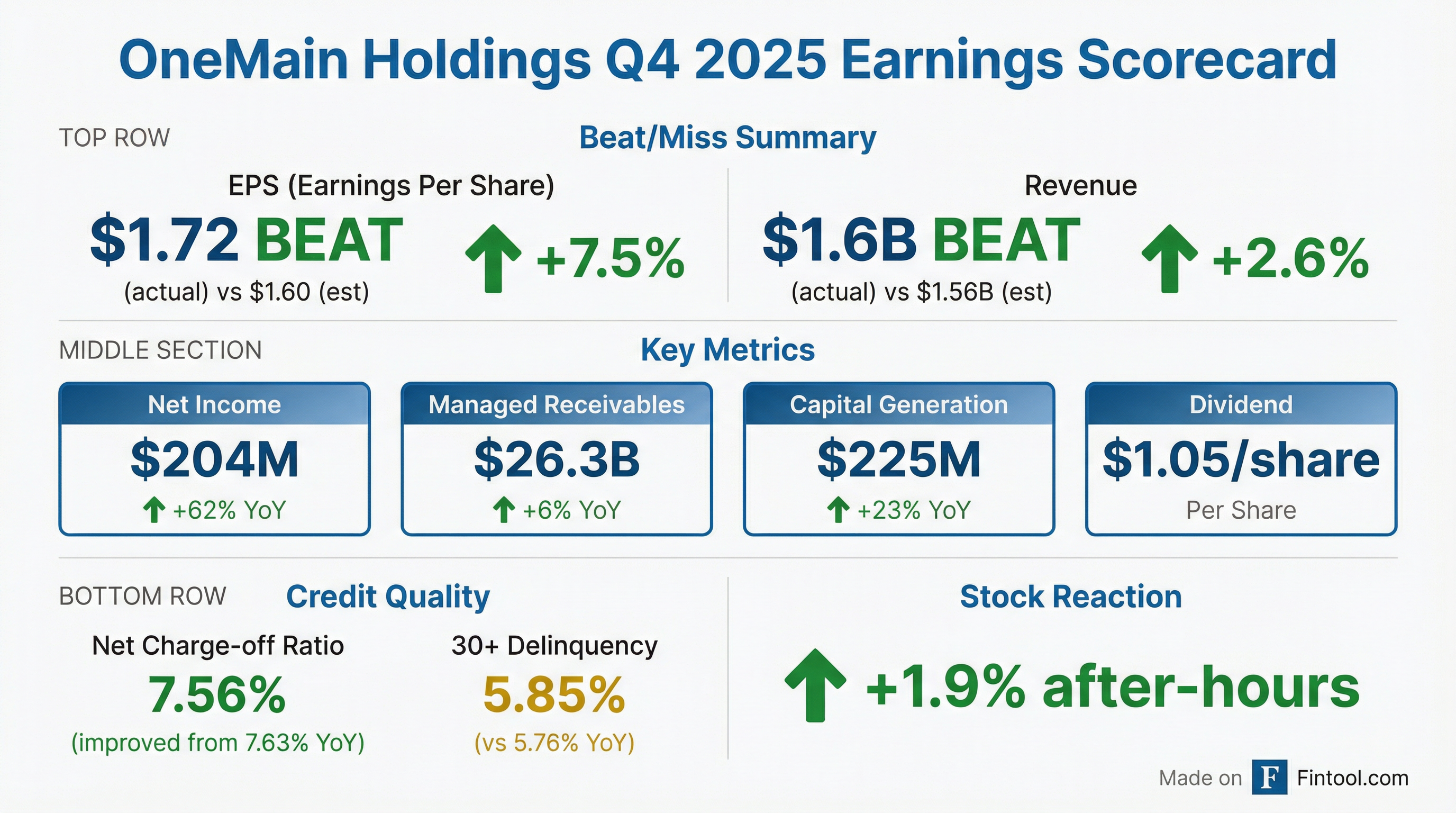

- OneMain Holdings reported Q4 2025 diluted EPS of $1.72 and full-year 2025 diluted EPS of $6.56, compared to $1.05 and $4.24 in the prior year periods, respectively.

- Net income for Q4 2025 was $204 million and $783 million for the full year 2025, up from $126 million and $509 million in the respective prior year periods.

- The company declared a quarterly dividend of $1.05 per share and repurchased approximately 1.2 million shares for $70 million during Q4 2025.

- Managed receivables increased by 6% to $26.3 billion as of December 31, 2025, from $24.7 billion at December 31, 2024.

- OneMain Holdings, Inc. reported diluted EPS of $1.72 and net income of $204 million for Q4 2025, compared to $1.05 and $126 million in the prior year quarter, respectively. For the full year 2025, diluted EPS was $6.56 and net income was $783 million. The C&I adjusted diluted EPS was $1.59 for Q4 2025 and $6.66 for the full year 2025.

- Managed receivables increased 6% to $26.3 billion at December 31, 2025, from $24.7 billion at December 31, 2024.

- The company declared a quarterly dividend of $1.05 per share and repurchased approximately 1.2 million shares of common stock for $70 million during Q4 2025.

- Total revenue for Q4 2025 was $1.6 billion, an 8% increase from the prior year quarter.

- As of December 31, 2025, the 30+ days delinquency ratio was 5.85% and the 90+ days delinquency ratio was 2.49%, with a net charge-off ratio of 7.56% for Q4 2025.

- TPG has extended and expanded its forward-flow agreement with OneMain Holdings to purchase approximately $2.4 billion of consumer and auto loans through June 30, 2028, building on prior commitments totaling about $1.3 billion.

- This agreement allows OneMain to free up balance-sheet capacity and recycle capital to support origination growth, while diversifying its funding sources.

- The deal deepens TPG's exposure to asset-backed consumer and auto credit, aligning with its broader push into asset-based lending following its acquisition of Angelo Gordon in 2023.

- Following the announcement, OneMain's stock dipped about 0.7% and TPG's shares fell roughly 0.2%.

- On December 18, 2025, OneMain Finance Corporation (OMFC), a direct subsidiary of OneMain Holdings, Inc. (OMH), issued $1.0 billion aggregate principal amount of 6.750% Senior Notes due 2033.

- The Notes mature on September 15, 2033, bear interest at 6.750% per annum payable semiannually starting March 15, 2026, and are OMFC's senior unsecured obligations, guaranteed by OMH.

- OMFC has the option to redeem the Notes, in whole or in part, at a "make-whole" redemption price prior to December 15, 2028, and at specified percentages (e.g., 103.3750% in 2028, 100.0000% in 2030 and thereafter) on or after December 15, 2028.

- The Indenture includes covenants that limit OMFC's ability to create liens and restrict consolidation, merger, or asset sales, and allows holders of at least 30% of the notes to declare an event of default.

Quarterly earnings call transcripts for OneMain Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more